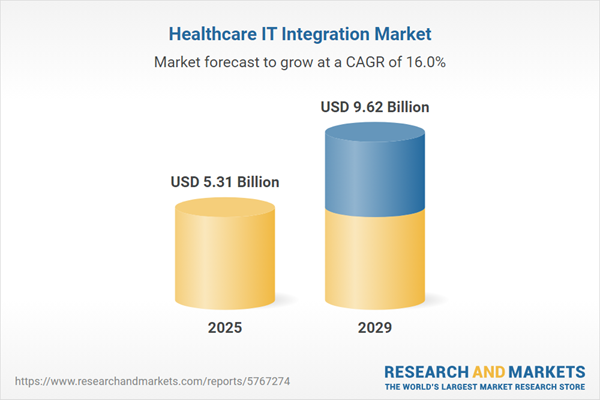

The healthcare IT integration market size has grown rapidly in recent years. It will grow from $4.79 billion in 2024 to $5.31 billion in 2025 at a compound annual growth rate (CAGR) of 10.8%. The growth in the historic period can be attributed to interoperability initiatives, population health management, regulatory compliance.

The healthcare IT integration market size is expected to see rapid growth in the next few years. It will grow to $9.62 billion in 2029 at a compound annual growth rate (CAGR) of 16%. The growth in the forecast period can be attributed to precision medicine initiatives, standardization efforts, consumer health wearables, increasing in mobile health applications, remote workforce enablement. Major trends in the forecast period include interoperability advancements, focus on patient-centric integration, precision medicine integration, population health management integration, cybersecurity and data privacy measures, remote workforce enablement, ai-driven predictive analytics.

The swift adoption of electronic health records (EHRs) by physicians is playing a significant role in the expansion of the healthcare IT integration market. An electronic health record is a structured digital collection of real-time patient data created by physicians or hospitals, making this information instantly and securely accessible to authorized users. The implementation of electronic health records necessitates healthcare IT software and its integration within healthcare institutions to ensure the smooth operation and management of extensive medical data. For example, in July 2024, the Office of the National Coordinator for Health Information Technology (ONC), a US-based official agency for health information technology, reported that around 96% of non-federal acute care hospitals and 86% of office-based physicians in the United States have adopted certified EHRs. This rapid adoption is expected to continue fueling growth in the healthcare IT integration market as more providers utilize digital solutions to enhance patient care and improve operational efficiency.

The rise in telehealth and telemedicine is anticipated to drive the growth of the healthcare IT integration market in the future. Telehealth encompasses the use of telecommunications technology to offer a broad spectrum of healthcare services and information remotely, while telemedicine specifically pertains to remote clinical consultations and healthcare delivery. The demand for telehealth services necessitates seamless data interoperability, integration with various healthcare systems, real-time access to patient information, and adherence to stringent regulations. Healthcare IT integration solutions facilitate healthcare providers in streamlining telehealth operations, enhancing patient care, and ensuring data security. They also support remote patient monitoring, scalability, cost-effectiveness, geographical accessibility, patient engagement, and overall improvements in healthcare delivery. For instance, in 2023, the Doximity State of Telemedicine Report, a US-based telehealth organization, revealed that approximately 80% of patients reported having utilized telemedicine at some point, indicating a substantial increase in usage since the onset of the COVID-19 pandemic. Furthermore, 60% of patients who had a telemedicine consultation in the past year participated in at least three virtual visits, showcasing a trend toward the recurring use of telehealth services. This ongoing adoption is expected to influence the future landscape of healthcare delivery. Consequently, the increase in telehealth and telemedicine is propelling the growth of the healthcare IT integration market.

Technological advancements in healthcare IT integration are a significant trend being pursued by companies in the healthcare IT integration market. For example, in June 2024, Oracle Corporation, a US-based software firm, launched the Oracle Health Insurance Data Exchange Cloud Service. This solution is intended to revolutionize how healthcare insurers handle data exchanges. The cloud-native service is designed to streamline the onboarding of evolving data formats and simplify complex data exchange requirements, addressing a vital need in the health insurance sector.

Major companies operating in the healthcare IT integration market are developing new procedure room visualization and integration solutions to sustain their position in the market. A procedure room visualization and integration solution is a comprehensive healthcare technology system designed to enhance the efficiency, functionality, and data management in medical procedure rooms. For instance, in July 2023, Olympus Corporation, a Japan based medical equipment manufacturing company launched the EASYSUITE ES-IP system. This system represents a modular and scalable solution for procedure room visualization and integration. The EASYSUITE ES-IP system is designed to enhance patient care pathways and clinical operations, offering a flexible and vendor-neutral solution that can integrate images and videos with various healthcare systems.

In July 2022, Healthcare Performance Group, Inc., (HPG), a US-based company operating in EHR technology acquired Health Data Specialists, LLC (HDS) for an undisclosed amount. Through this acquisition, Healthcare Performance Group, Inc., (HPG) aims to expand its ability to deliver results-oriented solutions for healthcare IT systems, applications, and workflows. Health Data Specialists, LLC (HDS) is a US-based company operating in healthcare information technology consulting services.

Major companies operating in the healthcare it integration market include Infor Inc., InterSystems Corporation, Cerner Corporation, Orion Health Group Limited, NXGN Management LLC (NextGen Healthcare), iNTERFACEWARE Inc., Allscripts Healthcare LLC, Epic Systems Corporation, Corepoint Health-Rhapsody, Oracle Corporation, GE Healthcare Technologies Inc., IBM Corporation, Siemens Healthcare GmbH, Qualcomm Life Inc., Medical Information Technology Inc., athenahealth Inc., PHC Holdings Corporation, CitiusTech Healthcare Technology Private Limited, Babylon Healthcare Services Ltd., AdvancedMD Inc., Axtria Inc., HealthEdge Holdings Inc., Definitive Healthcare Corporation, Accolade Inc., Modernizing Medicine Inc., Verily Life Sciences LLC, CompuGroup Medical AG, Global Healthcare Exchange LLC, Sema4 Inc., TherapyNotes LLC, Relias LLC, WebPT Inc., Telus Health Solutions GP, Benchling Inc., Color Genomics Inc., Access Healthcare Services Inc., eHealth Technologies Inc., Onyx Healthcare USA Inc., AngelEye Health LLC, Eddy Inc., Pluto Health, 1upHealth Inc., Optum Inc., Change Healthcare Inc., Koninklijke Philips N. V.

North America was the largest region in the healthcare IT integration market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the healthcare it integration market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the healthcare it integration market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

Healthcare IT integration refers to a variety of electronic methods that are used to manage patient data for both individual patients and groups of patients, including information about people's health and medical care. It includes a variety of electronic methods used for systematic collection of real-time data from patients in digital format to create a healthcare ecosystem. Healthcare IT integration allows information such as patients' medical history, current treatment information, treatment plans, important dates for treatments, laboratory reports, test results, and others to be retrieved instantly and securely available by authorised users to improve the quality of healthcare.

The main components of healthcare IT integration include products and services. Healthcare IT integration products are used in the integration of healthcare data such as interfaces and integration engines, medical device integration software, media integration software, and other integration tools. The different applications of healthcare IT integration include clinic integration, radiology integration, lab integration, hospital integration, and other applications.

The Healthcare IT Integration market research report is one of a series of new reports that provides healthcare IT integration market statistics, including healthcare IT integration industry global market size, regional shares, competitors with a healthcare IT integration market share, detailed healthcare IT integration market segments, market trends and opportunities, and any further data you may need to thrive in the healthcare IT integration industry. This healthcare IT integration market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The healthcare IT integration market includes revenues earned by entities by providing seamless information exchange among doctors and patients, and improving performance management. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Healthcare IT Integration Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on healthcare it integration market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for healthcare it integration? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The healthcare it integration market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) Covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Component: Product; Service2) By Application: Clinic Integration; Radiology Integration; Lab Integration; Hospital Integration; Other Applications

Subsegments:

1) By Product: Integration Engines; Middleware Solutions; Interface Engines; API Management Tools2) By Service: Consulting Services; Implementation Services; Support and Maintenance Services; Managed Services

Key Companies Mentioned: Infor Inc.; InterSystems Corporation; Cerner Corporation; Orion Health Group Limited; NXGN Management LLC (NextGen Healthcare)

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Healthcare IT Integration market report include:- Infor Inc.

- InterSystems Corporation

- Cerner Corporation

- Orion Health Group Limited

- NXGN Management LLC (NextGen Healthcare)

- iNTERFACEWARE Inc.

- Allscripts Healthcare LLC

- Epic Systems Corporation

- Corepoint Health-Rhapsody

- Oracle Corporation

- GE Healthcare Technologies Inc.

- IBM Corporation

- Siemens Healthcare GmbH

- Qualcomm Life Inc.

- Medical Information Technology Inc.

- athenahealth Inc.

- PHC Holdings Corporation

- CitiusTech Healthcare Technology Private Limited

- Babylon Healthcare Services Ltd.

- AdvancedMD Inc.

- Axtria Inc.

- HealthEdge Holdings Inc.

- Definitive Healthcare Corporation

- Accolade Inc.

- Modernizing Medicine Inc.

- Verily Life Sciences LLC

- CompuGroup Medical AG

- Global Healthcare Exchange LLC

- Sema4 Inc.

- TherapyNotes LLC

- Relias LLC

- WebPT Inc.

- Telus Health Solutions GP

- Benchling Inc.

- Color Genomics Inc.

- Access Healthcare Services Inc.

- eHealth Technologies Inc.

- Onyx Healthcare USA Inc.

- AngelEye Health LLC

- Eddy Inc.

- Pluto Health

- 1upHealth Inc.

- Optum Inc.

- Change Healthcare Inc.

- Koninklijke Philips N. V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 5.31 Billion |

| Forecasted Market Value ( USD | $ 9.62 Billion |

| Compound Annual Growth Rate | 16.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 46 |