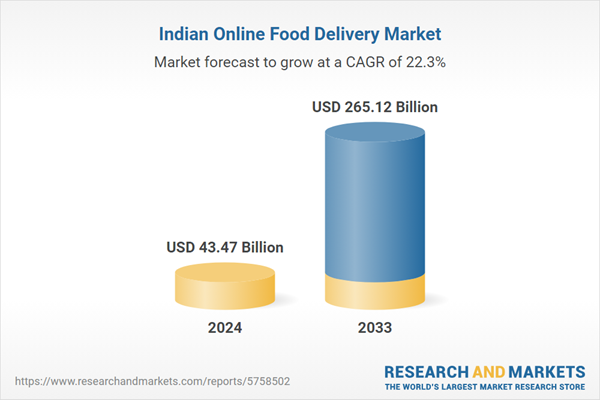

India Online Food Delivery Market is expected to reach US$ 43.47 billion in 2024 to US$ 265.12 billion by 2033, with a CAGR of 22.25 % from 2025 to 2033. Rapid digitalization, rising internet and smartphone usage, and shifting lifestyles that favor online food delivery are driving the expansion of the Indian online meal delivery market. The convenience it provides, the range of cuisines it offers, and the rise in marketing initiatives by the major companies are further factors contributing to the market's expansion. In addition, the growing number of double-income households, busy white-collar workers, and younger people with more disposable incomes are all contributing to the growth of the online meal delivery sector in India.Indian online food delivery market attained a value of nearly US$ 5.30 Billion in 2022

India Online Food Delivery Industry Overview

Online meal delivery makes it easier for people to order and have the food items they want delivered right to their door. It entails perusing the application or website, choosing from a large selection of cuisines, and paying using various methods. The user is informed by the website or application about how long food preparation and delivery should take. The demand for these services is rising in India as a result of these features combined with qualities like delivery convenience, speed, and accuracy.The market is expanding at the moment due to rising smartphone sales and easier access to high-speed internet facilities. This is driving the expansion of the online meal delivery business in India, along with the country's expanding working population and rising income levels. Despite the fact that the majority of the players are based in the nation's metropolis, Bangalore, Delhi, and Mumbai being the three biggest markets, vendors are increasingly focusing on smaller cities due to their significant growth potential. Additionally, the country's demand for online food delivery services is growing due to the growing trend of on-the-go food items and quick home delivery models that provide ready-to-eat (RTE), affordable, and convenient meal delivery options. Additionally, some of the major companies, like Zomato, McDonald's Corporation, and Domino's Pizza Inc., have implemented contactless delivery services in response to the growing number of COVID-19 cases. These services guarantee that the food is delivered safely with appropriate social distancing measures and that the customer does not come into contact with it with bare hands.

Growth Drivers for the India Online Food Delivery Market

Smartphone Adoption and Digital Penetration

The quick rise in smartphone uses and digital penetration is one of the main factors propelling India's online meal ordering and delivery business. More Indians are now able to access the internet thanks to the introduction of reasonably priced smartphones and easily available data plans. People may now conveniently order meals through websites or smartphone apps, which has completely changed the way people order food. In 2021, there were over 624 million smartphone users in India, and the number is still rising, according to a report by the Internet and Mobile Association of India (IAMAI). The online meal delivery industry gains from a wider consumer base and higher levels of engagement as more people adopt digital platforms.Additionally, a variety of customers, including tech-savvy millennials and older generations, find ordering meals online to be an appealing alternative due to the convenience and user-friendly interfaces of food delivery apps. The sector has grown as a result of this change in consumer behavior brought about by convenience.

Innovation and Partnerships in Restaurants

The strategic alliances between food delivery platforms and eateries are another important factor propelling the expansion of India's online food ordering and delivery business. Food aggregators such as Swiggy and Zomato have partnered with a wide variety of restaurants, from neighborhood eateries to well-known franchises. These collaborations provide customers a wide range of menu options to suit a variety of tastes and inclinations.Additionally, the industry's ongoing innovation has improved consumer experiences, shortened delivery times, and improved delivery logistics. Customers now find online meal ordering more alluring thanks to features like contactless delivery, real-time tracking, and enticing discounts. In turn, restaurants gain from the wider audience and better exposure that these platforms provide. Furthermore, the sector has taken on a new dimension as a result of the deployment of cloud kitchens, sometimes referred to as ghost kitchens. Restaurants can more effectively fulfill online orders thanks to cloud kitchens that are geared for meal delivery. Even in places with few dining options, the quick growth of meal delivery services has been made possible by this creative strategy.

India Online Food Delivery Market Overview by Regions

Metro areas like Delhi, Mumbai, Bangalore, and Hyderabad lead India's online meal delivery sector, driven by demand from urban lifestyles and high disposable incomes. Due to shifting consumer patterns and rising internet penetration, Tier 2 and Tier 3 cities are also expanding quickly. An overview of the market by region is given below:North India Online Food Delivery Market

The internet meal delivery business in North India is expanding rapidly, driven by places like Delhi, Chandigarh, Jaipur, and Lucknow. Convenient fast-food options are in increasing demand due to urbanization, changing consumer lifestyles, and increased disposable incomes. With a large number of restaurants and cuisines at customers' fingertips, Delhi, a key hub, leads the way in the adoption of online meal delivery. A greater number of people can now use food delivery services thanks to rising smartphone usage and internet penetration. Further propelling market expansion in North India is the emergence of regional businesses and food aggregators like Swiggy and Zomato.South India Online Food Delivery Market

With cities like Bangalore, Chennai, Hyderabad, and Kochi leading the way, South India's online meal delivery sector is growing quickly. The market is mostly driven by the region's increasing middle class, high internet penetration, and robust tech presence. Busy lifestyles and the ease of ordering from a variety of cuisines are driving an increase in demand for varied meal delivery alternatives in urban regions, especially Bangalore. Local businesses and smartphone apps like Swiggy and Zomato have been quickly adopted, and delivery from both restaurants and cloud kitchens is becoming more and more common. Growing customer preferences for quick, simple, and varied meal alternatives, together with alluring discounts and promotions, are contributing factors to South India's increasing propensity for online food ordering.India Online Food Delivery Company Analysis

The major participants in the India Online Food Delivery market includes Zomato, Swiggy, Jubiliant Foodworks Ltd., Yum Brands Inc., Uber Eats, Dominos, McDonalds, etc.India Online Food Delivery Company News

In March 2022, Zomato revealed its newest feature: food delivery in ten minutes. The function, which would only be accessible in prestigious cities, is meant to help Zomato grow its clientele and solidify its place in the Indian market.In 2022, According to individuals familiar with the situation, Swiggy, a food and grocery delivery service, has surfaced as a possible competitor for Metro AG, a German wholesale retailer, India operations. If the acquisition goes through, Metro Cash & Carry's wholesale locations will be able to support Swiggy's Instamart delivery concept. Swiggy has indicated interest in the deal. Swiggy's speedy grocery delivery service is called Instamart. The goal is to create a hub-and-spoke model in which Metro stores will feed Instamart stores, which may be real locations that customers can visit or may just offer delivery services.

Type- Industry is divided into 2 viewpoints:

1. Platform to consumer2. Restaurant to consumer

Payment - Industry is divided into 2 viewpoints:

1. Cash on Delivery2. Online

Cuisine- Industry is divided into 5 viewpoints:

1. Fast Food2. Indian

3. Chinese

4. Italian

5. Others

Cities- Industry is divided into 6 viewpoints:

1. Bangalore2. Delhi NCR

3. Mumbai

4. Hyderabad

5. Pune

6. Others

All companies have been covered with 5 Viewpoints

1. Overview2. Key Persons

3. Product Portfolio

4. Recent Development & Strategies

5. Revenue Analysis

Company Analysis

1. Zomato2. Swiggy

3. Jubiliant Foodworks Ltd.

4. Yum Brands Inc.

5. Uber Eats

6. Dominos

7. McDonalds

Table of Contents

Companies Mentioned

- Zomato

- Swiggy

- Jubiliant Foodworks Ltd.

- Yum Brands Inc.

- Uber Eats

- Dominos

- McDonalds

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 75 |

| Published | November 2024 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 43.47 Billion |

| Forecasted Market Value ( USD | $ 265.12 Billion |

| Compound Annual Growth Rate | 22.2% |

| Regions Covered | India |

| No. of Companies Mentioned | 7 |