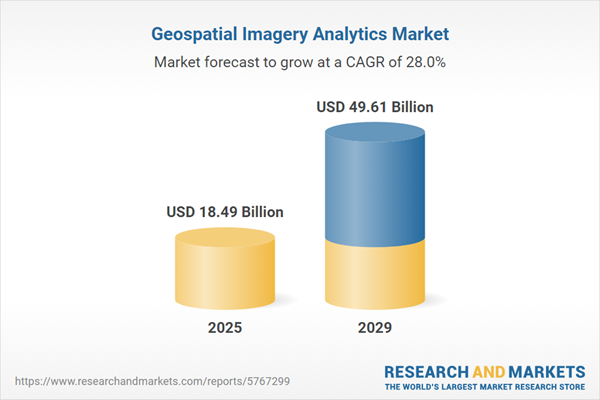

The geospatial imagery analytics market size has grown exponentially in recent years. It will grow from $14.73 billion in 2024 to $18.49 billion in 2025 at a compound annual growth rate (CAGR) of 25.5%. The growth in the historic period can be attributed to demand for location-based services, emergency response and disaster management, urban planning and smart cities development, environmental monitoring and conservation, defense and intelligence applications.

The geospatial imagery analytics market size is expected to see exponential growth in the next few years. It will grow to $49.61 billion in 2029 at a compound annual growth rate (CAGR) of 28%. The growth in the forecast period can be attributed to focus on climate change monitoring, infrastructure development projects, space tourism and exploration, global connectivity initiatives, healthcare and epidemiological studies, economic development and market intelligence, efforts to combat illegal activities. Major trends in the forecast period include advancements in satellite technology, cloud-based geospatial analytics platforms, application in precision agriculture, urban planning and smart cities, environmental monitoring and climate change analysis.

The growing demand for small satellites is anticipated to propel the growth of the geospatial imagery analytics market in the future. Small satellites typically weigh less than 100 kg, comparable to the size of a suitcase. They are utilized in imagery analytics to analyze small pieces of information worldwide at a lower cost, delivering more reliable and accurate results for detailed operations. For example, in September 2022, the Government Accountability Office, a US-based government agency, reported that there were nearly 5,500 active satellites in orbit as of spring 2022, with one estimate forecasting the launch of an additional 58,000 by 2030. Therefore, the rising demand for small satellites is driving the growth of the geospatial imagery analytics market.

The rising utilization of 5G networks is anticipated to fuel the growth of the geospatial imagery analytics market. 5G, or fifth-generation wireless technology, is the most recent advancement in mobile network technology, marking a significant leap in telecommunications and wireless connectivity. Geospatial imagery analytics leverages 5G networks to enable better real-time decision-making, improved resource management, and enhanced insights across various industries. For example, in September 2024, IOT Analytics, a Germany-based provider of IoT analytics, projected that private 5G connections will reach 8.16 million by 2030, accounting for 13% of the total 62.4 million 5G IoT connections globally. This growth is primarily driven by the increasing demand for IoT applications in sectors such as logistics, manufacturing, and smart infrastructure. Thus, the increased use of 5G networks is expected to propel the growth of the geospatial imagery analytics market in the future.

Technological advancements have become a significant trend gaining traction in the geospatial imagery analytics market. Leading companies in this field are rolling out new technological innovations to maintain their competitive edge. For example, in May 2023, Google LLC, a U.S.-based software company, launched Geospatial Creator. This powerful tool is designed to enable developers and creators to easily build and publish augmented reality (AR) experiences anchored in the real world. It utilizes ARCore and Google Maps Platform technologies, allowing users to create immersive content within minutes, without the need for extensive coding skills. The tool incorporates high-resolution 3D tiles that provide a realistic depiction of the chosen area, enabling creators to accurately visualize their digital content within the physical environment.

Major companies operating in the geospatial imaging analytics industry are adopting strategic partnerships approach to provide essential geospatial imaging analytics services to individuals, businesses, and governments. Strategic partnerships refers to a process in which companies leverage each other's strengths and resources to achieve mutual benefits and success. For instance, in July 2023, Locana, an Italy-based geospatial systems development and location and mapping technology company, partnered with OpenStreetMap, a US-based non-profit organization to enhance access to high-quality geographic data, reduce the cost of utilizing location intelligence, and enable more organizations to leverage insights derived from location data. Locana's partnership with OpenStreetMap US is significant because it provides further support for the OpenStreetMap project, enables access to high-quality geographic data, encourages innovative applications, promotes collaboration, and reflects a growing trend of corporate participation in the OSM community.

In April 2024, Descartes Labs, a U.S.-based geospatial analytics firm, acquired Geosite for an undisclosed sum. With this acquisition, Descartes Labs intends to bolster its geospatial intelligence capabilities by utilizing Geosite's advanced platform, which focuses on delivering actionable insights derived from satellite imagery and various geospatial data sources. Geosite is a U.S.-based company that specializes in geospatial intelligence and analytics.

Major companies operating in the geospatial imagery analytics market include Oracle Corporation, Hexagon AB,Environmental Systems Research Institute Inc.,TomTom NV, Trimble Inc., RMSI Private Limited,Planet Labs PBC,Maxar Technologies Holdings Inc.,L3Harris Technologies Inc., Google LLC., Zillion Info Tech Solutions Private Limited, Orbital Insight Inc., Mapidea Ltd., Satellite Imaging Corporation, Risk Management Solutions Inc., Fugro NV,onXmaps,GeoMoby,GeoMoby, Pitney Bowes Inc., AAM Pty Ltd., Critigen LLC., MDA CORPORATION LTD., PrecisionHawk Inc.,Sparkgeo Consulting Inc.

North America was the largest region in the geospacial imagery analytics market in 2024. The regions covered in the geospatial imagery analytics market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the geospatial imagery analytics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

Geospatial imagery analytics refers to an analytical solution that provides images and videos of the earth. Geospatial imagery analytics uses data collected from satellite images and is used for examining urban planning, climate conditions, and disaster response management. Companies in other sectors use the data to develop contingency plans for future risks. It is used to get information about natural phenomena and human activities occurring on the earth's surface.

The main types of geospatial imagery analytics are video-based analytics and imagery analytics. Imagery analysis, or image analysis, collects meaningful information from images, mainly from digital images utilizing digital image processing techniques. Image analysis tasks are as simple or as sophisticated as identifying a person from their face or reading bar-coded tags. The different technologies include global positioning systems (GPS), geographical information systems (GIS), remote sensing (RS), unmanned aerial vehicles (UAVs), and are deployed through the cloud and on-premises. The different organization sizes include large enterprises, small and medium-sized enterprises (SMEs), and are used in agriculture, mining and manufacturing, defense and security, energy, utility, and natural resources, government, healthcare, insurance, and other applications.

The geospatial imagery analytics market research report is one of a series of new reports that provides geospatial imagery analytics market statistics, including geospatial imagery analytics industry global market size, regional shares, competitors with a geospatial imagery analytics market share, detailed geospatial imagery analytics market segments, market trends and opportunities, and any further data you may need to thrive in the geospatial imagery analytics industry. This geospatial imagery analytics market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future state of the industry.

The geospatial imagery analytics market includes revenues earned by entities by providing satellite photographs, crisis management, climate change modeling, and weather imagery monitoring. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Geospatial Imagery Analytics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on geospatial imagery analytics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for geospatial imagery analytics? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The geospatial imagery analytics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) Covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Video-Based Analytics; Imagery Analytics2) By Geospatial Technology: Global Positioning System (GPS); Geographical Information Systems (GIS); Remote Sensing (RS); Unmanned Aerial Vehicles (UAVs)

3) By Deployment Mode: Cloud; on-Premises

4) By Organization Size: Large Enterprises; Small and Medium-Sized Enterprises (SMEs)

5) By Application: Agriculture; Mining and Manufacturing; Defense and Security; Energy, Utility, and Natural Resources; Government; Healthcare; Insurance; Other Applications

Subsegments:

1) By Video-Based Analytics: Real-time Video Processing; Object Detection and Tracking; Pattern Recognition; Event Detection2) By Imagery Analytics: Satellite Imagery Analysis; Aerial Imagery Analysis; Drone Imagery Analysis; Multispectral and Hyperspectral Imagery Analysis

Key Companies Mentioned: Oracle Corporation; Hexagon AB;Environmental Systems Research Institute Inc.;TomTom NV; Trimble Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Geospatial Imagery Analytics market report include:- Oracle Corporation

- Hexagon AB

- Environmental Systems Research Institute Inc.

- TomTom NV

- Trimble Inc.

- RMSI Private Limited

- Planet Labs PBC

- Maxar Technologies Holdings Inc.

- L3Harris Technologies Inc.

- Google LLC.

- Zillion Info Tech Solutions Private Limited

- Orbital Insight Inc.

- Mapidea Ltd.

- Satellite Imaging Corporation

- Risk Management Solutions Inc.

- Fugro NV

- onXmaps

- GeoMoby

- GeoMoby

- Pitney Bowes Inc.

- AAM Pty Ltd.

- Critigen LLC.

- MDA CORPORATION LTD.

- PrecisionHawk Inc.

- Sparkgeo Consulting Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 18.49 Billion |

| Forecasted Market Value ( USD | $ 49.61 Billion |

| Compound Annual Growth Rate | 28.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |