Key Highlights

- The COVID-19 pandemic impacted the market, so box truck sales fell during the pandemic. The preference for self- and individual mobility and social distancing norms drove down public transportation. However, rapid urbanization and the need for mass material movement have improved the market conditions in the post-pandemic period.

- Over the medium term, growing e-commerce and logistics sectors across the country will likely increase the demand for box trucks for transportation purposes. Factors like increasing regulations on vehicle emissions, advancement in vehicle safety, the introduction of driver-assist systems in vehicles, and rapidly growing logistics in the retail and e-commerce sectors have been significantly driving the demand for new and advanced box trucks during the forecast period.

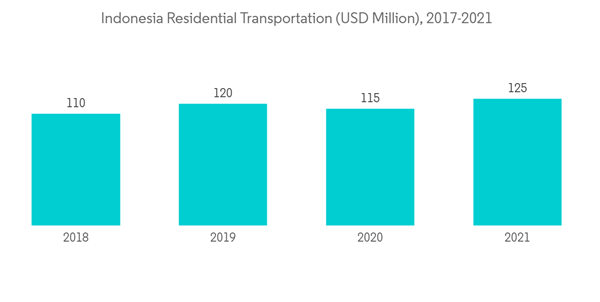

- Box trucks are in significant demand for residential applications such as transportation, boxes, furniture, and fragile goods. This is likely to witness substantial growth for the market during the forecast period.

- With the growing consumer trend toward one-day delivery across the country, the demand for box trucks is also rising. Box trucks often transport packages from one warehouse to another, where the parcels can then be loaded into delivery vans, which is anticipated to enhance the demand for box trucks during the forecast period.

Indonesia Box Truck Market Trends

Rise in residential and Commercial Transportation

- Box trucks are commonly used for residential and commercial transportation, such as transportation of furniture, transportation of fragile goods, and many others across the city, which in turn is likely to witness major growth for the market during the forecast period.

- Primarily, box trucks are experiencing an outpouring of demand from the e-commerce and logistics industry, wherein it is presumed that the e-commerce industry will possess ten-fold growth over the next two decades, which will subsequently draw the market in the coming years. Owing to an increase in internet access and smartphones, online retail sales and e-commerce have been increasing. This is likely to lead to a rise in the demand for box trucks in the view of timely deliveries of goods to customers.

- A dry van is also a box truck container used to transport non-perishable products. These trucks are completely enclosed and shuttered. These trucks are designed to transport vast commodities, freight, and equipment that do not require refrigeration.

- As these trailers are used by the full truckload (FTL) and less-than-truckload (LTL) fleet operators for their operations owing to their cost-efficiency and versatility, the active collaborations between fleet operators and logistic service providers to further enhance demand for these dry vans during the forecast period.

- The adoption of refrigerated box trucks is expected to increase significantly due to the expanding cold chain industry. These trailers are used widely in transporting perishable products like fish, meat, vegetables, etc., and are also deployed for transporting specialized medications that require specific temperature ranges.

Electric Box Trucks are dominating the market

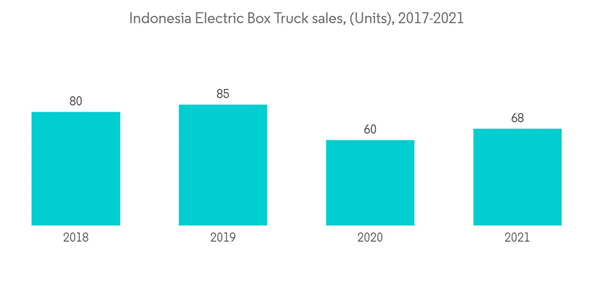

- Rising carbon emissions and climate change have posed a potential challenge for governing bodies. The transportation sector contributes significantly to greenhouse effects; according to International Energy Agency (IEA), the transportation sector accounts for around 37% of global Co2 emissions; nonetheless, the same issue has been faced by Indonesia as well.

- To minimize the carbon emission from the transportation sector, technologies of low or zero carbon emission are required to be deployed at a vast scale, not only in the passenger vehicle category but in the commercial. The Indonesian government introduced several policies to reduce emissions by 29% by 2030, which is anticipated to boost the market during the forecast period.

- In the context of zero carbon emission technologies, alternative fuel vehicles (AFV) offers significant energy-sustainable transportation and came up as a potential innovation to address the issue. Several vehicle manufacturers are introducing electric box trucks to zero-emission transportation across the country.

- For instance, in August 2022, Mitsubishi Fuso Truck and Bus Corporation introduced an all-electric light-duty e-canter truck in Indonesia. The truck distributes raw materials for a factory across the country.

- Shifting customer preference towards electric vehicles is an evident sign for future decarbonization and simultaneously decisive for charging stations. However, the penetration of electric box trucks is subjected to various attributes, including range, charging infrastructure, reliability, and specific regional clusters. This will likely witness major growth for the electric box trucks during the forecast period.

Indonesia Box Truck Market Competitor Analysis

Indonesia Box Truck Market is dominated by several key players such as Ford Motor Company, Mitsubishi Fuso Truck and Bus Corporation, Hino Motors Co. Ltd, and Many others. The rising expansion of truck manufacturers across the country will likely witness major market growth during the forecast period. For instance,In November 2022, Mitsubishi Fuso Truck and Bus Corporation announced that the official FUSO distributor of Indonesia, PT Krama Yudha Tiga Berlian Motors. The company explores its electric vehicle fleets across the country through this announcement.

In March 2022, Hino Motors introduced Hino vehicles with common rail engine standards that are more robust, economical, and environmentally friendly and have complied with Euro4 regulations.

In 2021, Schenker Petrolog Utama (SPU), part of DB Schenker Indonesia, added four double-deck wing box trucks to the existing land transport fleet.

Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Hino Motors Ltd

- Isuzu Motor Co. Ltd

- Mitsubishi Fuso Truck and Bus Corporatio

- Ford Motor Company

- Iveco Motor Group (CNH Industrial NV)

- Mercedes-Benz Group AG

- General Motors

- Fiat Chrysler Automobiles N.V.