A laboratory centrifuge is a specialized instrument used in scientific and medical settings to separate substances within a sample based on their density, mass, and other physical properties. This versatile device employs centrifugal force, which is generated by rapidly rotating the sample around a central axis. Laboratory centrifuges come in various types, such as microcentrifuges, which handle small volumes of samples, and larger floor-standing centrifuges capable of accommodating larger sample sizes and quantities. They are equipped with rotors of different designs to accommodate various tube sizes and sample volumes. They play a pivotal role in advancing research, diagnostics, and various scientific investigations by enabling efficient and precise separation of heterogeneous samples.

The growing prevalence of chronic diseases and viral infections, including cancer, cardiovascular diseases (CVDs), diabetes, kidney and liver disorders, hepatitis, malaria, and human immunodeficiency virus (HIV), is driving the global market. This is supported by the growing aging population, which is more susceptible to such health conditions, and the rising preference for personalized medical treatments and diagnostics. Furthermore, governmental efforts across various countries to enhance medication regulatory policies, standardize clinical studies, and refine reimbursement policies are contributing to the expansion of the market. Besides, universities, research institutions, and academic laboratories are key users of laboratory equipment, including centrifuges. This is supporting the market. As research funding and academic activities grow, the demand for centrifuges also increases. Furthermore, various industries such as food production, cosmetics, and manufacturing require quality control measures to ensure consistent product quality. Centrifuges are employed in these sectors to separate and analyze raw materials and finished products, thus impelling the market.

Laboratory Centrifuge Market Trends/Drivers:

Growing Biotechnology and Pharmaceutical Research

These industries are at the forefront of innovation, constantly seeking new ways to understand diseases, develop novel therapies, and improve healthcare outcomes. Laboratory centrifuges play a pivotal role in these pursuits by enabling precise separation, isolation, and analysis of various biological components. In the realm of biotechnology, researchers are delving into intricate cellular processes, protein interactions, and genetic mechanisms. To unravel these complexities, they require tools that can effectively separate and concentrate specific biomolecules and cellular structures. Laboratory centrifuges fulfill this needs by applying centrifugal force to segregate substances based on their mass and density. This is essential for studies in fields, such as genomics, proteomics, and molecular biology, where isolating nucleic acids, proteins, and organelles is critical for gaining insights into disease pathways and developing targeted therapies.Diagnostic Advancements in Healthcare

Centrifugation is a fundamental step in clinical laboratories, aiding in the separation of blood components, urine sediments, and other bodily fluids. With the rising prevalence of chronic diseases and infections, accurate and timely diagnostic information is essential for effective patient management. Technological advancements in centrifuge design have led to instruments with faster processing times, better sample handling capabilities, and improved ease of use. Moreover, the integration of centrifuges with other diagnostic technologies, such as flow cytometry and molecular diagnostics, enables comprehensive and multi-dimensional analysis of patient samples. As the healthcare industry continues to emphasize early disease detection and personalized treatment strategies, the demand for advanced laboratory centrifuges that enhance diagnostic accuracy and efficiency remains a significant market driver.Focus on Bioprocessing and Biomanufacturing

The biopharmaceutical industry, in particular, relies on centrifuges for various stages of production, including cell culture harvesting, protein purification, and cell debris removal. The demand for biopharmaceutical products, such as monoclonal antibodies, vaccines, and therapeutic proteins, is on the rise, necessitating scalable and efficient manufacturing processes. Centrifuges that offer large-capacity processing, gentle separation mechanisms, and easy scalability are sought after to meet the demands of bioprocessing facilities. Additionally, the emergence of regenerative medicine and cell therapy has driven the need for specialized centrifuges capable of handling delicate and valuable cellular materials. The laboratory centrifuge market responds to these demands by innovating technologies that optimize bioprocessing workflows, minimize product loss, and ensure consistent product quality, thus contributing significantly to the advancement of biomanufacturing practices.Laboratory Centrifuge Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product type, model type, rotor design, intended use, application, and end-user.Breakup by Product Type:

- Equipment

- Multipurpose Centrifuges

- Microcentrifuges

- Ultracentrifuges

- Minicentrifuges

- Others

- Accessories

- Rotors

- Tubes

- Centrifuge Bottles

- Buckets

- Plates

- Others

Equipment dominates the market

The report has provided a detailed breakup and analysis of the market based on the product type. This includes equipment (multipurpose centrifuges, microcentrifuges, ultracentrifuges, minicentrifuges, and others) and accessories (rotors, tubes, centrifuge bottles, buckets, plates, and others). According to the report, equipment represented the largest segment.Breakup by Model Type:

- Benchtop Centrifuges

- Floor-Standing Centrifuges

Benchtop centrifuges hold the largest share in the market

A detailed breakup and analysis of the market based on the model type has also been provided in the report. This includes benchtop centrifuges, and floor-standing centrifuges. According to the report, benchtop centrifuges accounted for the largest market share.Breakup by Rotor Design:

- Fixed-Angle Rotors

- Swinging-Bucket Rotors

- Vertical Rotors

- Others

Fixed angle rotors hold the largest share in the market

A detailed breakup and analysis of the market based on the rotor design has also been provided in the report. This includes fixed-angle rotors, swinging-bucket rotors, vertical rotors, and others. According to the report, fixed angle rotors accounted for the largest market share.Breakup by Intended Use:

- General Purpose Centrifuges

- Clinical Centrifuges

- Preclinical Centrifuges

General purpose centrifuges hold the largest share in the market

A detailed breakup and analysis of the market based on the intended use has also been provided in the report. This includes general purpose centrifuges, clinical centrifuges, and preclinical centrifuges. According to the report, general purpose centrifuges accounted for the largest market share.Breakup by Application:

- Diagnostics

- Microbiology

- Cellomics

- Genomics

- Proteomics

- Blood Component Separation

- Others

Diagnostics hold the largest share in the market

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes diagnostics, microbiology, cellomics, genomics, proteomics, blood component separation, and others. According to the report, diagnostics accounted for the largest market share.Breakup by End-User:

- Hospitals

- Biotechnology and Pharmaceutical Companies

- Academic and Research Institutions

Hospitals hold the largest share in the market

A detailed breakup and analysis of the market based on the end-user has also been provided in the report. This includes hospitals, biotechnology and pharmaceutical company, and academic and research institutions. According to the report, hospitals accounted for the largest market share.Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest laboratory centrifuge market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada), Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others), Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others), Latin America (Brazil, Mexico, and others), and the Middle East and Africa. According to the report, North America accounted for the largest market share.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Andreas Hettich GmbH & Co. KG

- Becton, Dickinson and Company

- Danaher Corporation

- Eppendorf AG

- GTCR LLC

- HERMLE Labortechnik

- Koki Holdings Co. Ltd.

- Kubota Corporation

- NuAire

- QIAGEN N.V.

- Sanofi Pasteur

- Sartorius

- Sigma Laborzentrifugen GmbH

- Thermo Fisher Scientific Inc.

Key Questions Answered in This Report

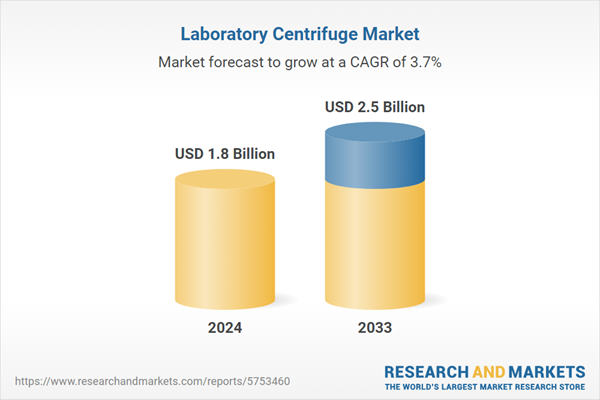

1. What was the size of the global laboratory centrifuge market in 2024?2. What is the expected growth rate of the global laboratory centrifuge market during 2025-2033?

3. What are the key factors driving the global laboratory centrifuge market?

4. What has been the impact of COVID-19 on the global laboratory centrifuge market?

5. What is the breakup of the global laboratory centrifuge market based on the product type?

6. What is the breakup of the global laboratory centrifuge market based on the model type?

7. What is the breakup of the global laboratory centrifuge market based on the rotor design?

8. What is the breakup of the global laboratory centrifuge market based on intended use?

9. What is the breakup of the global laboratory centrifuge market based on the application?

10. What is the breakup of the global laboratory centrifuge market based on the end-user?

11. What are the key regions in the global laboratory centrifuge market?

12. Who are the key players/companies in the global laboratory centrifuge market?

Table of Contents

Companies Mentioned

- Andreas Hettich GmbH & Co. KG

- Becton

- Danaher Corporation

- Eppendorf AG

- GTCR LLC

- HERMLE Labortechnik

- Koki Holdings Co. Ltd.

- Kubota Corporation

- NuAire

- QIAGEN N.V.

- Sanofi Pasteur

- Sartorius

- Sigma Laborzentrifugen GmbH

- Thermo Fisher Scientific Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 142 |

| Published | January 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 1.8 Billion |

| Forecasted Market Value ( USD | $ 2.5 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |