A workflow management system offers a framework for the setup, execution, and oversight of a specified list of tasks organized as a workflow application.

Workflow management software is a component of the attempts to automate and simplify company processes across various businesses and industry verticals. Growth in the market is anticipated to be fueled by advantages such as cost-effectiveness, better resource utilization, and improved business processes related to the installation of workflow management software. Workflow management software is becoming more necessary as businesses expand, their industries change, and they are forced to manage more significant data quantities and features.

Workflow management solutions boost productivity, employee happiness, and customer satisfaction by removing the monotonous chores weighing down 90% of employees.

By eliminating tiresome activities and expediting response times, workflow management solutions boost productivity, reduce employee angst, and boost customer satisfaction. The capacity to automate as much of the process as feasible is a crucial aspect of workflow management. Change is inevitable yet challenging to embrace at every age. In the twenty-first century, computers, laptops, and cell phones have increased the size of the workforce. People rely on their cell phones for business and personal chores and take advantage of the cloud's flexibility to access data from any device. Using a workflow management system should be easy, given the widespread exposure to technology improvements. It is amazing how many companies even fail to recognize the value of workflow software or a BPM solution for their company processes.

People using email as a business communication tool is the most prevalent and recurring error in any organization. While it should only be used for brief communications, it is intended to communicate information. Long email trails often include essential business files that vanish. Also, even when emails group all relevant communications together, workers will still deal with threads containing hundreds of messages, making the communication process ineffective. A workflow tool may prevent this by maintaining a single source of truth, tracking all changes, showing the most recent iteration of a discussion thread, and saving valuable time from having to go through several emails.

COVID-19 Impact Analysis

The COVID-19 outbreak has made supply chains' vulnerabilities clear. Critical IT service providers are part of a fragile ecosystem for the majority of IT enterprises. The service providers also made sure that mission-critical corporate clients had access to the tools and technology required to allow the speed, security, quality, and overall effectiveness of the services offered as a result of work-from-home regulations. Businesses are expected to be significantly impacted by the COVID-19 pandemic, which will stifle innovation, dampen profitability, and deplete cash flow. Yet, there has been a little detrimental effect on the software sector, particularly the market for workflow management systems.Market Growth Factors

Increasing use of Industry 4.0 by industrial businesses

Process automation is anticipated to expand significantly over the following years as Industry 4.0 ideas are increasingly adopted by industrial sectors, including oil & gas, food & beverage, and chemicals. With the introduction of Industry 4.0, most manufacturing industry processes and systems are automated by utilizing various technologies, including cyber-physical systems, IoT, and cloud computing, enabling production units to run effectively around the clock without human error. It assists in reducing manufacturing cycle times and achieving process efficiency from the sourcing of raw materials through the creation of the finished product. The adoption of Industry 4.0, therefore, sped up the development of the market for workflow management systems.Clearly define resources

Clarity on what is expected of responsible workers while carrying out duties within a process is provided by the role and task assignments. Such elements improve openness and accountability. You may achieve a simplified procedure and reliable outcomes with the appropriate workflow management application. For instance, customer support processes in telecoms are often managed via workflow management systems. These technologies can guarantee that consumers get timely service and that their questions are correctly addressed. The need is being driven by the deployment of workflow management systems in many sectors.Market Restraining Factors

Security and Privacy Issues

Physical security is necessary for manual procedures where data protection is required. Sometimes paperwork must be kept in protected file cabinets, or tasks must be carried out in secure locations. Automatic workflows enable data gathered via web forms to be despatched in an almost endless number of ways. When end users and management are shown how this data may be utilized to measure productivity, learn more about consumers, and fill out several forms with a single entry of data. Automation makes it simple to include security precautions and other checks and balances from the outset with the correct workflow software. Workflows, for instance, may be created such that only authorized individuals can access certain processes or specific data. Notwithstanding the enormous insight into process status that automated workflows provide, if security requires it, such access may be restricted to just certain persons.Component Outlook

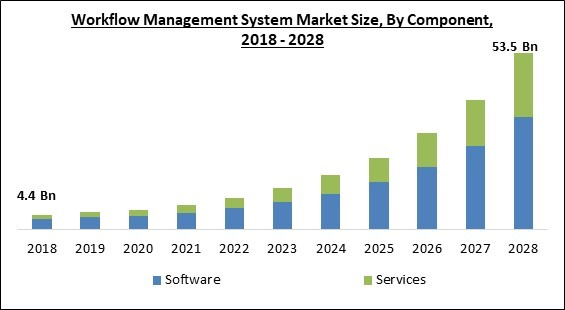

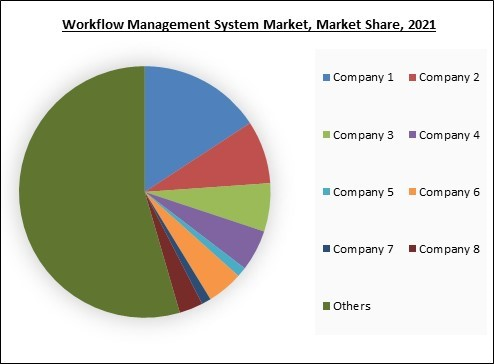

Based on component, the Workflow Management System Market is divided into Software and Service. In 2021, the software segment had the largest share of the market. Workflow management software's capacity to eliminate iterative work processes, which lower productivity, and modify traditional workflows augurs well for the sector's expansion. Software for managing workflows may be able to automate procedures and help with effective decision-making. Workflow is the effective movement of work and information through a business process.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

Software Type Outlook

Based on the Software Type, the Workflow Management System Market is divided into Production Workflow Systems, Messaging-based Workflow Systems, Web-based Workflow Systems, Suite-based Workflow Systems, and Others. In 2021, the Production Workflow System segment accounted for the largest revenue share. As with any project, developing a workflow may assist users in properly managing resources, making the most of their time, and ensuring the participation of the necessary teams and individuals. A production process may aid in eliminating inefficiencies, preventing expensive delays, and preventing misunderstanding since ROI is crucial for firms.Deployment Mode Outlook

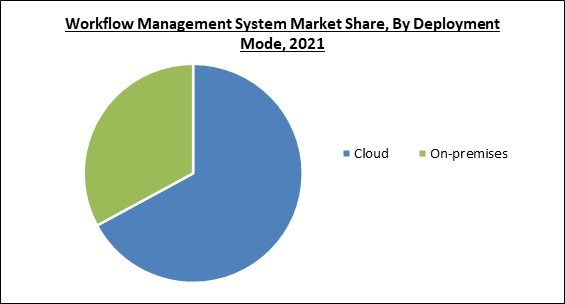

Based on deployment mode, the Workflow Management System Market is divided into Cloud and On-premises. In 2021, the on-premises segment obtained a prominent revenue share in the market. On-premise software's ability to be readily modified and adapted to the client's unique procedures may be credited with the segment's expansion. Initially, on-premise implementation was favored because it does not need an internet connection, is simple to customize, and guarantees complete control over sensitive corporate data. During the course of the projected period, the advantages offered by on-premise deployment will continue to fuel the industry.Vertical Outlook

Based on vertical, the Workflow Management System market can be classified into the BFSI, Healthcare, Retail, IT & Telecom, Travel & Hospitality, Transportation, and Others. The BFSI segment registered the major market share in 2021. Workflow management solutions in the BFSI sector include content management, records management, and business process automation. Workflow management systems can assist in establishing secure storage and communication systems for the data, allowing authorized access while thwarting all unauthorized attempts to access the data, taking into account the confidentiality associated with the data the incumbents of the BFSI industry must handle and the various ways this data can be exploited.Regional Outlook

Based on region, the Workflow Management System Market is divided into North America, Europe, Asia Pacific, and LAMEA. In 2021, North America accounted for maximum revenue share in the market. During the course of the projection period, it is anticipated that the expansion of the regional market for workflow management systems will be driven by the rising number of technology start-ups and the high use of cloud services, ERP, and CRM in North America. Also, Canadian and American investors offer to finance businesses creating software and services for workflow management systems.The Cardinal Matrix - Workflow Management System Market Competition Analysis

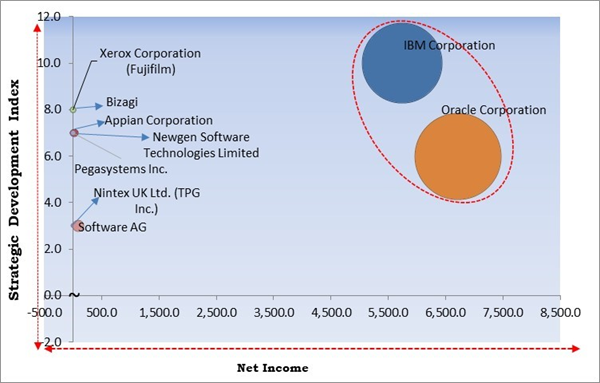

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; IBM Corporation and Oracle Corporation are the forerunners in the Workflow Management System Market. Companies such as Software AG, Newgen Software Technologies Limited, and Pegasystems Inc. are some of the key innovators in Workflow Management System Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include IBM Corporation, Oracle Corporation, Newgen Software Technologies Limited, Xerox Corporation, Appian Corporation, Nintex Global Ltd. (TPG Inc.), Software AG, Pegasystems Inc., Bizagi Group Limited, and Source Code Technologies LLC.

Strategies Deployed in Workflow Management System Market

Partnerships, Collaborations and Agreements:

- Sep-2022: Xerox came into partnership with LinkSquares, a Contract Lifecycle Management (CLM) platform for offering contract lifecycle management (CLM) capabilities to Xerox’s US customer base. LinkSquares' capabilities in providing contract management services and customer satisfaction would support Xerox’s customer base in enabling them to optimize work operations.

- Jul-2022: Newgen entered into partnership with Coforge, a digital services and solutions provider, to advance NewgenONE, a unified low-code digital transformation platform. With this partnership, Coforge’s capabilities in providing the implementation resource potential and business management power would be integrated with Newgen’s business insights-providing platform, NewgenONE, to help business leaders in the utilization of contextual content services, low code process automation, and customer communications management platforms in managing their business operations.

- Jun-2022: Newgen came into partnership with Anabatic Digital, an Indonesian-based IT solutions provider, to strengthen financial institutions to easily manage digital transformation processes. With this partnership, Anabatic's expertise in providing Mission Critical Digital Solutions would be combined with Newgen's technologies allowing Newgen to serve Indonesian financial institutions by enabling them to build integrated seamless journeys for their customers.

- Nov-2020: Bizagi and ABBYY, a document conversion, data capture, and linguistic software and services provider enterprise, came into a partnership to resolve the issues that businesses face while maintaining business continuity. With this partnership, Abbyy's intelligent document processing capabilities would be fused with Bizagi's low-code application platform for the transformation of manual and untrackable processes into agile digital applications to serve Bizagi's customers.

Product Launches and Product Expansions:

- Jan-2023: Software AG unveiled the launch of webMethods API Marketplace platform, an API and microservices management platform, to streamline the processes enabling developers to detect, perform on and deploy new APIs and integration tools or capabilities.

- Nov-2022: IBM unveiled IBM Business Analytics Enterprise software, developed for providing aid to enterprises in breaking down data and analytics silos for quick data-driven decision-making and providing direction in overcoming unpredictable obstacles. IBM Business Analytics Enterprise would encompass Analytics Content Hub that would provide integrated business intelligence solutions from different traders.

- Oct-2022: Oracle made enhancements in adding capabilities to the Oracle Fusion Cloud Applications portfolio with asset-driven solutions, a part of Oracle Fusion Service. Fused with Oracle Fusion Cloud Supply Chain & Manufacturing (SCM), Asset-Based Service developed for Tech-enabled and Manufacturing enterprises to facilitate companies enhancing customer satisfaction, cut costs, and elevate revenues through the optimization of service lifecycle management of assets.

- Sep-2022: Newgen released Low Code Trade Finance Platform, an all-inclusive, and customizable trade finance platform, facilitating banks in the paperless embracement and providing ease of flow in end-to-end processes that would act in accordance with domestic and international guidelines.

- Jul-2022: IBM made enhancements in adding capabilities to its business automation suite to incorporate two open-source offerings namely, IBM Process Automation Manager Open Edition and IBM Decision Manager Open Edition. IBM Process Automation Manager Open Edition would advance IBM's workflow offerings while Decision Manager Open Edition would add capabilities to IBM's decision management offerings.

- Jul-2022: Pegasystems Inc. released Pega Launchpad™, a cloud-driven, low-code application development platform. Pega Launchpad™ would strengthen customers to easily design and launch B2B SaaS applications for commercialization.

- Mar-2022: Oracle made enhancements in adding capabilities to Oracle Cloud Infrastructure, an advanced cloud developed for running applications securely and seamlessly. With added services and capabilities such as OCI Networking, OCI computes, and OCI bare metal instances would deliver customers, flexible infrastructure services, optimized resources, and reduced costs.

- Mar-2022: Xerox announced the launch of Workplace Productivity Solutions for improved productivity to serve hybrid workers. Workplace Productivity Solutions could be easily integrated with businesses' existing infrastructure, enabling businesses to make use of an extensive range of flexible collaboration and productivity tools.

- Nov-2021: Xerox released Xerox® Workflow Central, a secure, cloud-driven software platform that makes workflow automation and digitalization tools accessible from anywhere, anytime, facilitating groups to overcome obstacles that come in between workflow by enhancing productivity.

- Dec-2020: Appian unveiled an updated version of the Appian Low-code Automation Platform. This launch would make it simple for IT to propel quick and significant business value from a new generation of scalable and powerful company's automation technologies, combined on the sector's leading platform for low-code development. The latest platform introduction offers the automation technologies and the development speed that describes the new world of hyper automation.

- Oct-2020: Bizagi launched Customer Onboarding & KYC Accelerator for the management of onboarding of new customers. Customer Onboarding & KYC Accelerator would empower banks to manage their back-end processes enabling them to reduce costs and obtain high efficiencies all over diverse lines of business.

Mergers & Acquisition:

- May-2022: Pegasystems Inc. acquired Everflow, a Brazil-based process mining software enterprise. This acquisition would enable Pegasystems to harness the power of Everflow's intuitive software to allow Pega clients in fixing the untraceable process inefficiencies that lie in business operations.

- Jan-2020: Appian acquired Novayre Solutions SL, a developer of the Jidoka RPA platform. Through this acquisition, the company would create a single platform for RPA and low-code development allowing the integration of artificial intelligence, bots and humans.

Scope of the Study

By Component

- Software

- Production Workflow Systems

- Web-based Workflow Systems

- Messaging-based Workflow Systems

- Suite-based Workflow Systems

- Others

- Services

By Deployment Mode

- Cloud

- On-premises

By Vertical

- BFSI

- Telecom & IT

- Retail

- Healthcare

- Travel & Hospitality

- Transportation

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- IBM Corporation

- Oracle Corporation

- Newgen Software Technologies Limited

- Xerox Corporation

- Appian Corporation

- Nintex Global Ltd. (TPG Inc.)

- Software AG

- Pegasystems Inc.

- Bizagi Group Limited

- Source Code Technologies LLC

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Global Workflow Management System Market, by Component

1.4.2 Global Workflow Management System Market, by Deployment Mode

1.4.3 Global Workflow Management System Market, by Vertical

1.4.4 Global Workflow Management System Market, by Geography

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

3.1 Analyst's Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Product Launches and Product Expansions

3.2.3 Acquisition and Mergers

3.3 Market Share Analysis, 2021

3.4 Top Winning Strategies

3.4.1 Key Leading Strategies: Percentage Distribution (2018-2022)

3.4.2 Key Strategic Move: (Product Launches and Product Expansions: 2019, Sep - 2023, Jan) Leading Players

Chapter 4. Global Workflow Management System Market by Component

4.1 Global Software Market by Region

4.2 Global Workflow Management System Market by Software Type

4.2.1 Global Production Workflow Systems Market by Region

4.2.2 Global Web-based Workflow Systems Market by Region

4.2.3 Global Messaging-based Workflow Systems Market by Region

4.2.4 Global Suite-based Workflow Systems Market by Region

4.2.5 Global Others Market by Region

4.3 Global Services Market by Region

Chapter 5. Global Workflow Management System Market by Deployment Mode

5.1 Global Cloud Market by Region

5.2 Global On-premises Market by Region

Chapter 6. Global Workflow Management System Market by Vertical

6.1 Global BFSI Market by Region

6.2 Global Telecom & IT Market by Region

6.3 Global Retail Market by Region

6.4 Global Healthcare Market by Region

6.5 Global Travel & Hospitality Market by Region

6.6 Global Transportation Market by Region

6.7 Global Others Market by Region

Chapter 7. Global Workflow Management System Market by Region

7.1 North America Workflow Management System Market

7.1.1 North America Workflow Management System Market by Component

7.1.1.1 North America Software Market by Country

7.1.1.2 North America Workflow Management System Market by Software Type

7.1.1.2.1 North America Production Workflow Systems Market by Country

7.1.1.2.2 North America Web-based Workflow Systems Market by Country

7.1.1.2.3 North America Messaging-based Workflow Systems Market by Country

7.1.1.2.4 North America Suite-based Workflow Systems Market by Country

7.1.1.2.5 North America Others Market by Country

7.1.1.3 North America Services Market by Country

7.1.2 North America Workflow Management System Market by Deployment Mode

7.1.2.1 North America Cloud Market by Country

7.1.2.2 North America On-premises Market by Country

7.1.3 North America Workflow Management System Market by Vertical

7.1.3.1 North America BFSI Market by Country

7.1.3.2 North America Telecom & IT Market by Country

7.1.3.3 North America Retail Market by Country

7.1.3.4 North America Healthcare Market by Country

7.1.3.5 North America Travel & Hospitality Market by Country

7.1.3.6 North America Transportation Market by Country

7.1.3.7 North America Others Market by Country

7.1.4 North America Workflow Management System Market by Country

7.1.4.1 US Workflow Management System Market

7.1.4.1.1 US Workflow Management System Market by Component

7.1.4.1.1.1 US Workflow Management System Market by Software Type

7.1.4.1.2 US Workflow Management System Market by Deployment Mode

7.1.4.1.3 US Workflow Management System Market by Vertical

7.1.4.2 Canada Workflow Management System Market

7.1.4.2.1 Canada Workflow Management System Market by Component

7.1.4.2.1.1 Canada Workflow Management System Market by Software Type

7.1.4.2.2 Canada Workflow Management System Market by Deployment Mode

7.1.4.2.3 Canada Workflow Management System Market by Vertical

7.1.4.3 Mexico Workflow Management System Market

7.1.4.3.1 Mexico Workflow Management System Market by Component

7.1.4.3.1.1 Mexico Workflow Management System Market by Software Type

7.1.4.3.2 Mexico Workflow Management System Market by Deployment Mode

7.1.4.3.3 Mexico Workflow Management System Market by Vertical

7.1.4.4 Rest of North America Workflow Management System Market

7.1.4.4.1 Rest of North America Workflow Management System Market by Component

7.1.4.4.1.1 Rest of North America Workflow Management System Market by Software Type

7.1.4.4.2 Rest of North America Workflow Management System Market by Deployment Mode

7.1.4.4.3 Rest of North America Workflow Management System Market by Vertical

7.2 Europe Workflow Management System Market

7.2.1 Europe Workflow Management System Market by Component

7.2.1.1 Europe Software Market by Country

7.2.1.2 Europe Workflow Management System Market by Software Type

7.2.1.2.1 Europe Production Workflow Systems Market by Country

7.2.1.2.2 Europe Web-based Workflow Systems Market by Country

7.2.1.2.3 Europe Messaging-based Workflow Systems Market by Country

7.2.1.2.4 Europe Suite-based Workflow Systems Market by Country

7.2.1.2.5 Europe Others Market by Country

7.2.1.3 Europe Services Market by Country

7.2.2 Europe Workflow Management System Market by Deployment Mode

7.2.2.1 Europe Cloud Market by Country

7.2.2.2 Europe On-premises Market by Country

7.2.3 Europe Workflow Management System Market by Vertical

7.2.3.1 Europe BFSI Market by Country

7.2.3.2 Europe Telecom & IT Market by Country

7.2.3.3 Europe Retail Market by Country

7.2.3.4 Europe Healthcare Market by Country

7.2.3.5 Europe Travel & Hospitality Market by Country

7.2.3.6 Europe Transportation Market by Country

7.2.3.7 Europe Others Market by Country

7.2.4 Europe Workflow Management System Market by Country

7.2.4.1 Germany Workflow Management System Market

7.2.4.1.1 Germany Workflow Management System Market by Component

7.2.4.1.1.1 Germany Workflow Management System Market by Software Type

7.2.4.1.2 Germany Workflow Management System Market by Deployment Mode

7.2.4.1.3 Germany Workflow Management System Market by Vertical

7.2.4.2 UK Workflow Management System Market

7.2.4.2.1 UK Workflow Management System Market by Component

7.2.4.2.1.1 UK Workflow Management System Market by Software Type

7.2.4.2.2 UK Workflow Management System Market by Deployment Mode

7.2.4.2.3 UK Workflow Management System Market by Vertical

7.2.4.3 France Workflow Management System Market

7.2.4.3.1 France Workflow Management System Market by Component

7.2.4.3.1.1 France Workflow Management System Market by Software Type

7.2.4.3.2 France Workflow Management System Market by Deployment Mode

7.2.4.3.3 France Workflow Management System Market by Vertical

7.2.4.4 Russia Workflow Management System Market

7.2.4.4.1 Russia Workflow Management System Market by Component

7.2.4.4.1.1 Russia Workflow Management System Market by Software Type

7.2.4.4.2 Russia Workflow Management System Market by Deployment Mode

7.2.4.4.3 Russia Workflow Management System Market by Vertical

7.2.4.5 Spain Workflow Management System Market

7.2.4.5.1 Spain Workflow Management System Market by Component

7.2.4.5.1.1 Spain Workflow Management System Market by Software Type

7.2.4.5.2 Spain Workflow Management System Market by Deployment Mode

7.2.4.5.3 Spain Workflow Management System Market by Vertical

7.2.4.6 Italy Workflow Management System Market

7.2.4.6.1 Italy Workflow Management System Market by Component

7.2.4.6.1.1 Italy Workflow Management System Market by Software Type

7.2.4.6.2 Italy Workflow Management System Market by Deployment Mode

7.2.4.6.3 Italy Workflow Management System Market by Vertical

7.2.4.7 Rest of Europe Workflow Management System Market

7.2.4.7.1 Rest of Europe Workflow Management System Market by Component

7.2.4.7.1.1 Rest of Europe Workflow Management System Market by Software Type

7.2.4.7.2 Rest of Europe Workflow Management System Market by Deployment Mode

7.2.4.7.3 Rest of Europe Workflow Management System Market by Vertical

7.3 Asia Pacific Workflow Management System Market

7.3.1 Asia Pacific Workflow Management System Market by Component

7.3.1.1 Asia Pacific Software Market by Country

7.3.1.2 Asia Pacific Workflow Management System Market by Software Type

7.3.1.2.1 Asia Pacific Production Workflow Systems Market by Country

7.3.1.2.2 Asia Pacific Web-based Workflow Systems Market by Country

7.3.1.2.3 Asia Pacific Messaging-based Workflow Systems Market by Country

7.3.1.2.4 Asia Pacific Suite-based Workflow Systems Market by Country

7.3.1.2.5 Asia Pacific Others Market by Country

7.3.1.3 Asia Pacific Services Market by Country

7.3.2 Asia Pacific Workflow Management System Market by Deployment Mode

7.3.2.1 Asia Pacific Cloud Market by Country

7.3.2.2 Asia Pacific On-premises Market by Country

7.3.3 Asia Pacific Workflow Management System Market by Vertical

7.3.3.1 Asia Pacific BFSI Market by Country

7.3.3.2 Asia Pacific Telecom & IT Market by Country

7.3.3.3 Asia Pacific Retail Market by Country

7.3.3.4 Asia Pacific Healthcare Market by Country

7.3.3.5 Asia Pacific Travel & Hospitality Market by Country

7.3.3.6 Asia Pacific Transportation Market by Country

7.3.3.7 Asia Pacific Others Market by Country

7.3.4 Asia Pacific Workflow Management System Market by Country

7.3.4.1 China Workflow Management System Market

7.3.4.1.1 China Workflow Management System Market by Component

7.3.4.1.1.1 China Workflow Management System Market by Software Type

7.3.4.1.2 China Workflow Management System Market by Deployment Mode

7.3.4.1.3 China Workflow Management System Market by Vertical

7.3.4.2 Japan Workflow Management System Market

7.3.4.2.1 Japan Workflow Management System Market by Component

7.3.4.2.1.1 Japan Workflow Management System Market by Software Type

7.3.4.2.2 Japan Workflow Management System Market by Deployment Mode

7.3.4.2.3 Japan Workflow Management System Market by Vertical

7.3.4.3 India Workflow Management System Market

7.3.4.3.1 India Workflow Management System Market by Component

7.3.4.3.1.1 India Workflow Management System Market by Software Type

7.3.4.3.2 India Workflow Management System Market by Deployment Mode

7.3.4.3.3 India Workflow Management System Market by Vertical

7.3.4.4 South Korea Workflow Management System Market

7.3.4.4.1 South Korea Workflow Management System Market by Component

7.3.4.4.1.1 South Korea Workflow Management System Market by Software Type

7.3.4.4.2 South Korea Workflow Management System Market by Deployment Mode

7.3.4.4.3 South Korea Workflow Management System Market by Vertical

7.3.4.5 Singapore Workflow Management System Market

7.3.4.5.1 Singapore Workflow Management System Market by Component

7.3.4.5.1.1 Singapore Workflow Management System Market by Software Type

7.3.4.5.2 Singapore Workflow Management System Market by Deployment Mode

7.3.4.5.3 Singapore Workflow Management System Market by Vertical

7.3.4.6 Malaysia Workflow Management System Market

7.3.4.6.1 Malaysia Workflow Management System Market by Component

7.3.4.6.1.1 Malaysia Workflow Management System Market by Software Type

7.3.4.6.2 Malaysia Workflow Management System Market by Deployment Mode

7.3.4.6.3 Malaysia Workflow Management System Market by Vertical

7.3.4.7 Rest of Asia Pacific Workflow Management System Market

7.3.4.7.1 Rest of Asia Pacific Workflow Management System Market by Component

7.3.4.7.1.1 Rest of Asia Pacific Workflow Management System Market by Software Type

7.3.4.7.2 Rest of Asia Pacific Workflow Management System Market by Deployment Mode

7.3.4.7.3 Rest of Asia Pacific Workflow Management System Market by Vertical

7.4 LAMEA Workflow Management System Market

7.4.1 LAMEA Workflow Management System Market by Component

7.4.1.1 LAMEA Software Market by Country

7.4.1.2 LAMEA Workflow Management System Market by Software Type

7.4.1.2.1 LAMEA Production Workflow Systems Market by Country

7.4.1.2.2 LAMEA Web-based Workflow Systems Market by Country

7.4.1.2.3 LAMEA Messaging-based Workflow Systems Market by Country

7.4.1.2.4 LAMEA Suite-based Workflow Systems Market by Country

7.4.1.2.5 LAMEA Others Market by Country

7.4.1.3 LAMEA Services Market by Country

7.4.2 LAMEA Workflow Management System Market by Deployment Mode

7.4.2.1 LAMEA Cloud Market by Country

7.4.2.2 LAMEA On-premises Market by Country

7.4.3 LAMEA Workflow Management System Market by Vertical

7.4.3.1 LAMEA BFSI Market by Country

7.4.3.2 LAMEA Telecom & IT Market by Country

7.4.3.3 LAMEA Retail Market by Country

7.4.3.4 LAMEA Healthcare Market by Country

7.4.3.5 LAMEA Travel & Hospitality Market by Country

7.4.3.6 LAMEA Transportation Market by Country

7.4.3.7 LAMEA Others Market by Country

7.4.4 LAMEA Workflow Management System Market by Country

7.4.4.1 Brazil Workflow Management System Market

7.4.4.1.1 Brazil Workflow Management System Market by Component

7.4.4.1.1.1 Brazil Workflow Management System Market by Software Type

7.4.4.1.2 Brazil Workflow Management System Market by Deployment Mode

7.4.4.1.3 Brazil Workflow Management System Market by Vertical

7.4.4.2 Argentina Workflow Management System Market

7.4.4.2.1 Argentina Workflow Management System Market by Component

7.4.4.2.1.1 Argentina Workflow Management System Market by Software Type

7.4.4.2.2 Argentina Workflow Management System Market by Deployment Mode

7.4.4.2.3 Argentina Workflow Management System Market by Vertical

7.4.4.3 UAE Workflow Management System Market

7.4.4.3.1 UAE Workflow Management System Market by Component

7.4.4.3.1.1 UAE Workflow Management System Market by Software Type

7.4.4.3.2 UAE Workflow Management System Market by Deployment Mode

7.4.4.3.3 UAE Workflow Management System Market by Vertical

7.4.4.4 Saudi Arabia Workflow Management System Market

7.4.4.4.1 Saudi Arabia Workflow Management System Market by Component

7.4.4.4.1.1 Saudi Arabia Workflow Management System Market by Software Type

7.4.4.4.2 Saudi Arabia Workflow Management System Market by Deployment Mode

7.4.4.4.3 Saudi Arabia Workflow Management System Market by Vertical

7.4.4.5 South Africa Workflow Management System Market

7.4.4.5.1 South Africa Workflow Management System Market by Component

7.4.4.5.1.1 South Africa Workflow Management System Market by Software Type

7.4.4.5.2 South Africa Workflow Management System Market by Deployment Mode

7.4.4.5.3 South Africa Workflow Management System Market by Vertical

7.4.4.6 Nigeria Workflow Management System Market

7.4.4.6.1 Nigeria Workflow Management System Market by Component

7.4.4.6.1.1 Nigeria Workflow Management System Market by Software Type

7.4.4.6.2 Nigeria Workflow Management System Market by Deployment Mode

7.4.4.6.3 Nigeria Workflow Management System Market by Vertical

7.4.4.7 Rest of LAMEA Workflow Management System Market

7.4.4.7.1 Rest of LAMEA Workflow Management System Market by Component

7.4.4.7.1.1 Rest of LAMEA Workflow Management System Market by Software Type

7.4.4.7.2 Rest of LAMEA Workflow Management System Market by Deployment Mode

7.4.4.7.3 Rest of LAMEA Workflow Management System Market by Vertical

Chapter 8. Company Profiles

8.1 IBM Corporation

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Regional & Segmental Analysis

8.1.4 Research & Development Expenses

8.1.5 Recent strategies and developments:

8.1.5.1 Product Launches and Product Expansions:

8.1.5.2 Acquisition and Mergers:

8.1.6 SWOT Analysis

8.2 Oracle Corporation

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Segmental and Regional Analysis

8.2.4 Research & Development Expense

8.2.5 Recent strategies and developments:

8.2.5.1 Product Launches and Product Expansions:

8.2.6 SWOT Analysis

8.3 Newgen Software Technologies Limited

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Segmental and Regional Analysis

8.3.4 Research & Development Expense

8.3.5 Recent strategies and developments:

8.3.5.1 Partnerships, Collaborations, and Agreements:

8.3.5.2 Product Launches and Product Expansions:

8.4 Xerox Corporation

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Regional Analysis

8.4.4 Research & Development Expenses

8.4.5 Recent strategies and developments:

8.4.5.1 Partnerships, Collaborations, and Agreements:

8.4.5.2 Product Launches and Product Expansions:

8.5 Appian Corporation

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Regional Analysis

8.5.4 Research & Development Expense

8.5.5 Recent strategies and developments:

8.5.5.1 Product Launches and Product Expansions:

8.5.5.2 Acquisition and Mergers:

8.6 Nintex Global Ltd. (TPG Inc.)

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Regional Analysis

8.6.4 Recent strategies and developments:

8.6.4.1 Product Launches and Product Expansions:

8.7 Software AG

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Segmental and Regional Analysis

8.7.4 Research & Development Expense

8.7.5 Recent strategies and developments:

8.7.5.1 Product Launches and Product Expansions:

8.8 Pegasystems Inc.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Regional Analysis

8.8.4 Research & Development Expenses

8.8.5 Recent strategies and developments:

8.8.5.1 Product Launches and Product Expansions:

8.8.5.2 Acquisition and Mergers:

8.9 Bizagi Group Limited

8.9.1 Company Overview

8.9.2 Recent strategies and developments:

8.9.2.1 Partnerships, Collaborations, and Agreements:

8.9.2.2 Product Launches and Product Expansions:

8.10. Source Code Technologies LLC

8.10.1 Company Overview

Companies Mentioned

- IBM Corporation

- Oracle Corporation

- Newgen Software Technologies Limited

- Xerox Corporation

- Appian Corporation

- Nintex Global Ltd. (TPG Inc.)

- Software AG

- Pegasystems Inc.

- Bizagi Group Limited

- Source Code Technologies LLC