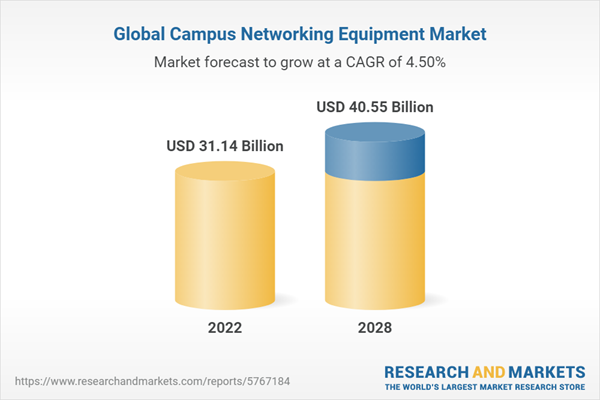

The global campus networking equipment market in 2022 was valued at US$31.14 billion. The market value is anticipated to grow to US$40.55 billion by 2028. Campus networking equipment refers to the hardware and software components used to build and manage the local area network (LAN) in a campus environment, such as a university, office park, or corporate campus. Campus networking effectively consists of three products: ethernet switches, routers, and WLAN equipment.

The market value is expected to grow at a CAGR of 4.50% during the forecast period of 2023-2028, with ethernet switch segment being the dominant type owing to increasing demand for reliable, secure, and high-speed networks. WLAN equipment market is expected to witness highest CAGR during forecasted years. With the increasing use of mobile devices such as smartphones, tablets, and laptops, there is a growing demand for wireless networks that can provide high-speed internet access and connectivity.

Market Segmentation Analysis:

- By Product: The report provides the bifurcation of the market into three segments based on the product: ethernet switch, WLAN and router. In 2022, in terms of value, Ethernet switch segment held the major share in the market, followed by WLAN. The increasing shift towards wireless infrastructure has led to the development of advanced wireless networking technologies such as 5G and Wi-Fi 6, which provide higher speeds, lower latency, and greater capacity than previous generations of wireless technology. The campus router market has been witnessing a decline. Owing to combination of switches offering Layer 3 functionality, the campus router market has been declining over past years.

- By Region: The report provides insight into the campus networking equipment market based on the geographical operations, namely North America, Europe, Asia Pacific and Rest of the world. North America held the major share in the market, owing to the rise in adoption of IoT devices. Rising demand for cloud adoption, digital content, and new data sovereignty laws will drive the North American region's network equipment market in the near future. Within North America, the US is leading the market, The US and Canada are among the largest markets for campus networking equipment in North America, due to their large populations and highly developed economies.

Market Dynamics:

- Growth Drivers: One of the most important factors impacting the global campus networking equipment market is growing need for network security. Campus networks are prone to cyber threats and attacks. With the increasing use of digital technologies on campuses, the need for robust network security has become critical. Campus networking equipment providers are offering advanced security solutions such as firewalls, intrusion detection systems, and antivirus software to ensure the security of campus networks. Furthermore, the market has been growing over the past few years, due to factors such as rapid expansion of educational institutions, growing volume of internet of things (IoT) devices, surge in adoption of cloud based services, increasing shift towards wireless infrastructure and many other factors.

- Challenges: However, the market has been confronted with some challenges specifically, high initial investment costs and complex integration requirements, etc.

- Trends: The market is projected to grow at a fast pace during the forecast period, due to various latest trends such as growth in edge computing, integration of artificial intelligence, growing 5G network and rise in BYOD trend, etc. The BYOD trend has created a demand for campus networking equipment that is compatible with a wide range of devices and can handle the increased traffic on campus networks. As a result, many networking equipment vendors have developed solutions that are designed to support BYOD environments, such as wireless access points, mobile device management software, and network security solutions. Furthermore, 5G technology offers much faster data transfer speeds and lower latency compared to previous generations of wireless networks. This enables campus networks to support a larger number of devices and applications simultaneously, which is particularly important given the growing number of smart devices and the Internet of Things (IoT) on campus. As a result, there is an increasing demand for 5G-enabled networking equipment such as routers, switches, and access points.

Impact Analysis of COVID-19 and Way Forward:

The COVID-19 pandemic led to lockdown across all the countries, forcing the educational and governmental institutions to close down their premises. This led to slowdown in new construction projects and building renovations, which has impacted the demand for networking equipment used in campus environments. As a result, many companies in the market have reported decreased sales and revenue in 2020. One of the primary challenges has been disruptions in global supply chains, as manufacturers and suppliers have had to deal with lockdowns, restrictions on travel and transportation, and workforce disruptions. This has led to delays in production and delivery of networking equipment, which has impacted the ability of organizations to upgrade or expand their network infrastructure.

Competitive Landscape:

Global campus networking equipment market is a consolidated market with Cisco’s dominance of the campus market has waned over the last decade. After Cisco, HPE with their Aruba products are the only other vendor (outside of Huawei/China) with a significant amount of share in the campus market. Arista has a great opportunity to grow from a small base. Arista is currently a small player in the campus market, but their data center switching leadership has given them a solid platform to expand from as they have largely had success in converting data center customers into campus customers.

The key players in the global campus networking equipment market are:

- Nvidia Corporation

- Dell Technologies Inc.

- Cisco Systems, Inc.

- Huawei Investment & Holding Co. Ltd.

- Hewlett Packard Enterprise

- Juniper Networks, Inc.

- Arista Networks, Inc.

- Extreme Networks, Inc.

- Alcatel-Lucent Enterprise

- CommScope (Ruckus Networks)

- Cambium Networks

- Fortinet Inc

Enterprise WLAN market is also expected to enjoy a higher five-year growth rate as corporate campuses increasingly transition to wireless technology. Cisco is currently the largest enterprise WLAN company by a wide margin, while TP-Link and CommScope are the two largest players in the market.

Table of Contents

1. Executive Summary

2. Introduction

2.1 Campus Networking Equipment: An Overview

2.1.1 Definition of Campus Networking Equipment

2.1.2 Simplified Campus Network Architecture

2.2 Campus Networking Equipment Segmentation: An Overview

2.2.1 Campus Networking Equipment Segmentation

3. Global Market Analysis

3.1 Global Campus Networking Equipment Market: An Analysis

3.1.1 Global Campus Networking Equipment Market: An Overview

3.1.2 Global Campus Networking Equipment Market by Value

3.1.3 Global Campus Networking Equipment Market by Product (Ethernet switch, WLAN and Router)

3.1.4 Global Campus Networking Equipment Market by Region (North America, Europe, Asia Pacific and Rest of the World)

3.2 Global Campus Networking Equipment Market: Product Analysis

3.2.1 Global Campus Networking Equipment Market by Product: An Overview

3.2.2 Global Campus Ethernet Switches Market by Value

3.2.3 Global Campus WLAN Equipment Market by Value

3.2.4 Global Campus Router Equipment Market by Value

4. Regional Market Analysis

4.1 North America Campus Networking Equipment Market: An Analysis

4.1.1 North America Campus Networking Equipment Market: An Overview

4.1.2 North America Campus Networking Equipment Market by Value

4.1.3 North America Campus Networking Equipment Market by Region (The US, Mexico, and Canada)

4.1.4 The US Campus Networking Equipment Market by Value

4.1.5 Canada Campus Networking Equipment Market by Value

4.1.6 Mexico Campus Networking Equipment Market by Value

4.2 Europe Campus Networking Equipment Market: An Analysis

4.2.1 Europe Campus Networking Equipment Market: An Overview

4.2.2 Europe Campus Networking Equipment Market by Value

4.2.3 Europe Campus Networking Equipment Market by Region (UK, Germany, France, Italy, Spain and Rest of Europe)

4.2.4 Germany Campus Networking Equipment Market by Value

4.2.5 United Kingdom Campus Networking Equipment Market by Value

4.2.6 France Campus Networking Equipment Market by Value

4.2.7 Italy Campus Networking Equipment Market by Value

4.2.8 Spain Campus Networking Equipment Market by Value

4.2.9 Rest of Europe Campus Networking Equipment Market by Value

4.3 Asia Pacific Campus Networking Equipment Market: An Analysis

4.3.1 Asia Pacific Campus Networking Equipment Market: An Overview

4.3.2 Asia Pacific Campus Networking Equipment Market by Value

4.3.3 Asia Pacific Campus Networking Equipment Market by Region (China, Japan, India, South Korea and Rest of Asia Pacific)

4.3.4 China Campus Networking Equipment Market by Value

4.3.5 Japan Campus Networking Equipment Market by Value

4.3.6 India Campus Networking Equipment Market by Value

4.3.7 South Korea Campus Networking Equipment Market by Value

4.3.8 Rest of Asia Pacific Campus Networking Equipment Market by Value

4.4 Rest of the World Campus Networking Equipment Market: An Analysis

4.4.1 Rest of the World Campus Networking Equipment Market: An Overview

4.4.2 Rest of the World Campus Networking Equipment Market by Value

5. Impact of COVID-19

5.1 Impact of COVID-19

5.1.1 Impact of COVID-19 on Campus Networking Equipment Market

5.1.2 Post-COVID-19 Scenario of Campus Networking Equipment Market

6. Market Dynamics

6.1 Growth Drivers

6.1.1 Growing Need For Network Security

6.1.2 Rapid Expansion Of Educational Institutions

6.1.3 Growing Volume of Internet of Things (IoT) Devices

6.1.4 Surge in Adoption of Cloud Based Services

6.1.5 Increasing Shift Towards Wireless Infrastructure

6.2 Challenges

6.2.1 High Initial Investment Costs

6.2.2 Complex Integration Requirements

6.3 Market Trends

6.3.1 Integration of Artificial Intelligence

6.3.2 Growing 5G Network

6.3.3 Growth in Edge Computing

6.3.4 Rise in BYOD Trend

7. Competitive Landscape

7.1 Global Campus Networking Equipment Market Players: Competitive Landscape

7.2 Global Campus Networking Equipment Players by Market Share

7.3 Global Enterprise WLAN Players by Market Share

8. Company Profiles

8.1 Nvidia Corporation

8.1.1 Business Overview

8.1.2 Operating Segments

8.1.3 Business Strategy

8.2 Dell Technologies Inc.

8.2.1 Business Overview

8.2.2 Operating Segments

8.2.3 Business Strategy

8.3 Cisco Systems, Inc.

8.3.1 Business Overview

8.3.2 Geographical Segments

8.3.3 Business Strategy

8.4 Huawei Investment & Holding Co. Ltd.

8.4.1 Business Overview

8.4.2 Operating Segments

8.4.3 Business Strategy

8.5 Hewlett Packard Enterprise

8.5.1 Business Overview

8.5.2 Operating Segments

8.5.3 Business Strategy

8.6 Juniper Networks, Inc.

8.6.1 Business Overview

8.5.2 Geographical Segments

8.6.3 Business Strategy

8.7 Arista Networks, Inc.

8.7.1 Business Overview

8.7.2 Geographical Segment

8.7.2 Business Strategy

8.8 Extreme Networks, Inc.

8.8.1 Business Overview

8.8.2 Geographical Segment

8.8.3 Business Strategy

8.9 Alcatel-Lucent Enterprise

8.9.1 Business Overview

8.9.2 Business Strategy

8.10 CommScope (Ruckus Networks)

8.10.1 Business Overview

8.10.2 Operating Segments

8.10.3 Business Strategy

8.11 Cambium Networks

8.11.1 Business Overview

8.11.2 Geographical Segments

8.11.3 Business Strategy

8.12 Fortinet Inc.

8.12.1 Business Overview

8.12.2 Geographical Segments

8.12.3 Business Strategy

List of Figures

Figure 1: Products of Campus Networking Equipment

Figure 2: Simplified Campus Network Architecture

Figure 3: Campus Networking Equipment Segmentation

Figure 4: Global Campus Networking Equipment Market by Value; 2018-2022 (US$ Billion)

Figure 5: Global Campus Networking Equipment Market by Value; 2023-2028 (US$ Billion)

Figure 6: Global Campus Networking Equipment Market by Product; 2022 (Percentage, %)

Figure 7: Global Campus Networking Equipment Market by Region; 2022 (Percentage, %)

Figure 8: Global Campus Ethernet Switches Market by Value; 2018-2022 (US$ Billion)

Figure 9: Global Campus Ethernet Switches Market by Value; 2023-2028 (US$ Billion)

Figure 10: Global Campus WLAN Equipment Market by Value; 2018-2022 (US$ Billion)

Figure 11: Global Campus WLAN Equipment Market by Value; 2023-2028 (US$ Billion)

Figure 12: Global Campus Router Equipment Market by Value; 2018-2022 (US$ Billion)

Figure 13: Global Campus Router Equipment Market by Value; 2023-2028 (US$ Billion)

Figure 14: North America Campus Networking Equipment Market by Value; 2018-2022 (US$ Billion)

Figure 15: North America Campus Networking Equipment Market by Value; 2023-2028 (US$ Billion)

Figure 16: North America Campus Networking Equipment Market by Region; 2022 (Percentage, %)

Figure 17: The US Campus Networking Equipment Market by Value; 2018-2022 (US$ Billion)

Figure 18: The US Campus Networking Equipment Market by Value; 2023-2028 (US$ Billion)

Figure 19: Canada Campus Networking Equipment Market by Value; 2018-2022 (US$ Million)

Figure 20: Canada Campus Networking Equipment Market by Value; 2023-2028 (US$ Billion)

Figure 21: Mexico Campus Networking Equipment Market by Value; 2018-2022 (US$ Million)

Figure 22: Mexico Campus Networking Equipment Market by Value; 2023-2028 (US$ Million)

Figure 23: Europe Campus Networking Equipment Market by Value; 2018-2022 (US$ Billion)

Figure 24: Europe Campus Networking Equipment Market by Value; 2023-2028 (US$ Billion)

Figure 25: Europe Campus Networking Equipment Market by Region; 2022 (Percentage, %)

Figure 26: Germany Campus Networking Equipment Market by Value; 2018-2022 (US$ Billion)

Figure 27: Germany Campus Networking Equipment Market by Value; 2023-2028 (US$ Billion)

Figure 28: United Kingdom Campus Networking Equipment Market by Value; 2018-2022 (US$ Billion)

Figure 29: United Kingdom Campus Networking Equipment Market by Value; 2023-2028 (US$ Billion)

Figure 30: France Campus Networking Equipment Market by Value; 2018-2022 (US$ Million)

Figure 31: France Campus Networking Equipment Market by Value; 2023-2028 (US$ Billion)

Figure 32: Italy Campus Networking Equipment Market by Value; 2018-2022 (US$ Million)

Figure 33: Italy Campus Networking Equipment Market by Value; 2023-2028 (US$ Million)

Figure 34: Spain Campus Networking Equipment Market by Value; 2018-2022 (US$ Million)

Figure 35: Spain Campus Networking Equipment Market by Value; 2023-2028 (US$ Million)

Figure 36: Rest of Europe Campus Networking Equipment Market by Value; 2018-2022 (US$ Billion)

Figure 37: Rest of Europe Campus Networking Equipment Market by Value; 2023-2028 (US$ Billion)

Figure 38: Asia Pacific Campus Networking Equipment Market by Value; 2018-2022 (US$ Billion)

Figure 39: Asia Pacific Campus Networking Equipment Market by Value; 2023-2028 (US$ Billion)

Figure 40: Asia Pacific Campus Networking Equipment Market by Region; 2022 (Percentage, %)

Figure 41: China Campus Networking Equipment Market by Value, 2018-2022 (US$ Billion)

Figure 42: China Campus Networking Equipment Market by Value; 2023-2028 (US$ Billion)

Figure 43: Japan Campus Networking Equipment Market by Value, 2018-2022 (US$ Million)

Figure 44: Japan Campus Networking Equipment Market by Value; 2023-2028 (US$ Billion)

Figure 45: India Campus Networking Equipment Market by Value, 2018-2022 (US$ Million)

Figure 46: India Campus Networking Equipment Market by Value; 2023-2028 (US$ Million)

Figure 47: South Korea Campus Networking Equipment Market by Value, 2018-2022 (US$ Million)

Figure 48: South Korea Campus Networking Equipment Market by Value; 2023-2028 (US$ Million)

Figure 49: Rest of Asia Pacific Campus Networking Equipment Market by Value, 2018-2022 (US$ Billion)

Figure 50: Rest of Asia Pacific Campus Networking Equipment Market by Value; 2023-2028 (US$ Billion)

Figure 51: Rest of the World Campus Networking Equipment Market by Value; 2018-2022 (US$ Million)

Figure 52: Rest of the World Campus Networking Equipment Market by Value; 2023-2028 (US$ Billion)

Figure 53: Global Number of Data Records Exposed; Q1 2020-Q3 2022 (Million)

Figure 54: India Lower Secondary Education Enrolment; 2019-2022 (Billion)

Figure 55: Global Number of Internet of Things (IoT) Devices Connections; 2019-2024 (Billion)

Figure 56: Global Whole Cloud Forecast; 2021-2025 (US$ Billion)

Figure 57: Global Artificial Intelligence Market; 2021-2030 (US$ Billion)

Figure 58: Global Number Of Mobile 5G Subscriptions; 2020-2028 (Billion)

Figure 59: Global Campus Networking Equipment Players by Market Share; 2022 (Percentage, %)

Figure 60: Global Enterprise WLAN Players by Market Share; 2022 (Percentage, %)

Figure 61: Nvidia Corporation Revenue by Operating Segments; 2022 (Percentage, %)

Figure 62: Dell Technologies Inc. Net Revenue by Operating Segment; 2022 (Percentage, %)

Figure 63: Cisco Systems, Inc. Revenue by Geographical Segment; 2022 (Percentage, %)

Figure 64: Huawei Investment & Holding Co. Ltd. Revenue by Segments; 2021 (Percentage, %)

Figure 65: Hewlett Packard Enterprise Net Revenue by Operating Segments; 2022 (Percentage, %)

Figure 66: Juniper Networks, Inc. Net Revenues by Geographical Segments; 2022 (Percentage, %)

Figure 67: Arista Networks, Inc. Revenue by Segment; 2022 (Percentage, %)

Figure 68: Extreme Networks, Inc. Net Revenues by Geographical Segment; 2022 (Percentage, %)

Figure 69: CommScope Net Sales by Operating Segments; 2021 (Percentage, %)

Figure 70: Cambium Networks Revenues by Geographical Segments; 2022 (Percentage, %)

Figure 71: Fortinet Inc. Revenue by Geographical Segments; 2022 (Percentage, %)

Companies Mentioned

- Nvidia Corporation

- Dell Technologies Inc.

- Cisco Systems, Inc.

- Huawei Investment & Holding Co. Ltd.

- Hewlett Packard Enterprise

- Juniper Networks, Inc.

- Arista Networks, Inc.

- Extreme Networks, Inc.

- Alcatel-Lucent Enterprise

- CommScope (Ruckus Networks)

- Cambium Networks

- Fortinet Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 138 |

| Published | April 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 31.14 Billion |

| Forecasted Market Value ( USD | $ 40.55 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |