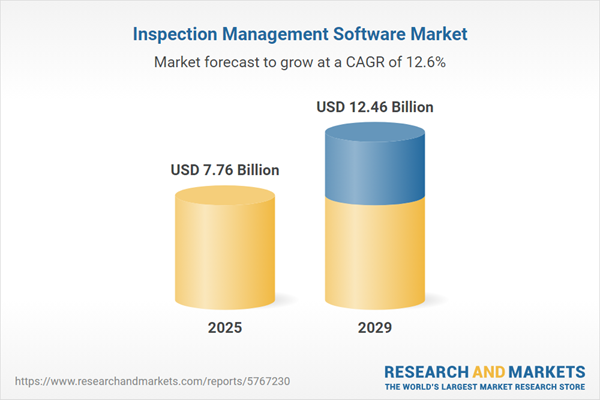

The inspection management software market size is expected to see rapid growth in the next few years. It will grow to $12.46 billion in 2029 at a compound annual growth rate (CAGR) of 12.6%. The growth in the forecast period can be attributed to emphasis on predictive maintenance, enhanced mobile capabilities, evolving cybersecurity concerns, market expansion across industries. Major trends in the forecast period include Industry 4 integration, rising demand for cloud-based solutions, technological advancements, digital transformation, and cloud-based solutions.

The inspection management software market size is expected to see rapid growth in the next few years. It will grow to $10.97 billion in 2028 at a compound annual growth rate (CAGR) of 10.7%. The anticipated growth in the forecast period can be attributed to an emphasis on predictive maintenance, improved mobile capabilities, the evolution of cybersecurity concerns, and market expansion across various industries. Major trends expected in this period include the integration of Industry 4 technologies, increasing demand for cloud-based solutions, ongoing technological advancements, digital transformation initiatives, and the continued adoption of cloud-based solutions.

The increasing need for inspection tasks, including scheduling, documentation, checklist creation, result recording, and follow-up actions, is expected to drive the growth of the inspection management software market in the forecast period. Inspections are crucial for maintaining product quality, regardless of an organization’s industry or size, and require extensive documentation, such as checklists and recording nonconformances for defective materials. For example, in April 2024, a report published by Port State Control (PSC) for 2023 by the Australian Maritime Safety Authority (AMSA), an Australian regulatory body, noted that a total of 1,444 PSC inspections were conducted. The detention rate, indicating the percentage of ships detained by PSC due to non-compliance with safety, security, or environmental regulations, increased to 6.8% for bulk carriers, up from 6.4% in 2022. Thus, the growing demand for inspection tasks is propelling the inspection management software market forward.

The increasing adoption of cloud-based solutions is anticipated to drive the growth of the inspection management software market in the coming years. Cloud adoption involves the integration and use of cloud computing services and technologies by individuals, organizations, or businesses. Cloud-based solutions have transformed inspection management software by enabling real-time collaboration, making inspection results, findings, and reports immediately accessible to authorized personnel. This promotes faster decision-making and enhances communication among inspectors, managers, and stakeholders. For example, in December 2023, the European Union, an international organization based in the Netherlands, reported that the percentage of EU businesses purchasing cloud computing services rose by 4.2 percentage points in 2023 compared to 2021. Additionally, in January 2023, Google LLC, a U.S.-based technology company, noted that 76% of people used the public cloud in 2022, a significant increase from 56% in 2021. Therefore, the growing adoption of cloud-based solutions is fueling the growth of the inspection management software market.

Leading companies in the inspection management software sector are leveraging advanced technologies, such as inspection management apps, to optimize the inspection process, enhance data accuracy, and improve compliance tracking. An inspection management app is a mobile or web-based tool that enables organizations to plan, conduct, and manage inspections more effectively. For example, in August 2024, ETQ LLC, a U.S.-based software company, launched the ETQ Reliance Quality Management System (QMS). This inspection management app is designed to streamline and automate quality inspections across manufacturing processes. The application minimizes reliance on paperwork by automating the inspection workflow, allowing for real-time visibility into quality operations. It aids in better planning and execution of inspections, enabling quality control teams to accurately identify product defects and ensure compliance with specifications. Additionally, the app serves as a central repository for shop-floor data, supporting analysis and continuous improvement initiatives throughout the manufacturing process.

Leading companies in the inspection management software market are increasingly forming partnerships to enhance their product offerings and consolidate their market positions. These collaborations are instrumental in driving innovation, leveraging complementary strengths, and expediting the development and deployment of cutting-edge solutions through the pooling of resources and expertise. For example, in January 2023, Betterview, a US-based property intelligence platform, joined forces with Plnar, a US-based insurtech software provider, to create AI-driven virtual inspection software. This strategic partnership brings together Betterview's expertise in exterior property insights with Plnar's proficiency in interior inspection capabilities, enabling insurers to gain comprehensive insights into properties.

In January 2022, Autodesk, a US-based company specializing in software products and services, acquired Moxion Cloud Solution for an undisclosed amount. This strategic acquisition is aimed at enhancing Autodesk's cloud platform for entertainment and media by expanding its capabilities beyond post-production into production. The acquisition is expected to attract new users to Autodesk and facilitate better integration of processes across the entire content production chain. The acquisition of Moxion moves Autodesk's client base upstream, from post-production to on-set production, which is a critical stage in the film and television production process. Moxion, based in New Zealand, is known for developing cloud-based digital dailies tools.

Major companies operating in the inspection management software market include Siemens AG, GE Inspection Technologies, Oracle Corporation, SAP SE, Schlumberger Limited, Baker Hughes Company, Halliburton Company, Olympus Corporation, Hexagon AB, Weatherford International plc, Vistech Corporation, Trimble Inc., Carl Zeiss Meditec AG, Dassault Systèmes SE, AVEVA Group plc, Topcon Corporation, Autodesk Inc., Bentley Systems Inc., Cognex Corporation, Leica Geosystems AG, Ideagen plc, Inspectivity Inc., e-Inspections Software Ltd.

Inspection management software is a digital solution used to ensure the safety of an organization's facilities. It includes features such as checklists, work order management, reporting, and analytics dashboards. This software helps businesses comply with health and safety regulations and maintain productivity.

The key components of inspection management software are solutions and services. These software solutions offer inspection capabilities to both technical and non-technical users across various industries. They enable management to effectively monitor high-risk suppliers and materials, control the quality of final products, reduce manufacturing costs, and minimize scrap. Inspection management software is used by both large enterprises and SMEs and can be deployed through cloud-based or on-premises solutions. Industries utilizing these software solutions include healthcare, pharmaceuticals, automation, manufacturing, retail, and information technology.

The inspection management software market size has grown strongly in recent years. It will grow from $6.65 billion in 2023 to $7.3 billion in 2024 at a compound annual growth rate (CAGR) of 9.9%. The growth in the historic period can be attributed to quality assurance, operational efficiency, risk mitigation, globalization, increased data volume.

North America was the largest region in the inspection management software market in 2024. The regions covered in the inspection management software market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the inspection management software market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The inspection management software market includes revenues earned by entities by providing services such as create forms and checklists, schedule inspections, record results and track corrective actions to completion. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Inspection Management Software Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on inspection management software market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for inspection management software? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The inspection management software market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Component: Solution; Services2) By Organization Size: Large Enterprises; Small and Medium-sized Enterprise (SMEs)

3) By Deployment Mode: Cloud; on-Premise

4) By Industry: Healthcare; Pharmaceutical; Automation; Manufacturing; Retail; Information and Technology

Subsegments:

1) By Solution: Inspection Planning Software; Inspection Scheduling Software; Inspection Reporting Software; Compliance Management Software2) By Services: Implementation Services; Training and Support Services; Consulting Services

Key Companies Mentioned: Siemens AG; GE Inspection Technologies; Oracle Corporation; SAP SE; Schlumberger Limited

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Siemens AG

- GE Inspection Technologies

- Oracle Corporation

- SAP SE

- Schlumberger Limited

- Baker Hughes Company

- Halliburton Company

- Olympus Corporation

- Hexagon AB

- Weatherford International plc

- Vistech Corporation

- Trimble Inc.

- Carl Zeiss Meditec AG

- Dassault Systèmes SE

- AVEVA Group plc

- Topcon Corporation

- Autodesk Inc.

- Bentley Systems Inc.

- Cognex Corporation

- Leica Geosystems AG

- Ideagen plc

- Inspectivity Inc.

- e-Inspections Software Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 7.76 Billion |

| Forecasted Market Value ( USD | $ 12.46 Billion |

| Compound Annual Growth Rate | 12.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |