Pharmaceutical contract packaging refers to the outsourcing of packaging services by pharmaceutical companies to specialized contract packaging firms. These firms are equipped with the necessary infrastructure and expertise to handle the packaging of pharmaceutical products, including medications, medical devices, and related healthcare items. The process of pharmaceutical contract packaging involves various stages, including design, labeling, and assembly of the final product packaging. The contract packaging companies ensure compliance with regulatory guidelines and industry standards, such as Good Manufacturing Practices (GMP) and Quality Assurance (QA) protocols. By opting for contract packaging services, pharmaceutical companies can benefit from several advantages. It allows them to focus on their core competencies, such as research and development, while entrusting packaging responsibilities to experts. This leads to increased operational efficiency and reduced time-to-market for their products. Additionally, contract packaging firms can offer cost-effective solutions by leveraging economies of scale and optimizing packaging processes.

Pharmaceutical companies are increasingly outsourcing their non-core activities, including packaging, to contract packaging firms. This allows them to focus on core competencies like research and development, while benefiting from the expertise and efficiency of contract packaging specialists. Additionally, the pharmaceutical industry is subject to strict regulations and quality standards imposed by health authorities worldwide. Contract packaging companies are well-versed in these regulations, ensuring that pharmaceutical products are packaged and labeled in compliance with Good Manufacturing Practices (GMP) and other relevant guidelines. Other than this, the pharmaceutical market is continuously expanding with new drug developments, personalized medicines, and innovative medical devices. Contract packaging firms offer customized and flexible solutions to accommodate the diverse packaging requirements of these products. Besides this, contract packaging offers cost advantages to pharmaceutical companies by eliminating the need for heavy investments in packaging infrastructure and equipment. Instead, they can leverage the capabilities of established contract packaging providers, resulting in cost savings. In line with this, the global pharmaceutical industry is witnessing significant growth, especially in emerging markets. As pharmaceutical companies expand their reach to new regions, they seek reliable contract packaging partners to ensure efficient and compliant packaging in diverse markets. Furthermore, contract packaging companies are continually adopting advanced technologies and automation in their processes. These innovations improve packaging efficiency, reduce errors, and enhance overall productivity, making them attractive partners for pharmaceutical firms. Moreover, increasing awareness about sustainability and environmental impact has led to a growing demand for eco-friendly and recyclable packaging solutions. Contract packaging companies are aligning their offerings with these green initiatives to meet market demands.

Pharmaceutical Contract Packaging Market Trends/Drivers

Increasing Outsourcing Trend

Pharmaceutical companies are increasingly turning to contract packaging firms to handle their packaging needs. This shift is primarily driven by the desire to focus on core competencies, such as drug development and marketing, while entrusting the specialized task of packaging to experienced professionals. By outsourcing packaging, pharmaceutical companies can streamline their operations, reduce operational costs, and improve overall efficiency. Contract packaging firms offer expertise in packaging materials, design, and regulatory compliance, which allows pharmaceutical companies to deliver high-quality products to the market in a timely manner. Additionally, outsourcing provides the flexibility to adapt to fluctuations in product demand, allowing pharmaceutical companies to respond swiftly to changing market dynamics.Stringent Regulatory Compliance

The pharmaceutical industry is heavily regulated by various health authorities worldwide to ensure patient safety and product efficacy. Compliance with Good Manufacturing Practices (GMP) and other regulatory guidelines is paramount for pharmaceutical companies. Contract packaging firms specialize in adhering to these strict regulations, as they possess in-depth knowledge of the applicable quality standards and industry best practices. Their expertise ensures that pharmaceutical products are accurately labeled, packaged, and traceable throughout the supply chain, reducing the risk of non-compliance and potential legal issues. By partnering with contract packaging providers, pharmaceutical companies can maintain their reputation for producing safe and reliable products, while mitigating the risks associated with regulatory non-compliance.Rising Demand for Medications and Medical Devices

The global pharmaceutical market is continuously expanding, with increasing demand for medications and medical devices across diverse regions. As pharmaceutical companies seek to penetrate new markets, they encounter unique packaging requirements and regional regulations. Contract packaging firms offer localized expertise and capabilities, enabling pharmaceutical companies to navigate the complexities of different markets seamlessly. These firms can adapt packaging designs, labeling, and language translations to comply with local regulations and cultural preferences. By partnering with contract packaging providers, pharmaceutical companies can efficiently enter new markets, capitalize on growth opportunities, and reach a broader customer base. This market expansion strategy allows pharmaceutical companies to extend their market presence while minimizing logistical challenges and ensuring a consistent and compliant packaging approach.Pharmaceutical Contract Packaging Industry Segmentation

This report provides an analysis of the key trends in each segment of the global pharmaceutical contract packaging market report, along with forecasts at the global and regional levels for 2025-2033. The report has categorized the market based on industry, type and packaging.Breakup by Industry

- Small Molecule

- Biopharmaceutical

- Vaccine

The small molecule pharmaceutical industry encompasses a broad range of traditional drugs that consist of low molecular weight compounds. These drugs are typically synthesized through chemical processes, and they constitute a significant portion of the pharmaceutical market. Small molecule drugs are widely used to treat various medical conditions and diseases, including cardiovascular disorders, infectious diseases, and metabolic disorders. Due to their relatively simple structure, small molecules can be easily mass-produced and formulated into different dosage forms, such as tablets and capsules. They also have a well-established manufacturing and packaging process, making them cost-effective to produce and distribute. The small molecule pharmaceutical industry remains a vital segment of the overall pharmaceutical market and continues to experience steady growth due to the constant demand for therapeutics targeting prevalent medical conditions.

The biopharmaceutical industry focuses on the development and production of pharmaceutical products derived from biological sources, such as living organisms or their components. Biopharmaceuticals include a wide range of products like monoclonal antibodies, vaccines, recombinant proteins, and gene therapies. These products are often more complex in structure and require advanced manufacturing processes, including biotechnology techniques like cell culture and genetic engineering. The biopharmaceutical sector has witnessed significant growth in recent years due to the increasing prevalence of chronic diseases, personalized medicine approaches, and advancements in biotechnology research. Biopharmaceutical products offer targeted and precise treatments, which have revolutionized disease management and patient care. As a result, this industry has become a key driver of innovation and growth within the pharmaceutical market.

The vaccine industry is dedicated to the development, manufacturing, and distribution of vaccines that prevent infectious diseases and protect public health. Vaccines are biological products designed to stimulate an immune response, providing immunity against specific pathogens. They play a crucial role in preventing the spread of communicable diseases and reducing the burden of infectious outbreaks. The vaccine industry has experienced remarkable growth and technological advancements, particularly in response to global health challenges like the COVID-19 pandemic. Vaccine development requires rigorous testing, clinical trials, and adherence to stringent regulatory standards to ensure safety and efficacy. The ongoing research in immunology and molecular biology continues to drive the innovation of novel vaccines to combat emerging diseases and improve public health outcomes globally. As governments and healthcare organizations prioritize vaccination programs, the vaccine industry remains a vital and indispensable component of the pharmaceutical market.

Breakup by Type

- Sterile

- Non-Sterile

A detailed breakup and analysis of the market based on the type has also been provided in the report. This includes sterile and non-sterile. According to the report, sterile packaging accounted for the largest market share.

Sterile products are those that are free from any viable microorganisms, making them suitable for direct administration into the body, such as through injections or infusions. They are essential in various medical settings, including hospitals, clinics, and home healthcare. The sterile products are widely used in treating serious and life-threatening medical conditions that require immediate and precise intervention. These products are crucial in emergency situations and surgical procedures, where contamination can have severe consequences. Additionally, the stringent regulatory requirements surrounding the manufacturing and distribution of sterile products contribute to their significance. Health authorities have strict guidelines to ensure the quality and sterility of these products, making the manufacturing process complex and specialized. Moreover, the growing demand for biopharmaceuticals and injectable drugs has further driven the dominance of the sterile segment. As biologics and personalized medicine gain popularity, the need for sterile packaging and administration becomes more pronounced, propelling the growth of this segment within the pharmaceutical market.

Breakup by Packaging

- Plastic Bottles

- Caps and Closures

- Blister Packs

- Prefilled Syringes

- Parenteral Vials and Ampoules

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging. This includes plastic bottles caps and closures, blister packs, prefilled syringes, parenteral vials and ampoules, and others. According to the report, plastic bottles represented the largest segment.

Plastic bottles offer a combination of versatility and cost-effectiveness that makes them widely preferred across various industries, including pharmaceuticals. Their lightweight nature and durability make them easy to handle during manufacturing, transportation, and storage, reducing overall logistics costs. Additionally, plastic bottles provide excellent barrier properties, protecting pharmaceutical products from external contaminants, moisture, and UV light. This safeguard helps maintain product integrity and extends shelf life, ensuring that medications and healthcare products remain effective and safe for consumption. Furthermore, plastic bottles come in a wide range of shapes and sizes, allowing for customization to meet specific packaging requirements. This flexibility makes them suitable for packaging various forms of pharmaceuticals, from liquid syrups and oral medications to solid tablets and capsules. Moreover, the recyclability of plastic bottles aligns with growing environmental concerns, as manufacturers and consumers increasingly prioritize sustainable packaging solutions. As the demand for eco-friendly packaging continues to rise, plastic bottles' recyclability contributes to their continued dominance as the largest segment in the pharmaceutical packaging market.

Breakup by Region

- United States

- Europe

- China

- India

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the United States, Europe, China, India, and others. According to the report, the United States was the largest market for pharmaceutical contract packaging.

The U.S. pharmaceutical market is one of the largest and most developed in the world, with a high demand for innovative drugs, medical devices, and healthcare products. The extensive pharmaceutical industry in the U.S. necessitates a robust contract packaging sector to handle the diverse packaging needs of various companies. Additionally, the U.S. pharmaceutical landscape is characterized by a dynamic regulatory environment, with stringent quality and safety standards enforced by agencies such as the Food and Drug Administration (FDA). Contract packaging companies in the U.S. are well-versed in these regulations and adhere to strict compliance protocols, providing assurance to pharmaceutical companies that their products will meet the necessary requirements. Other than this, the U.S. is home to numerous pharmaceutical companies, ranging from multinational corporations to innovative start-ups. Many of these companies prefer to outsource their packaging needs to specialized contract packaging firms to focus on their core competencies and achieve greater operational efficiency. Moreover, the presence of advanced technologies and infrastructure in the U.S. contributes to the country's dominance in the pharmaceutical contract packaging market. These resources enable contract packaging companies to offer a wide array of packaging solutions, including serialization, track-and-trace systems, and customized packaging designs. Furthermore, the U.S. contract packaging industry benefits from a highly skilled and trained workforce with expertise in various aspects of pharmaceutical packaging. This proficiency ensures that contract packaging companies can deliver high-quality and reliable packaging services to their clients.

Competitive Landscape

Leading contract packaging companies are investing heavily in advanced technologies and automation systems. These investments aim to streamline packaging processes, reduce manual errors, and improve overall operational efficiency. Automation enables faster and more precise packaging, leading to increased production capacities and shorter time-to-market for pharmaceutical products. Additionally, key players in the market are expanding their geographic presence to tap into emerging markets and cater to the growing demand for contract packaging services globally. By establishing facilities in strategic locations, they can provide localized services and offer more cost-effective solutions to pharmaceutical companies seeking to enter new regions. Other than this, environmental sustainability has become a significant concern for consumers and businesses alike. Many key players in the pharmaceutical contract packaging market are incorporating sustainable practices, such as using eco-friendly materials and optimizing packaging designs to reduce waste. These efforts align with the increasing demand for environmentally responsible packaging solutions. Furthermore, to broaden their service offerings and cater to diverse customer needs, key players often engage in collaborations and partnerships. These collaborations may involve joint ventures, technology-sharing agreements, or strategic alliances with pharmaceutical companies and other stakeholders. Such partnerships foster innovation, knowledge exchange, and access to a wider customer base.The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Key Questions Answered in This Report

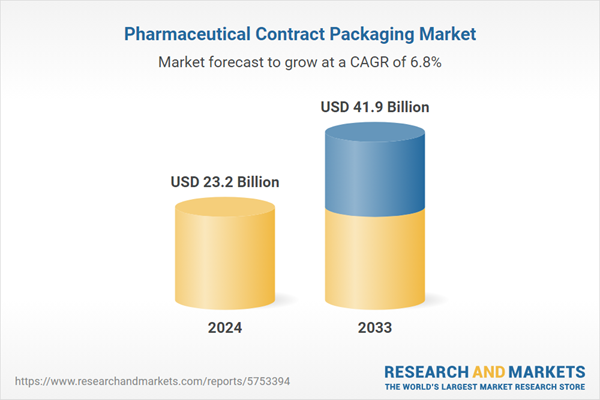

1. What was the size of the global pharmaceutical contract packaging market in 2024?2. What is the expected growth rate of the global pharmaceutical contract packaging market during 2025-2033?

3. What are the key factors driving the global pharmaceutical contract packaging market?

4. What has been the impact of COVID-19 on the pharmaceutical contract packaging market?

5. What is the breakup of the global pharmaceutical contract packaging market based on the type?

6. What is the breakup of the global pharmaceutical contract packaging market based on the packaging?

7. What are the key regions in the global pharmaceutical contract packaging market?

Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 138 |

| Published | February 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 23.2 Billion |

| Forecasted Market Value ( USD | $ 41.9 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |