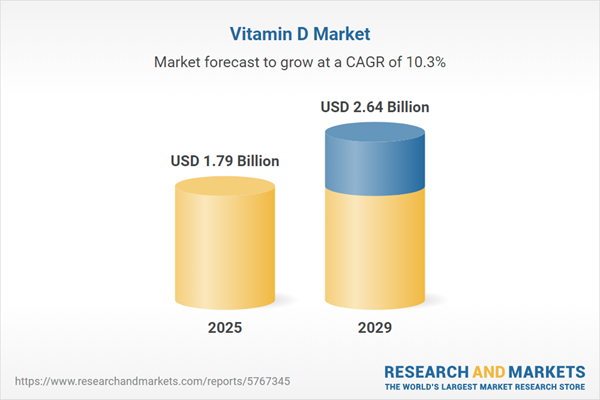

The vitamin D market size is expected to see rapid growth in the next few years. It will grow to $2.64 billion in 2029 at a compound annual growth rate (CAGR) of 10.3%. The growth in the forecast period can be attributed to rising demand for dietary supplements, emphasis on preventive healthcare, growing consumer interest in health and wellness, research advances in vitamin d benefits, increasing incidence of chronic diseases. Major trends in the forecast period include fortification of various food products with vitamin d, expansion of vegan vitamin d sources, personalized nutrition and vitamin d testing, adoption of vitamin d in beauty and skin care products, online retailing of vitamin d supplements.

The forecast of 10.3% growth over the next five years reflects a modest reduction of 0.3% from the previous estimate for this market. This reduction is primarily due to the impact of tariffs between the US and other countries. The imposition of tariffs may challenge U.S. pharmaceutical companies by raising costs of cholecalciferol and ergocalciferol raw materials imported from the UK and Netherlands, leading to reduced vitamin D supplement production and higher bone health product expenses. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The increasing incidence of osteoporosis among women is expected to drive the growth of the vitamin D market. Osteoporosis is a bone disease characterized by a decrease in bone mineral density and mass, as well as changes in bone quality or structure. This condition is often caused by insufficient levels of calcium and vitamin D in the body, raising the risk of fractures. Other contributing factors include a family history of osteoporosis, a parental history of hip fractures, a lower body mass index (BMI), and the female gender, which is associated with smaller, thinner bones compared to men. The rising prevalence of osteoporosis in women is likely to result in greater demand for vitamin D, an essential nutrient that aids in the absorption of calcium and phosphorus from food and helps build stronger bones in women after menopause. It also plays a role in treating conditions that lead to weak bones. For example, in September 2023, data from the Canadian Longitudinal Study on Aging, reported by the National Center for Biotechnology Information, indicated that 12.7% of females in community-dwelling older adults were diagnosed with osteoporosis by a physician, while 5.9% had DXA-confirmed osteoporosis. Additionally, a cross-sectional study by Buttros and colleagues found a 24.6% prevalence of osteoporosis in postmenopausal women aged 40 to 75, based on bone mineral density (BMD) measurements. Therefore, the rising incidence of osteoporosis in women is set to drive the growth of the vitamin D market.

The growth of the vitamin D market is further driven by the increasing prevalence of vitamin D deficiency. Vitamin D deficiency occurs when the body's vitamin D levels fall below normal, resulting in bone mineral loss, bone pain, muscle weakness, and bone softening. Notably, vitamin D supplements are utilized for treating severe deficiencies. According to data from HealthMatch in November 2022, 42% of adults in the US experienced vitamin D deficiencies, while 50% of children aged one to five and 70% of children aged six to eleven were affected by vitamin D deficiency. This growing prevalence of vitamin D deficiency contributes significantly to the expansion of the vitamin D market.

The emergence of faster-acting vitamin D supplements is a significant trend gaining traction in the vitamin D market. These supplements are designed to help achieve optimal vitamin D levels in the body more quickly than traditional vitamin D formulations. They are innovative and effective solutions used to address severe vitamin D deficiency more rapidly, facilitating quicker recovery for patients. Leading companies are focusing on providing these faster-acting vitamin D supplements to enhance their competitive position in the market. For example, in February 2024, Cadila Pharmaceuticals Ltd., an Indian pharmaceutical company, introduced an aqueous vitamin D injection. This innovative aqueous formulation of cholecalciferol offers a rapid solution for vitamin D deficiency, demonstrating improved pharmacokinetics and pharmacodynamics compared to conventional oil-based preparations, while also ensuring painless administration. This advancement addresses the urgent demand for quicker treatment results, thereby enhancing patient adherence to their treatment regimens.

Leading companies in the vitamin D market are focusing on product innovation, exemplified by the introduction of calcium and D3 gummies. These gummies combine essential nutrients, vitamin D3 and calcium, in a palatable and convenient form, particularly beneficial for individuals who struggle with traditional medication forms. Nutrazee, an India-based vegan dietary supplement brand, launched vegan vitamin D3 and calcium gummies in January 2022. These gummies are gluten-free, non-GMO, and free of artificial colors, catering to diverse dietary preferences and needs. Each serving of two gummies provides 200mg of calcium and 400 IU of vitamin D3, while a serving of three gummies contains 300mg of calcium and 600 international units of vitamin D3.

In July 2022, Nestlé Health Science S. A. acquired Puravida, a Belgium-based nutrition and lifestyle company, for an undisclosed amount. This acquisition aims to leverage Puravida's expertise in nutrition research and development, expanding the portfolio's breadth and depth across consumer and healthcare professional channels. The collaboration is expected to drive innovation, increase brand visibility, and create new growth opportunities.

Major companies operating in the vitamin d market include BASF SE, Koninklijke DSM NV, Fermenta Biotech Ltd., Xiamen Kingdomway Vitamin Co. Ltd., Zhejiang Medicine Co. Ltd., Abbott Laboratories, Bayer AG, Bluebonnet Nutrition, Carlson Labs, Country Life LLC, Doctor's Best Inc., Douglas Laboratories, Garden of Life LLC, GlaxoSmithKline plc, Jarrow Formulas, Kirkland Signature, Life Extension, Merck & Co. Inc., Metagenics LLC, Pharmavite LLC, Nature's Bounty Co. Ltd., Nestlé Health Science SA, Pfizer Inc., Protocol for Life Balance Inc., Pure Encapsulations Inc., Sanofi S. A., Source Naturals Inc., Sundown Naturals Inc., Swanson Health Products Inc., Twinlab Consolidated Corporation, Vital Nutrients Company Inc.

North America was the largest region in the vitmain D market in 2024. The regions covered in the vitamin d market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the vitamin d market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

The vitamin D market research report is one of a series of new reports that provides vitamin D market statistics, including vitamin D industry global market size, regional shares, competitors with a vitamin D market share, detailed vitamin D market segments, market trends and opportunities, and any further data you may need to thrive in the vitamin D industry. This vitamin D market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Vitamin D is a crucial nutrient required by the body in small amounts to maintain overall health. It plays a vital role in the absorption of calcium and phosphorus, essential for the development and maintenance of healthy bones and teeth. Vitamin D is soluble in fats and oils and is found in various food sources such as dairy products, fatty fish, and egg yolks.

There are two main types of vitamin D, vitamin D3 (cholecalciferol) and vitamin D2. Vitamin D3 is primarily derived from animal-based sources like oil, egg yolk, and butter, as well as dietary supplements. It facilitates the absorption of calcium in the body and is often used to treat conditions such as osteomalacia or rickets. Vitamin D3 is available in different strengths measured in International Units (IU), including 500,000 IU, 100,000 IU, and 40 MIU, and can be in oil or powder form. It is suitable for adults, pregnant women, and children to support their nutritional needs.

The vitamin D market consists of sales of ergocalciferol, cholecalciferol, and pre-vitamin D. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Vitamin D Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on vitamin d market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for vitamin d? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The vitamin d market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Vitamin D3; Vitamin D22) By IU Strength: 500,000 IU; 100,000 IU; 40 MIU

3) By Form: Oil; Powder

4) By End User: Adults; Pregnant Women; Children

Subsegments:

1) By Vitamin D3: Cholecalciferol (Natural Source); Synthetic Vitamin D32) By Vitamin D2: Ergocalciferol (Natural Source); Synthetic Vitamin D2

Companies Mentioned: BASF SE; Koninklijke DSM NV; Fermenta Biotech Ltd.; Xiamen Kingdomway Vitamin Co. Ltd.; Zhejiang Medicine Co. Ltd.; Abbott Laboratories; Bayer AG; Bluebonnet Nutrition; Carlson Labs; Country Life LLC; Doctor's Best Inc.; Douglas Laboratories; Garden of Life LLC; GlaxoSmithKline plc; Jarrow Formulas; Kirkland Signature; Life Extension; Merck & Co. Inc.; Metagenics LLC; Pharmavite LLC; Nature's Bounty Co. Ltd.; Nestlé Health Science SA; Pfizer Inc.; Protocol for Life Balance Inc.; Pure Encapsulations Inc.; Sanofi S. A.; Source Naturals Inc.; Sundown Naturals Inc.; Swanson Health Products Inc.; Twinlab Consolidated Corporation; Vital Nutrients Company Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Vitamin D market report include:- BASF SE

- Koninklijke DSM NV

- Fermenta Biotech Ltd.

- Xiamen Kingdomway Vitamin Co. Ltd.

- Zhejiang Medicine Co. Ltd.

- Abbott Laboratories

- Bayer AG

- Bluebonnet Nutrition

- Carlson Labs

- Country Life LLC

- Doctor's Best Inc.

- Douglas Laboratories

- Garden of Life LLC

- GlaxoSmithKline plc

- Jarrow Formulas

- Kirkland Signature

- Life Extension

- Merck & Co. Inc.

- Metagenics LLC

- Pharmavite LLC

- Nature's Bounty Co. Ltd.

- Nestlé Health Science SA

- Pfizer Inc.

- Protocol for Life Balance Inc.

- Pure Encapsulations Inc.

- Sanofi S. A.

- Source Naturals Inc.

- Sundown Naturals Inc.

- Swanson Health Products Inc.

- Twinlab Consolidated Corporation

- Vital Nutrients Company Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.79 Billion |

| Forecasted Market Value ( USD | $ 2.64 Billion |

| Compound Annual Growth Rate | 10.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 32 |