Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

One of the key drivers of the Rodenticides Market is the persistent challenge posed by rodent-borne diseases and damage to crops. Rodents, including rats and mice, are carriers of various diseases such as leptospirosis, hantavirus, and salmonellosis, making effective rodent control essential for public health. Moreover, rodents are known to damage crops, contaminate food supplies, and cause structural harm to buildings, leading to substantial economic losses. As a result, the demand for rodenticides has increased across agricultural, residential, and commercial sectors.

The agricultural sector is a significant consumer of rodenticides, employing these agents to protect crops from rodent-related damage. Crop losses due to rodent infestations can be extensive, impacting global food production and supply chains. In this context, the Rodenticides Market plays a pivotal role in ensuring food security by providing farmers with tools to manage rodent populations effectively and protect their harvests.

Urban areas and industrial facilities are also major contributors to the demand for rodenticides. Rodents can pose serious threats to infrastructure, electrical systems, and stored goods in urban environments and industrial settings. Effective rodent control is essential to prevent damage to property, avoid disruptions to business operations, and ensure the safety of occupants.

According to the 2019 American Housing Survey, among the 124 million occupied homes in the United States, 14.8 million reported seeing mice or rats inside the house over the course of a year.

The Rodenticides Market offers a diverse range of formulations, including bait stations, pellets, and liquid concentrates, to cater to different application needs. Bait stations, for instance, provide a targeted and controlled method of delivering rodenticides in areas where rodents are likely to be active. Pellets and liquid concentrates offer flexibility in application, allowing for customization based on the severity of the infestation and the specific environment.

However, the Rodenticides Market is not without its challenges. Environmental concerns, wildlife exposure, and potential harm to non-target species are significant issues that the industry grapples with. The development and use of anticoagulant rodenticides have come under scrutiny due to their persistence in the environment and the unintended poisoning of non-target species, including birds of prey. This has led to increased regulatory scrutiny and a push for the development of more environmentally friendly rodenticide alternatives.

In recent years, there has been a growing focus on integrated pest management (IPM) approaches, which emphasize a holistic and sustainable strategy for pest control. This has influenced the Rodenticides Market to explore and develop innovative solutions that align with IPM principles, such as the use of biological controls, improved bait formulations, and non-toxic alternatives.

In conclusion, the Rodenticides Market plays a vital role in addressing the global challenge of rodent control. With the increasing awareness of the economic and health impacts associated with rodent infestations, the market is expected to continue evolving, embracing sustainable practices, and developing innovative solutions to meet the diverse needs of agriculture, urban areas, and industrial settings. As regulations and consumer preferences drive the industry toward environmentally friendly alternatives, the Rodenticides Market is poised for a future characterized by responsible and effective pest management practices.

Key Market Drivers

Increasing Damage Caused by Rodent Attacks

The demand for Rodenticides in the global market is closely tied to the increasing damage caused by rodent attacks, thereby serving as a pivotal driver for growth during the forecast period. Rodents, including rats and mice, present significant threats to agriculture, public health, and property, necessitating effective measures for rodent control. As these damages escalate, the demand for Rodenticides is expected to surge, driven by the imperative to safeguard crops, prevent disease transmission, and mitigate structural damage.Rodents are notorious for inflicting substantial economic losses on farmers by damaging crops. They consume and contaminate stored grains, fruits, and vegetables, thereby impacting both the quantity and quality of agricultural produce. With the global population continuing to grow, enhancing food security and maximizing crop yields has become increasingly important. Rodenticides play a vital role in protecting agricultural productivity by managing rodent populations and minimizing crop losses, thereby fueling their demand.

The expanding trends of urbanization and industrialization contribute to the growing rodent menace. As more people migrate to urban areas, rodents find plentiful sources of food and shelter, resulting in infestations in residential and commercial spaces. This poses risks to public health, as rodents act as carriers of various diseases, such as leptospirosis, hantavirus, and salmonellosis. To prevent the spread of these diseases and safeguard human well-being, effective rodent control measures are increasingly necessary, amplifying the global demand for Rodenticides.

Environmental concerns regarding the use of chemicals and their harmful effects on humans and other living organisms are expected to limit demand. As a result, the application of such products is strictly controlled by rigorous regulations. In North America and Europe, there are regulations governing the use of chemical rodenticides. For example, in the U.S., all pesticide products must be registered with the Environmental Protection Agency (EPA) before they can be sold to the public. These products are

Key Market Challenges

Regulatory Compliance and Stringent Approvals

The regulatory approval process for new Rodenticides formulations and active ingredients can be lengthy and time-consuming. Companies in the Rodenticides market must undergo rigorous testing and submit comprehensive data to regulatory authorities for evaluation. The protracted approval timelines can delay the introduction of new products to the market, hindering a company's ability to respond quickly to emerging rodent control challenges.Variances in regulations and approval processes can create challenges for companies seeking to market their products globally. Adapting products to meet diverse regulatory standards adds another layer of complexity and can impede the seamless introduction of Rodenticides in multiple markets.

Key Market Trends

Global Urbanization and Changing Demographics

With the ongoing global trend of urbanization, cities are experiencing increased population density. This high density creates favorable conditions for rodent infestations, as these creatures thrive in areas with abundant food sources and shelter. As urban areas expand, the risk of rodent-human interactions also rises, necessitating robust pest management strategies. Rodenticides emerge as a crucial tool in controlling and preventing rodent populations in densely populated urban environments. Urban areas typically witness higher levels of food consumption and storage. Restaurants, grocery stores, and residential areas in cities provide ample food resources for rodents. The demand for Rodenticides is driven by the need to safeguard food supplies from contamination and loss caused by rodent activities.Key Market Players

- BASF SE

- Syngenta AG

- UPL Limited

- Neogen Corporation

- Liphatech, Inc

- Bayer CropScience Limited (Envu)

- Ecolab Inc.

- Rentokil Initial PLC

- Senestech, Inc.

- Rollins, Inc.

Report Scope:

In this report, the Global Rodenticides Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Rodenticides Market, By Type:

- Anticoagulant Rodenticides

- Non-coagulant Rodenticides

Rodenticides Market, By Mode of Application:

- Pellet

- Spray

- Powder

Rodenticides Market, By Rodent Type:

- Rat

- Mice

- Chipmunk

- Hamster

- Others

Rodenticides Market, By End Use:

- Agricultural Fields

- Warehouses

- Urban Centers

Rodenticides Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Rodenticides Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- BASF SE

- Syngenta AG

- UPL Limited

- Neogen Corporation

- Liphatech, Inc

- Bayer CropScience Limited (Envu)

- Ecolab Inc.

- Rentokil Initial PLC

- Senestech, Inc.

- Rollins, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 187 |

| Published | February 2025 |

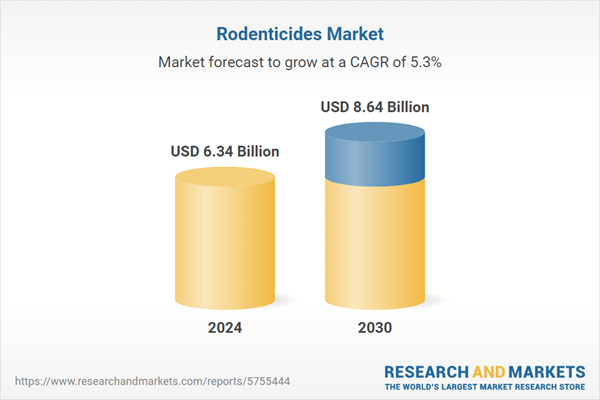

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.34 Billion |

| Forecasted Market Value ( USD | $ 8.64 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |