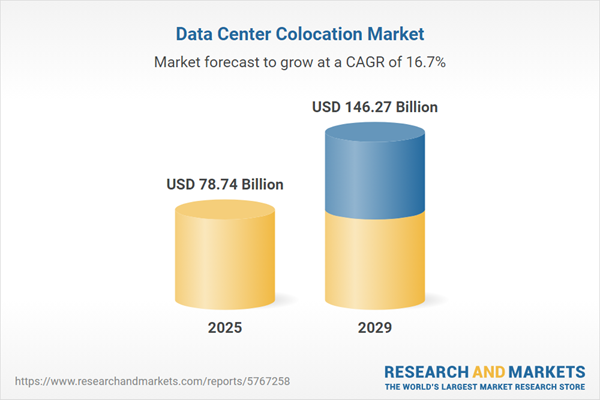

The data center colocation market size is expected to see rapid growth in the next few years. It will grow to $146.27 billion in 2029 at a compound annual growth rate (CAGR) of 16.7%. The growth in the forecast period can be attributed to edge computing growth, rise in internet of things (IoT) deployments, sustainability and green data centers, increased demand for managed services. Major trends in the forecast period include modular and prefabricated data centers, integration of 5G technology, AI and machine learning for data center optimization, increased interconnectivity services, focus on disaster recovery and business continuity.

The escalating expenses associated with maintaining an in-house data center have led many companies to opt for data center colocation services, thereby driving the demand within this market segment. Colocation services offer substantial cost savings compared to the operational costs of managing an in-house data center. To illustrate, the annual operational expenses for a sizable in-house data center typically fall within the range of $10 million to $25 million. By leveraging data center colocation services, companies can significantly decrease their expenditure on managing and upkeeping internal servers, consequently reducing their overall IT costs. Hence, the heightened expenses related to in-house data centers are contributing to the increased demand for data center colocation services.

The growing demand for cloud adoption is anticipated to drive the expansion of the data center colocation market in the coming years. Cloud adoption involves the integration and utilization of cloud computing services and resources by individuals, organizations, or businesses to enhance their IT capabilities and meet specific objectives. In the context of data center colocation, cloud adoption provides businesses with a secure, reliable, and well-connected environment that facilitates seamless integration, supports hybrid deployments, and offers the scalability and flexibility essential for dynamic business settings. For example, in December 2023, Eurostat, a Europe-based intergovernmental organization, reported that 45.2% of EU businesses utilized cloud computing services for software access, processing power, storage capacity, and other resources. Thus, the rising demand for cloud adoption is fueling the growth of the data center colocation market.

Major players in the data center colocation market are concentrating on developing advanced solutions tailored for specific applications, such as high-density colocation for AI workloads, to gain a competitive edge. High-density colocation for AI workloads provides specialized data center solutions aimed at meeting the rigorous computing and storage demands of artificial intelligence applications through scalable infrastructure and sophisticated power management. For example, in October 2022, DCX, a US-based startup in the data center sector, was launched with a focus on high-density colocation for AI workloads. DCX seeks to address the advanced needs of digital infrastructure. Their inaugural facility, DCX Goodyear 1, situated in the Greater Phoenix area, is designed to accommodate applications for AI and machine learning (ML). Goodyear 1, located in Goodyear, a rapidly growing data center hub in Phoenix, spans six acres and features two operational suites that support up to six megawatts of power, with the potential for expansion to 12 megawatts. Each data suite provides 700 kW to 1 megawatt of capacity, complete with critical infrastructure, including uninterruptible power supply (UPS) systems and waterless cooling solutions.

Key players within the data center colocation market are introducing cutting-edge technologies such as Air-Assisted Liquid Cooling (AALC) to drive their competitiveness and profitability. AALC technologies in this context are revolutionary cooling solutions specifically crafted to optimize the management of heat emanating from servers and other electronic elements within data center environments. For example, in August 2023, Digital Realty, a prominent US-based provider of data center, colocation, and interconnection solutions, unveiled a high-density colocation service under its PlatformDIGITAL umbrella. This service aims to address challenges associated with data proliferation and AI utilization, offering clients an innovative approach to amplify AI capabilities and extract maximum value from their data reservoirs.

In March 2022, Equinix Inc., a prominent US-based data center and colocation service provider, completed the acquisition of Entel's four data centers for $705 million. This strategic move by Equinix is part of its global expansion strategy, emphasizing a concentrated effort to reinforce its standing within the Latin American market. Over the past ten years, Equinix has allocated substantial investments totaling $1.2 billion in Latin America, underscoring its commitment to this region. Entel, a telecommunications firm headquartered in Chile, served as the entity divesting these data centers to Equinix, enabling Equinix to fortify its foothold and services in the dynamic Latin American market.

Major companies operating in the data center colocation market include AT&T Inc., China Telecom Corporation Limited, NTT Ltd., Element Critical, Global Switch Limited, Equinix Inc., Iron Mountain Incorporated, Digital Realty Trust Inc., Rackspace Technology Inc., Zayo Group Holdings Inc., CyrusOne Inc., CoreSite Realty Corporation, Sungard AS, Cyxtera Technologies Inc., Switch Ltd., QTS Realty Trust Inc., EdgeConneX Inc., Aligned Energy LLC, Netrality Data Centers Inc., Evoque Data Center Solutions, 365 Data Centers, Stream Data Centers, Compass Datacenters LLC, ServerFarm LLC, Digital Fortress Inc., RagingWire Data Centers Inc., DataBank Inc., Sabey Data Centers LLC, Verizon Communications Inc.

North America was the largest region in the data center colocation market in 2024. The regions covered in the data center colocation market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the data center colocation market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Data center colocation provides physical space with power, cooling, and security for housing servers and hardware, rented to third parties for setting up their data centers.

Data center colocation primarily comprises retail colocation and wholesale colocation. Retail colocation involves consumers leasing space within a data center, such as rack space within a caged-off area. Enterprises of varying sizes, including large corporations and small-scale businesses, utilize these colocation services. Implementation spans across multiple industry verticals, encompassing sectors such as BFSI (Banking, Financial Services, and Insurance), IT and telecommunications, government and defense, healthcare, and various other industries seeking data center solutions.

The data center colocation market research report is one of a series of new reports that provides data center colocation market statistics, including data center colocation industry global market size, regional shares, competitors with a data center colocation market share, detailed data center colocation market segments, market trends and opportunities, and any further data you may need to thrive in the data center colocation industry. This data center colocation market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The data center colocation market includes revenues earned by entities by providing bandwidth requirements while providing shared, secure spaces in cool, monitored environments that are ideal for servers. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Data Center Colocation Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on data center colocation market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for data center colocation? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The data center colocation market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Retail Colocation; Wholesale Colocation2) By Enterprise Size: Large Enterprise; Small Scale Enterprise

3) By End-User: BFSI; IT and Telecom; Government and Defense; Healthcare; Other End Users

Subsegments:

1) By Retail Colocation: Single Cabinets; Half Cabinets; Full Cabinets; Caged Space; Custom Suites2) By Wholesale Colocation: Private Data Center Suites; Dedicated Data Center Space; Large-Scale Colocation

Key Companies Mentioned: AT&T Inc.; China Telecom Corporation Limited; NTT Ltd.; Element Critical; Global Switch Limited

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- AT&T Inc.

- China Telecom Corporation Limited

- NTT Ltd.

- Element Critical

- Global Switch Limited

- Equinix Inc.

- Iron Mountain Incorporated

- Digital Realty Trust Inc.

- Rackspace Technology Inc.

- Zayo Group Holdings Inc.

- CyrusOne Inc.

- CoreSite Realty Corporation

- Sungard AS

- Cyxtera Technologies Inc.

- Switch Ltd.

- QTS Realty Trust Inc.

- EdgeConneX Inc.

- Aligned Energy LLC

- Netrality Data Centers Inc.

- Evoque Data Center Solutions

- 365 Data Centers

- Stream Data Centers

- Compass Datacenters LLC

- ServerFarm LLC

- Digital Fortress Inc.

- RagingWire Data Centers Inc.

- DataBank Inc.

- Sabey Data Centers LLC

- Verizon Communications Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 78.74 Billion |

| Forecasted Market Value ( USD | $ 146.27 Billion |

| Compound Annual Growth Rate | 16.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 29 |