Synthetic Paper Market Trends:

Environmental Sustainability

The growing concern for environmental sustainability is a significant driver of the global synthetic paper market. With increased awareness about deforestation and the environmental impact of traditional paper production, businesses and consumers are seeking alternatives. Synthetic paper, made from non-wood materials such as, polypropylene or polyester, is seen as an eco-friendlier option. It reduces the need for cutting down trees, conserving forests, and reducing greenhouse gas emissions associated with paper production. Additionally, synthetic paper is often recyclable and can be reused, further reducing its environmental footprint. Companies are increasingly adopting synthetic paper to align with their sustainability goals and meet consumer demand for eco-friendly products.Durability and Longevity Offered by the Product

Another driving factor in the global synthetic paper market is its superior durability and longevity compared to traditional paper. Synthetic paper is known for its resistance to tearing, moisture, chemicals, and UV rays. This makes it ideal for applications where traditional paper would deteriorate quickly, such as outdoor signage, maps, and labels on products exposed to harsh conditions. The longevity of synthetic paper ensures that information and branding remain intact over an extended period, reducing the need for frequent replacements. This saves costs for businesses and also minimizes waste. For instance, synthetic labels on products can endure throughout the lifecycle of this product, reducing the need for label replacements due to wear and tear.Printability and Customization

Synthetic paper can be customized to meet specific printing requirements, whether for vibrant graphics, high-resolution images, or intricate details. It readily accepts various printing methods, including offset, digital, and flexographic printing. This adaptability makes synthetic paper a preferred choice for applications such as, advertising materials, brochures, and packaging. Companies can create visually appealing and informative print materials with ease. The ability to reproduce intricate designs and maintain print quality even in challenging environments, such as wet or outdoor settings, is a significant advantage. Moreover, compatibility of synthetic paper with a wide range of ink types and printing equipment allows businesses to explore creative and innovative marketing strategies.Water and Tear Resistance

The inherent water and tear resistance of synthetic paper are driving its adoption in various industries. Unlike traditional paper, which can become easily damaged when exposed to moisture or rough handling, synthetic paper maintains its integrity. This property makes it highly suitable for applications where durability and resistance to external factors are crucial. In the packaging industry, for instance, synthetic paper is preferred for labels and tags on products that may come into contact with liquids or experience rough handling during shipping and storage. It ensures that essential product information remains legible and intact. Similarly, synthetic paper is used for outdoor signage, banners, and posters where exposure to rain and adverse weather conditions is common. Its resistance to water ensures that the messaging and branding remain effective, even in challenging outdoor environments. Additionally, the tear resistance of synthetic paper is valuable in applications where the risk of physical damage is high. For instance, in industrial settings where manuals and instructional materials are frequently used, synthetic paper ensures that vital information remains accessible and intact despite handling.Expanding Applications in Labeling and Packaging

The increasing demand for labeling and packaging solutions across various industries is a major driver of the global synthetic paper market. The versatility and suitability of this paper for these applications are well-recognized. In the food and beverage industry, synthetic paper is commonly used for labels on products that require moisture-resistant and durable packaging. It ensures that essential product information, branding, and regulatory details remain intact and visually appealing. Similarly, the pharmaceutical and healthcare sectors rely on synthetic paper for labeling prescription medications and medical devices. The ability to maintain the integrity of critical information on these products is vital for patient safety and regulatory compliance. Additionally, the growth of e-commerce has boosted the demand for synthetic paper in packaging. With the rise of online shopping, businesses require durable and customizable packaging solutions to protect products during transit and create a positive unboxing experience for consumers.Synthetic Paper Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, application, and end use industry.Breakup by Type:

- Biaxially Oriented Polypropylene (BOPP)

- High Density Polyethylene (HDPE)

- Polyethylene Terephthalate (PET)

- Others

Biaxially oriented polypropylene (BOPP) accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes biaxially oriented polypropylene (BOPP), high density polyethylene (HDPE), polyethylene terephthalate (PET), and others. According to the report, BOPP represented the largest segment.Breakup by Application:

- Label

- Hand Tags

- Medical Tags

- Others

- Non-Label

- Packaging

- Documents

- Others

Non-label holds the largest share in the industry

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes label (hand tags, medical tags, and others) and non-label (packaging, documents, and others). According to the report, non-label accounted for the largest market share.Breakup by End Use:

- Industrial

- Institutional

- Commercial/Retail

Industrial represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end use. This includes industrial, institutional, and commercial/retail. According to the report, industrial represented the largest segment.Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest synthetic paper market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Agfa-Gevaert N.V.

- Aluminium Féron GmbH & Co. KG

- Arjobex SAS

- Cosmo First Limited

- HOP Industries Corporation

- MDV Papier- und Kunststoffveredelung GmbH

- Nan Ya Plastics Corporation

- PPG Industries Inc.

- RELYCO

- Seiko Epson Corporation

- Toyobo Co. Ltd.

- Transcendia Inc.

- Yupo Corporation

Key Questions Answered in This Report

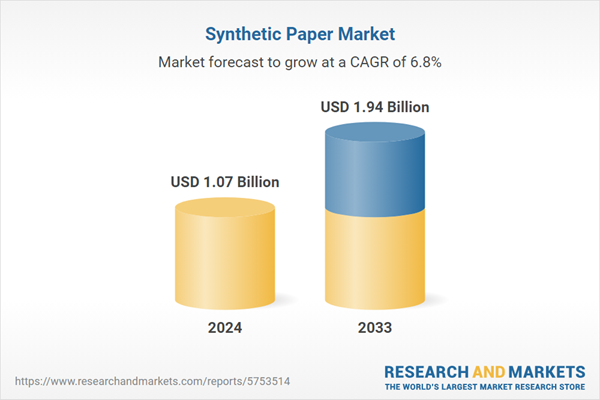

- What was the size of the global synthetic paper market in 2024?

- What is the expected growth rate of the global synthetic paper market during 2025-2033?

- What are the key factors driving the global synthetic paper market?

- What has been the impact of COVID-19 on the global synthetic paper market?

- What is the breakup of the global synthetic paper market based on the type?

- What is the breakup of the global synthetic paper market based on the application?

- What is the breakup of the global synthetic paper market based on the end use industry?

- What are the key regions in the global synthetic paper market?

- Who are the key players/companies in the global synthetic paper market?

Table of Contents

Companies Mentioned

- Agfa-Gevaert N.V.

- Aluminium Féron GmbH & Co. KG

- Arjobex SAS

- Cosmo First Limited

- HOP Industries Corporation

- MDV Papier- und Kunststoffveredelung GmbH

- Nan Ya Plastics Corporation

- PPG Industries Inc.

- RELYCO

- Seiko Epson Corporation

- Toyobo Co. Ltd.

- Transcendia Inc.

- Yupo Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 142 |

| Published | March 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 1.07 Billion |

| Forecasted Market Value ( USD | $ 1.94 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |