The term 'red sauce'refers to a sauce typically served as the main course rather than as an accompaniment to another dish. This type of sauce is typically created from tomatoes. Even though red sauces are frequently used with meat and vegetables, they are probably best recognized as the foundation of the sauces used in Mexican salsas and Italian pasta dishes.

Manufacturers prepare or package meals designed to be enjoyed wherever and whenever they are required with minimal to no preparation, such as defrosting or heating the food. These meals are known as convenience meals. Convenience foods are sold as ready-to-eat meals or goods stored at room temperature without spoiling. They also typically come in portable, portion-controlled packaging and are designed for a single serving.

The trend towards quicker food and consumption, mostly driven by a busy lifestyle, is the primary force behind the rise of convenience meals. Aesthetic appeal, usability, safety, variety, nutritional content, and ease of preparation are some criteria that must be met for foods marketed as convenient. In addition, consumers want these foods to taste well and provide adequate nourishment.

Customers are drawn to convenience foods because they come in a wide variety, are simple to prepare, and are readily available throughout the year. Also, a considerable amount of red sauce is consumed globally with fast food and convenience foods. As a result, an increase in the demand for food that can be prepared quickly should lead to an increase in the consumption of red sauce in the market. Consumers are showing an increased interest in products derived from natural sources, making this one of the most prominent market trends all over the world.

COVID-19 Impact Analysis

Due to the COVID pandemic, market participants will profit from a rise in demand for ready-to-eat and fast food. In addition, people now care more about their health and desire more nutrient-dense food. Shortly, it is anticipated that the consumption of red sauce in the food and beverage industries will increase dramatically. As a result, the market will probably grow consistently throughout the coming years. The change was made possible by rising consumer demand for food services, which allowed takeaways and off-trade outlets. As a consequence, the market recovered quickly after the lockdown and the lifting of the restrictions.Market Growth Factors

Consumers' growing demand for non-genetically modified ingredients

The significance of clean-label food ingredients is becoming more and more recognized by consumers, which has increased the demand for non-GMO ingredients. Additionally, customers' tastes for organic and food items without genetic modifications have changed due to the lack of safety in eating genetically modified foods. As a result, specialized non-GMO components are expanding their role in commonly consumed food products. As a result, non-GMO market players should see larger revenue returns in the future.Growing HORECA industry to drive market growth

The HoReCa (hotel, restaurant, and café) sector has had tremendous expansion in recent years and is one of the markets with the strongest growth rates worldwide. The sector carves a space in the retail market and is a large hospitality market that includes hotels, restaurants, and cafes. In addition, the HoReCa sector, which supports the hotel business, is increasingly populated by major participants in the spaghetti sauce market. Strong economic growth, a growing millennial population, and digitalization are key drivers of the hotel sector's expansion.Market Restraining Factor

Fluctuating raw material costs and intense competition

The fluctuating prices of the raw ingredients used in the manufacturing of red sauces present a significant challenge to the market's expansion, particularly in developing countries. Additionally, the installation costs for the processing equipment required to manufacture the red sauce are high, which may persuade other businesses to refrain from using the same procedures. It is anticipated that the vast majority of businesses will decide not to utilize the processing equipment, which would ultimately slow down the expansion of the red sauce market. This constrains the market growth for red sauce over the course of projection period.Packaging type Outlook

Based on packaging type, the red sauce market is segmented into bottles, pouches and others. In 2021, the bottle segment held the highest revenue share in the red sauce market. Everywhere in the world, red sauce is usually shipped in bottles, which are spherical containers with a small neck. To prevent spillage, evaporation, and other things from happening to the liquid inside, a tightly fitting stopper or cap are frequently incorporated. Glass bottles are also chosen for red sauce due to their transparency, high gloss, and range of pattern options. These bottles effectively safeguard the contents.Nature Outlook

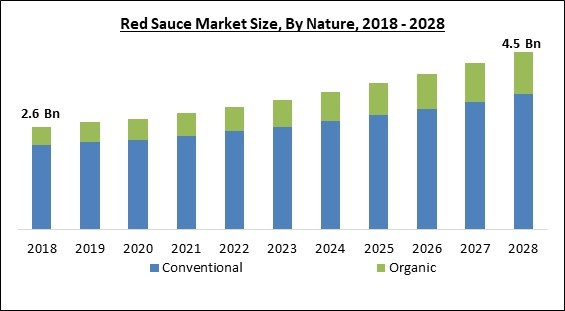

By nature, the red sauce market is fragmented into organic, and conventional. In 2021, the conventional segment witnessed the largest revenue share in the red sauce market. The traditional method of growing tomatoes ensures a significant harvest for the farmers and generates a sizeable profit for them. As a result, the producers provide a variety of low-cost ways to make red sauce. Additionally, many people in the food and beverage industries prefer classic red sauce.Distribution Channel Outlook

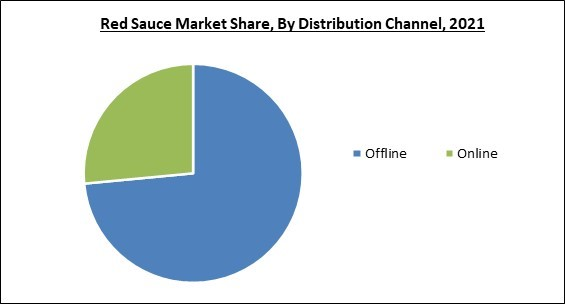

On the basis of distribution channel, the red sauce market is categorized into offline and online. In 2021, the online segment garnered a substantial revenue share in the red sauce market. Many of these manufacturers sell merchandise on their websites and online storefronts. Additionally, the internet adoption rate has greatly increased in recent years, leading to phenomenal growth in the e-commerce industry globally. This will result in market expansion in this segment over the projection period.Regional Outlook

Region wise, the red sauce market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2021, the North America region led the red sauce market by generating maximum revenue share. This is because it gives food, which is increasingly popular with customers, an unusual aroma, and because the texture helps to bring out the flavor. Due to its diverse flavor profile can mask the taste of many foods, including pizza, pasta, and spaghetti. Factors including the quick development of infrastructure and technological innovation in developing nations are driving the industry.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include The Kraft Heinz Company, Barilla G. e R. Fratelli S.p.A, General Mills Inc., Conagra Brands, Inc., Campbell Soup Company, Victoria Fine Foods, LLC (B&G Foods), Goya Foods, Inc., Organicville (Litehouse), Newman’s Own, Inc., and G.L. Mezzetta, Inc.

Scope of the Study

By Nature

- Conventional

- Organic

By Distribution Channel

- Offline

- Online

By Packaging Type

- Bottle

- Pouches

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- The Kraft Heinz Company

- Barilla G. e R. Fratelli S.p.A

- General Mills Inc.

- Conagra Brands, Inc.

- Campbell Soup Company

- Victoria Fine Foods, LLC (B&G Foods)

- Goya Foods, Inc.

- Organicville (Litehouse)

- Newman’s Own, Inc.

- G.L. Mezzetta, Inc.

Unique Offerings

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 Global Red Sauce Market, by Nature

1.4.2 Global Red Sauce Market, by Distribution Channel

1.4.3 Global Red Sauce Market, by Packaging Type

1.4.4 Global Red Sauce Market, by Geography

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition & Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Global Red Sauce Market by Nature

3.1 Global Conventional Market by Region

3.2 Global Organic Market by Region

Chapter 4. Global Red Sauce Market by Distribution Channel

4.1 Global Offline Market by Region

4.2 Global Online Market by Region

Chapter 5. Global Red Sauce Market by Packaging Type

5.1 Global Bottle Market by Region

5.2 Global Pouches Market by Region

5.3 Global Others Market by Region

Chapter 6. Global Red Sauce Market by Region

6.1 North America Red Sauce Market

6.1.1 North America Red Sauce Market by Nature

6.1.1.1 North America Conventional Market by Country

6.1.1.2 North America Organic Market by Country

6.1.2 North America Red Sauce Market by Distribution Channel

6.1.2.1 North America Offline Market by Country

6.1.2.2 North America Online Market by Country

6.1.3 North America Red Sauce Market by Packaging Type

6.1.3.1 North America Bottle Market by Country

6.1.3.2 North America Pouches Market by Country

6.1.3.3 North America Others Market by Country

6.1.4 North America Red Sauce Market by Country

6.1.4.1 US Red Sauce Market

6.1.4.1.1 US Red Sauce Market by Nature

6.1.4.1.2 US Red Sauce Market by Distribution Channel

6.1.4.1.3 US Red Sauce Market by Packaging Type

6.1.4.2 Canada Red Sauce Market

6.1.4.2.1 Canada Red Sauce Market by Nature

6.1.4.2.2 Canada Red Sauce Market by Distribution Channel

6.1.4.2.3 Canada Red Sauce Market by Packaging Type

6.1.4.3 Mexico Red Sauce Market

6.1.4.3.1 Mexico Red Sauce Market by Nature

6.1.4.3.2 Mexico Red Sauce Market by Distribution Channel

6.1.4.3.3 Mexico Red Sauce Market by Packaging Type

6.1.4.4 Rest of North America Red Sauce Market

6.1.4.4.1 Rest of North America Red Sauce Market by Nature

6.1.4.4.2 Rest of North America Red Sauce Market by Distribution Channel

6.1.4.4.3 Rest of North America Red Sauce Market by Packaging Type

6.2 Europe Red Sauce Market

6.2.1 Europe Red Sauce Market by Nature

6.2.1.1 Europe Conventional Market by Country

6.2.1.2 Europe Organic Market by Country

6.2.2 Europe Red Sauce Market by Distribution Channel

6.2.2.1 Europe Offline Market by Country

6.2.2.2 Europe Online Market by Country

6.2.3 Europe Red Sauce Market by Packaging Type

6.2.3.1 Europe Bottle Market by Country

6.2.3.2 Europe Pouches Market by Country

6.2.3.3 Europe Others Market by Country

6.2.4 Europe Red Sauce Market by Country

6.2.4.1 Germany Red Sauce Market

6.2.4.1.1 Germany Red Sauce Market by Nature

6.2.4.1.2 Germany Red Sauce Market by Distribution Channel

6.2.4.1.3 Germany Red Sauce Market by Packaging Type

6.2.4.2 UK Red Sauce Market

6.2.4.2.1 UK Red Sauce Market by Nature

6.2.4.2.2 UK Red Sauce Market by Distribution Channel

6.2.4.2.3 UK Red Sauce Market by Packaging Type

6.2.4.3 France Red Sauce Market

6.2.4.3.1 France Red Sauce Market by Nature

6.2.4.3.2 France Red Sauce Market by Distribution Channel

6.2.4.3.3 France Red Sauce Market by Packaging Type

6.2.4.4 Russia Red Sauce Market

6.2.4.4.1 Russia Red Sauce Market by Nature

6.2.4.4.2 Russia Red Sauce Market by Distribution Channel

6.2.4.4.3 Russia Red Sauce Market by Packaging Type

6.2.4.5 Spain Red Sauce Market

6.2.4.5.1 Spain Red Sauce Market by Nature

6.2.4.5.2 Spain Red Sauce Market by Distribution Channel

6.2.4.5.3 Spain Red Sauce Market by Packaging Type

6.2.4.6 Italy Red Sauce Market

6.2.4.6.1 Italy Red Sauce Market by Nature

6.2.4.6.2 Italy Red Sauce Market by Distribution Channel

6.2.4.6.3 Italy Red Sauce Market by Packaging Type

6.2.4.7 Rest of Europe Red Sauce Market

6.2.4.7.1 Rest of Europe Red Sauce Market by Nature

6.2.4.7.2 Rest of Europe Red Sauce Market by Distribution Channel

6.2.4.7.3 Rest of Europe Red Sauce Market by Packaging Type

6.3 Asia Pacific Red Sauce Market

6.3.1 Asia Pacific Red Sauce Market by Nature

6.3.1.1 Asia Pacific Conventional Market by Country

6.3.1.2 Asia Pacific Organic Market by Country

6.3.2 Asia Pacific Red Sauce Market by Distribution Channel

6.3.2.1 Asia Pacific Offline Market by Country

6.3.2.2 Asia Pacific Online Market by Country

6.3.3 Asia Pacific Red Sauce Market by Packaging Type

6.3.3.1 Asia Pacific Bottle Market by Country

6.3.3.2 Asia Pacific Pouches Market by Country

6.3.3.3 Asia Pacific Others Market by Country

6.3.4 Asia Pacific Red Sauce Market by Country

6.3.4.1 China Red Sauce Market

6.3.4.1.1 China Red Sauce Market by Nature

6.3.4.1.2 China Red Sauce Market by Distribution Channel

6.3.4.1.3 China Red Sauce Market by Packaging Type

6.3.4.2 Japan Red Sauce Market

6.3.4.2.1 Japan Red Sauce Market by Nature

6.3.4.2.2 Japan Red Sauce Market by Distribution Channel

6.3.4.2.3 Japan Red Sauce Market by Packaging Type

6.3.4.3 India Red Sauce Market

6.3.4.3.1 India Red Sauce Market by Nature

6.3.4.3.2 India Red Sauce Market by Distribution Channel

6.3.4.3.3 India Red Sauce Market by Packaging Type

6.3.4.4 South Korea Red Sauce Market

6.3.4.4.1 South Korea Red Sauce Market by Nature

6.3.4.4.2 South Korea Red Sauce Market by Distribution Channel

6.3.4.4.3 South Korea Red Sauce Market by Packaging Type

6.3.4.5 Singapore Red Sauce Market

6.3.4.5.1 Singapore Red Sauce Market by Nature

6.3.4.5.2 Singapore Red Sauce Market by Distribution Channel

6.3.4.5.3 Singapore Red Sauce Market by Packaging Type

6.3.4.6 Malaysia Red Sauce Market

6.3.4.6.1 Malaysia Red Sauce Market by Nature

6.3.4.6.2 Malaysia Red Sauce Market by Distribution Channel

6.3.4.6.3 Malaysia Red Sauce Market by Packaging Type

6.3.4.7 Rest of Asia Pacific Red Sauce Market

6.3.4.7.1 Rest of Asia Pacific Red Sauce Market by Nature

6.3.4.7.2 Rest of Asia Pacific Red Sauce Market by Distribution Channel

6.3.4.7.3 Rest of Asia Pacific Red Sauce Market by Packaging Type

6.4 LAMEA Red Sauce Market

6.4.1 LAMEA Red Sauce Market by Nature

6.4.1.1 LAMEA Conventional Market by Country

6.4.1.2 LAMEA Organic Market by Country

6.4.2 LAMEA Red Sauce Market by Distribution Channel

6.4.2.1 LAMEA Offline Market by Country

6.4.2.2 LAMEA Online Market by Country

6.4.3 LAMEA Red Sauce Market by Packaging Type

6.4.3.1 LAMEA Bottle Market by Country

6.4.3.2 LAMEA Pouches Market by Country

6.4.3.3 LAMEA Others Market by Country

6.4.4 LAMEA Red Sauce Market by Country

6.4.4.1 Brazil Red Sauce Market

6.4.4.1.1 Brazil Red Sauce Market by Nature

6.4.4.1.2 Brazil Red Sauce Market by Distribution Channel

6.4.4.1.3 Brazil Red Sauce Market by Packaging Type

6.4.4.2 Argentina Red Sauce Market

6.4.4.2.1 Argentina Red Sauce Market by Nature

6.4.4.2.2 Argentina Red Sauce Market by Distribution Channel

6.4.4.2.3 Argentina Red Sauce Market by Packaging Type

6.4.4.3 UAE Red Sauce Market

6.4.4.3.1 UAE Red Sauce Market by Nature

6.4.4.3.2 UAE Red Sauce Market by Distribution Channel

6.4.4.3.3 UAE Red Sauce Market by Packaging Type

6.4.4.4 Saudi Arabia Red Sauce Market

6.4.4.4.1 Saudi Arabia Red Sauce Market by Nature

6.4.4.4.2 Saudi Arabia Red Sauce Market by Distribution Channel

6.4.4.4.3 Saudi Arabia Red Sauce Market by Packaging Type

6.4.4.5 South Africa Red Sauce Market

6.4.4.5.1 South Africa Red Sauce Market by Nature

6.4.4.5.2 South Africa Red Sauce Market by Distribution Channel

6.4.4.5.3 South Africa Red Sauce Market by Packaging Type

6.4.4.6 Nigeria Red Sauce Market

6.4.4.6.1 Nigeria Red Sauce Market by Nature

6.4.4.6.2 Nigeria Red Sauce Market by Distribution Channel

6.4.4.6.3 Nigeria Red Sauce Market by Packaging Type

6.4.4.7 Rest of LAMEA Red Sauce Market

6.4.4.7.1 Rest of LAMEA Red Sauce Market by Nature

6.4.4.7.2 Rest of LAMEA Red Sauce Market by Distribution Channel

6.4.4.7.3 Rest of LAMEA Red Sauce Market by Packaging Type

Chapter 7. Company Profiles

7.1 The Kraft Heinz Company

7.1.1 Company Overview

7.1.2 Financial Analysis

7.1.3 Regional Analysis

7.1.4 Research & Development Expense

7.1.5 Recent strategies and developments:

7.1.5.1 Partnerships, Collaborations, and Agreements:

7.1.5.2 Product Launches and Product Expansions:

7.2 Barilla G. e R. Fratelli S.p.A

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Regional Analysis

7.2.4 Research & Development Expense

7.2.5 Recent strategies and developments:

7.2.5.1 Acquisition and Mergers:

7.3 General Mills Inc.

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Segmental and Regional Analysis

7.3.4 Research & Development Expenses

7.4 Conagra Brands, Inc.

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Segmental Analysis

7.4.4 Research & Development Expenses

7.5 Campbell Soup Company

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Segmental Analysis

7.5.4 Research & Development Expenses

7.6 Victoria Fine Foods, LLC (B&G Foods)

7.6.1 Company Overview

7.6.2 Financial Analysis

7.7 Goya Foods, Inc.

7.7.1 Company Overview

7.7.1.1 Geographical Expansions:

7.8 Organicville (Litehouse)

7.8.1 Company Overview

7.9 Newman’s Own, Inc.

7.9.1 Company Overview

7.10. G.L. Mezzetta, Inc.

7.10.1 Company Overview

Companies Mentioned

- The Kraft Heinz Company

- Barilla G. e R. Fratelli S.p.A

- General Mills Inc.

- Conagra Brands, Inc.

- Campbell Soup Company

- Victoria Fine Foods, LLC (B&G Foods)

- Goya Foods, Inc.

- Organicville (Litehouse)

- Newman’s Own, Inc.

- G.L. Mezzetta, Inc.