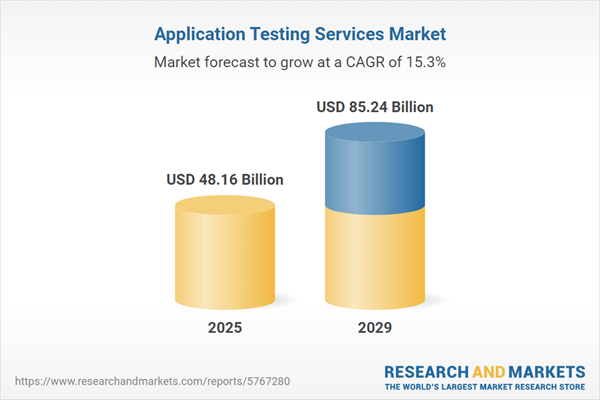

The application testing services market size is expected to see rapid growth in the next few years. It will grow to $85.24 billion in 2029 at a compound annual growth rate (CAGR) of 15.3%. The growth in the forecast period can be attributed to shift-left testing practices, continuous testing in DevOps pipelines, microservices and containerization, security testing in DevsecOps. Major trends in the forecast period include test automation and AI, shift-right testing, performance engineering, mobile application testing.

The projected surge in the application testing services market is propelled by the ongoing digital transformation within businesses. This transformation entails the comprehensive integration of digital technology across diverse operational domains, aiming to enhance efficiency, value, and innovation within organizations. Notably, such digital initiatives streamline application testing processes by delivering swifter feedback loops and reducing the time required to launch products and services. For instance, as of November 2023, the National Retail Association reported that about 11% of businesses have fully embraced digital strategies. This trend presents both opportunities and challenges for SMEs aiming to bolster their online presence. As businesses increasingly adopt digital transformations, the application testing services market is experiencing robust growth.

The anticipated surge in the application testing services market is attributed to the escalating adoption of the Internet of Things (IoT) in the coming forecast period. IoT signifies a network of interconnected devices that communicate and share data over the internet, facilitating the exchange and utilization of information. Within this framework, application testing services play a crucial role in ensuring the functionality, security, and interoperability of various interconnected devices and systems. Notably, as of September 2022, an Ericsson report revealed a global tally of 13.2 billion IoT connections, projected to surge by 18% to 34.7 billion connections by 2028. This steep rise reflects the increased deployment of autonomous systems and connected devices, driving the expansion of the application testing services market.

Strategic partnerships are increasingly becoming a prominent trend within the application testing services market. Numerous companies in this sector are opting for partnerships to fortify their market standing. An illustrative example is the collaboration between BT Group PLC, a UK-based telecommunications firm, and MTN Group Limited, a South African telecommunications entity. This partnership aims to deliver managed connectivity, cloud security, and voice services to MTN Business clients, marking a notable expansion for BT into new international territories. Although presented as an initiative under MTN's corporate umbrella, it seems that the South African division is spearheading this endeavor.

Major companies in the application testing services market are concentrating on advanced solutions, such as mobile testing services, to improve software quality and enhance user experience. Mobile testing services involve evaluating and validating the functionality, performance, and usability of mobile applications across various devices and platforms. For example, in April 2024, mabl, a US-based provider of test automation, introduced its mobile application testing service, utilizing machine learning (ML), generative AI, and computer vision to allow developers to thoroughly test their mobile apps without extensive coding. This service employs machine intelligence to remove manual selector tasks, speed up test creation, and identify gaps in test coverage, while also proactively mitigating performance degradation. The platform can quickly generate tests for both iOS and Android applications in just minutes, accommodating a range of technical skill levels.

In July 2023, Tricentis, an Austria-based software company, acquired Waldo for an undisclosed amount. This acquisition combines Waldo's specialized knowledge and technology with Tricentis's extensive expertise in test automation, enabling them to deliver higher-quality mobile applications at the speed and scale that businesses demand. Waldo is a US-based provider of application testing services.

Major companies operating in the application testing services market include Amazon Web Services Inc., Deloitte Touche Tohmatsu Limited, Accenture plc, International Business Machines Corporation, Tata Consultancy Services Limited, BT Group plc, Capgemini SE, Cognizant Technology Solutions Corporation, Infosys Limited, DXC Technology Company, Atos SE, Wipro Limited, Tech Mahindra Limited, EPAM Systems Inc., Capita plc, UST Global Inc., HCL Technologies Limited, Mindtree Limited, Hexaware Technologies Limited, Applause App Quality Inc., QA InfoTech Worldwide Inc., Cigniti Technologies Limited, Xoriant Corporation, Indium Software Limited, AQM Software Testing Lab Pvt Ltd, a1qa LLC, Software Quality Systems S.A., Sauce Labs Inc., ZYMR Inc., Testlio Inc., TestingXperts Pvt. Ltd., Qualitest Group, ThinkSys Inc.

Asia-Pacific was the largest region in the application testing services market in 2024. North America was the second-largest region of the application testing services market. The regions covered in the application testing services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the application testing services market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Application testing services encompass a wide array of verification and validation solutions aimed at supporting clients' quality assurance (QA) and quality control (QC) efforts for their applications. These services involve comprehensive evaluation and validation processes that assess both the technical and functional aspects of the tested components. Validation and verification activities are integral components of these services, focusing on scrutinizing the behavior and performance of the tested elements to ensure their adherence to specified standards and requirements.

The application testing services market encompasses various testing types crucial for evaluating applications, such as functionality testing, usability testing, performance testing, compatibility testing, security testing, compliance testing, automation testing, among others. Functionality testing specifically ensures that a system aligns with its designated functional requirements, validating the software against predefined criteria. The market includes representation from small, medium, and large enterprises, offering a spectrum of service types including professional and managed services. Diverse delivery modes, such as onshore, offshore, nearshore, and onsite, cater to different client preferences. Additionally, the market serves multiple industry verticals, including telecom and IT, BFSI, healthcare and life sciences, government and public sector, media and entertainment, manufacturing, retail, and various other sectors.

The application testing services market research report is one of a series of new reports that provides application testing services market statistics, including application testing services industry global market size, regional shares, competitors with an application testing services market share, detailed application testing services market segments, market trends and opportunities, and any further data you may need to thrive in the application testing services industry. This application testing services market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The application testing services market includes revenues earned by entities through localization testing, mobile application testing, and crowdsourced testing that are used to provide end-to-end application testing services. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Application Testing Services Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on application testing services market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for application testing services? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The application testing services market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Testing Type: Functionality Testing; Usability Testing; Performance Testing; Compatibility Testing; Security Testing; Compliance Testing; Automation Testing; Other Testing Types2) By Organization Size: Small and Medium Enterprises; Large Enterprises

3) By Service Type: Professional Services; Managed Services

4) By Delivery Model: Onshore; Offshore; Nearshore; Onsite

5) By Vertical: Telecom and IT; BFSI; Healthcare and Life Sciences; Government and Public Sector; Media and Entertainment; Manufacturing; Retail; Energy and Utilities; Logistics and Transportation; Other Verticals

Subsegments:

1) By Functionality Testing: Unit Testing; Integration Testing; System Testing; User Acceptance Testing (UAT)2) By Usability Testing: User Experience (UX) Testing; Accessibility Testing; a/B Testing; Beta Testing

3) By Performance Testing: Load Testing; Stress Testing; Endurance Testing; Scalability Testing

4) By Compatibility Testing: Cross-Browser Testing; Cross-Device Testing; Operating System Compatibility Testing; Network Compatibility Testing

5) By Security Testing: Penetration Testing; Vulnerability Scanning; Security Auditing; Risk Assessment

6) By Compliance Testing: Regulatory Compliance Testing; Standards Compliance Testing; Data Protection Compliance Testing

7) By Automation Testing: Test Automation Framework Development; Automated Regression Testing; Continuous Testing in DevOps; Script Development for Automated Tests

8) By Other Testing Types: Localization and Internationalization Testing; Smoke Testing; Recovery Testing; Installation Testing

Key Companies Mentioned: Amazon Web Services Inc.; Deloitte Touche Tohmatsu Limited; Accenture plc; International Business Machines Corporation; Tata Consultancy Services Limited

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Amazon Web Services Inc.

- Deloitte Touche Tohmatsu Limited

- Accenture plc

- International Business Machines Corporation

- Tata Consultancy Services Limited

- BT Group plc

- Capgemini SE

- Cognizant Technology Solutions Corporation

- Infosys Limited

- DXC Technology Company

- Atos SE

- Wipro Limited

- Tech Mahindra Limited

- EPAM Systems Inc.

- Capita plc

- UST Global Inc.

- HCL Technologies Limited

- Mindtree Limited

- Hexaware Technologies Limited

- Applause App Quality Inc.

- QA InfoTech Worldwide Inc.

- Cigniti Technologies Limited

- Xoriant Corporation

- Indium Software Limited

- AQM Software Testing Lab Pvt Ltd

- a1qa LLC

- Software Quality Systems S.A.

- Sauce Labs Inc.

- ZYMR Inc.

- Testlio Inc.

- TestingXperts Pvt. Ltd.

- Qualitest Group

- ThinkSys Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 48.16 Billion |

| Forecasted Market Value ( USD | $ 85.24 Billion |

| Compound Annual Growth Rate | 15.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 33 |