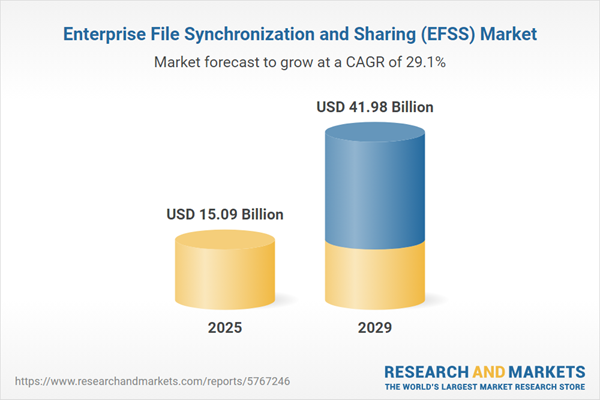

The enterprise file synchronization and sharing (EFSS) market size is expected to see exponential growth in the next few years. It will grow to $41.98 billion in 2029 at a compound annual growth rate (CAGR) of 29.1%. The growth in the forecast period can be attributed to enhanced security measures, content lifecycle management, user behavior analytics, data residency and sovereignty concerns. Major trends in the forecast period include integration with identity and access management (IAM) solutions, mobile file access and collaboration, hybrid cloud deployment models, compliance with data privacy regulations, enterprise-grade file syncing and sharing solutions.

The increase in data security concerns are expected to drive the growth of the enterprise file synchronization and sharing market in the coming years. Data security is a crucial aspect of a complete security plan that includes recognizing, evaluating, and mitigating threats connected to sensitive data security. Many businesses are concerned about the security of their digital data. To safeguard the data, enterprise file-synchronization and sharing (EFSS) platforms integrate security features such as authentication, data encryption, containerization, and tracking. According to AAG IT Services, a UK-based provider of IT products and services, globally, there were over 236. 1 million ransomware attacks, and 53. 35 million US citizens were affected by cybercrime in the first half of 2022. Also, according to Stefanini Group, a Brazil-based IT service management company, in 2021-2022, there has been a 300% increase in cybercrime.

The increasing remote work is expected to boost the growth of the enterprise file synchronization and sharing (EFSS) market going forward. Remote work, also known as telecommuting or telework, refers to a work arrangement in which employees or workers perform their job tasks and responsibilities from a location outside of the traditional workplace, typically from their homes or other remote locations. EFSS solutions offer a platform for geographically dispersed employees to seamlessly share, access, and collaborate on documents and files over the Internet. For instance, in September 2022, according to a report published by the United States Census Bureau, a US-based government agency, nearly half of the workforce in the District of Columbia, accounting for 48. 3%, engaged in remote work, marking the highest percentage of home-based workers among states and state equivalents in 2021. Additionally, states with the most significant proportions of remote workers included Washington (24. 2%), Maryland (24. 0%), Colorado (23. 7%), and Massachusetts (23. 7%). Therefore, the increasing remote work is driving the growth of the enterprise file synchronization and sharing (EFSS) market.

Major companies in the enterprise file synchronization and sharing (EFSS) market are creating technologically advanced solutions, such as storage platforms, to enhance customer service with advanced features. Storage platforms refer to systems or services that provide the infrastructure and tools necessary for storing, managing, and retrieving data, allowing users to securely save information in either physical or cloud-based environments. For instance, in October 2023, Hitachi Vantara, a US-based company that assists businesses in leveraging data for innovation and growth, launched the Hitachi Virtual Storage Platform One. This platform is a single hybrid cloud data solution designed to offer a unified data plane for both structured and unstructured data across block, file, and object storage. It enables businesses to seamlessly operate various applications on-premises and in the public cloud while minimizing the complexities often faced today. The platform simplifies the management of mission-critical workloads at scale by providing a unified architecture that integrates control plane, data fabric, and data plane capabilities across block, file, object, cloud, mainframe, and software-defined storage workloads. By eliminating infrastructure, data, and application silos, the Virtual Storage Platform One equips organizations with a dependable data foundation that allows them to access the necessary information when and where needed, all managed through a single AI-enabled software stack.

Major companies in the enterprise file synchronization and sharing (EFSS) market are developing technologically advanced services, such as file storage cloud services, to provide customers with enhanced features. A file storage cloud service is an online platform that enables users to securely store, manage, and access files over the internet, facilitating easy sharing and collaboration from any device. For example, in February 2024, Rakuten Symphony Inc., a Japan-based telecommunications company, launched Rakuten Drive. This service offers file storage cloud solutions tailored for both individual and enterprise customers, allowing users to quickly send large files while providing secure and user-friendly cloud storage and sharing options. Rakuten Drive will enhance its capabilities by enabling real-time viewing and editing of documents, presentations, and spreadsheets through the web version of Microsoft 365 applications such as Word, Excel, and PowerPoint. Additionally, the consumer-facing version of Rakuten Drive is integrated with Rakuten ID - a shared identifier that allows Rakuten members to access multiple services - making it convenient for approximately 100 million Rakuten members in Japan to use the service with their existing Rakuten ID.

In May 2024, FileCloud, a US-based provider of a secure enterprise file sync and share (EFSS) platform, acquired Signority for an undisclosed amount. This acquisition is intended to enhance FileCloud's offerings by integrating e-signature and advanced document workflow capabilities into its product portfolio, thereby strengthening its position in content governance and collaboration for unstructured data. Signority is a Canada-based provider of enterprise file synchronization and sharing (EFSS) solutions.

Major companies operating in the enterprise file synchronization and sharing (EFSS) market include Citrix Systems Inc., Axway Inc. (Syncplicity is a product of Axway), Egnyte Inc., Nextcloud GmbH, OpenText Corporation, Box Inc., Microsoft Azure (part of Microsoft Corporation), Dropbox Inc., Accellion Inc., Intralinks Holdings Inc., SkySync LLC, International Business Machines Corporation, Acronis International GmbH, CTERA Networks Ltd., HighQ Solutions Limited, XMedius Solutions Inc., Workshare Ltd., CodeLathe LLC, ExaVault Inc., GlobalSCAPE Inc., Acronis LLC, SmartFile Corp.

Enterprise file synchronization and sharing (EFSS) is used to improve content management, collaboration, and secure file sharing among employees. Enterprise file sync-and-share is a service that enables users to preserve files in the cloud or on-premises storage and subsequently access them on their desktops and mobile devices. They use file synchronization, or copying, to save files in an authorized data repository, which can subsequently be accessed remotely by employees using EFSS-compatible PCs, tablets, and smartphones.

The main components in enterprise file synchronization and sharing are solutions and services. The capability to use the cloud to provide employees with vital files while retaining security controls is known as an enterprise file synchronization and sharing (EFSS) solution. The different deployment modes include on-premises, cloud and are used in enterprise content management systems, enterprise storage, and backup, enterprise document collaboration, enterprise mobility, others. It is implemented in various verticals such as IT and telecom, banking, financial services, and insurance, retail, manufacturing, education, government, and others.

The enterprise file synchronization and sharing (EFSS) market research report is one of a series of new reports that provides enterprise file synchronization and sharing (EFSS) market statistics, including enterprise file synchronization and sharing (EFSS) industry global market size, regional shares, competitors with a enterprise file synchronization and sharing (EFSS) market share, detailed enterprise file synchronization and sharing (EFSS) market segments, market trends and opportunities, and any further data you may need to thrive in the enterprise file synchronization and sharing (EFSS) industry. This enterprise file synchronization and sharing (EFSS) market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

North America was the largest region in the enterprise file synchronization and sharing (EFSS) market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the enterprise file synchronization and sharing (efss) market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

The countries covered in the enterprise file synchronization and sharing (efss) market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

The enterprise file synchronization and sharing market includes revenues earned by entities by providing services such as live commenting, document version tracking and workflow process management. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Enterprise File Synchronization And Sharing (EFSS) Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on enterprise file synchronization and sharing (efss) market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for enterprise file synchronization and sharing (efss) ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The enterprise file synchronization and sharing (efss) market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Component: Solutions; Services2) By Deployment Mode: On-Premises; Cloud

3) By Application: Enterprise Content Management Systems; Enterprise Storage And Backup; Enterprise Document Collaboration; Enterprise Mobility; Other Applications

4) By End-User: IT And Telecom; Banking, Financial Services and Insurance; Retail; Manufacturing; Education; Government; Other End Users

Subsegments:

1) By Solutions: Cloud Storage Solutions; File Sharing Solutions; Collaboration Tools; Data Security Solutions; Mobile File Access Solutions2) By Services: Implementation Services; Consulting Services; Support And Maintenance Services; Training Services

Key Companies Mentioned: Citrix Systems Inc.; Axway Inc. (Syncplicity is a product of Axway); Egnyte Inc.; Nextcloud GmbH; OpenText Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Citrix Systems Inc.

- Axway Inc. (Syncplicity is a product of Axway)

- Egnyte Inc.

- Nextcloud GmbH

- OpenText Corporation

- Box Inc.

- Microsoft Azure (part of Microsoft Corporation)

- Dropbox Inc.

- Accellion Inc.

- Intralinks Holdings Inc.

- SkySync LLC

- International Business Machines Corporation

- Acronis International GmbH

- CTERA Networks Ltd.

- HighQ Solutions Limited

- XMedius Solutions Inc.

- Workshare Ltd.

- CodeLathe LLC

- ExaVault Inc.

- GlobalSCAPE Inc.

- Acronis LLC

- SmartFile Corp.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | January 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 15.09 Billion |

| Forecasted Market Value ( USD | $ 41.98 Billion |

| Compound Annual Growth Rate | 29.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |