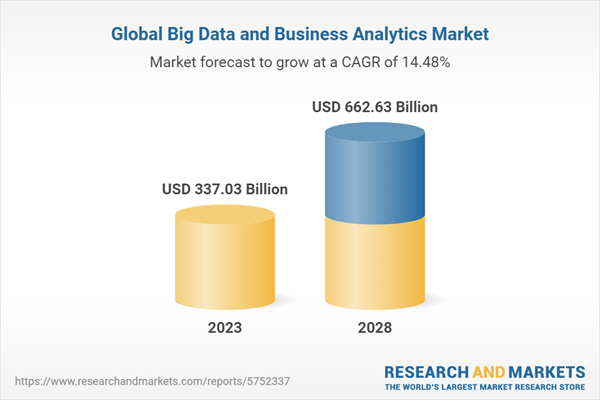

The global big data and business analytics market in 2022 was valued at US$294.16 billion. The market value is anticipated to grow to US$662.63 billion by 2028. Big data and business analytics refer to the process of gathering useful information from large set of structured and unstructured data for discovering hidden patterns and analyzing real-time information. Artificial Intelligence (AI) and Machine Learning (ML) are proving to be essential instruments to keep control over increasing amounts of data and to enable real-time execution.

The market value is expected to grow at a CAGR of 14.48% during the forecast period of 2023-2028, with software segment being the dominant component. There has been a surge in adoption of big data analytics software by various organizations to deliver enhanced & faster decision-making and to provide competitive advantage by analyzing and acting upon information in a timely manner. In addition, increase in demand for cloud-based big data analytics software among small & medium enterprises positively impacts the growth of the market.

Market Segmentation Analysis:

- By Component: The report provides the bifurcation of the market into three segments based on the component: software, services and hardware. In 2022, in terms of value, software segment held the major share in the market, followed by services. The increasing need for data-driven decision-making, the growing volume and variety of data, and the increasing adoption of cloud-based technologies are some of the factors driving the growth of the big data and business analytics software market.

- By Analytics Tool: The report provides the bifurcation of the market into into five segments based on the analytics tool: dash board & data visualization, data mining & warehousing, reporting tool, self-service tool and others. In 2022, dash board & data visualization held the major share in the market, followed by data mining & warehousing. The explosion of data from various sources has made it difficult for businesses to manage and analyze data effectively. Dashboard and data visualization tools help to simplify this process, providing a way to make sense of large volumes of data quickly and easily. This is expected to incline the growth of dash board & data visualization market.

- By Application: The report provides the bifurcation of the market into into six segments based on the application: customer analytics, supply chain analytics, marketing analytics, pricing analytics, workforce analytics and others. In 2022, customer analytics hold a dominant position in the big data and business analytics market due to rise of digital channels. Businesses are facing intense competition in various industries, leading to a need for differentiation. Customer analytics can help companies identify opportunities for innovation and new product development based on customer needs and preferences.

- By Industry Vertical: The report provides the bifurcation of the market into into ten segments based on the industry vertical: Banking, Financial Services and Insurance (BFSI), IT & telecom, manufacturing, healthcare, government, retail & e-commerce, education, energy & utilities, transportation and others. In 2022, BFSI hold a dominant position in the big data and business analytics market to gain insights into customer behavior, detect fraud, manage risks, and enhance operational efficiency. BFSI companies are using Big Data and Business Analytics to understand customer preferences, behavior, and needs to create targeted offerings that meet individual requirements. Financial fraud is a significant problem for BFSI companies, resulting in significant financial losses and reputational damage.

- By Region: The report provides insight into the big data and business analytics market based on the geographical operations, namely North America, Europe, Asia Pacific, Middle East & Africa and South America. North America held the major share in the market, owing to increasing adoption of cloud-based technologies, which are enabling businesses to store and analyze large amounts of data more efficiently and cost-effectively. Within North America, the US is leading the market. The US is an early adopter of advanced technologies, helping market vendors offer customized and advanced technology-enabled business analytics solutions for consumers. In addition, the region is witnessing high adoption of the cloud across organizations, thus enabling the proper implementation of business analytics.

Market Dynamics:

- Growth Drivers: One of the most important factors impacting the global big data and business analytics market is the surge in adoption of cloud computing. Cloud adoption have increased in recent times because vendors are making use of Software-as-a-Service (SaaS) to deliver cloud computing solutions. Besides, owing to AI and machine learning, global big data and business analytics market is expected to flourish during forecasted years as ML & AI can process large amounts of data quickly and accurately, which is essential for businesses to extract insights from their data. Furthermore, the market has been growing over the past few years, due to factors such as increasing amount of data, increasing use of big data analytics in supply chain management, and increasing adoption of big data analytics in various industries and many other factors.

- Challenges: However, the market has been confronted with some challenges specifically, data privacy and security and high cost of big data and business analytics solutions, etc.

- Trends: The market is projected to grow at a fast pace during the forecast period, due to various latest trends such as growing volume of internet of things (IoT) devices, emerging trends of social media analytics, increase in need to gain insights for business planning, rising use of dataops, evolution of streaming analytics and edge computing, etc. DataOps is playing a significant role in driving the growth of the big data market by enabling organizations to more effectively manage the challenges associated with big data. DataOps enables organizations to automate the testing and monitoring of data quality, which helps to improve the accuracy and reliability of data. Furthermore, Streaming analytics and edge computing can help organizations to be more efficient by reducing the amount of data that needs to be transmitted to the cloud or data center for analysis. This can help to reduce costs and improve performance, driving growth in the big data and business analytics market.

Impact Analysis of COVID-19 and Way Forward:

The COVID-19 pandemic has had a significant impact on the global big data and business analytics market. The pandemic has accelerated the adoption of big data and business analytics solutions across various industries, as companies look for ways to improve their operational efficiency, reduce costs, and gain insights into customer behavior. One of the biggest impacts of COVID-19 on the big data and business analytics market has been the increased demand for cloud-based solutions. With remote work becoming the norm for many businesses, there has been a growing need for cloud-based solutions that can be accessed from anywhere.

Competitive Landscape:

The global big data and business analytics market is highly fragmented due to the presence of many small and medium-sized companies competing with each other and large enterprises. Technological advancements in the market are also bringing sustainable competitive advantage to companies, and the market is witnessing multiple partnerships and mergers.

The key players in the global big data and business analytics market are:

- Amazon.com, Inc. (Amazon Web Services, Inc.)

- Microsoft Corp.

- International Business Machines Corporation (IBM)

- Oracle Corporation

- Salesforce.com, Inc.

- SAS Institute

- SAP SE

- Qlik

- Cisco Systems, Inc.

- Hewlett Packard Enterprise Company

- Teradata Corporation

- Accenture Plc.

Table of Contents

1. Executive Summary

2. Introduction

2.1 Big Data and Business Analytics: An Overview

2.1.1 Definition of Big Data and Business Analytics

2.2 Big Data and Business Analytics Segmentation: An Overview

2.2.1 Big Data and Business Analytics Segmentation

3. Global Market Analysis

3.1 Global Big Data and Business Analytics Market: An Analysis

3.1.1 Global Big Data and Business Analytics Market: An Overview

3.1.2 Global Big Data and Business Analytics Market by Value

3.1.3 Global Big Data and Business Analytics Market by Component (Software, Services And Hardware)

3.1.4 Global Big Data and Business Analytics Market by Analytics Tool (Dash Board & Data Visualization, Data Mining & Warehousing, Reporting Tool, Self-Service Tool And Others)

3.1.5 Global Big Data and Business Analytics Market by Application (Customer Analytics, Supply Chain Analytics, Marketing Analytics, Pricing Analytics, Workforce Analytics And Others)

3.1.6 Global Big Data and Business Analytics Market by Industry Vertical (BFSI, IT & Telecom, Manufacturing, Healthcare, Government, Retail & E-Commerce, Education, Energy & Utilities, Transportation And Others)

3.1.7 Global Big Data and Business Analytics Market by Region (North America, Asia Pacific, Europe, Middle East & Africa and South America)

3.2 Global Big Data and Business Analytics Market: Component Analysis

3.2.1 Global Big Data and Business Analytics Market by Component: An Overview

3.2.2 Global Big Data and Business Analytics Software Market by Value

3.2.3 Global Big Data and Business Analytics Services Market by Value

3.2.4 Global Big Data and Business Analytics Hardware Market by Value

3.3 Global Big Data and Business Analytics Market: Analytics Tool Analysis

3.3.1 Global Big Data and Business Analytics Market By Analytics Tool: An Overview

3.3.2 Global Dash board & Data Visualization Analytics Tool Market By Value

3.3.3 Global Data Mining & Warehousing Analytics Tool Market By Value

3.3.4 Global Reporting Analytics Tool Market By Value

3.3.5 Global Self-Service Analytics Tool Market By Value

3.3.6 Global Other Big Data and Business Analytics Tool Market By Value

3.4 Global Big Data and Business Analytics Market: Application Analysis

3.4.1 Global Big Data and Business Analytics Market By Application: An Overview

3.4.2 Global Customer Analytics Market By Value

3.4.3 Global Supply Chain Analytics Market By Value

3.4.4 Global Marketing Analytics Market By Value

3.4.5 Global Pricing Analytics Market By Value

3.4.6 Global Workforce Analytics Market By Value

3.4.7 Global Other Big Data and Business Analytics Market By Value

3.5 Global Big Data and Business Analytics Market: Industry Vertical Analysis

3.5.1 Global Big Data and Business Analytics Market By Industry Vertical: An Overview

3.5.2 Global BFSI Big Data and Business Analytics Market By Value

3.5.3 Global IT & Telecom Big Data and Business Analytics Market By Value

3.5.4 Global Manufacturing Big Data and Business Analytics Market By Value

3.5.5 Global Healthcare Big Data and Business Analytics Market By Value

3.5.6 Global Government Big Data and Business Analytics Market By Value

3.5.7 Global Retail & E-commerce Big Data and Business Analytics Market By Value

3.5.8 Global Education Big Data and Business Analytics Market By Value

3.5.9 Global Energy & Utilities Big Data and Business Analytics Market By Value

3.5.10 Global Transportation Big Data and Business Analytics Market By Value

3.5.11 Global Other Industries Big Data and Business Analytics Market By Value

4. Regional Market Analysis

4.1 North America Big Data and Business Analytics Market: An Analysis

4.1.1 North America Big Data and Business Analytics Market: An Overview

4.1.2 North America Big Data and Business Analytics Market by Value

4.1.3 North America Big Data and Business Analytics Market by Region (The US, Mexico, and Canada)

4.1.4 The US Big Data and Business Analytics Market by Value

4.1.5 Canada Big Data and Business Analytics Market by Value

4.1.6 Mexico Big Data and Business Analytics Market by Value

4.2 Asia Pacific Big Data and Business Analytics Market: An Analysis

4.2.1 Asia Pacific Big Data and Business Analytics Market: An Overview

4.2.2 Asia Pacific Big Data and Business Analytics Market by Value

4.2.3 Asia Pacific Big Data and Business Analytics Market by Region (China, Japan, India, South Korea, Australia and Rest of Asia Pacific)

4.2.4 China Big Data and Business Analytics Market by Value

4.2.5 India Big Data and Business Analytics Market by Value

4.2.6 Japan Big Data and Business Analytics Market by Value

4.2.7 South Korea Big Data and Business Analytics Market by Value

4.2.8 Australia Big Data and Business Analytics Market by Value

4.2.9 Rest of Asia Pacific Big Data and Business Analytics Market by Value

4.3 Europe Big Data and Business Analytics Market: An Analysis

4.3.1 Europe Big Data and Business Analytics Market: An Overview

4.3.2 Europe Big Data and Business Analytics Market by Value

4.3.3 Europe Big Data and Business Analytics Market by Region (UK, Germany, France, Italy and Rest of Europe)

4.3.4 United Kingdom Big Data and Business Analytics Market by Value

4.3.5 Germany Big Data and Business Analytics Market by Value

4.3.6 France Big Data and Business Analytics Market by Value

4.3.7 Italy Big Data and Business Analytics Market by Value

4.3.8 Rest of Europe Big Data and Business Analytics Market by Value

4.4 Middle East & Africa Big Data and Business Analytics Market: An Analysis

4.4.1 Middle East & Africa Big Data and Business Analytics Market: An Overview

4.4.2 Middle East & Africa Big Data and Business Analytics Market by Value

4.5 South America Big Data and Business Analytics Market: An Analysis

4.5.1 South America Big Data and Business Analytics Market: An Overview

4.5.2 South America Big Data and Business Analytics Market by Value

5. Impact of COVID-19

5.1 Impact of COVID-19

5.1.1 Impact of COVID-19 on Big Data and Business Analytics Market

5.1.2 Post-COVID-19 Scenario of Big Data and Business Analytics Market

6. Market Dynamics

6.1 Growth Drivers

6.1.1 Surge in Adoption of Cloud Computing

6.1.2 Integration of Artificial Intelligence

6.1.3 Increasing Amount Of Data

6.1.4 Increasing Use of Big Data Analytics in Supply Chain Management

6.1.5 Increasing Adoption Of Big Data Analytics In Various Industries

6.2 Challenges

6.2.1 Data Privacy and Security

6.2.2 High Cost Of Big Data And Business Analytics Solutions

6.3 Market Trends

6.3.1 Growing Volume of Internet of Things (IoT) Devices

6.3.2 Emerging Trends Of Social Media Analytics

6.3.3 Increase In Need To Gain Insights For Business Planning

6.3.4 Rising Use of DataOps

6.3.5 Evolution Of Streaming Analytics And Edge Computing

7. Competitive Landscape

7.1 Global Big Data and Business Analytics Market Players: Key Comparison

8. Company Profiles

8.1 Amazon.com, Inc. (Amazon Web Services, Inc.)

8.1.1 Business Overview

8.1.2 Operating Segments

8.1.3 Business Strategy

8.2 Microsoft Corp.

8.2.1 Business Overview

8.2.2 Operating Segments

8.2.3 Business Strategy

8.3 International Business Machines Corporation (IBM)

8.3.1 Business Overview

8.3.2 Operating Businesses

8.3.3 Business Strategy

8.4 Oracle Corporation

8.4.1 Business Overview

8.4.2 Operating Segments

8.4.3 Business Strategy

8.5 Salesforce.com, Inc.

8.5.1 Business Overview

8.5.2 Operating Segments

8.5.3 Business Strategy

8.6 SAS Institute

8.6.1 Business Overview

8.6.2 Business Strategy

8.7 SAP SE

8.7.1 Business Overview

8.7.2 Operating Segment

8.7.2 Business Strategy

8.8 Qlik

8.8.1 Business Overview

8.8.2 Business Strategy

8.9 Cisco Systems, Inc.

8.9.1 Business Overview

8.9.2 Geographic Segments

8.9.3 Business Strategy

8.10 Hewlett Packard Enterprise Company

8.10.1 Business Overview

8.10.2 Operating Segments

8.10.3 Business Strategy

8.11 Teradata Corporation

8.11.1 Business Overview

8.11.2 Operating Segments

8.11.3 Business Strategy

8.12 Accenture Plc.

8.12.1 Business Overview

8.12.2 Operating Segments

8.12.3 Business Strategy

List of Figures

Figure 1: Advantages of Big Data and Business Analytics

Figure 2: Big Data and Business Analytics Segmentation

Figure 3: Global Big Data and Business Analytics Market by Value; 2018-2022 (US$ Billion)

Figure 4: Global Big Data and Business Analytics Market by Value; 2023-2028 (US$ Billion)

Figure 5: Global Big Data and Business Analytics Market by Component; 2022 (Percentage, %)

Figure 6: Global Big Data and Business Analytics Market by Analytics Tool; 2022 (Percentage, %)

Figure 7: Global Big Data and Business Analytics Market by Application; 2022 (Percentage, %)

Figure 8: Global Big Data and Business Analytics Market by Industry Vertical; 2022 (Percentage, %)

Figure 9: Global Big Data and Business Analytics Market by Region; 2022 (Percentage, %)

Figure 10: Global Big Data and Business Analytics Software Market by Value; 2018-2022 (US$ Billion)

Figure 11: Global Big Data and Business Analytics Software Market by Value; 2023-2028 (US$ Billion)

Figure 12: Global Big Data and Business Analytics Services Market by Value; 2018-2022 (US$ Billion)

Figure 13: Global Big Data and Business Analytics Services Market by Value; 2023-2028 (US$ Billion)

Figure 14: Global Big Data and Business Analytics Hardware Market by Value; 2018-2022 (US$ Billion)

Figure 15: Global Big Data and Business Analytics Hardware Market by Value; 2023-2028 (US$ Billion)

Figure 16: Global Dashboard & Data Visualization Analytics Tool Market By Value; 2018-2022 (US$ Billion)

Figure 17: Global Dashboard & Data Visualization Analytics Tool Market By Value; 2023-2028 (US$ Billion)

Figure 18: Global Data Mining & Warehousing Analytics Tool Market By Value; 2018-2022 (US$ Billion)

Figure 19: Global Data Mining & Warehousing Analytics Tool Market By Value; 2023-2028 (US$ Billion)

Figure 20: Global Reporting Analytics Tool Market By Value; 2023-2028 (US$ Billion)

Figure 21: Global Reporting Analytics Tool Market By Value; 2023-2028 (US$ Billion)

Figure 22: Global Self-Service Analytics Tool Market By Value; 2018-2022 (US$ Billion)

Figure 23: Global Self-Service Analytics Tool Market By Value; 2023-2028 (US$ Billion)

Figure 24: Global Other Big Data and Business Analytics Tool Market By Value; 2018-2022 (US$ Billion)

Figure 25: Global Other Big Data and Business Analytics Tool Market By Value; 2023-2028 (US$ Billion)

Figure 26: Global Customer Analytics Market By Value; 2018-2022 (US$ Billion)

Figure 27: Global Customer Analytics Market By Value; 2023-2028 (US$ Billion)

Figure 28: Global Supply Chain Analytics Market By Value; 2018-2022 (US$ Billion)

Figure 29: Global Supply Chain Analytics Market By Value; 2023-2028 (US$ Billion)

Figure 30: Global Marketing Analytics Market By Value; 2018-2022 (US$ Billion)

Figure 31: Global Marketing Analytics Market By Value; 2023-2028 (US$ Billion)

Figure 32: Global Pricing Analytics Market By Value; 2018-2022 (US$ Billion)

Figure 33: Global Pricing Analytics Market By Value; 2023-2028 (US$ Billion)

Figure 34: Global Workforce Analytics Market By Value; 2018-2022 (US$ Billion)

Figure 35: Global Workforce Analytics Market By Value; 2023-2028 (US$ Billion)

Figure 36: Global Other Big Data and Business Analytics Market By Value; 2018-2022 (US$ Billion)

Figure 37: Global Other Big Data and Business Analytics Market By Value; 2023-2028 (US$ Billion)

Figure 38: Global BFSI Big Data and Business Analytics Market By Value; 2018-2022 (US$ Billion)

Figure 39: Global BFSI Big Data and Business Analytics Market By Value; 2023-2028 (US$ Billion)

Figure 40: Global IT & Telecom Big Data and Business Analytics Market By Value; 2018-2022 (US$ Billion)

Figure 41: Global IT & Telecom Big Data and Business Analytics Market By Value; 2018-2022 (US$ Billion)

Figure 42: Global Manufacturing Big Data and Business Analytics Market By Value; 2018-2022 (US$ Billion)

Figure 43: Global Manufacturing Big Data and Business Analytics Market By Value; 2018-2022 (US$ Billion)

Figure 44: Global Healthcare Big Data and Business Analytics Market By Value; 2018-2022 (US$ Billion)

Figure 45: Global Healthcare Big Data and Business Analytics Market By Value; 2018-2022 (US$ Billion)

Figure 46: Global Government Big Data and Business Analytics Market By Value; 2018-2022 (US$ Billion)

Figure 47: Global Government Big Data and Business Analytics Market By Value; 2018-2022 (US$ Billion)

Figure 48: Global Retail & E-commerce Big Data and Business Analytics Market By Value; 2018-2022 (US$ Billion)

Figure 49: Global Retail & E-commerce Big Data and Business Analytics Market By Value; 2018-2022 (US$ Billion)

Figure 50: Global Education Big Data and Business Analytics Market By Value; 2018-2022 (US$ Billion)

Figure 51: Global Education Big Data and Business Analytics Market By Value; 2018-2022 (US$ Billion)

Figure 52: Global Energy & Utilities Big Data and Business Analytics Market By Value; 2018-2022 (US$ Billion)

Figure 53: Global Energy & Utilities Big Data and Business Analytics Market By Value; 2018-2022 (US$ Billion)

Figure 54: Global Transportation Big Data and Business Analytics Market By Value; 2018-2022 (US$ Billion)

Figure 55: Global Transportation Big Data and Business Analytics Market By Value; 2018-2022 (US$ Billion)

Figure 56: Global Other Industries Big Data and Business Analytics Market By Value; 2018-2022 (US$ Billion)

Figure 57: Global Other Industries Big Data and Business Analytics Market By Value; 2018-2022 (US$ Billion)

Figure 58: North America Big Data and Business Analytics Market by Value; 2018-2022 (US$ Billion)

Figure 59: North America Big Data and Business Analytics Market by Value; 2023-2028 (US$ Billion)

Figure 60: North America Big Data and Business Analytics Market by Region; 2022 (Percentage, %)

Figure 61: The US Big Data and Business Analytics Market by Value; 2018-2022 (US$ Billion)

Figure 62: The US Big Data and Business Analytics Market by Value; 2023-2028 (US$ Billion)

Figure 63: Canada Big Data and Business Analytics Market by Value; 2018-2022 (US$ Billion)

Figure 64: Canada Big Data and Business Analytics Market by Value; 2023-2028 (US$ Billion)

Figure 65: Mexico Big Data and Business Analytics Market by Value; 2018-2022 (US$ Billion)

Figure 66: Mexico Big Data and Business Analytics Market by Value; 2023-2028 (US$ Billion)

Figure 67: Asia Pacific Big Data and Business Analytics Market by Value; 2018-2022 (US$ Billion)

Figure 68: Asia Pacific Big Data and Business Analytics Market by Value; 2023-2028 (US$ Billion)

Figure 69: Asia Pacific Big Data and Business Analytics Market by Region; 2022 (Percentage, %)

Figure 70: China Big Data and Business Analytics Market by Value, 2018-2022 (US$ Billion)

Figure 71: China Big Data and Business Analytics Market by Value; 2023-2028 (US$ Billion)

Figure 72: India Big Data and Business Analytics Market by Value, 2018-2022 (US$ Billion)

Figure 73: India Big Data and Business Analytics Market by Value; 2023-2028 (US$ Billion)

Figure 74: Japan Big Data and Business Analytics Market by Value, 2018-2022 (US$ Billion)

Figure 75: Japan Big Data and Business Analytics Market by Value; 2023-2028 (US$ Billion)

Figure 76: South Korea Big Data and Business Analytics Market by Value, 2018-2022 (US$ Billion)

Figure 77: South Korea Big Data and Business Analytics Market by Value; 2023-2028 (US$ Billion)

Figure 78: Australia Big Data and Business Analytics Market by Value, 2018-2022 (US$ Billion)

Figure 79: Australia Big Data and Business Analytics Market by Value; 2023-2028 (US$ Billion)

Figure 80: Rest of Asia Pacific Big Data and Business Analytics Market by Value, 2018-2022 (US$ Billion)

Figure 81: Rest of Asia Pacific Big Data and Business Analytics Market by Value; 2023-2028 (US$ Billion)

Figure 82: Europe Big Data and Business Analytics Market by Value; 2018-2022 (US$ Billion)

Figure 83: Europe Big Data and Business Analytics Market by Value; 2023-2028 (US$ Billion)

Figure 84: Europe Big Data and Business Analytics Market by Region; 2022 (Percentage, %)

Figure 85: United Kingdom Big Data and Business Analytics Market by Value; 2018-2022 (US$ Billion)

Figure 86: United Kingdom Big Data and Business Analytics Market by Value; 2023-2028 (US$ Billion)

Figure 87: Germany Big Data and Business Analytics Market by Value; 2018-2022 (US$ Billion)

Figure 88: Germany Big Data and Business Analytics Market by Value; 2023-2028 (US$ Billion)

Figure 89: France Big Data and Business Analytics Market by Value; 2018-2022 (US$ Billion)

Figure 90: France Big Data and Business Analytics Market by Value; 2023-2028 (US$ Billion)

Figure 91: Italy Big Data and Business Analytics Market by Value; 2018-2022 (US$ Billion)

Figure 92: Italy Big Data and Business Analytics Market by Value; 2023-2028 (US$ Billion)

Figure 93: Rest of Europe Big Data and Business Analytics Market by Value; 2018-2022 (US$ Billion)

Figure 94: Rest of Europe Big Data and Business Analytics Market by Value; 2023-2028 (US$ Billion)

Figure 95: Middle East & Africa Big Data and Business Analytics Market by Value; 2018-2022 (US$ Billion)

Figure 96: Middle East & Africa Big Data and Business Analytics Market by Value; 2023-2028 (US$ Billion)

Figure 97: South America Big Data and Business Analytics Market by Value; 2018-2022 (US$ Billion)

Figure 98: South America Big Data and Business Analytics Market by Value; 2023-2028 (US$ Billion)

Figure 99: Global Whole Cloud Forecast; 2021-2025 (US$ Billion)

Figure 100: Global Artificial Intelligence Market; 2021-2030 (US$ Billion)

Figure 101: Global Data Forecast; 2021-2026 (Thousand Exabytes)

Figure 102: Global Supply Chain Management Market; 2020-2026 (US$ Billion)

Figure 103: Global Number Of Data Records Exposed; Q1 2020-Q3 2022 (Million)

Figure 104: Global Number of Internet of Things (IoT) Devices Connections; 2019-2024 (Billion)

Figure 105: Amazon.com, Inc. Net Sales by Operating Segments; 2022 (Percentage, %)

Figure 106: Microsoft Corp. Revenue by Operating Segment; 2022 (Percentage, %)

Figure 107: International Business Machines Corporation (IBM) Revenue by Operating Segment; 2021 (Percentage, %)

Figure 108: Oracle Corporation Revenue by Operating Segments; 2022 (Percentage, %)

Figure 109: Salesforce.com, Inc. Revenue by Operating Regions; 2022 (Percentage,%)

Figure 110: SAP SE Revenue by Operating Segments; 2022 (Percentage, %)

Figure 111: Cisco Systems, Inc. Revenue by Geographic Segments; 2021 (Percentage, %)

Figure 112: Hewlett Packard Enterprise Company Net Revenue by Operating Segments; 2022 (Percentage, %)

Figure 113: Teradata Corporation Revenue by Operating Segment; 2022 (Percentage, %)

Figure 114: Accenture Plc. Revenue by Operating Segment; 2022 (Percentage, %)

Table 1: Global Big Data and Business Analytics Market Players : Key Comparison

Companies Mentioned

- Amazon.com, Inc. (Amazon Web Services, Inc.)

- Microsoft Corp.

- International Business Machines Corporation (IBM)

- Oracle Corporation

- Salesforce.com, Inc.

- SAS Institute

- SAP SE

- Qlik

- Cisco Systems, Inc.

- Hewlett Packard Enterprise Company

- Teradata Corporation

- Accenture Plc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 191 |

| Published | March 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 337.03 Billion |

| Forecasted Market Value ( USD | $ 662.63 Billion |

| Compound Annual Growth Rate | 14.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |