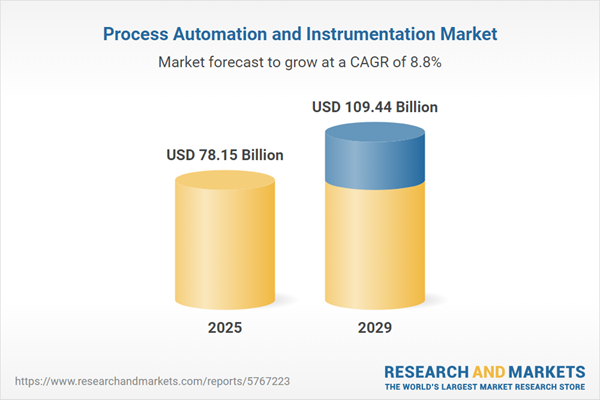

The process automation and instrumentation market size has grown strongly in recent years. It will grow from $73.74 billion in 2024 to $78.15 billion in 2025 at a compound annual growth rate (CAGR) of 6%. The growth in the historic period can be attributed to demand for operational efficiency, compliance and regulatory requirements, increased complexity of industrial processes, focus on safety and risk mitigation, energy efficiency initiatives.

The process automation and instrumentation market size is expected to see strong growth in the next few years. It will grow to $109.44 billion in 2029 at a compound annual growth rate (CAGR) of 8.8%. The growth in the forecast period can be attributed to predictive maintenance strategies, evolving regulatory landscape, modular and scalable automation, hybrid and flexible manufacturing. Major trends in the forecast period include digital twins for process optimization, cloud-based process automation solutions, cybersecurity measures for industrial networks, wireless instrumentation and communication, predictive maintenance and condition monitoring, cross-industry adoption of automation.

The growth of the process automation and instrumentation market is significantly fueled by the increasing emphasis of manufacturing firms on achieving cost savings and improved efficiency. This focus on enhancing productivity and minimizing errors is contributing to the expansion of the process automation and instrumentation market. As Gesrepair reports, manufacturing firms globally are actively investing in new manufacturing technology and making strategic investments to enhance their production processes. Consequently, the growing commitment of manufacturing firms to achieve cost savings and better efficiency is a key driver of the process automation and instrumentation market.

The rise in renewable energy is anticipated to drive the growth of the process automation and instrumentation market in the coming years. Renewable energy, often called clean energy or green energy, is derived from naturally occurring and replenishable sources that do not get depleted when utilized. By incorporating renewable energy sources into process automation and instrumentation, industrial operations can decrease their carbon footprint, lower energy expenses, and promote a more sustainable and environmentally friendly approach to production and manufacturing. For example, in July 2023, a report by the International Energy Agency, a France-based autonomous intergovernmental organization, revealed that the production of renewable energy from solar, wind, hydropower, geothermal, and ocean sources increased by over 8% in 2022. Thus, the growth of renewable energy is fueling the expansion of the process automation and instrumentation market.

Major companies in the process automation and instrumentation market are developing advanced products like intelligent instruments to boost accuracy, improve operational efficiency, facilitate real-time data monitoring, and optimize industrial processes across various sectors. Intelligent instruments are sophisticated devices that come with sensors, microprocessors, and communication capabilities, allowing them to execute automated functions, process data, and interact with other systems in real time. For example, in April 2024, Andritz AG, a machinery industry company based in Austria, launched the Smart Series. This series of intelligent instruments aims to enhance process efficiency and environmental sustainability for pulp and paper manufacturers by offering a diverse range of advanced measurement and monitoring solutions. The Smart Series includes various tools such as emission and gas analyzers, machine vision systems, and condition monitoring solutions.

Leading companies in the process automation and instrumentation market are developing innovative products, such as intelligent instruments, to improve accuracy, enhance operational efficiency, enable real-time data monitoring, and streamline industrial processes across various sectors. Intelligent instruments are sophisticated devices equipped with sensors, microprocessors, and communication capabilities, allowing them to perform automated functions, process data, and interact with other systems in real time. For example, in April 2024, Andritz AG, an Austria-based machinery industry company, launched the Smart Series. The Smart Series consists of intelligent instruments designed to enhance process efficiency and environmental sustainability for pulp and paper producers by offering a wide range of advanced measurement and monitoring solutions. This series includes various tools, such as emission and gas analyzers, machine vision systems, and condition monitoring solutions.

In October 2023, Emerson Electric Co., a US-based manufacturing company, acquired National Instruments Corporation (NI) for an undisclosed amount. Through this acquisition, Emerson Electric Co. aims to strengthen its position as a global automation leader and capitalize on key secular trends such as nearshoring, digital transformation, sustainability, and decarbonization. National Instruments Corporation (NI) is a US-based company that provides process automation and instrumentation software.

Major companies operating in the process automation and instrumentation market include ABB Limited, Danaher Corporation, Emerson Electric Company, Endress+Hauser Group Services AG, General Electric Company, Hollysys Automation Technologies Ltd., Honeywell International Inc., Mitsubishi Electric Corporation, Omron Corporation, Rockwell Automation Inc., Schneider Electric SE, Yokogawa Electric Corporation, Beckhoff Automation, Carlo Gavazzi Holding AG, Delta Electronics Inc., Inductive Automation LLC, Pepperl+Fuchs GmbH, Robert Bosch GmbH, Siemens AG, Eaton Corporation, Metso Corporation, Idec Corporation, Maple Systems Inc., AVEVA Group plc, Aspen Technology Inc., Mettler Toledo - Process Analytics, AlpHa Measurement Solutions, Sparling's technologies, Global Technology Systems, Hawk Measurement Systems, Heat Trace Products, James C. White Company Inc., Precision Digital Corporation, Pulsar Measurement - UK, Seametrics Inc.

North America was the largest region in the process automation and instrumentation market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the process automation and instrumentation market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the process automation and instrumentation market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

Process automation and instrumentation involve a series of activities dedicated to the creation and marketing of products related to process automation and instrumentation. This process utilizes technology to automate intricate business processes by employing software, hardware, and computing technology, thereby enabling more secure and efficient operations. The automation of processes serves to diminish errors and data loss while enhancing transparency, communication across departments, and the speed of processing in diverse industries.

The primary categories of process automation and instrumentation comprise field instruments, control valves, analyzers, and analytical instruments. Field instruments, which are typically deployed in challenging environments, incorporate sensors, actuators, advanced signal processing, and reliable communications. These instruments play a crucial role in capturing and interpreting data sent to the corporate level cloud. Solutions in this domain encompass programmable logic controllers (PLC), distributed control systems (DCS), supervisory control and data acquisition (SCADA), human-machine interaction (HMI), functional safety, and manufacturing execution systems (MES). These technologies find applications across various industries such as oil and gas, chemicals, pulp and paper, pharmaceuticals, metals and mining, food and beverages, as well as energy and power, including water and wastewater treatment.

The process automation and instrumentation market research report is one of a series of new reports that provides process automation and instrumentation market statistics, including process automation and instrumentation industry global market size, regional shares, competitors with a process automation and instrumentation market share, detailed process automation, and instrumentation market segments, market trends and opportunities, and any further data you may need to thrive in the process automation and instrumentation industry. This process automation and instrumentation market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The process automation and instrumentation market includes revenues earned by entities by providing pressure transmitters, flowmeters, temperature transmitters, level meters, field wireless, and device smart communicators. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Process Automation and Instrumentation Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on process automation and instrumentation market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for process automation and instrumentation? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The process automation and instrumentation market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Instrument: Field Instrument; Control Valve and Analyzer; Analytical Instrument2) by Solution: Programmable Logic Controller (PLC); Distributed Control System (DCS); Supervisory Control and Data Acquisition (SCADA); Human Machine Interaction (HMI); Functional Safety; Manufacturing Execution System (MES)

3) by Industry: Oil and Gas; Chemicals; Pulp and Paper; Pharmaceuticals; Metals and Mining; Food and Beverages; Energy and Power; Water and Wastewater Treatment

Subsegments:

1) by Field Instrument: Pressure Sensors; Temperature Sensors; Flow Meters; Level Sensors; Position Sensors2) by Control Valve and Analyzer: Control Valves; Flow Control Valves; Pressure Relief Valves; Analyzers

3) by Analytical Instrument; Spectroscopy Instruments; Chromatography Instruments; PH Meters; Conductivity Meters; Mass Spectrometers

Key Companies Mentioned: ABB Limited; Danaher Corporation; Emerson Electric Company; Endress+Hauser Group Services AG; General Electric Company

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Process Automation and Instrumentation market report include:- ABB Limited

- Danaher Corporation

- Emerson Electric Company

- Endress+Hauser Group Services AG

- General Electric Company

- Hollysys Automation Technologies Ltd.

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- Omron Corporation

- Rockwell Automation Inc.

- Schneider Electric SE

- Yokogawa Electric Corporation

- Beckhoff Automation

- Carlo Gavazzi Holding AG

- Delta Electronics Inc.

- Inductive Automation LLC

- Pepperl+Fuchs GmbH

- Robert Bosch GmbH

- Siemens AG

- Eaton Corporation

- Metso Corporation

- Idec Corporation

- Maple Systems Inc.

- AVEVA Group plc

- Aspen Technology Inc.

- Mettler Toledo - Process Analytics

- AlpHa Measurement Solutions

- Sparling's technologies

- Global Technology Systems

- Hawk Measurement Systems

- Heat Trace Products

- James C. White Company Inc.

- Precision Digital Corporation

- Pulsar Measurement - UK

- Seametrics Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 78.15 Billion |

| Forecasted Market Value ( USD | $ 109.44 Billion |

| Compound Annual Growth Rate | 8.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 35 |