The market for general surgical devices increased in Spain primarily due to increasing injuries, accidents, and growing demand for minimally invasive devices. An article by VaidamHealth, published in February 2022, stated that Spain experiences a surge of thousands of medical tourists annually. Spain was ranked seventh on the World Health Organization's international comparative list of the world's best health systems, with orthopedics, geriatrics, fertility treatments, and bariatrics being the most popular treatments. These medical tourists increase hospitalization rates and hospital stays, which is anticipated to increase the demand, thereby expected to drive the market studied. Spain's senior population increase will likely contribute to the market's growth. According to the article published by the CSIC unit in April 2021, data for Spain showed the share of the population aged 65 and above at 17%, equal to over 7 million people, of whom approximately 25% were over eighty. By 2050 as much as 30% of Spain's population will be aged over 65. Such an increase in the geriatric population is expected to drive the demand for general surgical devices, as they are prone to chronic diseases and require surgical care, thereby contributing to the market's growth.

Moreover, cardiac disorders have also become more prevalent, increasing the demand for surgical procedures. According to the Springer article published in May 2021, the reported prevalence of cardiovascular diseases among patients with type 2 diabetes ranged from 6.9% to 40.8%. The prevalence of coronary heart disease ranged from 4.7% to 37%, stroke from 3.5% to 19.6%, peripheral artery disease from 2.5 to 13%, and heart failure from 4.3 to 20.1%. Such prevalence of various cardiac disorders is expected to drive the demand for general surgical devices, thereby contributing to the market's growth. The growing population of surgical procedures is likely to register an increased demand for surgical medical instruments. In addition, technological advancements improved, making them more effective and minimally invasive. Hence this helped the market's growth.

The COVID-19 pandemic significantly impacted the market's growth during the lockdown period. This was mainly due to changes in surgical volumes and regional complications. As per the NIH article published in July 2021, the mean number of patients who underwent acute care surgery during the control and pandemic periods was 2.3 and 0.9 per day and hospital, representing a 58.9% decrease in acute care surgery activity. Thus the significant reduction of surgeries during the pandemic outbreak hampered the market's growth. However, the relaxation of lockdown restrictions after the pandemic raised the demand for general surgical devices due to postponed surgeries.

Spain General Surgical Devices Market Trends

Orthopedics is Expected to Register High Growth During the Forecast Period

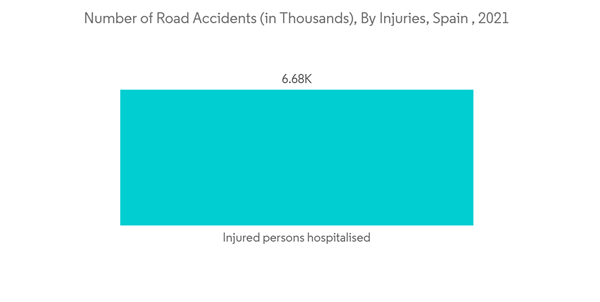

Orthopedic surgery or orthopedics is concerned with the musculoskeletal system. Orthopedic surgery treats musculoskeletal trauma, spine diseases, sports injuries, degenerative diseases, infections, tumors, and congenital disorders. The increase in orthopedic complications among the Spanish population is expected to drive the demand for general surgical devices, thereby contributing to the market’s growth over the forecast period.Recently, the number of accidents in Spain increased, which demanded surgical operations. The data from World Bank showed the cause of death by injury in Spain increased from 3.62% to 4% in 2021. This led to emergency procedures which drove the market’s growth.

Furthermore, the data updated by OECD in July mentioned that the number of people injured per million population was 1996.8 in Spain. This number is further expected to increase by the end of the year. These injuries are predicted to generate demand for general surgical devices and drive the market’s growth. Hence this resulted in more hospital admissions, which increased the number of surgeries, thereby boosting the surgical devices market.

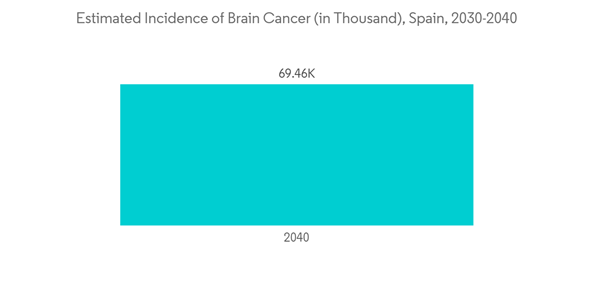

Neurology is Expected to hold a Notable Share in the Market Over the Forecast Period

Neurological disabilities include various disorders such as epilepsy, learning disabilities, neuromuscular disorders, autism, brain tumors, and cerebral palsy.Factors like the high prevalence of neurological disorders and the increasing demand for neurology surgical devices are expected to be crucial for the market's growth over the forecast period. For instance, the Science direct article published in February 2021 mentioned the prevalence of Alzheimer's disease among Spanish patients older than 65 ranged from 4% to 9%. The report also said dementia and Alzheimer's disease are higher in women for nearly every age group.

Another NCBI article published in July 2022 mentioned 30.7% of the patients had generalized tonic-clonic seizures, 26.9% had status epilepticus, 30.7% had focal impaired-awareness seizures, and 11.7% had secondarily generalized seizures. Such prevalence of various neurological disorders among the Spanish population is expected to drive the demand for effective surgical devices, thereby contributing to the growth of the studied segment.

Spain General Surgical Devices Market Competitor Analysis

The market is moderately consolidated and consists of a few major market players. Some of the major players in the market are B. Braun Melsungen AG, Boston Scientific Corporation, Cadence Inc., Conmed Corporation, and Johnson & Johnson.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- B. Braun Melsungen AG

- Boston Scientific Corporation

- Olympus Corporation

- Conmed Corporation

- Johnson & Johnson

- Smith & Nephew PLC

- Medtronic PLC