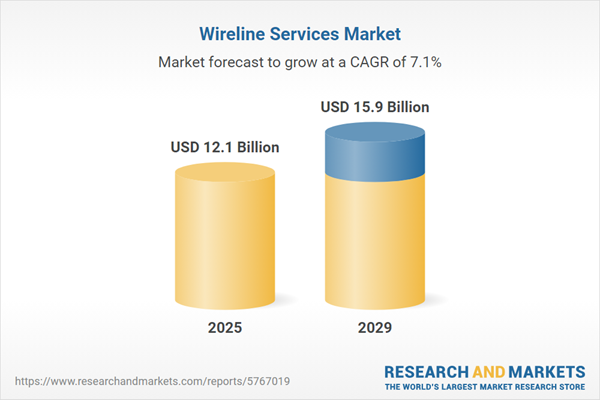

The wireline services market size is expected to see strong growth in the next few years. It will grow to $15.9 billion in 2029 at a compound annual growth rate (CAGR) of 7.1%. The growth in the forecast period can be attributed to unconventional resource development, focus on reservoir management, global energy demand, well integrity assessment, regulatory compliance, wireline services in offshore exploration. Major trends in the forecast period include advanced logging technologies, digital wireline services, downhole imaging technologies, advanced perforating systems, real-time data transmission systems.

The forecast of 7.1% growth over the next five years indicates a slight reduction of 0.1% from the previous projection. This reduction is primarily due to the impact of tariffs between the US and other countries. This is likely to directly affect the US through delays in acquiring high-strength logging cables from South Korea and downhole perforation tools from France, impacting well evaluation timelines. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The anticipated growth in the wireline services market is directly linked to the escalating levels of deep water and shallow water drilling activities. Deepwater drilling, which involves creating boreholes in the Earth's crust for oil extraction in deep-sea environments, relies significantly on wireline logging data to assess formations during oil and gas drilling operations. The surge in investment by oil and gas companies in new offshore drilling ventures targeting both deep and shallow water wells is poised to intensify the demand for wireline services. For instance, as reported by World Oil, a US-based technical publication catering to upstream professionals, the total number of wells drilled in 2021 stood at 36,630, rising to 40,879 in 2022, marking an 11.6% increase. This surge in drilling activity signifies a notable upswing in exploration and production efforts. Therefore, the surge in both deep water and shallow water drilling activities serves as the primary driver behind the burgeoning growth of the wireline services market.

The escalating demand for energy is poised to drive the expansion of the wireline services market. Energy demand signifies the consumption of energy propelled by human activities, fundamentally shaping the entire energy system. It dictates the overall energy usage, fuel preferences, and their locations within the energy supply framework. The increasing reliance on oil and gas production, a consequence of the world's mounting energy demand, necessitates greater utilization of wireline services for exploration, enhancement, and expansion purposes. For instance, as reported by the Energy Information Administration in 2022, primary energy consumption in the United States reached 100.4 quadrillion British thermal units (quads), marking a 3% surge from 2021. Hence, the surge in energy demand stands as the impetus driving the growth of the wireline services market.

Major companies in the wireline services market are prioritizing strategic collaborations to deliver reliable services to their customers. Strategic collaboration involves mutually beneficial partnerships between two or more independent entities that work together to achieve shared goals aligned with their strategic objectives. For example, in September 2024, Amazon Web Services (AWS), a US-based cloud computing company, expanded its partnership with SLB, a US-based oilfield services company, to improve the accessibility of applications from the Delfi digital platform. This collaboration aims to explore the deployment of low-carbon technologies within the energy sector, supporting the industry's transition toward more sustainable practices.

Prominent companies in the wireline services market are placing emphasis on innovative technologies, such as real-time wireline data visualization, to enhance the current features of their platforms. Real-time wireline data visualization involves utilizing technology to offer a live, consistent view of data across wireline operations as it is received from the rig. For example, in October 2022, Halliburton Corporation, a US-based oil service company, introduced HalVue, a real-time data monitoring program aimed at helping clients maximize asset value by providing a unified view of data as it is generated from the field during operations. With HalVue, users can swiftly and easily access complex yet impactful data, facilitating real-time collaboration.

In March 2022, Baker Hughes, a US-based oil and natural gas company, acquired Altus Intervention for an undisclosed amount. This acquisition notably enhances Baker Hughes' existing portfolio of oilfield technologies and integrated solutions, especially in boosting efficiencies in mature fields. The integration of Altus Intervention's capabilities will bolster Baker Hughes' life-of-well services, allowing operators to optimize their operations more effectively. Altus Intervention is a Norway-based company that specializes in providing well intervention services.

Major companies operating in the wireline services market include Siemens AG, Schneider Electric India Pvt Ltd., Schlumberger Limited, Baker Hughes Company, Halliburton Company, Emerson Electric Co, GE Oil & Gas Corporation, National Oilwell Varco Inc., SGS SA, China Oilfield Services Limited, Weatherford International plc, Nextier Oilfield Solutions Inc., Weir Oil and Gas Pty Ltd., Nabors Industries Ltd., Petrofac Limited, C&J Energy Services Inc., Oceaneering International Inc., Precision Drilling Corporation, RPC Inc., Superior Energy Services Inc., Select Energy Services Inc., Expro International Group Ltd., ProPetro Holding Corp, Archer Ltd., Scientific Drilling Controls Inc., OilServ Oil Field Services Ltd., Recon Petrotechnologies Ltd., Weltec Engineering Ltd., Allied-Horizontal Wireline Services LLC.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sharp rise in U.S. tariffs and ensuing trade tensions in spring 2025 are heavily impacting the oil and gas industry, especially in areas such as exploration equipment, pipeline development, and refining operations. Increased import duties on drilling rigs, steel pipes, and specialized machinery have significantly raised capital expenditures across both upstream and downstream segments. Midstream players are grappling with cost surges for essential components like valves, compressors, and storage tanks, causing delays and disruptions in expansion projects. Refiners, meanwhile, are contending with higher expenses for imported catalysts and control systems critical to operational efficiency. In addition, retaliatory tariffs from major trade partners have curtailed U.S. exports of liquefied natural gas (LNG) and crude oil, reducing global competitiveness. In response, companies are ramping up investments in domestic manufacturing alliances, digital asset management tools, and diversified energy portfolios to maintain resilience and protect profitability.

Wireline services involve lowering cables into an oil wellbore to collect information on the well's health, which is used to assess its efficiency and productivity.

In the context of the oil and gas industry, the main types of wireline services are electric lines and slicklines. Electric lines are used for the distribution of electric energy within residential developments or commercial complexes. Wireline services encompass various operations such as intervention, logging, and completion, which involve different types of well holes, including open hole and cased hole. These services can be deployed in onshore and offshore locations within the oil and gas industry.

The wireline services market research report is one of a series of new reports that provides wireline services market statistics, including Wireline services industry global market size, regional shares, competitors with a wireline services market share, detailed wireline services market segments, market trends and opportunities, and any further data you may need to thrive in the wireline services industry. This wireline services market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

North America was the largest market in the wireline services market in 2024. The regions covered in the wireline services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the wireline services market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The wireline services market includes revenues earned by entities by providing services such as case whole logging, directional drilling, coil tubing, and perforating services. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Wireline Services Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on wireline services market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for wireline services? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The wireline services market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Type: Electric Line; Slick Line2) by Service Type: Intervention; Logging; Completion

3) by Hole Type: Open Hole; Cased Hole

4) by Location of Deployment: Onshore; Offshore

Subsegments:

1) by Electric Line: Electrical Wireline Services; Well Logging Services2) by Slick Line: Slick Line Operations; Slick Line Services for Well Maintenance

Key Companies Profiled: Siemens AG; Schneider Electric India Pvt Ltd.; Schlumberger Limited; Baker Hughes Company; Halliburton Company; Emerson Electric Co; GE Oil & Gas Corporation; National Oilwell Varco Inc.; SGS SA; China Oilfield Services Limited; Weatherford International plc; Nextier Oilfield Solutions Inc.; Weir Oil and Gas Pty Ltd.; Nabors Industries Ltd.; Petrofac Limited; C&J Energy Services Inc.; Oceaneering International Inc.; Precision Drilling Corporation; RPC Inc.; Superior Energy Services Inc.; Select Energy Services Inc.; Expro International Group Ltd.; ProPetro Holding Corp; Archer Ltd.; Scientific Drilling Controls Inc.; OilServ Oil Field Services Ltd.; Recon Petrotechnologies Ltd.; Weltec Engineering Ltd.; Allied-Horizontal Wireline Services LLC.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Wireline Services market report include:- Siemens AG

- Schneider Electric India Pvt Ltd.

- Schlumberger Limited

- Baker Hughes Company

- Halliburton Company

- Emerson Electric Co

- GE Oil & Gas Corporation

- National Oilwell Varco Inc.

- SGS SA

- China Oilfield Services Limited

- Weatherford International plc

- Nextier Oilfield Solutions Inc.

- Weir Oil and Gas Pty Ltd.

- Nabors Industries Ltd.

- Petrofac Limited

- C&J Energy Services Inc.

- Oceaneering International Inc.

- Precision Drilling Corporation

- RPC Inc.

- Superior Energy Services Inc.

- Select Energy Services Inc.

- Expro International Group Ltd.

- ProPetro Holding Corp

- Archer Ltd.

- Scientific Drilling Controls Inc.

- OilServ Oil Field Services Ltd.

- Recon Petrotechnologies Ltd.

- Weltec Engineering Ltd.

- Allied-Horizontal Wireline Services LLC.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | July 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 12.1 Billion |

| Forecasted Market Value ( USD | $ 15.9 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |