COVID-19 had a significant economic consequence on the Dutch economy. Due to the lockdown, many Danish businesses suffered a significant loss of income as a consequence of the interruption of production, and closure of stores. However, this has created a positive impact on Denmark’s life and non-life insurance market because people started turning more and more toward life Insurance.

The insurance sector in Denmark is characterized as highly developed with particularly high penetration and density. Property and casualty insurance in Denmark has shown a favorable underwriting result with relatively low expense ratios. The number of non-life insurance companies has decreased from 113 in 2008 to below 60 in 2020.

The Danish Financial Supervisory Authority (FSA) is responsible for the regulation and supervision of insurance companies. There are some statutory insurances for everyone in Denmark. These include liability insurance for motor vehicles, dog insurance, and insurance against fire for real estate owners. Employers are also obligated to take out injury insurance for their employees, which covers all work-related injuries.

Denmark Life & Non-Life Insurance Market Trends

Rising Premiums for the Property and Casualty Insurance in Denmark

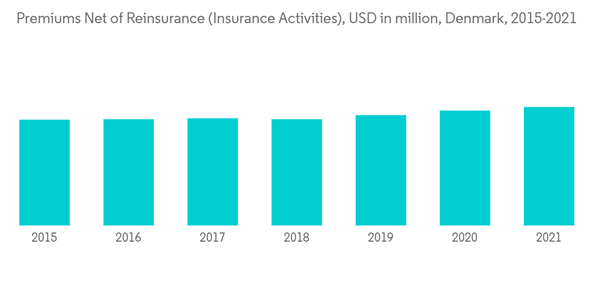

Denmark accounts for nearly 27% share in the Nordic P&C market which makes it the second-largest country in the Nordic P&C insurance market. Premiums written by Danish insurance companies in the property and casualty segment is on rising steadily since 2010. The premium (net of reinsurance) for the insurance activities is increasing, it reached USD 10000 million in 2020.Danish insurance market does not have the same level of high concentration as the other Nordic countries. The premium for Motor vehicle insurance and Fire and other damage to a property represents the two largest shares for property and casualty insurance in Denmark, returns of P&C insurers have remained relatively steady despite the increased number of weather-related claims.

Financial Literacy and Rising Household Savings Boosting Insurance Market in Denmark

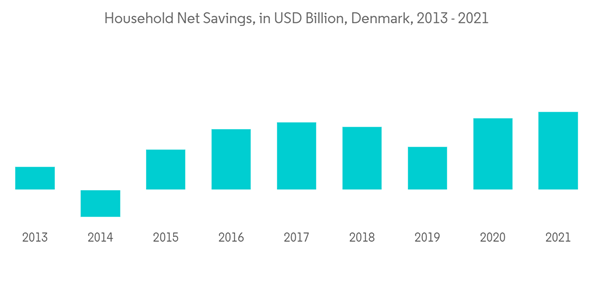

Financial literacy is one of the key factors influencing people’s attitudes towards life insurance. Individuals are more likely to invest in their financial security and save for retirement as they become more aware of the risks they are exposed to and gain a better understanding of the characteristics of available insurance products and pension schemes.The household net savings in Denmark were negative in 2014, at USD 3.79 and increased in the following years, and reached a peak of USD 10.01 billion in 2020. Household savings as a share of disposable income in Denmark is 6.04% in 2020 up 30% from 2015.

Denmark Life & Non-Life Insurance Market Competitor Analysis

The report covers major international players operating in the Denmark Life & Non-Life Insurance Market. In terms of market share, few of the major players currently dominate the market. However, with technological advancement and product innovation, domestic to international companies are increasing their market presence by securing new contracts and tapping new markets. It has major players including Tryg, PFA Pension, Topdanmark, Alm brand, Codan, etc.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Tryg

- PFA pension

- Topdanmark

- Alm brand

- Codan

- Gjensidige

- Sygeforsikring denmark

- Larerstandens Brandforsikring

- Danica

- LB Forsikring

- GF-Forsikring