The main types of antimony covered in this report are: antimony trioxide; antimony pentoxide; alloys; metal ingots; and others. Antimony is used in various applications, such as flame retardants; plastic additives; lead acid batteries; glass and ceramics; and others. The various end-user industries of antimony are: chemical; automotive; electrical & electronics; and other industries.

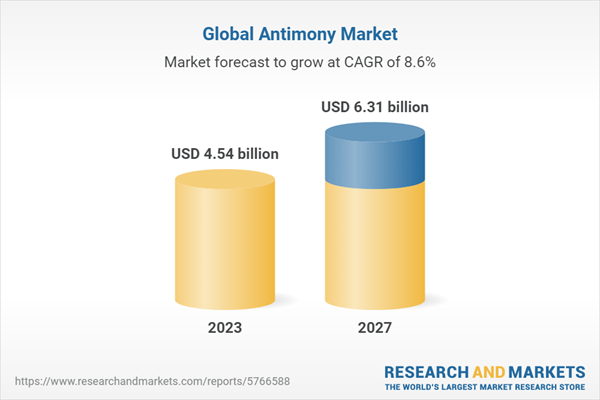

The global antimony market grew from $4.17 billion in 2022 to $4.54 billion in 2023 at a compound annual growth rate (CAGR) of 8.9%. The Russia-Ukraine war disrupted the chances of global economic recovery from the COVID-19 pandemic, at least in the short term. The war between these two countries has led to economic sanctions on multiple countries, a surge in commodity prices, and supply chain disruptions, causing inflation across goods and services and affecting many markets across the globe. The antimony market is expected to grow to $6.31 billion in 2027 at a CAGR of 8.6%.

The antimony research report is one of a series of new reports that provides antimony statistics, including antimony industry global market size, regional shares, competitors with antimony share, detailed antimony segments, market trends and opportunities, and any further data you may need to thrive in the antimony industry. This antimony research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Strategic collaborations and joint ventures between companies is a key trend gaining popularity in the antimony market. Companies producing antimony are undergoing partnerships and collaborations to develop new technologies and antimony products. For instance, in May 2021, United States Antimony, a company that produces antimony and sells antimony products, and Perpetua, a mining company that is based in the United States, signed a collaboration agreement. This potential partnership would provide the only antimony products mined and refined in the United States. Both companies benefit from the mine's proximity to US Antimony's processing facilities.

In 2021, Far East Antimony Ltd acquired the Solonechenskoye antimony property, located in the Zabaikalsky Krai region of Far Eastern Russia. With this acquisition, Far East Antimony aims to develop the Solonechenskoye deposit, which is one of the largest undeveloped antimony deposits in the world.

Asia-Pacific was the largest region in the antimoney market in 2022. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the antimony market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa.

The countries covered in the Antimony market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA.

The increasing fire accidents and stringent fire safety regulations are expected to propel the growth of the antimony market. According to fire safety rules, prevention is the first step in avoiding fire-related accidents. As a result of an increase in fire accidents, demand for fire safety regulations, led to an increase in antimony production as antimony is commonly used as a flame inhibitor in fire-resistant apparel, flame retardants, and various fire protection systems. According to the National Fire Protection Association (NFPA), there were 1,388,500 fires in the United States in 2020, with 3,500 civilian deaths and 15,200 injuries. According to the NFPA, there was a 23% increase in fire-related deaths in 2020 from 2012. Therefore, a rise in fire incidents and stringent fire safety regulations drive the antimony market.

The antimony market consists of sales of sodium stibogluconate, antimony trichloride, antimony oxychloride, metal alloys, and ceramics.Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

Major players in the antimony market are BASF SE, Campine NV, Huachang Antimony Industry, AMG Advanced Metallurgical Group, Hunan Chenzhou Mining Group Co. Ltd., Lambert Metals International, Mandalay Resources Ltd., Nihon Seiko Co. Ltd., NYACOL Nano Technologies Inc., Recylex, Suzuhiro Chemical, Belmont Metals, United States Antimony, Village Main Reef Ltd., Yunnan Muli Antimony Industry Co. Ltd., and Belmont Metals.

This product will be delivered within 3-5 business days.

Table of Contents

1. Executive Summary2. Antimony Market Characteristics

3. Antimony Market Trends And Strategies

4. Antimony Market - Macro Economic Scenario

4.1 COVID-19 Impact On Antimony Market

4.2 Ukraine-Russia War Impact On Antimony Market

4.3 Impact Of High Inflation On Antimony Market

5. Antimony Market Size And Growth

5.1. Global Antimony Historic Market, 2017-2022, $ Billion

5.1.1. Drivers Of The Market

5.1.2. Restraints On The Market

5.2. Global Antimony Forecast Market, 2022-2027F, 2032F, $ Billion

5.2.1. Drivers Of The Market

5.2.2. Restraints On the Market

6. Antimony Market Segmentation

6.1. Global Antimony Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

- Antimony Trioxide

- Antimony Pentoxide

- Alloys

- Metal Ingots

- Other Types

- Flame retardant

- Plastic additives

- Lead acid batteries

- Glass & ceramics

- Other Applications

- Chemical

- Automotive

- Electrical & electronics

- Other End Use Industries

7.1. Global Antimony Market, Split By Region, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

7.2. Global Antimony Market, Split By Country, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

8. Asia-Pacific Antimony Market

8.1. Asia-Pacific Antimony Market Overview

- Region Information, Impact Of COVID-19, Market Information, Background Information, Government Initiatives, Regulations, Regulatory Bodies, Major Associations, Taxes Levied, Corporate Tax Structure, Investments, Major Companies

8.3. Asia-Pacific Antimony Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

9. China Antimony Market

9.1. China Antimony Market Overview

9.2. China Antimony Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F,$ Billion

9.3. China Antimony Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2022-2027F, 2032F,$ Billion

10. India Antimony Market

10.1. India Antimony Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

10.2. India Antimony Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

11. Japan Antimony Market

11.1. Japan Antimony Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

11.2. Japan Antimony Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

12. Australia Antimony Market

12.1. Australia Antimony Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

12.2. Australia Antimony Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

13. Indonesia Antimony Market

13.1. Indonesia Antimony Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

13.2. Indonesia Antimony Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

14. South Korea Antimony Market

14.1. South Korea Antimony Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

14.2. South Korea Antimony Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

15. Western Europe Antimony Market

15.1. Western Europe Antimony Market Overview

15.2. Western Europe Antimony Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

15.3. Western Europe Antimony Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

16. UK Antimony Market

16.1. UK Antimony Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

16.2. UK Antimony Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

17. Germany Antimony Market

17.1. Germany Antimony Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

17.2. Germany Antimony Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

18. France Antimony Market

18.1. France Antimony Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

18.2. France Antimony Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

19. Eastern Europe Antimony Market

19.1. Eastern Europe Antimony Market Overview

19.2. Eastern Europe Antimony Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

19.3. Eastern Europe Antimony Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

20. Russia Antimony Market

20.1. Russia Antimony Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

20.2. Russia Antimony Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

21. North America Antimony Market

21.1. North America Antimony Market Overview

21.2. North America Antimony Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

21.3. North America Antimony Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

22. USA Antimony Market

22.1. USA Antimony Market Overview

22.2. USA Antimony Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

22.3. USA Antimony Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

23. South America Antimony Market

23.1. South America Antimony Market Overview

23.2. South America Antimony Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

23.3. South America Antimony Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

24. Brazil Antimony Market

24.1. Brazil Antimony Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

24.2. Brazil Antimony Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

25. Middle East Antimony Market

25.1. Middle East Antimony Market Overview

25.2. Middle East Antimony Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

25.3. Middle East Antimony Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

26. Africa Antimony Market

26.1. Africa Antimony Market Overview

26.2. Africa Antimony Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

26.3. Africa Antimony Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

27. Antimony Market Competitive Landscape And Company Profiles

27.1. Antimony Market Competitive Landscape

27.2. Antimony Market Company Profiles

27.2.1. BASF SE

27.2.1.1. Overview

27.2.1.2. Products and Services

27.2.1.3. Strategy

27.2.1.4. Financial Performance

27.2.2. Campine NV

27.2.2.1. Overview

27.2.2.2. Products and Services

27.2.2.3. Strategy

27.2.2.4. Financial Performance

27.2.3. Huachang Antimony Industry

27.2.3.1. Overview

27.2.3.2. Products and Services

27.2.3.3. Strategy

27.2.3.4. Financial Performance

27.2.4. AMG Advanced Metallurgical Group

27.2.4.1. Overview

27.2.4.2. Products and Services

27.2.4.3. Strategy

27.2.4.4. Financial Performance

27.2.5. Hunan Chenzhou Mining Group Co. Ltd.

27.2.5.1. Overview

27.2.5.2. Products and Services

27.2.5.3. Strategy

27.2.5.4. Financial Performance

28. Key Mergers And Acquisitions In The Antimony Market

29. Antimony Market Future Outlook and Potential Analysis

30. Appendix

30.1. Abbreviations

30.2. Currencies

30.3. Historic And Forecast Inflation Rates

30.4. Research Inquiries

30.5. About the Publisher

30.6. Copyright And Disclaimer

Executive Summary

Antimony Market Global Market Report 2023 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on antimony market market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase

- Gain a truly global perspective with the most comprehensive report available on this market covering 50+ geographies.

- Understand how the market has been affected by the COVID-19 and how it is responding as the impact of the virus abates.

- Assess the Russia - Ukraine war’s impact on agriculture, energy and mineral commodity supply and its direct and indirect impact on the market.

- Measure the impact of high global inflation on market growth.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

Description:

Where is the largest and fastest growing market for antimony market? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The antimony market market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

Scope

Markets Covered:

1) By Type: Antimony Trioxide; Antimony Pentoxide; Alloys; Metal Ingots; Other Types2) By Application: Flame retardant; Plastic additives; Lead acid batteries; Glass & ceramics; Other Applications

3) By End User Industry: Chemical; Automotive; Electrical & electronics; Other End-Users

Companies Mentioned: BASF SE; Campine NV; Huachang Antimony Industry; AMG Advanced Metallurgical Group; Hunan Chenzhou Mining Group Co. Ltd.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita,

Data segmentations: country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- BASF SE

- Campine NV

- Huachang Antimony Industry

- AMG Advanced Metallurgical Group

- Hunan Chenzhou Mining Group Co. Ltd.

- Lambert Metals International

- Mandalay Resources Ltd

- Nihon Seiko Co. Ltd.

- NYACOL Nano Technologies Inc.

- Recylex

- Suzuhiro Chemical

- Belmont Metals

- United States Antimony

- Village Main Reef Ltd.

- Yunnan Muli Antimony Industry Co. Ltd.

- Belmont Metals

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2023 |

| Forecast Period | 2023 - 2027 |

| Estimated Market Value ( USD | $ 4.54 billion |

| Forecasted Market Value ( USD | $ 6.31 billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |