Increasing Demand for Real-Time Image Visualization

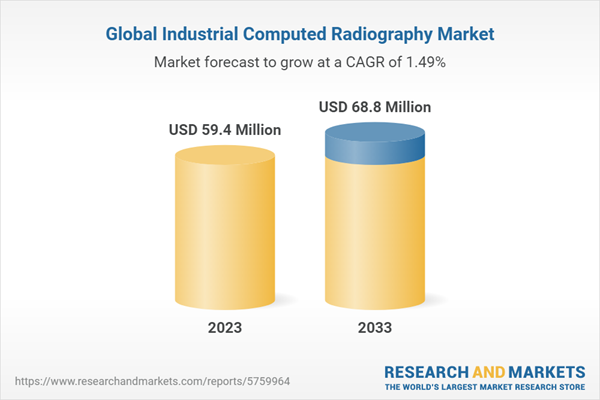

The global industrial computed radiography market is estimated to reach $68.8 million in 2033 from $59.1 million in 2022, at a growth rate of 1.49% during the forecast period 2023-2033. The growth in the industrial computed radiography system market is expected to be driven by the evolution of Industry 4.0 practices and an increase in the need for portable radiography systems.

Market Lifecycle Stage

Conventionally, the industrial non-destructive radiography inspection methods are carried out using the conventional X-Ray machine that uses film to capture images of the defects, and the technicians identify the defects from the film manually. This method consumed huge time to capture the image and required skilled laborers to operate the equipment and identify images. In addition, it requires a huge storage facility to store the films. So, the radiography solution manufacturers developed an upgraded version of conventional X-Ray solutions known as industrial computed radiography.

The industrial computed radiography solutions help the technician to capture the image using an imaging plate and convert the image into a digital format using a computed radiography (CR) reader. This reduced the time of capturing the image and helped to visualize the defects digitally using the review station and acquisition software. Furthermore, it helps to save the image of the defects digitally, which requires the cost spent on storage facilities and can be shared with clients easily.

One of the major factors attributing to the demand of industrial computed radiography solution is the rising demand from the commercial aviation industry, which is driven by the order backlog for next-generation commercial aircraft that is expected to be built.

Impact

The global industrial computed radiography market is observing steady growth, which is expected to drive investments and partnerships across computed radiography technology. The major challenge in the industrial computed radiography market is there is lack of skilled laborers to conduct non-destructive testing using computed radiography systems. In addition, the growth of the digital radiography system increases the demand for real-time image visualization and automatic defect identification technology. This leads the developer to move toward the digital radiography system, which affects the growth of industrial computed radiography systems in the market. In addition, the oil and gas and aerospace industries are looking for a more compact and portable radiography system that offers real-time image visualization even offshore to rectify the defect quickly and efficiently. Therefore, non-destructive testing service providers and industrial computed radiography system manufacturers are gradually moving toward digital radiography systems from computed radiography systems.

Market Segmentation

Segmentation 1: by Application

- Aerospace and Defense

- Automotive

- Oil and Gas

- Power and Energy

- Security

- Explosive Ordnance Disposal and Improvised Explosive Device

- Electronics and Semiconductors

- Food and Drugs

- Transportation Infrastructure

- Construction

- Marine

- Manufacturing

- Heavy Industries

- Others

Among all these applications, aerospace and defense and oil and gas are expected to dominate the market.

Segmentation 2: by Component

- Imaging Plates

- Computed Radiography Reader (Digitizer)

- Review Station with Acquisition Software

Based on components, imaging plates are expected to dominate in terms of volume as they are the major consumable in the industrial computed radiography market and are usually replaced after certain intervals.

Segmentation 3: by Region

- North America - U.S. and Canada

- Europe - France, Germany, Russia, U.K, and Rest-of-Europe

- Asia-Pacific - China, Japan, India, and Rest-of-Asia-Pacific

- Rest-of-the-World - Middle and Africa and Latin America

Based on region, the industrial computed radiography market is expected to be dominated by Europe, and in terms of country, the U.S. is expected to dominate during the forecast period.

Recent Developments in the Global Industrial Computed Radiography Market

- In September 2022, DÜRR NDT GmbH & Co. KG partnered with JME Ltd. to develop an innovative X-Ray solution. The partnership would help JME Ltd. to utilize the D-Tect X software with the DXB:1 to inspect circumferential welds in applications such as new pipelines.

- In July 2022, L3Harris Technologies partnered with DÜRR NDT GmbH & Co. KG to utilize ScanX Discover HC computed radiography scanner to electronically capture X-Ray images and then project them digitally on a monitor for evaluation.

- In February 2021, DÜRR NDT GmbH & Co. KG launched a new D-Tect X NDT software, which offers high performance, is user-friendly, and is extremely flexible.

- In November 2019, Rigaku Corporation extended its partnership with Covalent Metrology to install two of its new analytical instruments in the new facility of Covalent Metrology located in Sunnyvale, California.

- In June 2018, Carestream Health partnered with ayData Management, LLC to offer customers integrated DICONDE-based archive storage solutions worldwide. By utilizing the ayData Management NDT archiving suite of products, Carestream's NDT would be able to enhance its end-to-end digital product line.

Demand - Drivers and Limitations

The following are the drivers for the global industrial computed radiography market:

- Emerging Demand from the Aerospace and Defense Industry

- Rising Demand for Computed Radiography Due to the Evolution of Industry 4.0 Practices

- Rising Demand for Portable Computed Radiography

The following are the challenges for the global industrial computed radiography market:

- Lack of Skilled Labors

- Increasing Demand for Real-Time Image Visualization

The following are the opportunities for the global industrial computed radiography market:

- Persisting Need for CR Capabilities in Oil and Gas Domain

- Opportunities in the Aviation/MRO Domain

- Opportunities in Providing NDT Certification to Technician

How can this report add value to an organization?

Platform/Innovation Strategy: The product segment helps the reader understand the various component that is integrated with industrial computed radiography to conduct safe, secure, and efficient non-destructive testing. Moreover, the study provides the reader with a detailed understanding of the components, such as imaging plates and computed radiography readers. In addition, it provides a detailed understanding of the acquisition software that the review station uses to review the images captured by the imaging plates.

Growth/Marketing Strategy: The global industrial computed radiography market has seen major development activities by key players operating in the market, such as business expansion activities, contracts, mergers, partnerships, collaborations, and joint ventures. The favored strategy for the companies has been contracted to strengthen their position in the industrial computed radiography market. For instance, in September 2022, DÜRR NDT GmbH & Co. KG partnered with JME Ltd. to develop an innovative X-Ray solution. The partnership would help JME Ltd. to utilize the D-Tect X software with the DXB:1 to inspect circumferential welds in applications such as new pipelines. Furthermore, in July 2022, L3Harris Technologies partnered with DÜRR NDT GmbH & Co. KG to utilize ScanX Discover HC computed radiography scanner to electronically capture X-Ray images and then project them digitally on a monitor for evaluation.

Competitive Strategy: Key players in the global industrial computed radiography market analyzed and profiled in the study involve industrial computed radiography manufacturers that offer docking systems and enabling capabilities. Moreover, a detailed competitive benchmarking of the players operating in the global industrial computed radiography market offers various solutions to conduct non-destructive testing efficiently through portable computed radiography systems. Additionally, comprehensive competitive strategies such as contracts, partnerships, agreements, acquisitions, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analysis of the company's coverage, product portfolio, and market penetration.

In 2022, the top segment players leading the market included established players manufacturing industrial computed radiography, constituting 100% of the presence in the market. Since it is an established product, the industrial computed radiography market doesn't have startups.

Key Companies Profiled

- Carestream Health

- DÜRR NDT GmbH & Co. KG

- FUJIFILM Holdings America Corporation

- L3Harris Technologies, Inc.

- MQS Technologies Pvt. Ltd.

- Rigaku Corporation

- Virtual Media Integration

- Waygate Technologies (Baker Hughes Company)

Table of Contents

1 Markets

1.1 Industry Outlook

1.1.1 Industrial Computed Radiography Market: Overview

1.1.2 Computed Radiography Services within the Non-Destructive Testing Landscape

1.1.3 Evolving Technological Trends and Disruptions in Computed Radiography Services

1.1.3.1 Artificial Neural Networks for Defect Detection

1.1.3.2 Battery-Operated Flat Panel Detectors

1.1.3.3 Mobile Computed Tomography

1.1.3.4 Computed Laminography

1.1.4 Comparison of Computed Radiography (CR) vs. Digital Radiography (DR) vs. Computed Tomography (CT)

1.1.5 Evolving End-User Requirements for Industrial Computed Radiography Market

1.2 Business Dynamics

1.2.1 Business Drivers

1.2.1.1 Emerging Demand from the Aerospace and Defense Industry

1.2.1.2 Rising Demand for Computed Radiography Due to the Evolution of Industry 4.0 Practices

1.2.1.2.1 Case Study: Advantages of Using CR Technology Observed by Emerson Electric Co.

1.2.1.3 Rising Demand for Portable Computed Radiography

1.2.2 Business Challenges

1.2.2.1 Lack of Skilled Labors

1.2.2.2 Increasing Demand for Real-Time Image Visualization

1.2.3 Business Strategies

1.2.3.1 Business Strategies

1.2.3.1.1 New Product Launch and Business Expansion

1.2.3.2 Corporate Strategies

1.2.4 Business Opportunities

1.2.4.1 Persisting Need for CR Capabilities in Oil and Gas Domain

1.2.4.2 Opportunities in the Aviation/MRO Domain

1.2.4.3 Opportunities in Providing NDT Certification to Technician

2 Service

2.1 Global Industrial Computed Radiography Market (by Application)

2.1.1 Market Overview

2.1.1.1 Demand Analysis of the Industrial Computed Radiography Market (by Application)

2.1.2 Aerospace and Defense

2.1.2.1 Casting Manufacturing

2.1.2.2 Assembly

2.1.2.3 Maintenance, Repair, and Overhaul (MRO)

2.1.2.4 Weld Inspection

2.1.2.5 Foreign Object Detection (FOD)

2.1.3 Automotive

2.1.3.1 Automatic - Inline Integrated Solution (Robotics/Automatic)

2.1.3.2 Manual

2.1.4 Oil and Gas

2.1.4.1 Weld Inspection

2.1.4.2 Corrosion (Integrity)

2.1.4.3 Others (Valve Checks, Parts, and Flanges)

2.1.5 Power and Energy

2.1.5.1 Weld Inspection

2.1.5.2 Corrosion (Integrity)

2.1.5.3 Others (Valve Checks, Parts, and Flanges)

2.1.6 Security

2.1.6.1 Border Patrol

2.1.6.2 Travel (Airport or Government Buildings)

2.1.7 Explosive Ordnance Disposal and Improvised Explosive Device

2.1.7.1 Explosive Ordnance Disposal (EOD)/Weapons of Mass Destruction (WMD)

2.1.8 Electronics and Semiconductors

2.1.8.1 Automatic - Inline Integrated Solution (Robotics/Automatic)

2.1.8.2 Manual

2.1.9 Food and Drugs

2.1.9.1 Automatic - Inline Integrated Solution (Robotics/Automatic)

2.1.10 Transportation Infrastructure

2.1.10.1 Structural Integrity (Bridges)

2.1.11 Construction

2.1.11.1 Concrete

2.1.12 Marine

2.1.12.1 Casting Manufacturing

2.1.12.2 Assembly

2.1.12.3 Maintenance, Repair, and Overhaul (MRO)

2.1.12.4 Weld Inspection

2.1.13 Manufacturing

2.1.13.1 Automatic - Inline Integrated Solution (Robotics/Automatic)

2.1.13.2 Assembly

2.1.14 Heavy Industries

2.1.14.1 Automatic - Inline Integrated Solution (Robotics/Automatic)

2.1.15 Others

2.1.15.1 Railways

2.1.15.2 Pulp and Paper

2.1.15.3 Academic Research and Development

2.1.15.4 Mining

2.1.15.5 Archeological Investigations

3 Products

3.1 Global Industrial Computed Radiography Market (by Component)

3.1.1 Market Overview

3.1.1.1 Demand Analysis of the Industrial Computed Radiography Market (by Component)

3.1.2 Imaging Plates

3.1.3 Computed Radiography Reader (Digitizer)

3.1.4 Review Station with Acquisition Software

4 Region

4.1 Global Industrial Computed Radiography Market (by Region)

4.2 North America

4.2.1 Markets

4.2.1.1 Key Industrial Computed Radiography Manufacturers in North America

4.2.1.2 Business Drivers

4.2.1.3 Business Challenges

4.2.1.4 North America Industrial Computed Radiography Market (by Country)

4.2.2 North America (by Country)

4.2.2.1 U.S.

4.2.2.1.1 Markets

4.2.2.1.1.1 Key Industrial Computed Radiography Manufacturers in the U.S.

4.2.2.1.2 Product

4.2.2.1.2.1 U.S. Industrial Computed Radiography Market (Components by Application)

4.2.2.2 Canada

4.2.2.2.1 Product

4.2.2.2.1.1 Canada Industrial Computed Radiography Market (Components by Application)

4.3 Europe

4.3.1 Markets

4.3.1.1 Key Industrial Computed Radiography Manufacturers in Europe

4.3.1.2 Business Drivers

4.3.1.3 Business Challenges

4.3.1.4 Europe Industrial Computed Radiography Market (by Country)

4.3.2 Europe (by Country)

4.3.2.1 Germany

4.3.2.1.1 Markets

4.3.2.1.1.1 Key Industrial Computed Radiography Manufacturers in Germany

4.3.2.1.2 Product

4.3.2.1.2.1 Germany Industrial Computed Radiography Market (Components by Application)

4.3.2.2 France

4.3.2.2.1 Product

4.3.2.2.1.1 France Industrial Computed Radiography Market (Components by Application)

4.3.2.3 Russia

4.3.2.3.1 Product

4.3.2.3.1.1 Russia Industrial Computed Radiography Market (Components by Application)

4.3.2.4 U.K.

4.3.2.4.1 Product

4.3.2.4.1.1 U.K. Industrial Computed Radiography Market (Components by Application)

4.3.2.5 Rest-of-Europe

4.3.2.5.1 Product

4.3.2.5.1.1 Rest-of-Europe Industrial Computed Radiography Market (Components by Application)

4.4 Asia-Pacific

4.4.1 Markets

4.4.1.1 Key Industrial Computed Radiography Manufacturer in Asia-Pacific

4.4.1.2 Business Drivers

4.4.1.3 Business Challenges

4.4.1.4 Asia-Pacific Industrial Computed Radiography Market (by Country)

4.4.2 Asia-Pacific (by Country)

4.4.2.1 China

4.4.2.1.1 Product

4.4.2.1.1.1 China Industrial Computed Radiography Market (Components by Application)

4.4.2.2 India

4.4.2.2.1 Markets

4.4.2.2.1.1 Key Industrial Computed Radiography Manufacturers in India

4.4.2.2.2 Product

4.4.2.2.2.1 India Industrial Computed Radiography Market (Components by Application)

4.4.2.3 Japan

4.4.2.3.1 Markets

4.4.2.3.1.1 Key Industrial Computed Radiography Manufacturers in Japan

4.4.2.3.2 Product

4.4.2.3.2.1 Japan Industrial Computed Radiography Market (Components by Application)

4.4.2.4 Rest-of-Asia-Pacific

4.4.2.4.1 Product

4.4.2.4.1.1 Rest-of-Asia-Pacific Industrial Computed Radiography Market (Components by Application)

4.5 Rest-of-the-World

4.5.1 Markets

4.5.1.1 Business Drivers

4.5.1.2 Business Challenges

4.5.1.3 Rest-of-the-World Industrial Computed Radiography Market (by Region)

4.5.2 Rest-of-the-World (by Region)

4.5.2.1 Middle East and Africa

4.5.2.1.1 Product

4.5.2.1.1.1 Middle East and Africa Industrial Computed Radiography Market (Components by Application)

4.5.2.2 Latin America

4.5.2.2.1 Product

4.5.2.2.1.1 Latin America Industrial Computed Radiography Market (Components by Application)

5 Markets - Competitive Benchmarking & Company Profiles

5.1 Market Share Analysis

5.2 Industrial Computed Radiography Developers

5.2.1 Carestream Health

5.2.1.1 Company Overview

5.2.1.1.1 Role of Carestream Health in the Global Industrial Computed Radiography Market

5.2.1.1.2 Customers

5.2.1.1.3 Product Portfolio

5.2.1.2 Business Strategies

5.2.1.2.1 Product Launches

5.2.1.3 Corporate Strategies

5.2.1.3.1 Partnerships

5.2.1.4 Analyst View

5.2.2 DÜRR NDT GmbH & Co. KG

5.2.2.1 Company Overview

5.2.2.1.1 Role of DÜRR NDT GmbH & Co. KG in the Global Industrial Computed Radiography Market

5.2.2.1.2 Customers

5.2.2.1.3 Product Portfolio

5.2.2.2 Business Strategies

5.2.2.2.1 New Product Launches and Expansions

5.2.2.3 Corporate Strategies

5.2.2.3.1 Partnerships, Agreements, and Contracts

5.2.2.4 Analyst View

5.2.3 FUJIFILM Holdings America Corporation

5.2.3.1 Company Overview

5.2.3.1.1 Role of FUJIFILM Holdings America Corporation in the Global Industrial Computed Radiography Market

5.2.3.1.2 Customers

5.2.3.1.3 Product Portfolio

5.2.3.2 R&D Analysis

5.2.3.3 Analyst View

5.2.4 L3Harris Technologies, Inc.

5.2.4.1 Company Overview

5.2.4.1.1 Role of L3Harris Technologies, Inc. in the Global Industrial Computed Radiography Market

5.2.4.1.2 Customers

5.2.4.1.3 Product Portfolio

5.2.4.2 Analyst View

5.2.5 MQS Technologies Pvt. Ltd.

5.2.5.1 Company Overview

5.2.5.1.1 Role of MQS Technologies Pvt. Ltd. in the Global Industrial Computed Radiography Market

5.2.5.1.2 Customers

5.2.5.1.3 Product Portfolio

5.2.5.2 Analyst View

5.2.6 Rigaku Corporation

5.2.6.1 Company Overview

5.2.6.1.1 Role of Rigaku Corporation in the Global Industrial Computed Radiography Market

5.2.6.1.2 Customers

5.2.6.1.3 Product Portfolio

5.2.6.2 Corporate Strategies

5.2.6.2.1 Partnerships

5.2.6.3 Analyst View

5.2.7 Virtual Media Integration

5.2.7.1 Company Overview

5.2.7.1.1 Role of Virtual Media Integration in the Global Industrial Computed Radiography Market

5.2.7.1.2 Customers

5.2.7.1.3 Product Portfolio

5.2.7.2 Analyst View

5.2.8 Waygate Technologies (Baker Hughes Company)

5.2.8.1 Company Overview

5.2.8.1.1 Role of Waygate Technologies in the Global Industrial Computed Radiography Market

5.2.8.1.2 Customers

5.2.8.1.3 Product Portfolio

5.2.8.2 R&D Analysis

5.2.8.3 Analyst View

6 Growth Opportunities and Recommendation

6.1 Growth Opportunities

6.1.1 Growth Opportunity: Increasing Need for Digital Storage and Sharing of Data

6.1.1.1 Recommendations

6.1.2 Growth Opportunity: Increasing Need for In-House Testing

6.1.2.1 Recommendations

7 Research Methodology

7.1 Factors for Data Prediction and Modeling

List of Figures

Figure 1: Global Industrial Computed Radiography Market, Units, 2022-2033

Figure 2: Global Industrial Computed Radiography Market, $Million, 2022-2033

Figure 3: Global Industrial Computed Radiography Market, Consumables (Imaging Plates), Units, 2022-2033

Figure 4: Global Industrial Computed Radiography Market, Consumables (Imaging Plates), $Million, 2022-2033

Figure 5: Global Industrial Computed Radiography Market (by Application), Units, 2023 and 2033

Figure 6: Global Industrial Computed Radiography Market (by Application), $Million, 2023 and 2033

Figure 7: Global Industrial Computed Radiography Market (by Region), $Million, 2023

Figure 8: Global Industrial Computed Radiography Market Coverage

Figure 9: Factors Analyzed in Business Dynamics

Figure 10: Commercial Aircraft Order Backlog (as of December 2021)

Figure 11: Share of Key Market Strategies and Developments, January 2020- November 2022

Figure 12: Global Industrial Computed Radiography Market (by Application)

Figure 13: Global Industrial Computed Radiography Market (by Component)

Figure 14: Global Industrial Computed Radiography Market Share (by Company), $Million, 2022

Figure 15: FUJIFILM Holdings America Corporation: R&D Analysis, $Million, 2019-2021

Figure 16: Waygate Technologies: R&D Analysis, $Million, 2019-2021

Figure 17: Research Methodology

Figure 18: Top-Down Approach

Figure 19: Assumptions and Limitations

List of Tables

Table 1: Comparison of Computed Radiography (CR) vs. Digital Radiography (DR) vs. Computed Tomography (CT)

Table 2: Advantages and Disadvantages of Computed Radiography:

Table 3: Advantages and Disadvantages of Digital Radiography:

Table 4: New Product Launch, January 2018- January 2023

Table 5: Expansion, January 2018- January 2023

Table 6: Partnerships, Collaborations, Agreements, and Contracts, January 2018- January 2023

Table 7: Global Industrial Computed Radiography Market (by Imaging Plate), Units and $Million, 2022-2033

Table 8: Global Industrial Computed Radiography Market (by Computed Radiography Reader), Units and $Million, 2022-2033

Table 9: Global Industrial Computed Radiography Market (by Review Station with Acquisition Software, by Application), Units and $Million, 2022-2033

Table 10: Global Industrial Computed Radiography Market (by Component), Units and $Million, 2022-2033

Table 11: Global Industrial Computed Radiography Market (by Region), Units and $Million, 2022-2033

Table 12: North America Industrial Computed Radiography Market (by Country), Units and $Million, 2022-2033

Table 13: U.S. Industrial Computed Radiography Market (by Imaging Plate, by Application), Units and $Million, 2022-2033

Table 14: U.S. Industrial Computed Radiography Market (by Computed Radiography Reader (Digitizer), by Application), Units and $Million, 2022-2033

Table 15: U.S. Industrial Computed Radiography Market (by Review Station with Acquisition Software, by Application), Units and $Million, 2022-2033

Table 16: Canada Industrial Computed Radiography Market (by Imaging Plate, by Application), Units and $Million, 2022-2033

Table 17: Canada Industrial Computed Radiography Market (by Computed Radiography Reader (Digitizer), by Application), Units and $Million, 2022-2033

Table 18: Canada Industrial Computed Radiography Market (by Review Station with Acquisition Software, by Application), Units and $Million, 2022-2033

Table 19: Europe Industrial Computed Radiography Market (by Country), Units and $Million, 2022-2033

Table 20: Germany Industrial Computed Radiography Market (by Imaging Plate, by Application), Units and $Million, 2022-2033

Table 21: Germany Industrial Computed Radiography Market (by Computed Radiography Reader (Digitizer), by Application), Units and $Million, 2022-2033

Table 22: Germany Industrial Computed Radiography Market (by Review Station with Acquisition Software, by Application), Units and $Million, 2022-2033

Table 23: France Industrial Computed Radiography Market (by Imaging Plate, by Application), Units and $Million, 2022-2033

Table 24: France Industrial Computed Radiography Market (by Computed Radiography Reader (Digitizer), by Application), Units and $Million, 2022-2033

Table 25: France Industrial Computed Radiography Market (by Review Station with Acquisition Software, by Application), Units and $Million, 2022-2033

Table 26: Russia Industrial Computed Radiography Market (by Imaging Plate, by Application), Units and $Million, 2022-2033

Table 27: Russia Industrial Computed Radiography Market (by Computed Radiography Reader (Digitizer), by Application), Units and $Million, 2022-2033

Table 28: Russia Industrial Computed Radiography Market (by Review Station with Acquisition Software, by Application), Units and $Million, 2022-2033

Table 29: U.K. Industrial Computed Radiography Market (by Imaging Plate, by Application), Units and $Million, 2022-2033

Table 30: U.K. Industrial Computed Radiography Market (by Computed Radiography Reader (Digitizer), by Application), Units and $Million, 2022-2033

Table 31: U.K. Industrial Computed Radiography Market (by Review Station with Acquisition Software, by Application), Units and $Million, 2022-2033

Table 32: Rest-of-Europe Industrial Computed Radiography Market (by Imaging Plate, by Application), Units and $Million, 2022-2033

Table 33: Rest-of-Europe Industrial Computed Radiography Market (by Computed Radiography Reader (Digitizer), by Application), Units and $Million, 2022-2033

Table 34: Rest-of-Europe Industrial Computed Radiography Market (by Review Station with Acquisition Software, by Application), Units and $Million, 2022-2033

Table 35: Asia-Pacific Industrial Computed Radiography Market (by Country), Units and $Million, 2022-2033

Table 36: China Industrial Computed Radiography Market (by Imaging Plate, by Application), Units and $Million, 2022-2033

Table 37: China Industrial Computed Radiography Market (by Computed Radiography Reader (Digitizer), by Application), Units and $Million, 2022-2033

Table 38: China Industrial Computed Radiography Market (by Review Station with Acquisition Software, by Application), Units and $Million, 2022-2033

Table 39: India Industrial Computed Radiography Market (by Imaging Plate, by Application), Units and $Million, 2022-2033

Table 40: India Industrial Computed Radiography Market (by Computed Radiography Reader (Digitizer), by Application), Units and $Million, 2022-2033

Table 41: India Industrial Computed Radiography Market (by Review Station with Acquisition Software, by Application), Units and $Million, 2022-2033

Table 42: Japan Industrial Computed Radiography Market (by Imaging Plate, by Application), Units and $Million, 2022-2033

Table 43: Japan Industrial Computed Radiography Market (by Computed Radiography Reader (Digitizer), by Application), Units and $Million, 2022-2033

Table 44: Japan Industrial Computed Radiography Market (by Review Station with Acquisition Software, by Application), Units and $Million, 2022-2033

Table 45: Rest-of-Asia-Pacific Industrial Computed Radiography Market (by Imaging Plate, by Application), Units and $Million, 2022-2033

Table 46: Rest-of-Asia-Pacific Industrial Computed Radiography Market (by Computed Radiography Reader (Digitizer), by Application), Units and $Million, 2022-2033

Table 47: Rest-of-Asia-Pacific Industrial Computed Radiography Market (by Review Station with Acquisition Software, by Application), Units and $Million, 2022-2033

Table 48: Rest-of-the-World Industrial Computed Radiography Market (by Region), Units and $Million, 2022-2033

Table 49: Middle East and Africa Industrial Computed Radiography Market (by Imaging Plate, by Application), Units and $Million, 2022-2033

Table 50: Middle East and Africa Industrial Computed Radiography Market (by Computed Radiography Reader (Digitizer), by Application), Units and $Million, 2022-2033

Table 51: Middle East and Africa Industrial Computed Radiography Market (by Review Station with Acquisition Software, by Application), Units and $Million, 2022-2033

Table 52: Latin America Industrial Computed Radiography Market (by Imaging Plate, by Application), Units and $Million, 2022-2033

Table 53: Latin America Industrial Computed Radiography Market (by Computed Radiography Reader (Digitizer), by Application), Units and $Million, 2022-2033

Table 54: Latin America Industrial Computed Radiography Market (by Review Station with Acquisition Software, by Application), Units and $Million, 2022-2033

Table 55: Carestream Health: Product Portfolio

Table 56: Carestream Health: Product Launches

Table 57: Carestream Health: Partnerships

Table 58: DÜRR NDT GmbH & Co. KG: Product Portfolio

Table 59: DÜRR NDT GmbH & Co. KG: New Product Launches and Expansions

Table 60: DÜRR NDT GmbH & Co. KG: Partnerships, Agreements, and Contracts

Table 61: FUJIFILM Holdings America Corporation: Product Portfolio

Table 62: L3Harris Technologies, Inc.: Product Portfolio

Table 63: MQS Technologies Pvt. Ltd.: Product Portfolio

Table 64: Rigaku Corporation: Product Portfolio

Table 65: Rigaku Corporation: Partnerships

Table 66: Virtual Media Integration: Product Portfolio

Table 67: Waygate Technologies: Product Portfolio

Companies Mentioned

- Carestream Health

- DÜRR NDT GmbH & Co. KG

- FUJIFILM Holdings America Corporation

- L3Harris Technologies, Inc.

- MQS Technologies Pvt. Ltd.

- Rigaku Corporation

- Virtual Media Integration

- Waygate Technologies (Baker Hughes Company)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 221 |

| Published | March 2023 |

| Forecast Period | 2023 - 2033 |

| Estimated Market Value ( USD | $ 59.4 Million |

| Forecasted Market Value ( USD | $ 68.8 Million |

| Compound Annual Growth Rate | 1.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |