During the outbreak of COVID-19, there was a negative impact on the repair and rehabilitation market as construction projects in the residential and commercial sectors also halted. Furthermore, the repair and rehabilitation market encountered several issues, including supply chain disruptions, production shutdowns, labor shortages, and cash flow constraints. All of these reasons impacted the repair and rehabilitation market, as growth in building and infrastructure projects was hampered by the COVID-19 pandemic. The market for repair and renovation has recovered from the pandemic and is growing very quickly right now.

Key Highlights

- In the short term, growth in the market is expected to be driven by more home repairs. This is expected to continue throughout the forecast period.

- But it is thought that changing raw material prices and large investments in capital are the main things that will slow the growth of the market.

- Nevertheless, rising innovative rehabilitation technologies are likely to create lucrative opportunities for the market.

Due to an increase in building projects, China will lead the market's growth over the next few years.

Asia-Pacific Repair and Rehabilitation Market Trends

Residential Segment to Dominate the Market

- The residential segment is expected to hold a significant market share, as concrete repair mortars extend the life spans of existing infrastructure and save the cost of new production. Moreover, the mortar's superior structural strength further ensures its durability over the long term, thereby reducing the investment.

- Cementitious concrete mortar is utilized in the residential sector for brick-based applications such as fences and walls. It helps structures in many ways, such as by making them resistant to corrosion and preventing internal supports from rusting. It also helps structures absorb moisture.

- Epoxy concrete repair mortar is mostly used for jobs that need a lot of strength, like fixing cracked or broken concrete floors, making concrete stronger, and making it last longer.

- Concrete repair mortar has excellent impermeability, tensile strength, and stress resistance. Its use as a significant building material for home repair and restoration will likely grow over time.

- It is used in buildings, toilets, basements that have been dug out, water tanks, swimming pools, repairing concrete and masonry walls, terrace roofs, and protecting concrete from salt.

- On August 31, 2022, an old residential structure in Shuangjiang township, Tongdao Dong autonomous county, Huaihua, Hunan province, central China, was renovated. The renovation of historic urban residential communities is an important endeavor that improves people's quality of life and is a critical component of China's attempts to progress urban redevelopment. Improving the environment and services in historic urban residential communities is vital for satisfying people's aspirations for a better life and encouraging high-quality economic and social development.

- The State Council of the People's Republic of China says that China started fixing up 55,600 old urban neighborhoods last year. This is part of the country's efforts to make living conditions better in these areas.

- According to the Ministry of Housing and Urban-Rural Development, this figure exceeds the annual target of 53,000 residential communities specified in the government work report for 2021. In recent years, the Chinese government has prioritized the transformation of shantytowns. By 2020, China will renovate about 40,300 outdated urban residential communities, which will help nearly 7.36 million households.

- According to the 14th five-year plan for public service (2021-2025), the country plans to fix up another 219,000 old urban neighborhoods between 2021 and 2025. This will help the country's economy and society grow in a good way.

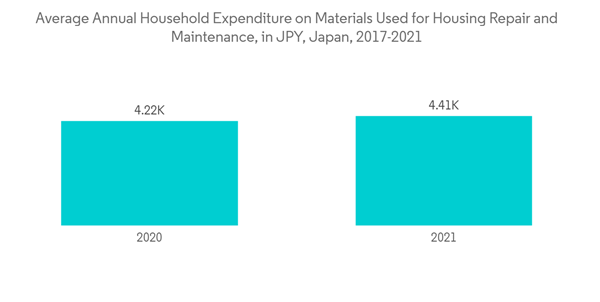

- According to the Ministry of Internal Affairs and Communications (Japan), in 2021, the average annual household expenditure on materials used in housing repairs and maintenance in Japan will amount to JPY 4,410 (USD 31.95), compared to JPY 4,221 (USD 32.03) in 2020.

- All of the things we've talked about so far are likely to drive the residential segment, which may also affect the demand for repair and rehabilitation over the next few years.

China is Anticipated to Hold a Major Share

- China holds a prominent share of the Asia-Pacific repair and rehabilitation market. The region is set to continue to flourish in its dominance over the forecast period.

- The Ministry of Housing and Urban-Rural Development says that by the end of October 2021, 53,400 old urban residential compounds in China had been rebuilt or fixed, which was more than the 53,000 goal set in the government work report for 2021.

- The projects, which include putting in elevators and facilities for people with disabilities and fixing old pipelines, are part of a larger national effort to speed up urbanization and rural rehabilitation.

- E-China's old residential renovation projects were started on August 20, 2021. Workers were hard at work renovating and upgrading an old residential area in Yaohai district, Hefei city, Anhui province, East China.

- Several Chinese provinces have announced major infrastructure projects that will be completed by the end of 2021. The Guangxi Zhuang Autonomous Region in South China has several big construction projects totaling USD 29.15 billion. These initiatives cover a broad range of infrastructure projects, including transportation and basic infrastructure.

- The State Party has continued to work on implementing the Great Wall Master Plan 2018-2035, approved by China's State Council, and has inaugurated the Great Wall National Culture Park. The state's efforts also included on-site conservation activities, capacity building for conservation professionals, a consolidation of the legal basis for the property's conservation, research and training activities, public outreach activities, and the active use of new conservation technologies.

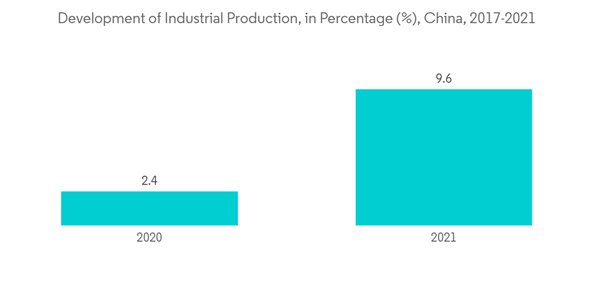

- According to the National Bureau of Statistics of China, in 2021, China's industrial production increased by about 9.6% compared to the previous year.

- So, it's likely that all of the above factors will increase demand for the Asia-Pacific repair and rehabilitation market over the next few years.

Asia-Pacific Repair and Rehabilitation Market Competitor Analysis

The repair and rehabilitation market in Asia-Pacific is partially fragmented in nature. Some major manufacturers in the market include SIKA AG, Saint-Gobain, RPM International Inc., MBCC Group, and Fosroc, Inc., among others (in no particular order).Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION1.1 Study Assumptions

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Drivers

4.1.1 Rising Repair Activities in Residential Sectors

4.1.2 Other Drivers

4.2 Restraints

4.2.1 Regulations Related to VOC Emmisions

4.2.2 Other Restraints

4.3 Industry Value Chain Analysis

4.4 Porter's Five Forces Analysis

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Power of Buyers

4.4.3 Threat of New Entrants

4.4.4 Threat of Substitute Products and Services

4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

5.1 Product Type

5.1.1 Injection Grouting Materials

5.1.1.1 Cement-based

5.1.1.2 Resin-based

5.1.2 Modified Mortars

5.1.2.1 Cement-based

5.1.2.2 Resin-based

5.1.3 Fiber Wrapping Systems

5.1.3.1 Carbon Fiber

5.1.3.2 Glass Fiber

5.1.4 Rebar Protectors

5.1.5 Micro-concrete Mortars

5.1.6 Other Product Types

5.2 Application

5.2.1 Commercial

5.2.2 Industrial

5.2.3 Infrastructure

5.2.4 Residential

5.3 Geography

5.3.1 China

5.3.2 India

5.3.3 Japan

5.3.4 South Korea

5.3.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

6.2 Market Share (%) **/ Ranking Analysis

6.3 Strategies Adopted by Leading Players

6.4 Company Profiles

6.4.1 Arkema

6.4.2 CICO Group

6.4.3 FairMate

6.4.4 Fosroc, Inc.

6.4.5 MBCC Group

6.4.6 Pidilite Industries Ltd.

6.4.7 RPM International Inc.

6.4.8 Saint-Gobain

6.4.9 SIKA AG

6.4.10 STP Limited

6.4.11 Thermax Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

7.1 Rising Innovative Rehabilitation Technologies

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Arkema

- CICO Group

- FairMate

- Fosroc, Inc.

- MBCC Group

- Pidilite Industries Ltd.

- RPM International Inc.

- Saint-Gobain

- SIKA AG

- STP Limited

- Thermax Limited