A countertop is a raised surface part of a counter used to set items down or serve food. A collection of chairs or stools frequently surrounds counters to provide sitting. A countertop is a fundamental piece of furniture used in kitchens, labs, retail spaces, restrooms, and offices supported by cabinets. Per their functionality, durability, beauty, and necessities, such as built-in appliances for the appropriate application, countertops are made from various materials. Due to their numerous uses and extensive utilities, countertops will likely generate significant revenue during the anticipated time.

The demand for contemporary worktops installed over cabinets and low-height furniture has increased due to recent technological advancements in the building sector. The construction business utilizes advanced tools, heavy machinery, mobile applications, robotics, drones, and 3D printing to supply cutting-edge and unique functionality items around the globe. Current countertop industry trends include using rust-free concrete, tactile and leather surfaces, recycled wood, eco-friendly composite stone, and non-porous laminates as cabinet-building materials.

Also, shortly, the kitchen cabinetry industry will increase significantly due to the leading companies' use of customer-driven marketing tactics. It is feasible to meet the demand for diverse business segments effectively and efficiently with cutting-edge materials for cabinet construction. So, the demand for designer goods is driven by consumers' desire for hip designs that will make their kitchens, baths, or offices aesthetically current and highly useful.

The world's continually growing restaurant business and urbanization will generate tremendous demand for cutting-edge items. In addition, the market is expanding due to the rising demand in the cabinetry industry for high-quality manufactured stones. It is expected that seamlessly finished quartz will be used to build kitchen countertops worldwide, making it a popular material on the market.

COVID-19 Impact Analysis

The COVID-19 effect has caused misery and continued for some time in 2020 and 2021. The instant shutdown halted the primary centers for mining, fabrication, and construction, severely impeding worldwide production. The demand has shifted to basic items due to the closure of factories, construction sites, hotels, and other businesses, which has hampered the expansion of the countertops market. Furthermore, countertop production has drastically declined due to labor limitations and a lack of raw materials in several countries. In addition, trade restrictions have impacted the supply chain for countertops.Market Growth Factors

Increasing spending on renovating and repairing buildings

With its expanding applications in the residential and commercial sectors, such as modular kitchens and beautiful shelves for toiletries in opulent bathrooms, countertops play a significant role. Due to the increased demand for engineered and natural stone in the construction of new buildings, major countertop manufacturers are concentrating on creating a variety of materials. In addition, work platforms are in greater demand due to investments made by construction companies worldwide to renovate existing structures. The regional market would expand as a result of this factor.Growing urbanization across the globe

The portrayal of consumers' lifestyles through home décor is thought to be successful. Both the developed and emerging regional markets are seeing growth in this. Globalization and increasing urbanization are the main causes of this. The need for these products to improve home interiors is increasing as urbanization spreads throughout regional countries like India. The need for new styles to make their kitchens, bathrooms, or offices aesthetically current with hyper-functionality has increased, which will lead to an expansion in the countertops market.Market Restraining Factor

Hazardous radiations produced by granite

Granite contains naturally occurring radioactive materials that can release minute amounts of gamma and beta radiation, which can hinder the use of the product. Government agencies all around the world have put in place some norms and restrictions governing the radiation levels in granite in order to assure safety. To decrease the impact of hazardous radiations from the granite integrated into the house, the Environment Protection Agency (EPA) has set the safety threshold for radon gas levels in the household at four epicures. It has a comparable lung cancer risk as smoking half a pack of cigarettes. As a result, the expansion of the countertop market would be constrained throughout the anticipated time period by dangerous radiations from natural granite stone.Materials Outlook

Based on materials, the countertops market is segmented into granite, solid surface, engineered quartz, laminate, marble, and others. In 2021, the marble segment procured a promising revenue share in the countertops market. Because marble is frequently found in colors like white, yellow, red, and black, it is frequently utilized in interior décor. It is used to create numerous artifacts, including sculptures. Kitchen countertops, floors, and bathroom tiles are all made of marble. There are numerous types of marble on the market, including black, grey, cream, and red marble. Because of its aesthetic appeal, marble is frequently utilized in interior design.Application Outlook

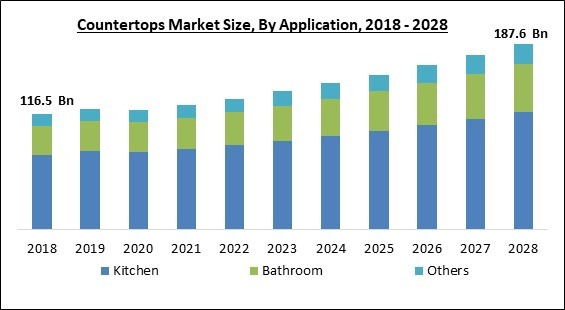

On the basis of application, the countertops market is fragmented into kitchen, bathroom, and others. The kitchen segment witnessed the largest revenue share in the countertops market in 2021. This application segment's expansion is accelerated by the growing demand for kitchen countertops. Also, the segment growth is anticipated to pick up speed during the projection period due to an increase in the average share of dwelling space devoted to kitchens in new residential constructions.End-user Outlook

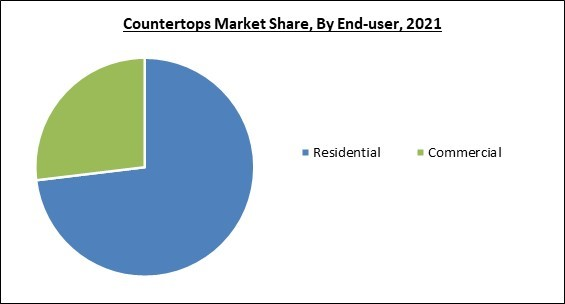

By end-user, the countertops market is divided into residential and commercial. In 2021, the commercial segment recorded a remarkable revenue share in the countertops market. The demand for products in the commercial segment is accelerating due to the world's increasing number of restaurants, hotels, bars, and cafés. Travellers' rising demand for luxurious bathrooms and kitchens, even in low-cost lodgings, is also placing pressure on luxury and mid-range hotel owners, who are upgrading finishes, furniture, and worktops, adding features, and rethinking the guest experience. Over the projected timeframe, this will fuel the segment's expansion.Regional Outlook

Region-wise, the countertops market, is analysed across North America, Europe, Asia Pacific and LAMEA. In 2021, the Asia Pacific region projected the maximum revenue share in the countertops market. This high percentage can be attributed to rising living standards and ongoing renovation initiatives for both residential and commercial building units. Moreover, the market will be driven by the continuing demand for countertop replacement as a home improvement project. Furthermore, as customers strive to upgrade from laminates and solid surfaces to more aesthetically pleasing and natural-looking surface materials, the demand for the product will be driven by the rising consumer interest in engineered stone, porcelain slab, and butcher-block worktops.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Masco Corporation, Cambria Company LLC, Aristech Surfaces LLC (Trinseo PLC), Wilsonart LLC, Caesarstone Ltd., Formica Group (Broadview Holding), Cosentino Global, S.L.U., MS International, Inc., Dal-Tile Corporation (Mohawk Industries, Inc.), and Rosskopf + Partner AG (Hope Bearer Foundation)

Recent Strategies Deployed in Countertops Market

Partnerships, Collaborations and Agreements:

- Nov-2022: Wilsonart extended its partnership with Rugby ABP, a wholesaler of specialty building products. The partnership involves assigning Rugby as Wilsonart's exclusive distributor in the New Mexico region. The extended partnership reflects both the company's devotion to delivering top-notch services and surfacing options to its customers.

- Jul-2022: Wilsonart extended its partnership with Wurth Wood Group, a US-based provider of architectural products, decor, building products, etc. The partnership involves making Wurth Wood, Wilsonart's exclusive wholesale distributor in the Southern Louisiana region.

- Nov-2021: Wilsonart partnered with HomeSphere, a US-based developer of a customer retention and acquisition platform intended for the real estate industry. Homesphere's deep network benefits Wilsonart by enabling it to communicate with its target audience adequately and efficiently.

- Jun-2020: Cambria came into partnership with Millennium Granite & Marble, a US-based fabricator, and installer of countertops. The partnership involves providing Cambria with access to MGM's supreme quality stone products.

Product Launches and Product Expansions:

- Oct-2022: Daltile launched Stylizer, a visualizer. Through this launch, the company intends to streamline the shopping experience for its clients. The new feature introduced on Daltile's website allows users to visualize a room.

- Aug-2022: Daltile unveiled four new designs under the One Quartz extra-large slab program. The new designs are available in three themes, Liberty Black, Arabescato Twilight, and Nightfall. Further, the designs are scratch and stain resistant and are non-porous.

- Aug-2020: Cambria and Gensler jointly launched The Coordinates Collection by Cambria. The collection includes 14 quartz designs intended for both residential and commercial uses.

Acquisitions and Mergers:

- Jan-2021: Caesarstone completed the acquisition of Omicron Granite and Tile, a leading stone supplier. The addition of Omicron expands Caesarstone's already existing network and aligns with its strategy to expand globally, deliver better service to its clients, and at the same time improve logistical efficiency.

- Sep-2020: Caesarstone took over Lioli Ceramica, an India-based manufacturer of porcelain countertop slabs. The addition of Lioli Ceramica is a major milestone in Caesarstone's journey to expand its presence globally. Further, this acquisition aligns with Caesarstone's aim to become the first brand of choice for countertops.

- Aug-2020: Wilsonart signed an agreement to take over Alpine Sales, a US-based wholesale distributor of hardware and solid surfaces. The addition of Alpine perfectly fits well with Wilsonart's corporate values and significantly improves the services Wilsonart offers.

Geographical Expansions:

- Dec-2021: Cambria expanded its plant located in Minnesota, United States. The expansion involves establishing a new polishing line, and a line to shape quartz slabs on the South part of the plant. This expansion expands Cambria's production capacity, and further allows it to manufacture large slabs.

Scope of the Study

By Application

- Kitchen

- Bathroom

- Others

By End-user

- Residential

- Commercial

By Material

- Granite

- Solid Surface

- Engineered Quartz

- Laminate

- Marble

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Masco Corporation

- Cambria Company LLC

- Aristech Surfaces LLC (Trinseo PLC)

- Wilsonart LLC

- Caesarstone Ltd.

- Formica Group (Broadview Holding)

- Cosentino Global, S.L.U.

- MS International, Inc.

- Dal-Tile Corporation (Mohawk Industries, Inc.)

- Rosskopf + Partner AG (Hope Bearer Foundation)

Unique Offerings

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Global Countertops Market, by Application

1.4.2 Global Countertops Market, by End-user

1.4.3 Global Countertops Market, by Material

1.4.4 Global Countertops Market, by Geography

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition & Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

3.1 Recent Industry Wide Strategic Developments

3.1.1 Partnerships, Collaborations and Agreements

3.1.2 Product Launches and Product Expansions

3.1.3 Acquisition and Mergers

3.1.4 Geographical Expansions

3.2 Top Winning Strategies

3.2.1 Key Leading Strategies: Percentage Distribution (2018-2022)

3.2.2 Key Strategic Move: (Partnerships, Collaborations and Agreements : 2018, Jan - 2022, Nov) Leading Players

Chapter 4. Global Countertops Market by Application

4.1 Global Kitchen Market by Region

4.2 Global Bathroom Market by Region

4.3 Global Others Market by Region

Chapter 5. Global Countertops Market by End-user

5.1 Global Residential Market by Region

5.2 Global Commercial Market by Region

Chapter 6. Global Countertops Market by Material

6.1 Global Granite Market by Region

6.2 Global Solid Surface Market by Region

6.3 Global Engineered Quartz Market by Region

6.4 Global Laminate Market by Region

6.5 Global Marble Market by Region

6.6 Global Others Market by Region

Chapter 7. Global Countertops Market by Region

7.1 North America Countertops Market

7.1.1 North America Countertops Market by Application

7.1.1.1 North America Kitchen Market by Country

7.1.1.2 North America Bathroom Market by Country

7.1.1.3 North America Others Market by Country

7.1.2 North America Countertops Market by End-user

7.1.2.1 North America Residential Market by Country

7.1.2.2 North America Commercial Market by Country

7.1.3 North America Countertops Market by Material

7.1.3.1 North America Granite Market by Country

7.1.3.2 North America Solid Surface Market by Country

7.1.3.3 North America Engineered Quartz Market by Country

7.1.3.4 North America Laminate Market by Country

7.1.3.5 North America Marble Market by Country

7.1.3.6 North America Others Market by Country

7.1.4 North America Countertops Market by Country

7.1.4.1 US Countertops Market

7.1.4.1.1 US Countertops Market by Application

7.1.4.1.2 US Countertops Market by End-user

7.1.4.1.3 US Countertops Market by Material

7.1.4.2 Canada Countertops Market

7.1.4.2.1 Canada Countertops Market by Application

7.1.4.2.2 Canada Countertops Market by End-user

7.1.4.2.3 Canada Countertops Market by Material

7.1.4.3 Mexico Countertops Market

7.1.4.3.1 Mexico Countertops Market by Application

7.1.4.3.2 Mexico Countertops Market by End-user

7.1.4.3.3 Mexico Countertops Market by Material

7.1.4.4 Rest of North America Countertops Market

7.1.4.4.1 Rest of North America Countertops Market by Application

7.1.4.4.2 Rest of North America Countertops Market by End-user

7.1.4.4.3 Rest of North America Countertops Market by Material

7.2 Europe Countertops Market

7.2.1 Europe Countertops Market by Application

7.2.1.1 Europe Kitchen Market by Country

7.2.1.2 Europe Bathroom Market by Country

7.2.1.3 Europe Others Market by Country

7.2.2 Europe Countertops Market by End-user

7.2.2.1 Europe Residential Market by Country

7.2.2.2 Europe Commercial Market by Country

7.2.3 Europe Countertops Market by Material

7.2.3.1 Europe Granite Market by Country

7.2.3.2 Europe Solid Surface Market by Country

7.2.3.3 Europe Engineered Quartz Market by Country

7.2.3.4 Europe Laminate Market by Country

7.2.3.5 Europe Marble Market by Country

7.2.3.6 Europe Others Market by Country

7.2.4 Europe Countertops Market by Country

7.2.4.1 Germany Countertops Market

7.2.4.1.1 Germany Countertops Market by Application

7.2.4.1.2 Germany Countertops Market by End-user

7.2.4.1.3 Germany Countertops Market by Material

7.2.4.2 UK Countertops Market

7.2.4.2.1 UK Countertops Market by Application

7.2.4.2.2 UK Countertops Market by End-user

7.2.4.2.3 UK Countertops Market by Material

7.2.4.3 France Countertops Market

7.2.4.3.1 France Countertops Market by Application

7.2.4.3.2 France Countertops Market by End-user

7.2.4.3.3 France Countertops Market by Material

7.2.4.4 Russia Countertops Market

7.2.4.4.1 Russia Countertops Market by Application

7.2.4.4.2 Russia Countertops Market by End-user

7.2.4.4.3 Russia Countertops Market by Material

7.2.4.5 Spain Countertops Market

7.2.4.5.1 Spain Countertops Market by Application

7.2.4.5.2 Spain Countertops Market by End-user

7.2.4.5.3 Spain Countertops Market by Material

7.2.4.6 Italy Countertops Market

7.2.4.6.1 Italy Countertops Market by Application

7.2.4.6.2 Italy Countertops Market by End-user

7.2.4.6.3 Italy Countertops Market by Material

7.2.4.7 Rest of Europe Countertops Market

7.2.4.7.1 Rest of Europe Countertops Market by Application

7.2.4.7.2 Rest of Europe Countertops Market by End-user

7.2.4.7.3 Rest of Europe Countertops Market by Material

7.3 Asia Pacific Countertops Market

7.3.1 Asia Pacific Countertops Market by Application

7.3.1.1 Asia Pacific Kitchen Market by Country

7.3.1.2 Asia Pacific Bathroom Market by Country

7.3.1.3 Asia Pacific Others Market by Country

7.3.2 Asia Pacific Countertops Market by End-user

7.3.2.1 Asia Pacific Residential Market by Country

7.3.2.2 Asia Pacific Commercial Market by Country

7.3.3 Asia Pacific Countertops Market by Material

7.3.3.1 Asia Pacific Granite Market by Country

7.3.3.2 Asia Pacific Solid Surface Market by Country

7.3.3.3 Asia Pacific Engineered Quartz Market by Country

7.3.3.4 Asia Pacific Laminate Market by Country

7.3.3.5 Asia Pacific Marble Market by Country

7.3.3.6 Asia Pacific Others Market by Country

7.3.4 Asia Pacific Countertops Market by Country

7.3.4.1 China Countertops Market

7.3.4.1.1 China Countertops Market by Application

7.3.4.1.2 China Countertops Market by End-user

7.3.4.1.3 China Countertops Market by Material

7.3.4.2 Japan Countertops Market

7.3.4.2.1 Japan Countertops Market by Application

7.3.4.2.2 Japan Countertops Market by End-user

7.3.4.2.3 Japan Countertops Market by Material

7.3.4.3 India Countertops Market

7.3.4.3.1 India Countertops Market by Application

7.3.4.3.2 India Countertops Market by End-user

7.3.4.3.3 India Countertops Market by Material

7.3.4.4 South Korea Countertops Market

7.3.4.4.1 South Korea Countertops Market by Application

7.3.4.4.2 South Korea Countertops Market by End-user

7.3.4.4.3 South Korea Countertops Market by Material

7.3.4.5 Singapore Countertops Market

7.3.4.5.1 Singapore Countertops Market by Application

7.3.4.5.2 Singapore Countertops Market by End-user

7.3.4.5.3 Singapore Countertops Market by Material

7.3.4.6 Malaysia Countertops Market

7.3.4.6.1 Malaysia Countertops Market by Application

7.3.4.6.2 Malaysia Countertops Market by End-user

7.3.4.6.3 Malaysia Countertops Market by Material

7.3.4.7 Rest of Asia Pacific Countertops Market

7.3.4.7.1 Rest of Asia Pacific Countertops Market by Application

7.3.4.7.2 Rest of Asia Pacific Countertops Market by End-user

7.3.4.7.3 Rest of Asia Pacific Countertops Market by Material

7.4 LAMEA Countertops Market

7.4.1 LAMEA Countertops Market by Application

7.4.1.1 LAMEA Kitchen Market by Country

7.4.1.2 LAMEA Bathroom Market by Country

7.4.1.3 LAMEA Others Market by Country

7.4.2 LAMEA Countertops Market by End-user

7.4.2.1 LAMEA Residential Market by Country

7.4.2.2 LAMEA Commercial Market by Country

7.4.3 LAMEA Countertops Market by Material

7.4.3.1 LAMEA Granite Market by Country

7.4.3.2 LAMEA Solid Surface Market by Country

7.4.3.3 LAMEA Engineered Quartz Market by Country

7.4.3.4 LAMEA Laminate Market by Country

7.4.3.5 LAMEA Marble Market by Country

7.4.3.6 LAMEA Others Market by Country

7.4.4 LAMEA Countertops Market by Country

7.4.4.1 Brazil Countertops Market

7.4.4.1.1 Brazil Countertops Market by Application

7.4.4.1.2 Brazil Countertops Market by End-user

7.4.4.1.3 Brazil Countertops Market by Material

7.4.4.2 Argentina Countertops Market

7.4.4.2.1 Argentina Countertops Market by Application

7.4.4.2.2 Argentina Countertops Market by End-user

7.4.4.2.3 Argentina Countertops Market by Material

7.4.4.3 UAE Countertops Market

7.4.4.3.1 UAE Countertops Market by Application

7.4.4.3.2 UAE Countertops Market by End-user

7.4.4.3.3 UAE Countertops Market by Material

7.4.4.4 Saudi Arabia Countertops Market

7.4.4.4.1 Saudi Arabia Countertops Market by Application

7.4.4.4.2 Saudi Arabia Countertops Market by End-user

7.4.4.4.3 Saudi Arabia Countertops Market by Material

7.4.4.5 South Africa Countertops Market

7.4.4.5.1 South Africa Countertops Market by Application

7.4.4.5.2 South Africa Countertops Market by End-user

7.4.4.5.3 South Africa Countertops Market by Material

7.4.4.6 Nigeria Countertops Market

7.4.4.6.1 Nigeria Countertops Market by Application

7.4.4.6.2 Nigeria Countertops Market by End-user

7.4.4.6.3 Nigeria Countertops Market by Material

7.4.4.7 Rest of LAMEA Countertops Market

7.4.4.7.1 Rest of LAMEA Countertops Market by Application

7.4.4.7.2 Rest of LAMEA Countertops Market by End-user

7.4.4.7.3 Rest of LAMEA Countertops Market by Material

Chapter 8. Company Profiles

8.1 Caesarstone Ltd.

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Regional Analysis

8.1.4 Research & Development Expenses

8.1.5 Recent strategies and developments:

8.1.5.1 Acquisition and Mergers:

8.2 Dal-Tile Corporation (Mohawk Industries, Inc.)

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Segmental and Regional Analysis

8.2.4 Recent strategies and developments:

8.2.4.1 Product Launches and Product Expansions:

8.3 Masco Corporation

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Segmental and Regional Analysis

8.4 Aristech Surfaces LLC (Trinseo PLC)

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Segmental and Regional Analysis

8.4.4 Research & Development Expenses

8.5 Cambria Company LLC

8.5.1 Company Overview

8.5.2 Recent strategies and developments:

8.5.2.1 Partnerships, Collaborations, and Agreements:

8.5.2.2 Product Launches and Product Expansions:

8.5.2.3 Geographical Expansions:

8.6 Wilsonart LLC

8.6.1 Company Overview

8.6.2 Recent strategies and developments:

8.6.2.1 Partnerships, Collaborations, and Agreements:

8.6.2.2 Product Launches and Product Expansions:

8.6.2.3 Acquisition and Mergers:

8.7 Formica Group (Broadview Holding)

8.7.1 Company Overview

8.7.2 Recent strategies and developments:

8.7.2.1 Partnerships, Collaborations, and Agreements:

8.8 Cosentino Global, S.L.U.

8.8.1 Company Overview

8.9 MS International, Inc.

8.9.1 Company Overview

8.10. Rosskopf + Partner AG (Hope Bearer Foundation)

8.10.1 Company Overview

Companies Mentioned

- Masco Corporation

- Cambria Company LLC

- Aristech Surfaces LLC (Trinseo PLC)

- Wilsonart LLC

- Caesarstone Ltd.

- Formica Group (Broadview Holding)

- Cosentino Global, S.L.U.

- MS International, Inc.

- Dal-Tile Corporation (Mohawk Industries, Inc.)

- Rosskopf + Partner AG (Hope Bearer Foundation)