Due to the COVID-19 pandemic and subsequent lockdowns, the market experienced a substantial decline. Despite the fact that buyers' reluctance to purchase new vehicles and lower cash reserves prevented them from doing so, the slump was not as significant as that of new car sales. However, the market is anticipated to resume its pace in the coming years as life returns to normal. Because public transportation can be risky, the pandemic made owning a car an unavoidable part of life. Before COVID-19, people who preferred public transportation are now potential buyers in the market for used cars.

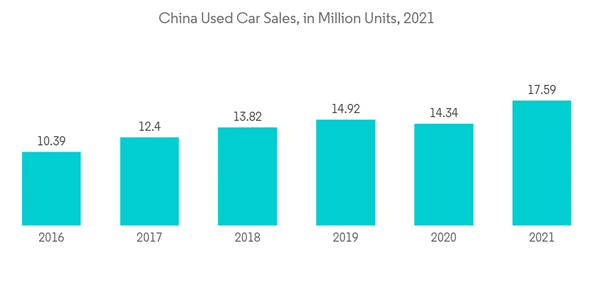

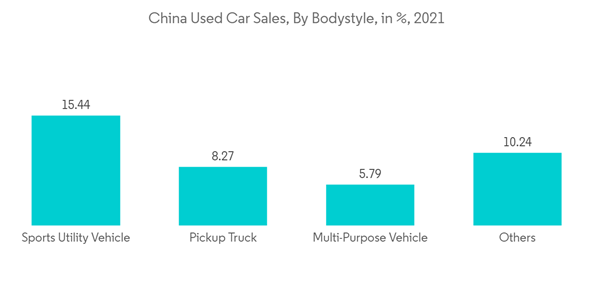

There were approximately 17.59 million used cars sold in China in 2021, a 22.7% increase from 2020. This was because a large portion of the population planned to purchase a car after the virus subsided and mobility restrictions had been lifted. Taking into account the affordability factor and interest in SUVs, the Chinese used car market is expected to grow in the near future.

However, given the pandemic's employment uncertainty, pay cuts, and job losses, new cars are becoming increasingly out of reach for middle-class consumers. Used cars offer a viable and balanced alternative.Chinese authorities have instructed local governments to eliminate policies that prevent cross-regional sales of used cars in order to facilitate trade and increase consumption in the country.

China Used Car Market Trends

Internet Penetration Creating Demand for Online Channels

Due to the rapid expansion of online channels in the industry, the Chinese used car market is expanding. For e-customer experience and brand recognition, Chinese online used car selling platforms are increasing their investments in physical retail stores. Online marketplaces for used cars have been used by an increasing number of Chinese buyers. These marketplaces have lavishly spent on advertising campaigns to convince customers that purchasing cars online is less expensive, simpler, and more transparent than visiting a dealership. However, the players have relied on venture capital firms for consistent funding and investment up until this point.Between 2020 and 2021, this number increased by 85 million, or 10%. In the same month, 65.2% of Chinese people used the internet. By using digitalization to make their offerings more appealing to customers, used car dealers are taking advantage of this technological advancement and becoming more organized.

More people are buying used cars in the country due to features like the availability of a lot of photos and videos of the cars on online platforms and the ease with which they can get financing online.

Due to the rapid expansion of online channels in the industry, the Chinese used car market is expanding. In an effort to enhance customer experience and brand recognition, Chinese online platforms for selling used cars are increasing their investments in physical retail stores. Online marketplaces for used cars are being used by an increasing number of Chinese buyers.These marketplaces have lavishly spent on advertising campaigns to convince customers that purchasing cars online is less expensive, simpler, and more transparent than visiting a dealership.However, the players have relied on venture capital firms for consistent funding and investment up until this point. For instance, in May 2022, Uxin Limited, a website where people can buy and sell used cars, announced that it had reached a deal with a few investors to sell convertible notes worth USD 230 million. Uxin intends to improve cross-regional used car transactions with the new funds, a new area of focus the company has been betting on.Through a private placement, it entered a convertible note purchasing agreement with China-based multi-category online classifieds platform, 58.com, as well as with US-based investment firms Warburg Pincus and TPG and other unidentified investors.

Growing Used Car Financing Aiding Market Growth

When customers borrow money to purchase new or used automobiles, they make larger down payments and repay their loans more quickly than Americans. In 2021, GM Financial's joint venture in China, SAIC-GMAC Automotive Financial, issued retail loans totaling USD 12.3 billion and performed significantly better in terms of net charge-offs. According to GM Financial, only around 40% of vehicles purchased in China are financed.The fact that loans take an average of 27 months to pay off and require a 40% down payment is another appealing feature of the Chinese auto financing market. Twenty-five auto finance companies got approval for establishment by the end of 2021. Auto finance companies are advantageous in the auto industry chain because they are backed by automakers. In recent years, they have expanded rapidly with abundant channel resources.

When it comes to retail, auto finance companies work closely with original equipment manufacturers (OEMs) to carry out promotions and boost auto sales by enhancing loan products, digitizing procedures, lowering loan thresholds, and making car buyers' lives easier. Dealers received steady financial support from auto finance companies along the supply chain. In response to lack of funds for some dealers, they intentionally extended the repayment term and reduced loan interest and fees, particularly during COVID-19 in 2020.

China has accelerated the expansion of used car financing at a rapid pace and achieved exceptional output due to a variety of rules and regulations that encouraged the use of the vehicles.

China Used Car Market Competitor Analysis

The Chinese Used Car Market is fragmented and is occupied by online players and company-operated used car dealers. The major players include Guazi, Uxin Group, Renreche, Souche, CAR Inc, and others. Online dealers of used cars compete on a variety of factors, including the number of cities they serve, the number of value-added services they offer, the number of quality checks they conduct before selling automobiles, and the inventory of vehicles. They offer a variety of services, including vehicle inspections, consulting, financing, and insurance for vehicles, as well as door-to-door delivery and after-sale services.While Uxin Group has more than 200 offline outlets to offer its customers after-sale services, Guazi offers its services in more than 200 cities across China. In China, Renrenche is present in more than 80 cities. The Chinese used car industry is dominated by several of business models, including C2C, B2C, C2B, B2B, and C2B2C.

Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Guazi

- Uxin Group

- Renreche

- Souche

- CAR Inc.

- Autosome Inc.