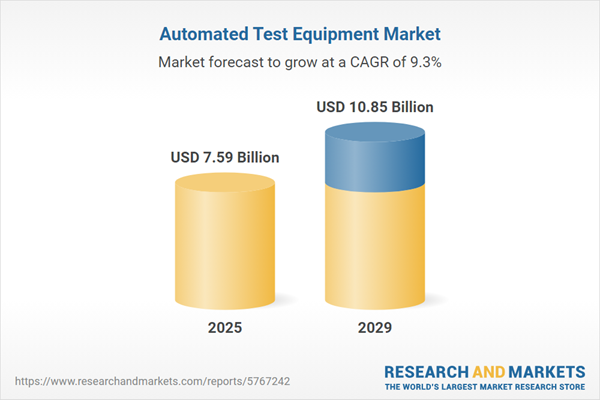

The automated test equipment market size has grown strongly in recent years. It will grow from $7.21 billion in 2024 to $7.59 billion in 2025 at a compound annual growth rate (CAGR) of 5.4%. The growth in the historic period can be attributed to quality assurance and cost efficiency, globalization of electronics manufacturing, demand for higher production throughput, focus on time-to-market, need for real-time monitoring and feedback.

The automated test equipment market size is expected to see strong growth in the next few years. It will grow to $10.85 billion in 2029 at a compound annual growth rate (CAGR) of 9.3%. The growth in the forecast period can be attributed to focus on test cost reduction, focus on energy-efficient electronics, rise of automotive electronics, test data analytics, in-circuit testing advancements. Major trends in the forecast period include focus on automotive electronics testing, high-density interconnect (HDI) testing, flexible and scalable ate solutions, increased emphasis on cybersecurity testing, rise in IoT device testing.

The escalating demand for consumer electronics is playing a pivotal role in fostering growth within the automated test equipment sector. Consumer electronics encompass various home gadgets, digital devices, and equipment used for everyday household purposes. Automated testing equipment is instrumental in assessing and ensuring the quality of these consumer electronics, leading to a proportional rise in the demand for automated test equipment. According to the India Brand Equity Foundation, an Indian government export promotion agency, projections indicate that the consumer electronics industry is poised to reach $21. 18 billion by 2025. This surge in demand for consumer electronics is anticipated to be a driving force behind the growth of the automated test equipment market.

The burgeoning production within the automobile industry is anticipated to significantly propel the expansion of the automated test equipment market. Automobile production encompasses the manufacturing process of motor vehicles, including cars, trucks, and other vehicle types. Automated test equipment solutions hold substantial importance in verifying the quality, functionality, and safety of various automotive components like sensors, control units, and communication modules during manufacturing and testing phases. As reported by the European Automobile Manufacturers' Association, global motor vehicle production surged to 85. 4 million units in 2022, marking a substantial 5. 7% increase from the preceding year, 2021. Furthermore, The National Automobile Dealers Association reported that light vehicle production in North America is forecasted to escalate from 14. 2 million units in 2022 to 15. 4 million units in 2023, driven by steady enhancements in the supply chain. Hence, the burgeoning automobile production is expected to be a significant driver propelling the automated test equipment market.

Strategic alliances have emerged as a prevailing trend gaining traction within the automated test equipment landscape. Key industry players in this sector are actively pursuing partnerships to meet evolving consumer demands. An illustrative example is the strategic alliance announced in July 2023 between ProteanTecs Ltd., an Israel-based software company, and Teradyne, Inc. This collaboration aims to enhance semiconductor testing and debugging processes for sophisticated system-on-chips (SoCs). By integrating proteanTecs' on-chip agent information and analysis software with Teradyne's test programs, customers benefit from heightened device visibility on the tester, allowing inline and real-time decision-making. Teradyne Inc., a US-based automatic test equipment manufacturer, stands as a pivotal entity in this strategic partnership. Both companies plan to showcase their collaborative efforts at DAC and SEMICON West through a joint demonstration.

Prominent entities within the automated test equipment market are strategically focusing on innovating their product offerings, exemplified by the introduction of novel solutions like test workflow subscription bundles to cater to their existing consumer base more effectively. A test workflow subscription bundle represents a packaged service or solution provided by a company, granting subscription-based access to a comprehensive set of test processes, tools, or applications. National Instruments Corporation, a US-based firm renowned for manufacturing automated test equipment and virtual instrumentation software, unveiled in March 2022 a test workflow subscription bundle tailored for automated test systems. This solution equips engineers with a single software license enabling the creation and execution of test or measurement systems. This amalgamated software suite supports engineers engaged in developing research validation and manufacturing test applications, fostering practical knowledge acquisition, refining test system development, maximizing test data value, and expediting product launches to market.

In August 2023, Transcat, Inc., a publicly traded company based in the US, acquired Axiom Test Equipment, Inc. for an undisclosed amount. This acquisition aligns with Transcat's strategy to enhance its rental offerings and drive growth by utilizing Axiom’s profitability and skilled workforce. This move bolsters Transcat’s market presence and profitability in the test equipment sector. Axiom Test Equipment, Inc., also based in the US, specializes in rental services and the development of automated test equipment (ATE) solutions that optimize testing processes across various industries.

Major companies operating in the automated test equipment market include Aemulus Holdings, Chroma ATE Inc., Astronics Corporation, Advantest Corporation, SPEA S. p. A., Teradyne Inc., STAr Technologies Inc., Roos Instruments Inc., National Instruments Corporation, Agilent Technologies Inc., Anritsu Company, Rohde & Schwarz GmbH & Co KG, Xcerra Corporation, TRICOR Systems Inc., Advint LLC, Solvay S. A., Aeroflex Inc., Marvin Test Solutions Inc., Shinbashi Inc., OMRON Corporation, Yokogawa Electric Corporation, Teledyne Technologies Incorporated, Cobham plc, Averna Technologies Inc., Test Research Inc., TestEquity LLC, Testforce Systems Inc., Testek Inc., TestWorld Inc.

Automated Test Equipment (ATE) refers to computer-controlled test and measurement equipment designed for testing with minimal human interaction. It plays a crucial role in evaluating the quality and functionality of various applications, particularly in testing printed circuit boards, interconnections, and verifications.

The primary types of products in the automated test equipment market include Memory IC Test Systems, Linear & Discrete Test Systems, System-on-Chip (SoC) Test Systems, and others. Memory IC Test Systems are integrated circuits configured to store bits of data in memory cells within a memory array, primarily used for storing and retrieving electronic data. Various technologies involved in ATE include WCDMA and RF technology, LTE technology, optical inspection technology, machine vision technology, X-Ray inspection technology, and others. Components such as industrial PCs, mass interconnects, handlers, probers, and more are integral to ATE systems. This technology finds applications across diverse sectors, including aerospace and defense, consumer electronics, IT and telecommunications, automotive, healthcare, and others.

The automated test equipment market research report is one of a series of new reports that provides automated test equipment market statistics, including automated test equipment industry global market size, regional shares, competitors with an automated test equipment market share, detailed automated test equipment market segments, market trends and opportunities, and any further data you may need to thrive in the automated test equipment industry. This automated test equipment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

North America was the largest region in the automated test equipment market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the automated test equipment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

The countries covered in the automated test equipment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

The automated test equipment market consists of sales of printed circuit boards, analog-to-digital converters (ADCs), digital-to-analog converters (DACs), comparators, track-and-hold amplifiers, and video products. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Automated Test Equipment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on automated test equipment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for automated test equipment? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The automated test equipment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Memory IC Test System; Linear And Discrete Test System; System-on-Chip (SoC) Test System; Other Products2) By Component: Industrial PC; Mass Interconnect; Handler; Prober; Other Components

3) By Technology: WCDMA and RF Technology Based Testing; LTE Technology Based Testing; Optical Inspection Technology Testing; Machine Vision Technology Testing; X-Ray Inspection Technology; Other Technologies

Subsegments:

1) By Memory IC Test System: DRAM Test Systems; NAND Flash Test Systems; SRAM Test Systems2) By Linear And Discrete Test System: Analog Test Systems; Power Management IC Test Systems; RF And Microwave Test Systems

3) By System-On-Chip (SoC) Test System: Digital SoC Test Systems; Mixed-Signal SoC Test Systems; Embedded System Test Solutions

4) By Other Products: Burn-In Test Systems; Functional Test Systems; Production Test Systems

Key Companies Mentioned: Aemulus Holdings; Chroma ATE Inc.; Astronics Corporation; Advantest Corporation; SPEA S. p. A.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Automated Test Equipment market report include:- Aemulus Holdings

- Chroma ATE Inc.

- Astronics Corporation

- Advantest Corporation

- SPEA S. p. A.

- Teradyne Inc.

- STAr Technologies Inc.

- Roos Instruments Inc.

- National Instruments Corporation

- Agilent Technologies Inc.

- Anritsu Company

- Rohde & Schwarz GmbH & Co KG

- Xcerra Corporation

- TRICOR Systems Inc.

- Advint LLC

- Solvay S. A.

- Aeroflex Inc.

- Marvin Test Solutions Inc.

- Shinbashi Inc.

- OMRON Corporation

- Yokogawa Electric Corporation

- Teledyne Technologies Incorporated

- Cobham plc

- Averna Technologies Inc.

- Test Research Inc.

- TestEquity LLC

- Testforce Systems Inc.

- Testek Inc.

- TestWorld Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | January 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 7.59 Billion |

| Forecasted Market Value ( USD | $ 10.85 Billion |

| Compound Annual Growth Rate | 9.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |