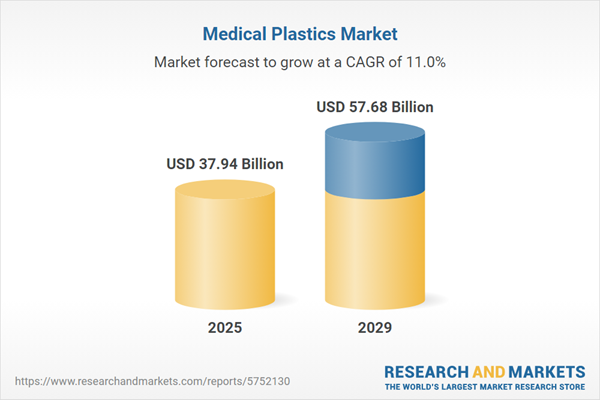

The medical plastics market size has grown strongly in recent years. It will grow from $34.83 billion in 2024 to $37.94 billion in 2025 at a compound annual growth rate (CAGR) of 8.9%. The growth in the historic period can be attributed to biocompatibility and sterilization, aging population, minimally invasive procedures, global health preparedness, customized implants.

The medical plastics market size is expected to see rapid growth in the next few years. It will grow to $57.68 billion in 2029 at a compound annual growth rate (CAGR) of 11%. The growth in the forecast period can be attributed to patient-centric care, lightweight and durable materials, single-use devices, cost-efficiency, sustainable and eco-friendly plastics. Major trends in the forecast period include 3D printing advancements, nanotechnology integration, smart and connected devices, advanced materials, medical device innovation.

The significant advancement in medical plastic technology is playing a crucial role in the growth of the medical plastics market. Recent years have witnessed notable progress in medical plastics technology, including techniques like injection molding and insert molding, along with the introduction of new materials. These advancements, coupled with innovative ideas, have gained prominence in the healthcare sector. Medical plastics are characterized by their neutrality, as they do not react with the physical or chemical properties of the products they contain or when implanted in the human body. Technologies such as 3D printing have also become popular in medical plastics, offering manufacturers distinct advantages. For instance, the utilization of 3D anatomic models as surgical guides, as reported by the American Hospital Association, led to a reduction in surgery time by 62 minutes, resulting in savings of $3,720 per case. The ongoing progress in medical plastic technology is poised to drive substantial growth in the medical plastics market.

The anticipated rise in healthcare expenditure is set to drive the growth of the medical plastics market in the coming years. Healthcare expenditure encompasses the total amount spent on healthcare-related products and services, including medical equipment, pharmaceuticals, hospitalization, treatments, and other healthcare costs. Medical plastics find extensive use in sterile packaging, disposable devices, and implants due to their biocompatibility and durability. As reported by the Centers for Medicare & Medicaid Services in May 2023, healthcare spending in the United States is projected to increase by 2.7% to reach $4.3 trillion, equivalent to $12,914 per person in 2021. Consequently, the upward trend in healthcare expenditure is a significant driver for the medical plastics market.

The elimination of single-use plastics emerges as a noteworthy trend adopted by companies in the medical plastics market, driven by environmental concerns associated with single-use plastics. The move towards eliminating single-use plastics aligns with environmental conservation efforts. Companies are actively focusing on introducing products made from eco-friendly materials that can be recycled. This strategic shift not only enhances brand value but also provides a competitive edge in the market, capturing additional market share. Trvst Ltd. reports that hospitals generate over 5 million tons of waste annually, with approximately 25% of that waste attributed to plastic. In response, companies like EnviroPak LLC offer reusable steam sterilization pouch systems as an eco-friendly alternative to single-use pouches, contributing to a reduction in plastic waste. Additionally, NewGen Surgical provides a 100% plant-based, recyclable kit packaging tray that minimizes carbon dioxide emissions by 55% compared to traditional foam trays.

Major companies in the medical plastics market are actively engaging in strategic partnerships to drive revenue and foster innovation. These partnerships facilitate collaborative research, material innovation, and expanded market reach, contributing to advancements in healthcare product development. For instance, Eastman Chemical Company partnered with Ethicon Inc. in September 2022 to integrate Eastman Renew materials into medical device sterile-barrier packaging, contributing to a more sustainable approach within the healthcare sector. This collaboration marks Ethicon as a pioneer in incorporating medical-grade Eastman Renew materials in its product packaging.

In July 2024, DuPont, a US-based chemical company, acquired Donatelle Plastics for an undisclosed amount. This acquisition brings complementary advanced technologies and capabilities to DuPont, including medical device injection molding and liquid silicone rubber processing. It also strengthens the organization's precision machining, device assembly, and tool building capabilities. Donatelle Plastics is a US-based manufacturer of medical plastic products.

Major companies operating in the medical plastics market include BASF SE, Celanese Corporation, Solvay S.A., Arkema SA, Eastman Chemical Company, Dow Inc., Saudi Arabia's Basic Industries Corporation, Evonik Industries AG, Röchling SE & Co. KG, Nolato AB, Saint-Gobain Performance Plastics, Orthoplastics Ltd., Tekni-Plex Inc., HMC Polymers Co. Ltd., ARAN BIOMEDICAL TEORANTA, Trelleborg AB, Raumedic AG, Ensinger GmbH, RTP Company Inc., Foster Corporation, PolyOne Corporation, DSM Engineering Plastics Pvt. Ltd., Covestro AG, DuPont de Nemours Inc., Exxon Mobil Corporation, Lubrizol Corporation, Trinseo LLC, Mitsubishi Chemical Corporation, Sumitomo Chemical Co. Ltd., Kuraray Co. Ltd.

Asia-Pacific was the largest region in the medical plastics market in 2024. The regions covered in the medical plastics market research report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the medical plastics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK and USA.

Medical plastics refer to a category of plastic products specifically designed for use in the healthcare industry. These plastics exhibit resistance to temperature variations, corrosion, and chemicals, making them well-suited for various medical applications. Medical plastics find applications in the manufacturing and packaging of medical products.

The primary types of medical plastics include polyvinyl chloride (PVC), polypropylene (PP), engineering plastics, polyethylene (PE), polystyrene (PS), silicones, and others. Polyvinyl chloride (PVC) plastics, for example, are both economical and versatile thermoplastic polymers extensively utilized in the production of medical devices. The manufacturing processes for medical plastics include extrusion, injection molding, blow molding, and others, such as rotational molding and compression molding. Medical plastics play a crucial role in the production of medical disposables, medical instruments, prosthetics and implants, drug packaging, and various other applications within the healthcare sector.

The medical plastics market research report is one of a series of new reports that provides medical plastics market statistics, including medical plastics industry global market size, regional shares, competitors with a medical plastics market share, detailed medical plastics market segments, market trends and opportunities, and any further data you may need to thrive in the medical plastics industry. This medical plastics market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The medical plastics market consists of sales of polycarbonate, acrylonitrile butadiene styrene (ABS), polyethylene terephthalate glycol (PETG), and polymethyl methacrylate. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Medical Plastics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on medical plastics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for medical plastics? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The medical plastics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) Covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Polyvinyl Chloride (PVC); Polypropylene (PP); Engineering Plastics; Polyethylene (PE); Polystyrene (PS); Silicones; Other Types2) By Process Technology: Extrusion; Injection Molding; Blow Molding; Other Process Technologies

3) By Application: Medical Disposables; Medical Instruments; Prosthetics & Implants; Drugs Packaging; Other Applications

Subsegments:

1) By Polyvinyl Chloride (PVC): Rigid PVC; Flexible PVC2) By Polypropylene (PP): Homopolymer Polypropylene; Copolymer Polypropylene

3) By Engineering Plastics: Polycarbonate (PC); Nylon (Polyamide); Acrylonitrile Butadiene Styrene (ABS)

4) By Polyethylene (PE): Low-Density Polyethylene (LDPE); High-Density Polyethylene (HDPE)

5) By Polystyrene (PS): General Purpose Polystyrene (GPPS); High Impact Polystyrene (HIPS)

6) By Silicones: Liquid Silicone Rubber (LSR); High-Temperature Vulcanized (HTV) Silicone

7) By Other Types: Thermoplastic Elastomers (TPE); Bio-based Plastics; Polyurethane (PU)

Key Companies Mentioned: BASF SE; Celanese Corporation; Solvay S.a.; Arkema SA; Eastman Chemical Company

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Medical Plastics market report include:- BASF SE

- Celanese Corporation

- Solvay S.A.

- Arkema SA

- Eastman Chemical Company

- Dow Inc.

- Saudi Arabia's Basic Industries Corporation

- Evonik Industries AG

- Röchling SE & Co. KG

- Nolato AB

- Saint-Gobain Performance Plastics

- Orthoplastics Ltd.

- Tekni-Plex Inc.

- HMC Polymers Co. Ltd.

- ARAN BIOMEDICAL TEORANTA

- Trelleborg AB

- Raumedic AG

- Ensinger GmbH

- RTP Company Inc.

- Foster Corporation

- PolyOne Corporation

- DSM Engineering Plastics Pvt. Ltd.

- Covestro AG

- DuPont de Nemours Inc.

- Exxon Mobil Corporation

- Lubrizol Corporation

- Trinseo LLC

- Mitsubishi Chemical Corporation

- Sumitomo Chemical Co. Ltd.

- Kuraray Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 37.94 Billion |

| Forecasted Market Value ( USD | $ 57.68 Billion |

| Compound Annual Growth Rate | 11.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |