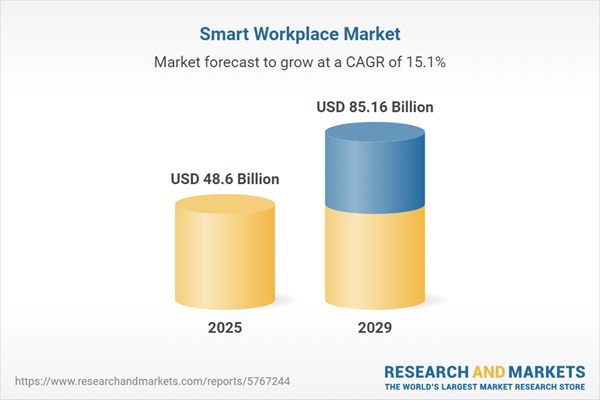

The smart workplace market size has grown strongly in recent years. It will grow from $44.33 billion in 2024 to $48.6 billion in 2025 at a compound annual growth rate (CAGR) of 9.6%. The growth in the historic period can be attributed to customization and personalization, flexible and agile workspaces, flexible work environments, energy efficiency and sustainability.

The smart workplace market size is expected to see rapid growth in the next few years. It will grow to $85.16 billion in 2029 at a compound annual growth rate (CAGR) of 15.1%. The growth in the forecast period can be attributed to focus on employee experience and wellness, cognitive collaboration, data privacy and compliance, zero trust security model, employee analytics. Major trends in the forecast period include adoption of IoT for workplace connectivity, occupancy and space utilization monitoring, voice-activated and gesture-controlled interfaces, enhanced security and access control, real-time collaboration tools and unified communications.

The anticipated growth in the smart workplace market is driven by the increasing prevalence of IoT-linked devices. IoT-linked devices, referring to nonstandard computing devices wirelessly connected to a network with data transmission capabilities, foster a highly interconnected workplace. This connectivity facilitates seamless communication and data sharing among devices and systems, ultimately enhancing workplace efficiency. An Ericsson report from November 2022 revealed that broadband IoT (4G/5G) connections, powering the majority of cellular IoT devices, reached 1. 3 billion in 2022. Projections indicate that nearly 60% of cellular IoT connections by the end of 2028 will be broadband IoT connections, with 4G being the predominant connection type. North East Asia is expected to lead in cellular IoT connections, surpassing 2 billion connections in 2023. Hence, the growth of IoT-linked devices is a significant factor propelling the smart workplace market.

The rise of remote and hybrid work models is anticipated to drive the growth of the smart workplace market in the future. Remote and hybrid work refers to a work arrangement where employees perform their tasks from locations outside the traditional workplace, often from their homes or other remote sites. The increasing prevalence of these work models highlights the need for smart workplaces, which provide the essential tools and infrastructure to support a modern, adaptable, and efficient work environment, both in the office and in remote settings. This trend contributes to the ongoing expansion of the smart workplace market. For example, in February 2022, AT&T Inc., a U.S.-based telecommunications company, projected that the percentage of companies adopting a hybrid work model, where employees alternate between remote and office work, would rise from 42% in 2021 to 81% by 2024. Therefore, the increase in remote and hybrid work models is fueling the growth of the smart workplace market.

Major companies in the smart workplace market are responding to market demands by developing smart workplace applications. These applications utilize data and automation to optimize office environments, enhance productivity, and improve the overall employee working experience. For example, Planon, a Netherlands-based provider of a smart workplace management platform, introduced the Planon Workplace App in March 2023. This application establishes a personalized, mobile-centric link between individuals and their workplace, services, and facilities. The app enhances the hybrid work experience by offering users a convenient and personalized mobile interface, allowing them to find and reserve desks and meeting rooms, submit service requests, and access information about colleagues.

Companies in the smart workplace market are focusing on advanced technologies, such as AI-powered workplace solutions, to cater to a broader customer base and increase revenue. AI-powered workplace solutions leverage artificial intelligence to optimize various aspects of the modern workplace. inspace, a US-based workspace solution provider, launched an AI-driven platform in June 2023, utilizing powerful AI and machine learning technologies to enhance space utilization and streamline office administration. This platform introduces a new level of intelligence, efficiency, and customization to office environments, contributing to a more streamlined and efficient workplace.

In July 2023, InVentry, a UK-based technology company, acquired Hipla Technologies for an undisclosed amount. This acquisition aims to enhance InVentry's product portfolio and add value to its existing customer base. Hipla Technologies, based in Singapore, is a provider of smart workplace solutions.

Major companies operating in the smart workplace market include Carrier Corporate, Honeywell International Inc., Johnson Controls, Daikin Industries, General Electric Company, Philips Lumileds, Acuity Brands, LG Electronics, OSRAM Licht AG, RavenWindow, Schneider Electric SE, Research Frontiers, NICE Systems, SAGE Electrochromics, Bosch Security Systems, Cisco Systems Inc., Siemens AG, Kronos Incorporated, ATOSS Software AG, Teem Technologies, Crestron Electronics Inc., Axis Communications, Koninklijke Philips NV, United Technologies Corporation, Signify NV, Verizon Communications Inc., Martela Oyj, Microsoft Corporation, Google LLC, Amazon Web Services Inc., Oracle Corporation.

North America was the largest region in the smart workplace market in 2024. Asia-Pacific is expected to grow faster in the forecast period. The regions covered in the smart workplace market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the smart workplace market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

A smart workplace is characterized by its ability to facilitate new work styles and enhance employee efficiency through the digitalization of physical objects.

The primary product categories in the smart workplace market include smart lighting, security systems, energy management systems, heating, ventilation, and air conditioning (HVAC) control systems, and audio-video conferencing systems. Smart lights, a component of smart workplaces, are connected to the internet, enabling remote control, voice-assisted operation, and decision-making capabilities while following predefined schedules. Security systems encompass tools such as alarm systems, door access hardware, video cameras, and contact sensors to ensure workplace safety. Energy management systems are designed to deliver and manage energy requirements in a smart workplace, reducing wastage, consumption, and optimizing usage to cut costs. HVAC control systems regulate air conditioning, heating, and ventilation operations in a smart workplace. Audio-video conferencing systems facilitate video and audio calls in these environments. Smart workplaces can be found in both retrofit buildings and new construction offices. Solutions in this market are delivered through software, services, and managed services.

The smart workplace market research report is one of a series of new reports that provides smart workplace market statistics, including smart workplace industry global market size, regional shares, competitors with a smart workplace market share, detailed smart workplace market segments, market trends and opportunities, and any further data you may need to thrive in the smart workplace industry. This smart workplace market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The smart workplace market consists of revenues earned by entities by providing technologies, services and solutions that connect and engages the employees with their workplace. A smart workplace uses technology and networking to enable people to work better, faster, and smarter and also helps improve productivity and collaboration between people. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Smart Workplace Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on smart workplace market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for smart workplace? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The smart workplace market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product: Smart Light; Security Systems; Energy Management systems; HVAC Control Systems; Audio-Video Conferencing Systems2) by Office Type: Retrofit Buildings; New Construction Offices

3) by Solution: Software; Services; Managed Services

Subsegments:

1) by Smart Light: Smart LED Bulbs; Smart Lighting Controls; Daylight Harvesting Systems; Motion-Activated Lighting2) by Security Systems: Access Control Systems; Surveillance Cameras; Intrusion Detection Systems; Smart Locks

3) by Energy Management Systems: Smart Meters; Energy Analytics Software; Demand Response Solutions; Renewable Energy Integration Systems

4) by HVAC Control Systems: Smart Thermostats; Zoning Systems; HVAC Monitoring Systems; Automated Ventilation Control

5) by Audio-Video Conferencing Systems: Video Conferencing Equipment; Collaboration Software; Integrated AV Solutions; Smart Presentation Tools

Key Companies Mentioned: Carrier Corporate; Honeywell International Inc.; Johnson Controls; Daikin Industries; General Electric Company

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Smart Workplace market report include:- Carrier Corporate

- Honeywell International Inc.

- Johnson Controls

- Daikin Industries

- General Electric Company

- Philips Lumileds

- Acuity Brands

- LG Electronics

- OSRAM Licht AG

- RavenWindow

- Schneider Electric SE

- Research Frontiers

- NICE Systems

- SAGE Electrochromics

- Bosch Security Systems

- Cisco Systems Inc.

- Siemens AG

- Kronos Incorporated

- ATOSS Software AG

- Teem Technologies

- Crestron Electronics Inc.

- Axis Communications

- Koninklijke Philips NV

- United Technologies Corporation

- Signify NV

- Verizon Communications Inc.

- Martela Oyj

- Microsoft Corporation

- Google LLC

- Amazon Web Services Inc.

- Oracle Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 48.6 Billion |

| Forecasted Market Value ( USD | $ 85.16 Billion |

| Compound Annual Growth Rate | 15.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 32 |