Speak directly to the analyst to clarify any post sales queries you may have.

Key Winning Imperatives in the Global Home Fragrance Market

- A candle's personalized and emotional appeal is an increasingly significant factor in a consumer’s purchasing decisions.

- Eco-friendly packaging for home fragrance products with nature-friendly and organic components, such as corrugated hemp boxes and jute bags, will support the growth of sustainable packaging for home fragrance products.

- Aromatherapy helps in easing stress, depression, and anxiety and boosts the feeling of relaxation, and improves sleep.

MARKET TRENDS & OPPORTUNITIES

Rising Preference For Personalized Scented Candles

Nowadays, candles have become household accessories to have in the home. The candle industry has experienced a big boom in the past few years. The personalization of candles is becoming more popular, and people are looking for personal stamps on a product with the freedom to design and customize products according to their preferences. People looking to customize candles with their own aromatic choices have been creating opportunities for home fragrance market players to offer new products to consumers.Shift In Focus Toward Sustainability

Modern consumers are highly concerned about environmental maintenance, which makes them adopt sustainable choices. Therefore, eco-friendly home fragrance packaging boxes have more preference over the rest of the products in the competition. Also, sustainable packaging will be aided by eco-friendly packaging for home fragrance products made of natural and organic materials, such as jute bags and corrugated hemp boxes.Rising Penetration Of E-Commerce Channels

E-commerce sales have steadily risen for years, and the increase in internet penetration has supported the growth worldwide. Due to the rising disposable incomes and changing lifestyles in several regions, the demand for home fragrances has significantly increased. E-commerce platforms such as Amazon, eBay, and Shopify are gaining huge traction among consumers for purchasing home fragrances such as luxury candles, reed diffusers, room fresheners, etc. E-commerce retailers market artistically designed home fragrances, especially candles with elaborate shapes and sculptural crafting. This has created a spike in consumer interest in purchasing home fragrances and boosted the global industry.INDUSTRY RESTRAINTS

Potential Health Risks

Several fragrances can lead to health problems. According to Healthdirect, around one in three people report health problems when exposed to fragrance products. These health problems can include headaches, asthma attacks, hay fever, nausea, migraine, seizures, breathing problems, rashes, congestion, and dizziness. Inhaling essential oils that are diffused is generally safe for most people. Some people might react to the fumes and get an asthma attack. In addition, essential oils can cause severe lung infections, known as pneumonitis, for some people. Therefore, such factors with the potential for health risks are anticipated to hinder the growth of the home fragrance market during the forecast period.SEGMENTATION INSIGHTS

INSIGHTS BY PRODUCT

The candle market dominated the global home fragrance market, accounting for over 37% share in 2022. Mostly, a scented candle comprises a combination of natural and synthetic fragrances. The fragrance material might be derived from essential oils or synthetic aroma chemicals. Before, candles were necessary; now, they are used as a luxury to enhance homes. Initially, they were very simple in design and used to light the night, although now they work to offer scent and decorative aspects. Scented candles are popular and bring fresh, new scents to the consumer. The segment is anticipated to generate additional revenue of USD 1.24 billion during the forecast period and is growing at an absolute rate of 36.43% by 2028.Segmentation by Product

- Candles

- Room Sprays

- Reed Diffusers

- Essential Oils & Wax Melts

- Incense Sticks & Cones

- Others

INSIGHTS BY FORM

The liquid form segment held the largest global home fragrance market share in 2022. Liquid home fragrance product includes essential oils, room sprays, etc. They are a mixture of aroma compounds, fixatives, and solvents in liquid form. Further, essential oils are concentrated hydrophobic liquids containing volatile chemical compounds from plants, i.e., easily evaporated at normal temperatures. The segment is anticipated to generate additional revenue of USD 1.5 billion during the forecast period.Segmentation by Form

- Liquid

- Semi-Solid

- Solid

INSIGHTS BY DISTRIBUTION CHANNEL

The supermarkets & hypermarkets distribution channel dominated the global home fragrance market and was valued at over USD 4 billion in 2022. The segment includes home fragrance products such as scented candles, reed diffusers, room sprays, incense sticks & cones, etc., in supermarkets & hypermarkets, which are primarily self-serving shops offering a wide variety of food and other household products. Most major players have started offering a broad range of home fragrance products through supermarkets and hypermarkets. The distribution methods are the key influencers in determining the sales and industry share of the brands in the global home fragrance market. Home fragrance product distribution is highly significant and requires research to understand the most effective and safe channel. Major retail channels like Walmart, Costco, Walgreens, Sainsbury’s, and Morrisons are major sources of sales for home fragrance products in western countries.Segmentation by Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online

- Others

GEOGRAPHICAL ANALYSIS

North America dominated the global home fragrance market in 2022, valued at over USD 3 billion. The rising preference of consumers towards sustainable and natural products, increasing disposable income, and growing prevalence of lifestyle well-being are the factors supporting the demand for home fragrance products in the region. Furthermore, the U.S. and Canada are the major industries in the region. The most popular types of candles are container and jar candles with American consumers. Consumers are progressively purchasing candles as a focal point for their home décor and aromatherapy, such as stress reduction and relaxation.Segmentation by Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- APAC

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- GCC

- South Africa

COMPETITIVE LANDSCAPE

The global home fragrance market is highly fragmented, and the degree of fragmentation is expected to accelerate during the forecast period. There is a significant number of global and domestic vendors across the geographies. While large organizations with a considerable budget have pricing, flexibility in approach, and the ability to customize solutions as their top criteria, smaller organizations do not emphasize reporting as much. Further, pricing is the top criterion, while expertise and testimonials are at the bottom. Vendors compete in terms of brand value, customization ability, price, skilled workforce, and technological capability.Key Company Profiles

- Procter & Gamble

- S.C. Johnson & Son

- Godrej Consumer Products

- Reckitt Benckiser Group

- Newell Brands

Other Prominent Vendors

- Henkel

- Faultless Brands

- Beaumont Products

- ILLUME

- GALA GROUP

- Voluspa

- Seda France’s

- NEST

- The Estée Lauder Companies

- Bougie et Senteur

- Circle E Candles

- Esteban

- Broken Top Brands

- Bridgewater Candle Company

- The Copenhagen Company

- Pure Source India

- Asian Aura

- Odonil

- ScentAir

- P.F. Candle Company

KEY QUESTIONS ANSWERED:

1. How big is the home fragrance market?2. What is the growth rate of the global home fragrance market?

3. Which region dominates the global home fragrance market share?

4. What are the significant trends in the home fragrance industry?

5. Who are the key players in the global home fragrance market?

Table of Contents

1 Research Methodology2 Research Objectives

3 Research Process

4 Scope & Coverage

4.1 Market Definition

4.1.1 Inclusions

4.1.2 Exclusions

4.1.3 Market Estimation Caveats

4.2 Base Year

4.3 Scope of the Study

4.4 Market Segmentation

4.4.1 Market Segmentation by Product

4.4.2 Market Segmentation by Form

4.4.3 Market Segmentation by Distribution Channel

4.4.4 Market Segmentation by Geography

5 Report Assumptions & Caveats

5.1 Key Caveats

5.2 Currency Conversion

5.3 Market Derivation

6 Premium Insights

6.1 Market Overview

6.1.1 Market Trends

6.1.2 Market Opportunities

6.1.3 Market Enablers

6.1.4 Market Challenges

6.2 Segment Overview

6.3 Competitive Landscape

7 Market at a Glance

8 Introduction

8.1 Overview

8.1.1 Fragrances

8.2 Value Chain Analysis

8.2.1 Fragrance Industry

8.2.2 Candle Industry

8.2.3 Raw Material Suppliers

8.2.4 Manufacturers

8.2.5 Distributors

8.2.6 End-Users

9 Market Opportunities & Trends

9.1 Preference for Personalized Scented Candles

9.2 Focus on Sustainable Packaging

9.3 Advent of Aromatherapy

10 Market Growth Enablers

10.1 Penetration of E-Commerce Channels

10.2 Popularity Among Gen Z & Millennial Populations

10.3 Rapid Urbanization

10.4 Increased Mental Health Problems

11 Market Restraints

11.1 Highly Competitive & Fragmented Market

11.2 Potential Health Risks

12 Market Landscape

12.1 Market Overview

12.2 Market Size & Forecast

12.3 Five Forces Analysis

12.3.1 Threat of New Entrants

12.3.2 Bargaining Power of Suppliers

12.3.3 Bargaining Power of Buyers

12.3.4 Threat of Substitutes

12.3.5 Competitive Rivalry

13 Product

13.1 Market Snapshot & Growth Engine

13.2 Market Overview

13.3 Candles

13.3.1 Market Overview

13.3.2 Market Size & Forecast

13.3.3 Market by Geography

13.4 Room Sprays

13.4.1 Market Overview

13.4.2 Market Size & Forecast

13.4.3 Market by Geography

13.5 Reed Diffusers

13.5.1 Market Overview

13.5.2 Market Size & Forecast

13.5.3 Market by Geography

13.6 Essential Oils & Wax Melts

13.6.1 Market Overview

13.6.2 Market Size & Forecast

13.6.3 Market by Geography

13.7 Incense Sticks & Cones

13.7.1 Market Overview

13.7.2 Market Size & Forecast

13.7.3 Market by Geography

13.8 Others

13.8.1 Market Overview

13.8.2 Market Size & Forecast

13.8.3 Market by Geography

14 Form

14.1 Market Snapshot & Growth Engine

14.2 Market Overview

14.3 Liquid

14.3.1 Market Overview

14.3.2 Market Size & Forecast

14.3.3 Market by Geography

14.4 Semi-Solid

14.4.1 Market Overview

14.4.2 Market Size & Forecast

14.4.3 Market by Geography

14.5 Solid

14.5.1 Market Overview

14.5.2 Market Size & Forecast

14.5.3 Market by Geography

15 Distribution Channel

15.1 Market Snapshot & Growth Engine

15.2 Market Overview

15.3 Supermarkets & Hypermarkets

15.3.1 Market Overview

15.3.2 Market Size & Forecast

15.3.3 Market by Geography

15.4 Convenience Stores

15.4.1 Market Overview

15.4.2 Market Size & Forecast

15.4.3 Market by Geography

15.5 Online

15.5.1 Market Overview

15.5.2 Market Size & Forecast

15.5.3 Market by Geography

15.6 Others

15.6.1 Market Overview

15.6.2 Market Size & Forecast

15.6.3 Market by Geography

16 Geography

16.1 Market Snapshot & Growth Engine

16.2 Geographic Overview

17 North America

17.1 Market Overview

17.2 Market Size & Forecast

17.3 Market Segmentation

17.4 Product

17.4.1 Market Size & Forecast

17.5 Form

17.5.1 Market Size & Forecast

17.6 Distribution Channel

17.6.1 Market Size & Forecast

17.7 Key Countries

17.7.1 Us: Market Size & Forecast

17.7.2 Canada: Market Size & Forecast

18 Europe

18.1 Market Overview

18.2 Market Size & Forecast

18.3 Market Segmentation

18.4 Product

18.4.1 Market Size & Forecast

18.5 Form

18.5.1 Market Size & Forecast

18.6 Distribution Channel

18.6.1 Market Size & Forecast

18.7 Key Countries

18.7.1 Germany: Market Size & Forecast

18.7.2 Uk: Market Size & Forecast

18.7.3 France: Market Size & Forecast

18.7.4 Italy: Market Size & Forecast

18.7.5 Spain: Market Size & Forecast

19 Apac

19.1 Market Overview

19.2 Market Size & Forecast

19.3 Market Segmentation

19.4 Product

19.4.1 Market Size & Forecast

19.5 Form

19.5.1 Market Size & Forecast

19.6 Distribution Channel

19.6.1 Market Size & Forecast

19.7 Key Countries

19.7.1 China: Market Size & Forecast

19.7.2 India: Market Size & Forecast

19.7.3 Japan: Market Size & Forecast

19.7.4 Australia: Market Size & Forecast

19.7.5 South Korea: Market Size & Forecast

20 Latin America

20.1 Market Overview

20.2 Market Size & Forecast

20.3 Market Segmentation

20.4 Product

20.4.1 Market Size & Forecast

20.5 Form

20.5.1 Market Size & Forecast

20.6 Distribution Channel

20.6.1 Market Size & Forecast

20.7 Key Countries

20.7.1 Brazil: Market Size & Forecast

20.7.2 Mexico: Market Size & Forecast

20.7.3 Argentina: Market Size & Forecast

21 Middle East & Africa

21.1 Market Overview

21.2 Market Size & Forecast

21.3 Market Segmentation

21.4 Product

21.4.1 Market Size & Forecast

21.5 Form

21.5.1 Market Size & Forecast

21.6 Distribution Channel

21.6.1 Market Size & Forecast

21.7 Key Countries

21.7.1 Gcc: Market Size & Forecast

21.7.2 South Africa: Market Size & Forecast

22 Competitive Landscape

22.1 Competition Overview

23 Key Company Profiles

23.1 Procter & Gamble

23.1.1 Business Overview

23.1.2 Product Offerings

23.1.3 Key Strategies

23.1.4 Key Strengths

23.1.5 Key Opportunities

23.2 S.C. Johnson & Son

23.2.1 Business Overview

23.2.2 Product Offerings

23.2.3 Key Strategies

23.2.4 Key Strengths

23.2.5 Key Opportunities

23.3 Godrej Consumer Products

23.3.1 Business Overview

23.3.2 Product Offerings

23.3.3 Key Strategies

23.3.4 Key Strengths

23.3.5 Key Opportunities

23.4 Reckitt Benckiser Group

23.4.1 Business Overview

23.4.2 Product Offerings

23.4.3 Key Strategies

23.4.4 Key Strengths

23.4.5 Key Opportunities

23.5 Newell Brands

23.5.1 Business Overview

23.5.2 Product Offerings

23.5.3 Key Strategies

23.5.4 Key Strengths

23.5.5 Key Opportunities

24 Other Prominent Vendors

24.1 Henkel

24.1.1 Business Overview

24.1.2 Product Offerings

24.2 Faultless Brands

24.2.1 Business Overview

24.2.2 Product Offerings

24.3 Beaumont Products

24.3.1 Business Overview

24.3.2 Product Offerings

24.4 Illume (Regent Holding Company)

24.4.1 Business Overview

24.4.2 Product Offerings

24.5 Gala Group

24.5.1 Business Overview

24.5.2 Product Offerings

24.6 Voluspa

24.6.1 Business Overview

24.6.2 Product Offerings

24.7 Seda France's

24.7.1 Business Overview

24.7.2 Product Offerings

24.8 Nest

24.8.1 Business Overview

24.8.2 Product Offerings

24.9 the Estée Lauder Companies

24.9.1 Business Overview

24.9.2 Product Offerings

24.10 Bougie Et Senteur

24.10.1 Business Overview

24.10.2 Product Offerings

24.11 Circle E Candles

24.11.1 Business Overview

24.11.2 Product Offerings

24.12 Esteban

24.12.1 Business Overview

24.12.2 Product Offerings

24.13 Broken Top Brands

24.13.1 Business Overview

24.13.2 Product Offerings

24.14 Bridgewater Candle Company

24.14.1 Business Overview

24.14.2 Product Offerings

24.15 the Copenhagen Company

24.15.1 Business Overview

24.15.2 Product Offerings

24.16 Pure Source India

24.16.1 Business Overview

24.16.2 Product Offerings

24.17 Asian Aura

24.17.1 Business Overview

24.17.2 Product Offerings

24.18 Odonil (Dabur)

24.18.1 Business Overview

24.18.2 Product Offerings

24.19 Scentair

24.19.1 Business Overview

24.19.2 Product Offerings

24.2 P.F. Candle Company

24.20.1 Business Overview

24.20.2 Product Offerings

25 Report Summary

25.1 Key Takeaways

25.2 Strategic Recommendations

26 Quantitative Summary

26.1 Market by Product

26.2 Market by Form

26.3 Market by Distribution Channel

26.4 Market by Geography

26.5 North America

26.5.1 Product

26.5.2 Form

26.5.3 Distribution Channel

26.6 Europe

26.6.1 Product

26.6.2 Form

26.6.3 Distribution Channel

26.7 Apac

26.7.1 Product

26.7.2 Form

26.7.3 Distribution Channel

26.8 Latin America

26.8.1 Product

26.8.2 Form

26.8.3 Distribution Channel

26.9 Middle East & Africa

26.9.1 Product

26.9.2 Form

26.9.3 Distribution Channel

27 Appendix

27.1 Abbreviations

Companies Mentioned

- Procter & Gamble

- S.C. Johnson & Son

- Godrej Consumer Products

- Reckitt Benckiser Group

- Newell Brands

- Henkel

- Faultless Brands

- Beaumont Products

- ILLUME

- GALA GROUP

- Voluspa

- Seda France’s

- NEST

- The Estée Lauder Companies

- Bougie et Senteur

- Circle E Candles

- Esteban

- Broken Top Brands

- Bridgewater Candle Company

- The Copenhagen Company

- Pure Source India

- Asian Aura

- Odonil

- ScentAir

- P.F. Candle Company

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

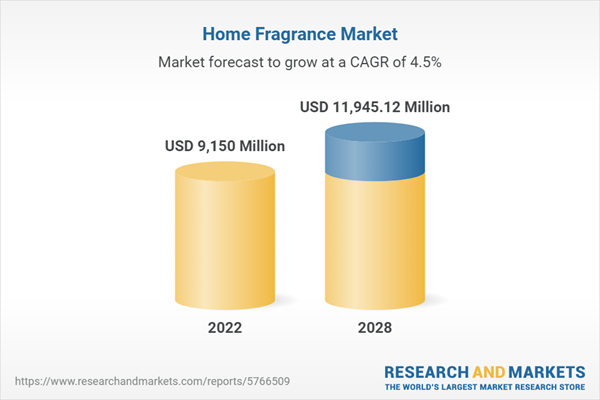

| Report Attribute | Details |

|---|---|

| No. of Pages | 233 |

| Published | April 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 9150 Million |

| Forecasted Market Value ( USD | $ 11945.12 Million |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |