COVID-19 negatively impacted the market in 2020. However, the market has now been estimated to have reached pre-pandemic levels and is forecasted to grow steadily.

Key Highlights

- The driving factors that tend to the market growth include initiatives and policies from the government for the development of infrastructure, increasing revenue generation from various industries such as plastics, pulp, and paper, among others, and a rising trend of a shift in focus towards bio-based coatings are the key market trends that are driving the market.

- The infrastructure sector dominated the market and is likely to continue its dominance during the forecast period.

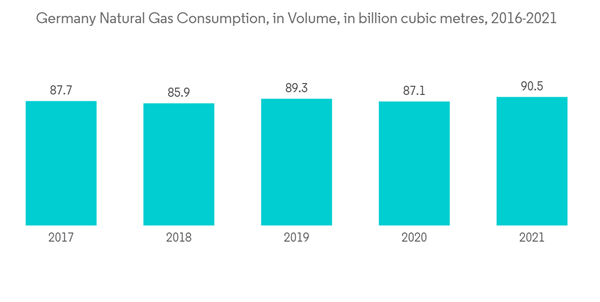

- Moreover, with the increasing natural gas consumption in the country, companies and organizations are increasing production activities. They are finding more areas of exploration, driving the demand for protective coatings in the oil and gas sector of the country.

- The Russia-Ukraine war has impacted the supply chain, causing a hike in raw materials prices and creating a hindrance in the market.

- The growing options for bio-based coatings are further likely to provide opportunities for the studied market during the forecast period.

Key Market Trends

The Rise in Demand from the Infrastructure Sector

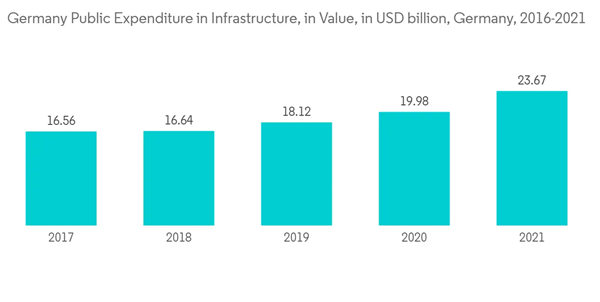

- The infrastructure sector is one of the major end users of protective coatings. The industry requires corrosion and environmental effects-resistant coatings due to exposure of infrastructure surfaces to heat & sunlight, water, and acid rain, dust, and other chemical effects.

- The infrastructure sector uses protective coatings for bridges and coastal Structures, including roads and rail structures, Water Treatment, public power generation, transmission, and other infrastructure, including public buildings. Moreover, organizations in Germany are shifting focus towards strict environmental regulations, which has led to an increased demand for sustainable coating systems with lesser VOCs and longer life, which may be effective in protecting assets.

- In 2022, the German Rail (DB), the federal government, and the federal states increased investment in the modernization of rail infrastructure from around USD 12.7 billion in 2021 to USD 13.6 billion in 2022 by USD 900 million. This investment project includes renovations of 140 bridges and 800 stations. The investment growth is further expected to grow with the increasing demand for urbanization in European countries.

- Moreover, with a positive outlook toward growing infrastructure, in 2022, Germany signed a work plan for cooperation to strengthen quality infrastructure which is expected to positively impact the protective coatings market in the region.

- All the above factors are expected to augment the demand for protective coatings for the infrastructure sector during the forecast period.

Increasing Activity in the Oil and Gas Sector

- The oil and gas industry is another major end-user of protective coatings. Because of the high-temperature environment in which it operates, the industry necessitates heat-resistant coatings. Coatings are also used to protect metal and steel structures from corrosion when exposed to moist and damp conditions. In the oil and gas industry, they are used for tanks, pipes, valves, and pumps among others.

- To prevent corrosion during oil and gas transportation to refineries, the oil and gas industry uses protective coatings for both upstream and downstream segments. The industry has been looking for ways to reduce capital costs. The need to comply with stringent environmental regulations has resulted in a lesser VOC content-based coatings demand in the region which is expected to have positive growth in the forecast period.

- Offshore oil and gas production faces some of the most difficult challenges. As a result, the coating systems used must be capable of withstanding these conditions. Long-term exposure to penetrating UV rays, as well as constant contact with heat waves in the oil and gas sector, increases the demand for protective coatings.

- However, in response to the Russia-Ukraine conflict, Germany has taken steps to halt the process of certifying the Nord Stream Two gas pipeline from Russia, in addition to other sanctions in support of Ukraine. The temporary suspension of Russian imports of petroleum and related products is likely to affect the protective coatings market in the region.

- According to BP Statistical Review 2022, the total natural gas consumption in the country was 90.5 billion cubic meters in 2021, registering a growth rate of 4.2% from 87.1 billion cubic meters in 2020.

- All the above-mentioned factors are expected to create the demand for protective coatings for the oil and gas industry during the forecast period.

Competitive Landscape

The German protective coatings market is fragmented in nature. Some of the major players in the market (not in any particular order) include RPM International Inc, AkzoNobel NV, Jotun, the Sherwin-Williams Company, and PPG Industries, among others.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION1.1 Study Assumptions

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Market Overview

4.2 Market Drivers

4.2.1 The Rise in Demand from the Infrastructure sector

4.2.2 Increasing Activity in the Oil and Gas Sector.

4.3 Market Restraints

4.3.1 Fluctuations in Raw Material Prices

4.3.2 Other Restraints

4.4 Industry Value Chain Analysis

4.5 Porter's Five Forces Analysis

4.5.1 Threat of New Entrants

4.5.2 Bargaining Power of Buyers/Consumers

4.5.3 Bargaining Power of Suppliers

4.5.4 Threat of Substitute Products

4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value)

5.1 Resin Type

5.1.1 Epoxy

5.1.2 Acrylic

5.1.3 Alkyd

5.1.4 Polyurethane

5.1.5 Polyester

5.1.6 Other Resin Type

5.2 Technology

5.2.1 Water Borne Coatings

5.2.2 Solvent Borne Coatings

5.2.3 Powder Coatings

5.2.4 Other Coatings

5.3 End User Industry

5.3.1 Oil and Gas

5.3.2 Mining

5.3.3 Power

5.3.4 Infrastructure

5.3.5 Other End User Industry

6 COMPETITIVE LANDSCAPE

6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

6.2 Market Share (%) **/Ranking Analysis

6.3 Strategies Adopted by Leading Players

6.4 Company Profiles

6.4.1 AkzoNobel N.V.

6.4.2 Axalta Coating Systems

6.4.3 Beckers Group

6.4.4 German Polymers & Coatings (Pvte)

6.4.5 HEGGEL GmBH

6.4.6 Hempel A/S

6.4.7 Jotun

6.4.8 MIPA SE

6.4.9 PPG Industries Inc.

6.4.10 RPM International Inc

6.4.11 The Sherwin Williams Company

6.4.12 WEILBURGER Coatings GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

7.1 Bio-Based Coatings for Sustainable Solutions

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AkzoNobel N.V.

- Axalta Coating Systems

- Beckers Group

- German Polymers & Coatings (Pvte)

- HEGGEL GmBH

- Hempel A/S

- Jotun

- MIPA SE

- PPG Industries Inc.

- RPM International Inc

- The Sherwin Williams Company

- WEILBURGER Coatings GmbH