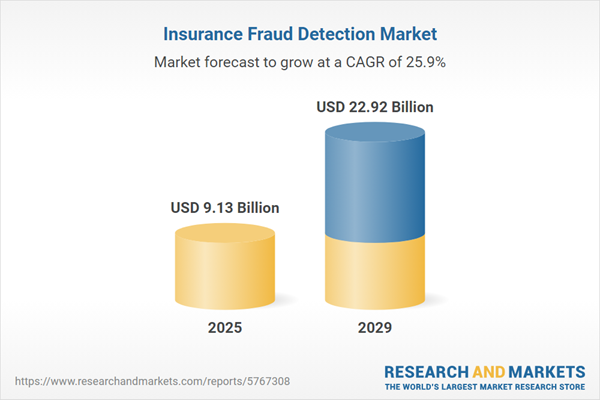

The insurance fraud detection market size has grown exponentially in recent years. It will grow from $7.5 billion in 2024 to $9.13 billion in 2025 at a compound annual growth rate (CAGR) of 21.6%. The growth in the historic period can be attributed to rising instances of insurance fraud, complexity of fraud schemes, regulatory compliance requirements, customer demand for security, globalization of insurance markets.

The insurance fraud detection market size is expected to see exponential growth in the next few years. It will grow to $22.92 billion in 2029 at a compound annual growth rate (CAGR) of 25.9%. The growth in the forecast period can be attributed to global data sharing platforms, regulatory emphasis on fraud prevention, insider threat detection, enhanced identity verification, increased cybersecurity measures. Major trends in the forecast period include rise of advanced analytics and machine learning, collaboration with insurtech companies, focus on real-time fraud prevention, focus on digital identity verification, use of geospatial data for risk assessment, regulatory compliance and reporting.

The growth of the insurance fraud detection market is anticipated to be driven by the increasing frequency of cyberattacks. Cyberattacks, deliberate and dangerous attempts to access an individual's or organization's data, pose a significant threat to insurance companies due to their extensive collection of personal policyholder data. Insurers, unlike many other industries, not only handle sensitive financial data but also amass a considerable volume of protected personal sensitive information. As reported by the Anti-Phishing Working Group in June 2022, the first quarter of 2022 witnessed a 15% increase in phishing attacks compared to the previous quarter, emphasizing the heightened risk. This surge in cyberattacks is a pivotal factor propelling the growth of the insurance fraud detection market.

The escalating instances of insurance frauds are expected to further contribute to the expansion of the insurance fraud detection market. Insurance fraud involves intentionally deceiving or misleading insurance companies for financial gain through false claims or misrepresentation. Effective insurance fraud detection is crucial for upholding the integrity of the insurance industry, preventing financial losses, and ensuring that legitimate claimants receive rightful benefits. The Insurance Fraud Enforcement Department reported a substantial 61% surge in insurance fraud in the UK, attributed in part to the cost-of-living crisis, underscoring the need for robust fraud detection measures. This rise in various insurance frauds is poised to fuel the growth of the insurance fraud detection market.

Technological advancements are becoming a significant trend in the insurance fraud detection market. Many companies are introducing new solutions with enhanced technologies to better monitor and detect fraudulent insurance claims for their clients. For example, in June 2024, Clara Analytics Inc., a US-based software company, launched CLARA Fraud. This fraud detection tool leverages AI and extensive workers' compensation datasets to increase visibility into suspicious claims. It provides alerts and data-supported reasons for SIU referrals, enabling claims professionals to confidently investigate potential fraud, reduce false positives, and uncover fraudulent activities across millions of claims.

Major players in the insurance fraud detection market are focusing on product innovation to improve the accuracy and efficiency of identifying fraudulent insurance claims, ultimately minimizing financial losses for insurers. Innovative products in this field leverage advanced data analytics, cloud technology, artificial intelligence, and machine learning to proactively identify and mitigate fraudulent activities within the insurance industry. An illustration of this is Verisk's launch of ClaimSearch, a cloud-based system designed to combat insurance fraud in Israel. ClaimSearch utilizes advanced analytics and data inputs from the local insurance industry to transform anti-fraud efforts in the country.

In February 2022, Charles Taylor InsureTech acquired the majority share of Fraud Keeper, a UK-based company specializing in detecting, preventing, mitigating, and managing fraudulent transactions in the insurance sector. This acquisition is expected to enable Fraud Keeper to expand its proven technology to new markets and client situations globally, aligning with Charles Taylor's counter-fraud strategy and specialist investigation services.

Major companies operating in the insurance fraud detection market include ACI Worldwide Inc., BAE Systems PLC, BRIDGEi2i Analytics Solutions Pvt. Ltd., Datawalk Inc., DXC Technology Co., Experian PLC, Fair Isaac Corp., Fiserv Inc., FRISS Inc., International Business Machines Corporation, iovation Inc., Kount Inc., Relx Group, Oracle Corp., SAP SE, SAS Institute Inc., Scorto Inc., TransUnion LLC, Wipro Ltd., Accenture plc, Equifax Inc., Perceptiviti Inc, Shift Technology S. A., Verisk Analytics, Inc., Mody Data Solution Pvt. Ltd., Pixalate, Inc., Skopenow Inc., Sigma Insights Inc., Fraud Guard LLC.

North America was the largest region in the insurance fraud detection market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the insurance fraud detection market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the insurance fraud detection market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

Insurance fraud detection is a method aimed at identifying and preventing fraudulent activities related to money or insurance. Various software-based solutions are employed to analyze historical patterns and incidents, predicting and preventing future occurrences. Organizations utilize insurance fraud detection for fraud analytics, authentication, governance, risk management, and compliance to safeguard databases and identify vulnerabilities.

The primary deployment types of insurance fraud detection are on-premises and cloud. On-premises insurance fraud detection involves software that is implemented and activated on computers located on the premises of the individual or using the software, rather than at a distant facility like a server farm or cloud. The components of insurance fraud detection include solutions and services, catering to both small and medium-sized enterprises (SMEs) and large enterprises. Applications of insurance fraud detection encompass claims fraud, identity theft, payment and billing fraud, and money laundering. These applications find use across various end-users such as insurance companies, insurance intermediaries, agents and brokers, and other entities.

The insurance fraud detection market research report is one of a series of new reports that provides insurance fraud detection market statistics, including insurance fraud detection industry global market size, regional shares, competitors with an insurance fraud detection market share, detailed insurance fraud detection market segments, market trends and opportunities, and any further data you may need to thrive in the insurance fraud detection industry. This insurance fraud detection market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The insurance fraud detection includes revenues earned by entities by statistical data analysis services, multi-layered process, behavioral biometrics services, adaptive and predictive analytics servies. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Insurance Fraud Detection Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on insurance fraud detection market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for insurance fraud detection? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The insurance fraud detection market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) Covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Component: Solution; Services2) By Organization Size: Small and Medium-Sized Enterprises (SMEs); Large Enterprises

3) By Deployment Type: on-Premises; Cloud

4) By Application: Claims Fraud; Identity Theft; Payment and Billing Fraud; Money Laundering

5) By End User: Insurance Companies; Agents and Brokers; Insurance Intermediaries; Other End Users

Subsegments:

1) By Solution: Fraud Analytics; Authentication Solutions; Governance, Risk, and Compliance (GRC) Solutions; Identity Verification Solutions; Predictive Analytics2) By Services: Managed Services; Professional Services; Consulting Services; Training and Support Services; System Integration Services

Key Companies Mentioned: ACI Worldwide Inc.; BAE Systems PLC; BRIDGEi2i Analytics Solutions Pvt. Ltd.; Datawalk Inc.; DXC Technology Co.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Insurance Fraud Detection market report include:- ACI Worldwide Inc.

- BAE Systems PLC

- BRIDGEi2i Analytics Solutions Pvt. Ltd.

- Datawalk Inc.

- DXC Technology Co.

- Experian PLC

- Fair Isaac Corp.

- Fiserv Inc.

- FRISS Inc.

- International Business Machines Corporation

- iovation Inc.

- Kount Inc.

- Relx Group

- Oracle Corp.

- SAP SE

- SAS Institute Inc.

- Scorto Inc.

- TransUnion LLC

- Wipro Ltd.

- Accenture plc

- Equifax Inc.

- Perceptiviti Inc,

- Shift Technology S. A.

- Verisk Analytics, Inc.

- Mody Data Solution Pvt. Ltd.

- Pixalate, Inc.

- Skopenow Inc.

- Sigma Insights Inc.

- Fraud Guard LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 9.13 Billion |

| Forecasted Market Value ( USD | $ 22.92 Billion |

| Compound Annual Growth Rate | 25.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |