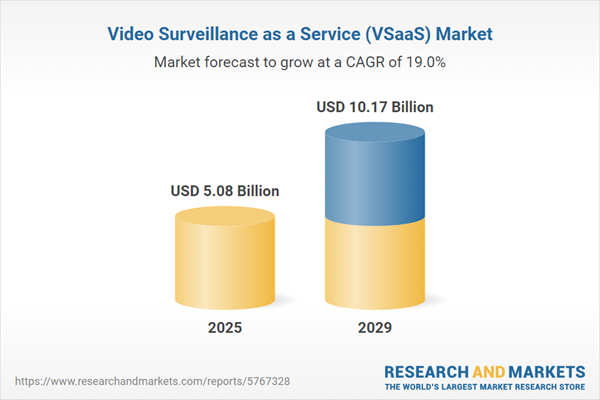

The video surveillance as a service (VSaaS) market size is expected to see rapid growth in the next few years. It will grow to $10.17 billion in 2029 at a compound annual growth rate (CAGR) of 19%. The growth in the forecast period can be attributed to increased emphasis on data security, remote workforce monitoring, focus on vertical-specific solutions. Major trends in the forecast period include integration with Internet of things (IoT), subscription-based service models, high-resolution and megapixel cameras, data storage and management solutions.

The surge in video surveillance as a service (VSaaS) market is attributed to smart city initiatives. These cities leverage ICT to enhance operations, public data exchange, and governmental services, promoting safety measures. Governments globally strive to create smarter, more efficient communities. Intelligent video monitoring aids emergency responses and crime prevention. For example, by August 2023, 74% of projects in 100 Indian Smart Cities were completed, with a substantial budget allocation effectively utilized.

The projected surge in the Video Surveillance as a Service (VSaaS) market is attributed to increased retail penetration. Retail, involving the direct sale of goods or services to consumers, stands to benefit from VSaaS, which bolsters security through cloud-based video monitoring and analytics. Notably, in November 2023, the House of Commons reported a substantial rise in retail sales in Great Britain to £9 billion ($9.9 billion) per week, up from £8.4 billion ($9.3 billion) in September 2023. This elevation in retail penetration is a driving force behind the expected growth of the VSaaS market.

Major players in the Video Surveillance as a Service (VSaaS) sector are concentrating on developing cloud-based solutions integrated with AI, specifically edge AI analytics. VIVOTEK, a Taiwan-based IP surveillance provider, launched VORTEX in August 2022. This solution incorporates cameras, cloud, and deep learning technology to deliver AI-powered surveillance. Its hybrid cloud architecture allows storage and analysis directly within the camera, benefiting Small and Medium-sized Businesses (SMBs) with reduced time, cost, and bandwidth limitations.

Major contenders in the Video Surveillance as a Service (VSaaS) realm are concentrating on refining their platforms, such as video API platforms, aiming to empower developers in cloud video surveillance. This strategic focus intends to establish a competitive advantage within the market. Eagle Eye Networks, a US-based video surveillance company, rolled out the V3 iteration of its Video API Platform in September 2023. This enhanced version offers developers a comprehensive and faster tool to create video applications. The platform, built on an open architecture with extensive RESTful API and camera support, facilitates easy application development leveraging cloud video surveillance. The upgraded API, an evolution from its predecessors, incorporates customer feedback and requests, elevating video analytics, AI integration, and scalability. Organizations utilizing Eagle Eye's Video API Platform for cloud-based surveillance solutions are recommended to adopt the new API V3 for enhanced capabilities.

In August 2024, AxxonSoft, an Ireland-based provider of video surveillance as a service, partnered with Vaxtor. This collaboration seeks to enhance security solutions by integrating AxxonSoft's management software with Vaxtor's advanced analytics, thereby offering users improved features for surveillance and security management. Vaxtor is a U.S.-based provider of video analytics products and solutions.

Major companies operating in the video surveillance as a service (VSaaS) market include Cisco Systems Inc., Honeywell International Inc., Johnson Controls International plc, Hikvision Digital Technology Co Ltd., ADT Security Services Inc., Bosch Security Systems GmbH, Alarm.com, Axis Communications AB, Avigilon A Motorola Solutions Company, Verint Systems Inc., VIVOTEK Inc., Genetec Inc., Pelco, Eagle Eye Networks Inc., Brivo Systems Inc., Salient Systems Inc., Mobotix AG, Ozvision Inc., March Networks Corp, IndigoVision Group plc, CameraFTP Service, Timetec Cloud Sdn Bhd, 3xLOGIC Inc., MIRASYS Inc., Duranc Inc., Camcloud Inc., Cloudastructure Inc., Hanwha Techwin Co Ltd., IVIDEON Inc., Pacific Control Systems LLC, Panasonic Corporation, Securitas AB, Stanley Black & Decker Inc., Verkada Inc.

Asia-Pacific was the largest region in the video surveillance as a service (VSaaS) market in 2024. The regions covered in the video surveillance as a service (vsaas) market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the video surveillance as a service (vsaas) market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Video Surveillance as a Service (VSaaS) offers a cloud-based security solution, enabling users to remotely access their Internet Protocol (IP) cameras via any computer. This convenient access facilitates monitoring and retrieval of surveillance footage from anywhere.

Video Surveillance as a Service (VSaaS) encompasses IP-based and analog systems. IP-based cameras, integral to Video Management Systems (VMS), enable live streaming, recording, and footage retrieval. They operate via Internet-enabled data transmission, reliant on LAN connections. Analog setups capture images, converting them into digital formats for viewing via monitors or routers on internal networks for remote access. VSaaS offers managed, hybrid, and hosted services, catering to sectors such as industrial, residential, defense, institutions, public facilities, and commercial entities.

The video surveillance as a service (VSaaS) market research report is one of a series of new reports that provides video surveillance as a service (VSaaS) market statistics, including video surveillance as a service (VSaaS) industry global market size, regional shares, competitors with video surveillance as a service (VSaaS) market share, detailed video surveillance as a service (VSaaS) market segments, market trends and opportunities, and any further data you may need to thrive in the video surveillance as a service (VSaaS) industry. This video surveillance as a service (VSaaS) market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The video surveillance as a service (VsaaS) market includes revenues earned by entities by providing cloud-based video surveillance services such as video recording, storage, remote viewing, and management alerts. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Video Surveillance As a Service (VSaaS) Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on video surveillance as a service (vsaas) market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for video surveillance as a service (vsaas)? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The video surveillance as a service (vsaas) market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: IP-Based; Analog2) By Service: Managed; Hybrid; Hosted

3) By End User: Industrial; Residential; Military and Defense; Institutional; Public Facilities; Commercial; Other End Users

Subsegments:

1) By IP-Based: Cloud-Based IP Surveillance; on-Premises IP Surveillance2) By Analog: Traditional Analog Cameras; Hybrid Systems (Analog and IP)

Key Companies Mentioned: Cisco Systems Inc.; Honeywell International Inc.; Johnson Controls International plc; Hikvision Digital Technology Co Ltd.; ADT Security Services Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Cisco Systems Inc.

- Honeywell International Inc.

- Johnson Controls International plc

- Hikvision Digital Technology Co Ltd.

- ADT Security Services Inc.

- Bosch Security Systems GmbH

- Alarm.com

- Axis Communications AB

- Avigilon A Motorola Solutions Company

- Verint Systems Inc.

- VIVOTEK Inc.

- Genetec Inc.

- Pelco

- Eagle Eye Networks Inc.

- Brivo Systems Inc.

- Salient Systems Inc.

- Mobotix AG

- Ozvision Inc.

- March Networks Corp

- IndigoVision Group plc

- CameraFTP Service

- Timetec Cloud Sdn Bhd

- 3xLOGIC Inc.

- MIRASYS Inc.

- Duranc Inc.

- Camcloud Inc.

- Cloudastructure Inc.

- Hanwha Techwin Co Ltd.

- IVIDEON Inc.

- Pacific Control Systems LLC

- Panasonic Corporation

- Securitas AB

- Stanley Black & Decker Inc.

- Verkada Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 5.08 Billion |

| Forecasted Market Value ( USD | $ 10.17 Billion |

| Compound Annual Growth Rate | 19.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 34 |