The COVID-19 pandemic had a significant impact on nursing homes initially, with enormous outbreaks reported in long-term care facilities across the globe. It not only affected residents but also care workers and visitors. According to an article titled 'COVID-19: Management in nursing homes', published by Mark Yurkofsky and MDJoseph G Ouslander in September 2022, due to the significant percentage of older people and those with underlying chronic diseases, COVID-19 had a disproportionately adverse impact on nursing home (NH) populations during the initial phase of the outbreak. The high resident-to-healthcare personnel (HCP) ratios, the enclosed environment, the use of resident common spaces, and the difficulties faced by dementia patients who find it difficult to adhere to social distance and universal masking policies impacted the health of the patients. However, nursing home and long-term care services started resuming with proper COVID-19 guidelines in the latter phase of the outbreak. As per the 2022 report, Long Term Care News, in early 2021, the Agency for Health Care Administration (AHCA) executives predicted that a 1% increase in occupancy each month would put nursing homes back on firm ground. Furthermore, as per the article published in 2021 titled 'Challenges and Futures of Long-Term Care Industry after COVID-19 Pandemic', the study showed that, after the COVID-19, there are many additional new options that can offer adequate and reasonably priced care for possible elderly or dependents who may need residential care. Governments modified their norms regarding long-term care facilities in order to accommodate people and help the settings financially. Additionally, home-and community-based care is likely to take over as the major form of care in the long-term care sector in the post-pandemic phase. Thus, due to the aforementioned factors, COVID-19 had a significant impact on the long term care market.

In addition, favorable long-term care insurance plans, increasing adoption of long term care homes by the older population, and technological advancements in the field of long-term care are boosting the market’s growth.

For instance, the article published in 2021 titled 'The future of long-term care requires investment in both facility- and home-based services' stated that the Dutch, Norwegian, and Swedish systems are prioritizing Home & Community Based Services (HCBS) for nursing care homes. Public spending on long-term care as a share of GDP in the Netherlands (3.7%), Norway (3.3%), and Sweden (3.2%) far exceeds the United States (0.5%).

Furthermore, technological advancements in the field of long-term care are anticipated to uplift market growth. For instance, as per the June 2022 update, American HealthTech, an EHR provider for the long-term care and post-acute care sector, collaborated with Brown University, Exponent Inc., and MatrixCare to collect and use nursing home residents’ electronic medical records and associated data, such as lab results, to create comprehensive resident EHRs to help providers monitor their residents’ needs and outcomes. According to the Agency for Health Care Administration (AHCA), the health records system is anticipated to assist public health reporting and enable researchers to produce real-world evidence on various therapies and care techniques for the elderly and people with disabilities in nursing homes. Hence, this initiative is likely to provide an uplift to the market and thereby boost the market's growth.

Thus, due to the aforementioned factors, the long-term care market is expected to witness significant growth over the forecast period. However, the high cost associated with nursing services and a lack of awareness of long-term care services restrains the market's growth.

Long Term Care Market Trends

Nursing Care Segment Projected to Have Notable Growth Rate Over the Forecast Period

A nursing home/care is a place where elderly or disabled people can receive residential care. The presence of several facilities offering nursing care to the growing aging population worldwide is a major factor driving the nursing care segment's growth. Many nursing homes are increasingly taking a more holistic approach to long-term care. The nursing staff is treating home residents as complex individuals rather than only treating their symptoms resulting from medical conditions. These are focused on cultivating wellness and improvement over illness and maintenance.During the COVID-19 pandemic, there was a significant influence on the elderly population, particularly those living in long-term care facilities, with a significant impact on mortality and morbidity. Thus, strenuous action was required to alleviate the impact of COVID-19. This was achieved by addressing nursing staff shortages and safeguarding the health of their staff as they cared for sick patients. As of June 2021, a report by 'The American Health Care Association and the National Center for Assisted Living (AHCA/NCAL)' surveyed 616 nursing facilities and found that 94% of them are suffering from a staffing deficit. As a result, long-term care facilities had to find new and more effective ways to recruit and retain nursing staff to meet the care demands.

Thus, considering the above trends, such as the presence of many facilities providing nursing care and medical supervision and a growing need for nursing staff, the segment is anticipated to witness growth over the forecast period.

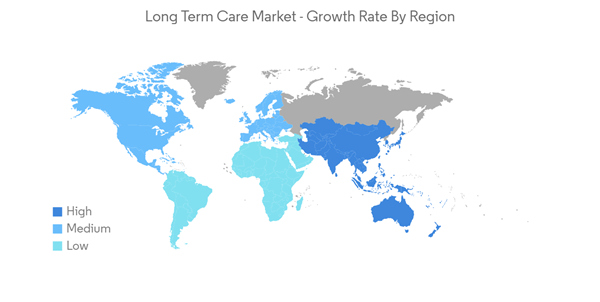

North America Dominates the Market and the Region is Expected to do the Same Over the Forecast Period

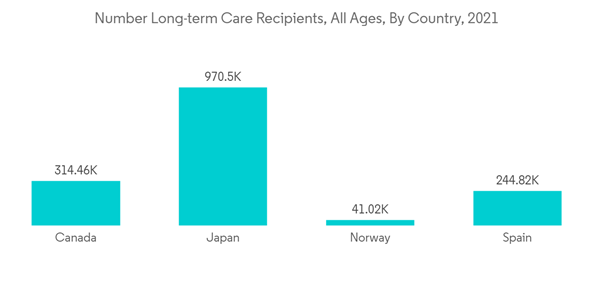

North America holds the major share in the long-term care market during the forecast period. This region is leading owing to factors such as the increasing geriatric population, favorable government policies, and more insurance coverage.According to the Department of Health and Human Services (HHS), 7 out of 10 seniors who reach the age of 65 are now projected to need long-term care (LTC). It is anticipated that 24 million Americans will require long-term care by 2030. Thus, these factors benefit the growth of the market in this region. Moreover, government initiatives and programs to support people in their old age are likely to boost the market's growth. For instance, in April 2022, the World Health Organization (WHO) stated that due to the rapidly aging population, health and social care systems need to be transformed to provide integrated, person-centered care that takes older adults' needs, objectives, and preferences into account. For that purpose, WHO developed the integrated care for older people (ICOPE) approach and a three-phase implementation pilot program to support the Member States, including the United States, in adapting to the provision of integrated care.

Furthermore, company developments and joint ventures that promote the growth of long-term care settings are more common in North America. For instance, in March 2022, Canada-based long-term care company Extendicare announced an agreement to acquire a 15% managed to interest in 24 long-term care homes from Revera and formed a redevelopment joint venture with Axium. This agreement allowed 56 long-term care homes to double the Extendicare assisted portfolio of managed homes.

Thus, these aforementioned factors are likely to boost the market's growth in the North American region.

Long Term Care Market Competitor Analysis

The long-term care market is a fragmented market with a large number of regional and international players in the industry. With the rising patient awareness levels and high prevalence of diseases, many regional players are expected to be part of the long-term care market over the forecast period. Some of the major players in the market are Brookdale Senior Living, Inc., Sunrise Senior Living, Atria Senior Living, Inc., Extendicare, Inc., and Sonida Senior Living, among others.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Brookdale Senior Living, Inc.

- Sunrise Senior Living

- Atria Senior Living, Inc.

- Extendicare, Inc.

- Sonida Senior Living

- Diversicare Healthcare Services Inc.

- Health PEI (Government of Prince Edward Island)

- Genesis Healthcare Corp.

- Revera Inc.

- Home Instead, Inc.

- Amedisys, Inc.