Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising Demand for Dairy Products

The rising demand for dairy products continues to shape livestock management and feeding practices globally. Consumers are increasingly shifting towards protein-rich, natural food sources, with dairy being a central component of daily diets. In 2024, retail sales of traditional dairy milk in the U.S. increased by 3.5%, reflecting a renewed preference for animal-based milk over plant-based alternatives. This resurgence is driven by its nutritional profile, including calcium, protein, and essential vitamins, particularly among health-conscious and fitness-focused consumers.The organic dairy segment has also seen remarkable momentum, growing by 9.8% in the last year as more consumers opt for ethically produced and hormone-free milk, cheese, and yogurt. This demand is particularly strong in North America and Western Europe, where quality and sustainability are key purchasing factors. These preferences are encouraging dairy producers to enhance feeding systems that ensure animal welfare, milk quality, and consistent output across varying herd sizes.

In developing regions, dairy consumption is rising rapidly due to changing dietary habits, urbanization, and increasing incomes. Countries in Asia and Africa are witnessing an uptick in demand for milk, cheese, and value-added dairy products such as yogurt and flavored milk. As a result, dairy farms are expanding, and farmers are investing in automated feeding systems to meet higher productivity targets while maintaining consistent nutrition levels for livestock. These systems also reduce labor dependency and enable efficient feed utilization, aligning with the need to scale production sustainably.

Furthermore, the trend of functional and fortified dairy products - like lactose-free milk, probiotic yogurts, and high-protein cheese - is pushing dairy producers to adopt precision feeding techniques. This ensures livestock receive the optimal balance of nutrients to meet modern dairy standards. Automated feeding systems are increasingly used to tailor rations based on animal health, lactation stage, and productivity goals. As consumer demand becomes more segmented and specialized, the role of advanced feeding solutions in the dairy supply chain will only grow stronger.

Key Market Challenges

High Initial Investment Cost

The high initial investment cost is a significant barrier to the widespread adoption of feeding systems, particularly among small and medium-scale livestock farms. Advanced systems - such as self-propelled feeders, sensor-driven conveyor units, and software-integrated platforms - require substantial upfront capital for procurement, installation, and infrastructure modifications. For many farmers operating with limited budgets, these costs are difficult to justify, even when the long-term benefits are evident.In regions where financing options, subsidies, or government support are limited, farmers are more likely to continue with manual or semi-automated feeding processes. The fear of slow return on investment and uncertainty over system lifespan further discourage capital-intensive spending. Additionally, pricing structures are often not transparent or standardized, making it harder for end-users to compare alternatives and plan effectively for the future. As a result, adoption remains slow outside of large commercial operations with greater access to capital.

Beyond the equipment itself, ancillary costs add to the financial burden of implementing feeding systems. These include civil works for retrofitting barns, upgrading power supplies, integrating software platforms, and training staff to operate the new technologies. Maintenance contracts, software licensing fees, and periodic system upgrades must also be factored into the total cost of ownership, which can be substantial over time.

For smaller farms, such long-term obligations can strain operational budgets and create financial risk. Moreover, some advanced systems require compatible digital infrastructure - such as IoT sensors, cloud connectivity, or AI-based monitoring tools which further raises the cost barrier. Without clear pathways for financing, leasing, or cooperative ownership models, many potential users remain sidelined. Consequently, despite the efficiency and productivity gains these systems promise, high upfront investment remains one of the most persistent challenges restraining market growth.

Key Market Trends

Emphasis 0n Sustainability and Animal Welfare

The growing emphasis on sustainability and animal welfare is significantly influencing the global feeding systems market. Livestock producers are increasingly adopting automated feeding systems that ensure precise feed distribution, minimizing overfeeding and reducing feed waste - a major contributor to resource inefficiency and greenhouse gas emissions. These systems help align farming operations with sustainable practices by optimizing feed conversion ratios and decreasing the environmental footprint per unit of milk or meat produced.Additionally, automated feeders limit the need for chemical inputs and support controlled nutrient intake, which contributes to healthier livestock. As consumers and regulatory bodies demand greater transparency and eco-responsibility in food production, farmers are embracing these technologies to meet certification standards and environmental benchmarks. This trend is particularly prominent in regions with strict environmental policies, such as Europe and North America, where precision feeding supports broader climate goals and responsible land-use management.

Alongside environmental sustainability, animal welfare has become a central focus in livestock farming, and advanced feeding systems play a vital role in supporting this shift. Consistent, well-timed feeding schedules reduce animal stress and aggression, while tailored rations improve digestion, health, and productivity. Automated systems can monitor individual animal behavior and adjust feeding accordingly, promoting comfort and well-being throughout the production cycle. These improvements align with growing consumer expectations for ethically produced animal products and support retailers and food brands aiming to market higher-welfare products. Moreover, governments and industry organizations are increasingly tying financial incentives and compliance requirements to animal welfare standards. Feeding systems that enhance welfare not only improve livestock outcomes but also protect farm reputations and ensure access to premium markets.

Key Market Players

- Pellon Group Oy

- Afimilk Ltd.

- CTB, Inc.

- Trioliet B.V.

- GEA Group Aktiengesellschaft

- Maskinfabrikken Cormall A/S

- HETWIN Automation System GmbH

- JH AGRO A/S

- Rovibec Agrisolutions Inc.

- Lely Industries N.V.

Report Scope:

In this report, Global Feeding Systems market has been segmented into following categories, in addition to the industry trends which have also been detailed below:Feeding Systems Market, By Type:

- Rail-Guided Feeding System

- Conveyor Feeding System

- Self-Propelled Feeding System

Feeding Systems Market, By Livestock:

- Ruminant

- Poultry

- Swine

- Others

Feeding Systems Market, By Technology:

- Manual

- Automated

- RFID

- Guidance & Remote Sensing

- Others

Feeding Systems Market, By region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- Malaysia

- Australia

- Japan

- Europe

- Germany

- France

- United Kingdom

- Spain

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Egypt

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in global feeding systems market.Available Customizations:

With the given market data, the publisher offers customizations according to a company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Pellon Group Oy

- Afimilk Ltd.

- CTB, Inc.

- Trioliet B.V.

- GEA Group Aktiengesellschaft

- Maskinfabrikken Cormall A/S

- HETWIN Automation System GmbH

- JH AGRO A/S

- Rovibec Agrisolutions Inc.

- Lely Industries N.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | August 2025 |

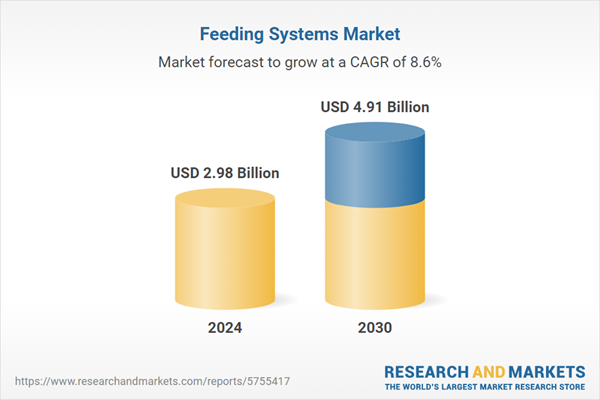

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.98 Billion |

| Forecasted Market Value ( USD | $ 4.91 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |