COVID-19 negatively impacted the market in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the medium term, the increasing demand for nonferrous metals and demand for minerals from neighboring countries such as China, Russia, and European nations are expected to drive the market's growth.

- On the other hand, the lack of infrastructure, capital, and the low-level mineral processing units within the nation are expected to hamper the growth of Kazakhstan's mining market during the forecast period.

- Nevertheless, in the forecast period, mining equipment innovation and adaptation of the latest technologies, such as AI and IoT, will likely create lucrative growth opportunities for the Kazakhstan mining market.

Kazakhstan Mining Market Trends

Coal Mining to Dominate the Market

- Kazakhstan contains Central Asia's largest coal reserves, and according to the BP Statistical Review of World Energy 2022, the proven coal reserves in 2021 were about 26.61 billion tonnes.

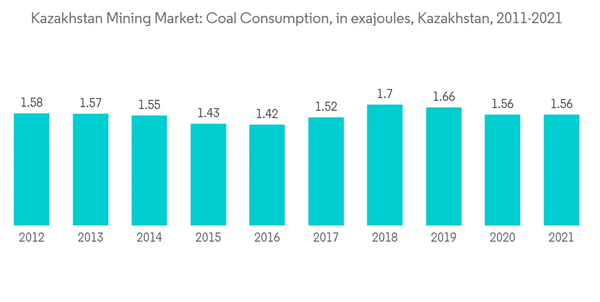

- In 2021, Kazakhstan's coal production amounted to around 2.1 exajoules, up by nearly two percent compared to the previous year. Kazakhstan's coal consumption amounted to 1.56 exajoules in 2021. From 1998 to 2021, consumption of coal in the Central Asia countries increased consumption peaking in the latter year.

- Further, Kazakhstan is one of the largest coal exporters to Europe, China, and Russia. In 2022, Kazakhstan will be one of the largest exporters of coal to Europe due to its rich coal reserves in the absence of Russian coal due to sanctions imposed by the major nations.

- For instance, in the first seven months of 2022, coal exports increased by 5.8% compared to the previous year during the same time, and the country produced 66.4 million tons in 2022 in the first seven months.

- Moreover, according to the International Energy Agency, the country depends on coal for its power production, and about 70% of the electricity generation is by coal. The increasing energy demand with the growing economy would aid the coal mining market in the nation.

- In July 2022, Kazakhstan exported 2.85 million tons of coal and coke to the European Union (EU) countries since the beginning of this year, as its coal is suitable for their power plants. Kazakhstan exported an average of 0.81 million tons of coal to EU nations in the previous year. From January to June 2022, Kazakhstan produced 57.4 million tons of coal, 5.9 percent more than a year earlier, with a profit of 271 billion tenges (USD 564 million).

- Overall, the increasing exports, high coal-proven reserves, and the country's dependence on coal power plants would aid the coal mining market during the forecast period.

Increasing Demand for Non Ferrous Metals

- According to the International Trade Administration, Kazakhstan is the world's largest producer of Uranium, with a total output share of 33% of the world and extensive gold, titanium, and manganese reserves.

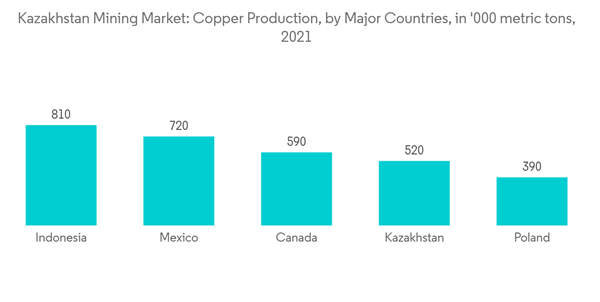

- Moreover, the copper mine production was about 21 million metric tons in 2021, and Kazakhstan copper production recorded 520'000 metric tons in the same year.

- Further, in 2021, the mining sector accounted for 17% of the country's GDP, and hard minerals and metals made up about 16% of the country's export value. For instance, according to the International Trade Administration, in 2021, the country earned USD 2.5 billion from exports of refined copper to non-Eurasian Economic Union countries, USD 792 million from zinc exports, USD 538 million from silver, USD 369 million from aluminum, USD 251 million from lead and USD 121 million from titanium.

- Furthermore, the Dolinny Mine is an underground mine in East Kazakhstan. It is owned by Glencore Plc and produced an estimated 630.009 Thousand tonnes of copper in 2020, and the mine is expected to be operational until 2030.

- In August 2022, East Star Resources Plc announced the award of three new licenses comprising 55 blocks (1794-EL, 1795-EL, 1799-EL) on the Rudny Altai volcanogenic massive sulfide (VMS) belt in Kazakhstan. New Licences incorporate two historic operating (extremely high grade) copper-lead-zinc mines (Pokrovskoye and Talovskaya), one known deposit (Verkhubinskoye), and many historical mineral occurrences.

- Overall, the high availability of nonferrous reserves and the exports of nonferrous minerals during the forecast period would aid the market.

Kazakhstan Mining Market Competitor Analysis

The Kazakhstan mining market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include National Mining Company Tau-Ken Samruk JSC, NAC Kazatomprom JSC, Eurasian Resources Group S.à r.l., ArcelorMittal S.A., and Kazakhmys Corporation.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- National Mining Company Tau-Ken Samruk JSC

- NAC Kazatomprom JSC

- Eurasian Resources Group S. r.l.

- ArcelorMittal S.A.

- Kazakhmys Corporation

- KAZ Minerals PLC

- KAZZINC JSC