The prevalence of digestive health issues, including irritable bowel syndrome, cholecystitis, and others, is increasing among the Asian population due to the adoption of the western diet that includes bread, pasta, etc. The surge in the consumption of high-sodium foods is also increasing the prevalence of digestive health issues. For instance, the survey on the digestive health of Indian families conducted by ITC in 2021 revealed that 56% of Indian families had reported digestive health problems. As a result, consumers are more inclined to use digestive supplements, such as prebiotics and probiotics supplements, to overcome their digestive health problems, as they help to maintain good gut health. Moreover, the increasing consumer focus on weight management, coupled with a rising number of physical fitness centers in the region, is also anticipated to drive the growth of the market studied.

The key factors augmenting the growth of the market studied are the increasing prevalence of obesity, the rising aging population, and growing consumer awareness about the benefits of the products. The continuous development in product innovation and easy availability of digestive supplements on online and offline platforms also contributes to the growth of the market studied.

APAC Digestive Health Supplements Market Trends

Growing Concern about Gut Health

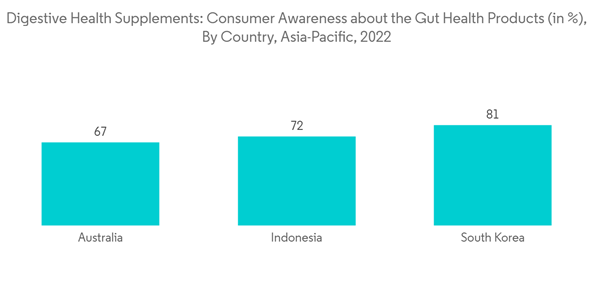

The rising consumer awareness regarding gut health is anticipated to propel the demand for digestive supplement products. Owing to this demand, the key players are actively offering prebiotic and probiotic supplements in the market to maintain a healthy gut. For instance, in September 2022, PanTheryx, an integrative digestive and immune health company, introduced a probiotic supplement under the brand Truebiotics, which acts as diarrhea support for children and adults. Millennials, being technologically advanced, update themselves with the facts related to health and try to amend their routines and consumption habits accordingly. This is inflating the demand for digestive supplements. This is expected to drive the market for probiotic supplements in the near future. Thus, the market growth and increased interest in gut health products offer a large opportunity for companies focused on developing products targeting gut health conditions. Moreover, the market for probiotics and prebiotic supplements is growing, along with new research developments that can uncover greater knowledge of the microbiome, as well as the value of specific compounds for digestion and a broader range of health benefits.Escalating Consumer Investment in Preventive Healthcare

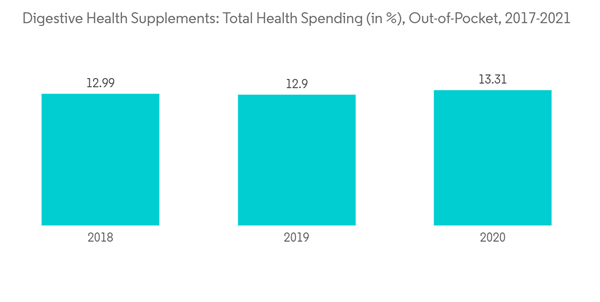

In the past few years, Asian consumer spending on health and wellness products has been increasing due to higher per-capita out-of-pocket spending in the healthcare sector. Such trends have prompted consumers to opt for digestive health supplements. Growth in the working population, rising disposable income, and penetration of international brands are the key factors contributing to the increased consumption of digestive health supplements across emerging countries. Moreover, the increasing healthcare expenditure of the Asian population is also anticipated to drive the growth of the Asia-Pacific digestive supplements market. According to the Australian Institute of Health and Welfare, healthcare expenditure in Australia was recorded as an average of USD 7,926 per person and comprised 10.2% of overall economic activity in 2020. Therefore, the increasing healthcare spending is expected to drive sales in the Asia-Pacific digestive health supplements market.On the other hand, the aging population consumes digestive health supplements to enhance the digestion process owing to the less efficient digestion. For instance, 28.7% of the population in Japan was 65 or older in 2020. Thus, the growing geriatric population in the region is also anticipated to propel the growth of the market studied.

APAC Digestive Health Supplements Market Competitor Analysis

The Asia-Pacific digestive health supplements market includes market players such as Abbott, Amway, Bayer AG, DuPont de Nemours, GNC Holdings, LLC, Herbalife International of America Inc., NOW Foods, Nestlé, Nordic Naturals, and ORGANIC INDIA. The key strategies adopted by the players are product innovation, expansion, and partnership. Manufacturers are investing heavily in R&D to enhance their product portfolios and brand positioning through product differentiation. Further, leading companies are focused on innovative marketing efforts such as health claims and clean labels to gain consumer interest.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- Amway

- Bayer AG

- DuPont de Nemours

- GNC Holdings LLC

- Herbalife Nutrition

- NOW Foods

- Nestle Inc.

- Nordic Naturals

- ORGANIC INDIA