Key Highlights

- Increasing building and construction activities in China are likely to drive market growth.

- The demand for floor coatings from the industrial sector is expected to dominate the market studied, and it is expected to grow during the forecast period due to the increasing demand from the chemical industry.

- Conversely, strict regulations on VOCs released for floor coatings hinder the market growth.

- The Rising demand for environment-friendly floor coatings is expected to act as an opportunity to drive the market in the coming years.

- In Asia-Pacific, China dominates the market with the most significant consumption of Floor Coating.

APAC Floor Coatings Market Trends

Growing Demand for Floor Coatings in the Industrial Applications

- The Industrial Application is dominating the overall floor coatings market. The core sector is construction, chemical, manufacturing, and other such food and beverages industries, providing demand for Floor coatings in the region.

- In Asia-Pacific, Rapid industrialization and the development of manufacturing and processing plants in the countries like China, Japan, and South Korea are expected to fuel demand for floor coatings in the Pharmaceutical, Food and Beverage, and Industrial Plants.

- In Asia-Pacific, China serves as one of the significant Chemical markets in terms of production and consumption. Many major companies in the market studied have their chemical plants in China, accounting for more than 35% of global chemical sales - resulting in the demand for floor coatings.

- In the food and beverage industry, the risk of microbial growth from spills is high. As a result, these contaminants reduce the purity of processed foods. To avoid such issues, the industry requires durable and thick floor coverings that act as a protective barrier, preventing pollutants from entering the concrete substrate and ensuring a clean surface.

- For Instance, In April 2020, BMW began constructing a 3.2-square-kilometer plant in InTiexi, China. The expanded facility is expected to help BMW manufacture 150,000 EVs a year. The new plant is scheduled to start manufacturing vehicles by the end of 2022.

- Thus, the industrial application segment will likely dominate the market during the forecast period.

China to Dominate the Market

- In the Asia-Pacific region, China dominated the market share, with rising consumption from the construction, chemical, manufacturing, and other industries such as food and beverages, providing demand for Floor coatings in the region.

- The construction industry in China is expanding significantly. According to the National Bureau of Statistics of China, in 2021, the construction output in China was valued at approximately CNY 29.31 trillion. Creating a major scope for floor coatings used during construction activities to enhance the building properties.

- China's growth has been driven mostly by rapid development in the residential and commercial construction sectors supported by the growing economy. In China, the housing authorities of Hong Kong launched several measures to push start the construction of low-cost housing. The officials aim to provide 301,000 public housing units in 10 years till 2030.

- In Mar 2021, Allnex Announced a Design to Accelerate the Construction of a Manufacturing Base for Environmental Protection Resins in Zhejiang Province, China. The 100,000 square-meter new plants will produce environmentally friendly resins, with the aim to promote green innovation and meet the growing demands of China

- In July 2022, Covestro announced that it had broke ground for the construction of two new production facilities in Shanghai, China. The new plant for polyurethane dispersions (PUDs), as well as a further line for polyester resins, from which PUDs are produced and are used in more environmentally compatible coatings and adhesives for a wide range of applications, including construction, furniture among others.

- All the aforementioned factors are expected to act as driving factors for the Floor coatings market during the forecast period.

APAC Floor Coatings Market Competitor Analysis

The Asia-Pacific Floor Coatings Market, in general, is a fragmented market, with no significant share to any particular company. The same applies to all the subtypes of floor coatings. The top companies in the market include (not in any specific order) SIKA AG, the Sherwin-Williams Company, PPG Industries Inc., RPM International Inc., and Akzo Nobel NV.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

1 INTRODUCTION1.1 Study Assumptions

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Market Drivers

4.1.1 Increasing Building and Construction Activities in China

4.1.2 Growing Demand for Floor Coatings in the Industrial Applications

4.1.3 Other Drivers

4.2 Market Restraints

4.2.1 Strict Regulations on VOCs Released for Floor Coatings

4.2.2 Other Restraints

4.3 Industry Value Chain Analysis

4.4 Porters Five Force Analysis

4.4.1 Threat of New Entrants

4.4.2 Bargaining Power of Buyers/Consumers

4.4.3 Bargaining Power of Suppliers

4.4.4 Threat of Substitute Products

4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

5.1 Resin Type

5.1.1 Epoxy

5.1.2 Acrylic

5.1.3 Alkyd

5.1.4 Polyurethane

5.1.5 Polyaspartics

5.1.6 Other Resin Type

5.2 Floor Material

5.2.1 Wood

5.2.2 Concrete

5.2.3 Other Floor Materials

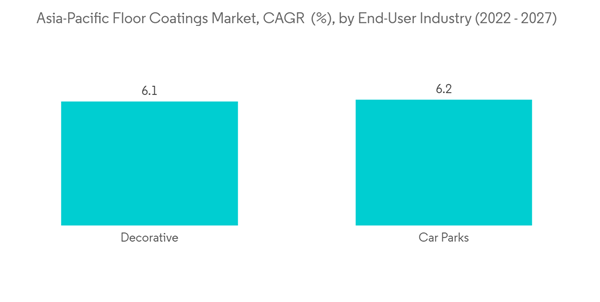

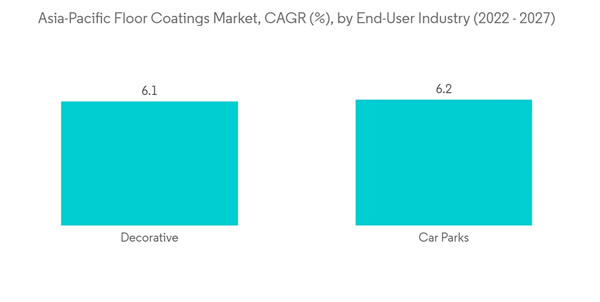

5.3 End-User Industry

5.3.1 Industrial

5.3.2 Decorative

5.3.3 Car Parks

5.4 Geography

5.4.1 China

5.4.2 India

5.4.3 Japan

5.4.4 South Korea

5.4.5 ASEAN

5.4.6 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

6.2 Market Share (%) **/Ranking Analysis

6.3 Strategies Adopted by Leading Players

6.4 Company Profiles

6.4.1 AkzoNobel NV

6.4.2 ArmorPoxy

6.4.3 BASF SE

6.4.4 Henkel AG & Co. KGaA

6.4.5 Jotun

6.4.6 Kansai Nerolac Paints Limited

6.4.7 LATICRETE INTERNATIONAL INC.

6.4.8 Mapei

6.4.9 NIPSEA Group

6.4.10 PPG Industries Inc.

6.4.11 Sika AG

6.4.12 Tambour

6.4.13 Teknos Group

6.4.14 The Sherwin Williams

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

7.1 Rising Demand for Environment-friendly Floor Coatings

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AkzoNobel NV

- ArmorPoxy

- BASF SE

- Henkel AG & Co. KGaA

- Jotun

- Kansai Nerolac Paints Limited

- LATICRETE INTERNATIONAL INC.

- Mapei

- NIPSEA Group

- PPG Industries Inc.

- Sika AG

- Tambour

- Teknos Group

- The Sherwin Williams