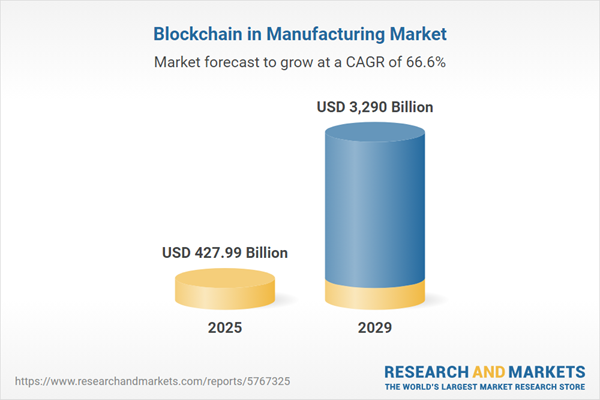

The blockchain in manufacturing market size has grown exponentially in recent years. It will grow from $248.93 billion in 2024 to $427.99 billion in 2025 at a compound annual growth rate (CAGR) of 71.9%. The growth in the historic period can be attributed to need for enhanced supply chain visibility, increased concerns about counterfeiting, growing complexity of manufacturing processes, adoption of smart contracts in manufacturing, demand for improved data security in manufacturing.

The blockchain in manufacturing market size is expected to see exponential growth in the next few years. It will grow to $3.29 trillion in 2029 at a compound annual growth rate (CAGR) of 66.6%. The growth in the forecast period can be attributed to integration of blockchain in industry 4 initiatives, growing emphasis on traceability and transparency, increased adoption of decentralized manufacturing networks, rise in regulatory compliance requirements, expansion of blockchain applications beyond supply chain. Major trends in the forecast period include development of consortiums and industry alliances, use of blockchain for quality assurance and compliance, integration of internet of things (IoT) with blockchain, adoption of tokenization in manufacturing transactions, focus on sustainability and ethical sourcing through blockchain.

The rising demand for blockchain technology from end-use industries worldwide is fueling the growth of the blockchain market. In the industrial sector, blockchain can facilitate a completely new manufacturing business model by enhancing visibility across all aspects of the process, including suppliers, strategic sourcing, procurement, and supplier quality, as well as shop floor operations, which encompass machine-level monitoring and servicing. For example, in February 2024, the Energy Information Administration, a U.S.-based government agency, reported that cryptocurrency mining operations in the U.S. have significantly increased electricity demand, accounting for an estimated 0.6% to 2.3% of the country's total electricity consumption. Thus, the growing demand for blockchain across various sectors is anticipated to drive the growth of blockchain in the manufacturing market in the future.

The cross-border trade is expected to propel the blockchain in the manufacturing market going forward. Cross-border trade refers to the buying and selling of goods, services, or commodities between two or more countries, typically involving the movement of products across national borders. Blockchain technology in manufacturing enhances transparency, security, and traceability, facilitating smoother cross-border trade operations and reducing fraud and disputes. For instance, according to the data from InterTradeIreland, a Northern Ireland-based organization focusing on Cross-Border Trade and Business Development, indicates that the value of cross-border trade in goods, involving movements from either Northern Ireland to Ireland (NST) or from Ireland to Northern Ireland (SNT), amounted to €10. 2 billion ($12. 39 billion) in 2022. This marked an increase from the previous year when the value stood at €7. 8 billion ($9. 48 billion) in 2021. Therefore, cross-border trade is driving the blockchain in the manufacturing market.

Leading companies in the blockchain manufacturing sector are concentrating on creating technologically advanced solutions, such as the Tezos blockchain ecosystem, to enhance supply chain transparency and boost operational efficiency through decentralized processes. The Tezos blockchain ecosystem is a decentralized platform that supports smart contracts and decentralized applications (dApps) with integrated governance, enabling stakeholders to propose and vote on protocol upgrades. Its self-amending capability encourages continuous innovation and scalability while ensuring security and decentralization. For example, in June 2023, Moi Technology Ltd., an India-based technology firm, launched the Babylon Testnet to address challenges in the blockchain industry. The Babylon Testnet enhances the blockchain landscape with improved security, flexibility, and scalability, addressing efficiency and user interaction issues. Its participant-centric approach fosters a fair and sustainable digital ecosystem, empowering users and developers to engage seamlessly and make smarter decisions.

Key players in the Blockchain in Manufacturing market are concentrating on creating innovative technological solutions, such as the Web3 Acceleration Platform, to improve interoperability and scalability in decentralized applications. The Web3 Acceleration Platform is a comprehensive framework that allows developers to efficiently design, deploy, and scale decentralized applications (dApps) by offering essential tools and resources for smart contract integration and user identity management across various blockchain networks. For example, in June 2023, Fujitsu, a Japan-based information and communications technology firm, launched the Web3 Acceleration Platform to support the development of Web3 services and enhance collaboration by enabling secure data exchange and advanced computing capabilities through its cutting-edge Data e-TRUST technology. This platform fosters a global co-creation environment, enabling diverse partners to work together on innovative applications while promoting digital trust and authenticity in transactions.

In May 2022, Peak Rock Capital, a US-based private investment firm acquired Mojix Inc for an undisclosed amount. Through this acquisition, Peak Rock Capital aimed to support Mojix in enhancing its technology capabilities, increasing its geographic footprint, and strengthening its presence in core industry verticals. Mojix Inc is a US-based company providing item-level intelligence solutions for the manufacturing, supply chain, and retail sectors. Leveraging blockchain technology, Mojix's software is capable of automating tasks related to food safety compliance, expiration date tracking, and efficient inventory management.

Major companies operating in the blockchain in manufacturing market include Advanced Micro Devices Inc., Amazon Web Services Inc., Blockchain Foundry Inc., CargoX Inc., Chronicled Inc., Xayn AG, Factom Inc., International Business Machines Corporation, Intel Corporation, Microsoft Corporation, Nvidia Corporation, Oracle Corporation, Riddle&Code GmbH, Wipro Limited, Everledger Ltd., Accenture PLC, BigchainDB GmbH, ChromaWay AB, LO3 Energy Inc., SAP SE, Siemens AG, Baidu Inc., Huawei Technologies Co. Ltd., Deloitte Touche Tohmatsu Limited, HCL Technologies Ltd., Tata Consultancy Services Limited, Capgemini SE, Infosys Limited, Chainway Information Technology Co. Ltd., The Bitfury Group, Sphera Solutions Inc., Provenance Ltd.

Blockchain in manufacturing involves the application of decentralized ledger technology to improve transparency, traceability, and security within supply chains. It is utilized to monitor the origin of materials, optimize processes, and ensure adherence to regulations. This technology enables manufacturers to minimize fraud, enhance efficiency, and build trust among stakeholders.

The main application of blockchain in the manufacturing market is logistics and supply chain management, counterfeit management, quality control, compliance, and others. The logistics and supply chain management in the blockchain are used by different industry sectors to improve supply chain management. It allows supply chain partners to share trusted data through permissioned blockchain solutions. It has components such as platform and services used in various sectors such as energy and power, industrial, automotive, pharmaceuticals, aerospace and defense, food and beverages, textile and clothing, and others.

The blockchain in the manufacturing market research report is one of a series of new reports that provides blockchain in the manufacturing market statistics, including blockchain in the manufacturing industry global market size, regional shares, competitors with a blockchain in the manufacturing market share, detailed blockchain in the manufacturing market segments, market trends and opportunities, and any further data you may need to thrive in the blockchain in the manufacturing industry. This blockchain in the manufacturing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Asia-Pacific was the largest region in the blockchain in manufacturing market in 2024. The regions covered in the blockchain in manufacturing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

The countries covered in the blockchain in manufacturing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

The blockchain in the manufacturing market includes revenues earned by entities by offering blockchain technology in manufacturing services which includes providing digitally transformed processes of manufacturing with the help of numerous systems and applications. Blockchain technology helps the manufacturing industry by making the supply chain more secure and processes more transparent. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Blockchain in Manufacturing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on blockchain in manufacturing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for blockchain in manufacturing? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The blockchain in manufacturing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Applications: Logistics and Supply Chain Management; Counterfeit Management; Quality Control And Compliance; Other Applications2) By Component: Platform; Services

3) By End-Use: Energy And Power; Industrial; Automotive; Pharmaceuticals; Aerospace And Defense; Food And Beverages; Textile And Clothing; Other End-Users

Subsegments:

1) By Logistics And Supply Chain Management: Inventory Management; Shipment Tracking; Supplier Verification2) By Counterfeit Management: Product Authentication; Traceability Solutions; Brand Protection

3) By Quality Control And Compliance: Regulatory Compliance Tracking; Quality Assurance Documentation; Audit Trail Management

4) By Other Applications: Equipment Maintenance And Tracking; Smart Contracts For Manufacturing Processes; Data Sharing And Collaboration Platforms

Key Companies Mentioned: Advanced Micro Devices Inc.; Amazon Web Services Inc.; Blockchain Foundry Inc.; CargoX Inc.; Chronicled Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Blockchain in Manufacturing market report include:- Advanced Micro Devices Inc.

- Amazon Web Services Inc.

- Blockchain Foundry Inc.

- CargoX Inc.

- Chronicled Inc.

- Xayn AG

- Factom Inc.

- International Business Machines Corporation

- Intel Corporation

- Microsoft Corporation

- Nvidia Corporation

- Oracle Corporation

- Riddle&Code GmbH

- Wipro Limited

- Everledger Ltd.

- Accenture PLC

- BigchainDB GmbH

- ChromaWay AB

- LO3 Energy Inc.

- SAP SE

- Siemens AG

- Baidu Inc.

- Huawei Technologies Co. Ltd.

- Deloitte Touche Tohmatsu Limited

- HCL Technologies Ltd.

- Tata Consultancy Services Limited

- Capgemini SE

- Infosys Limited

- Chainway Information Technology Co. Ltd.

- The Bitfury Group

- Sphera Solutions Inc.

- Provenance Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | January 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 427.99 Billion |

| Forecasted Market Value ( USD | $ 3290 Billion |

| Compound Annual Growth Rate | 66.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 33 |