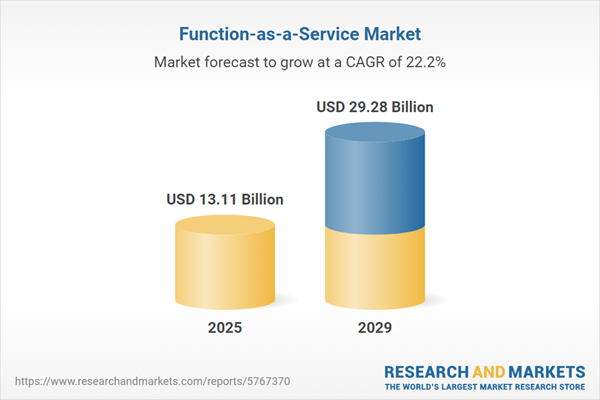

The function-as-a-service market size has grown rapidly in recent years. It will grow from $11.15 billion in 2024 to $13.11 billion in 2025 at a compound annual growth rate (CAGR) of 17.5%. The growth in the historic period can be attributed to rise of serverless computing, shift towards microservices architecture, demand for scalability and flexibility, focus on cost efficiency, simplified development and deployment.

The function-as-a-service market size is expected to see exponential growth in the next few years. It will grow to $29.28 billion in 2029 at a compound annual growth rate (CAGR) of 22.2%. The growth in the forecast period can be attributed to innovation and evolution in functionality, growing adoption in various industries, increasing role in IoT and ai integration, integration with edge computing, expansion of ecosystem and vendor offerings. Major trends in the forecast period include efforts towards cost optimization, automation and ci/cd integration, development of serverless frameworks, enhanced security and compliance measures, continuous improvement in scalability and performance, integration with edge computing.

The increase in app development activities is expected to drive the growth of the function-as-a-service (FaaS) market. Apps are becoming increasingly popular because of their ease of use and enhanced accessibility. As the need for apps grows, so does the demand for app development platforms such as paid cloud/function-as-a-service. This serverless backend process creates a computer program or a set of programs to perform the client's allotted activities. This growing app demand has resulted in increasing the use of FaaS services. According to the store stats 2022 report, by the swiss-based software company 42matters AG, on average, 1,300 new Android apps are released daily in the Google Play Store, and 1,130 new iOS apps are produced daily in the Apple App Store. Therefore, the increase in app development activities drives the function-as-a-service market growth.

The increasing transition from DevOps is anticipated to drive the growth of the function-as-a-service (FaaS) market in the coming years. DevOps is a methodology in the software development and IT sectors that seeks to integrate and automate the efforts of software development (Dev) and IT operations (Ops) teams. As a serverless computing model, FaaS inherently automates infrastructure management and resource provisioning, aligning with the automation principles of DevOps. For example, in 2024, according to Spacelift, a US-based company that provides a platform for managing cloud infrastructure and services, organizations are projected to boost their investment in DevSecOps automation by 35% in 2024. Consequently, the growing transition from DevOps is expected to propel the function-as-a-service market forward.

Strategic partnerships for enhancing capabilities are a key trend adopted in the function-as-a-service market. Strategic partnerships offer various advantages such as innovation through collaborative research and development, new solutions creation, enhancement of existing capabilities, and more. The function of service companies is to partner with other key market players to enhance their capabilities, innovate and offer new solutions to customers. For instance, Red Hat, Inc., a US-based open-source software firm, and Microsoft Corporation, a US-based technology corporation have extended their partnership till at least 2024. Both companies have been active in open source communities, bringing major Microsoft technologies such as SQL Server and. NET to Red Hat Enterprise Linux and Red Hat OpenShift FaaS. The collaboration will continue as part of their expanded collaboration to create new ideas for the larger Linux community.

Major players operating in the Function-as-a-Service market are focusing on partnerships and collaborations to work towards common goals that can be more effectively achieved by combining resources, expertise, or capabilities. For instance, in March 2023, Amazon Web Services Inc. (AWS), a US-based cloud computing services provider, formalized its strategic partnership with the New Zealand government, solidifying its commitment to provide computer cloud training to 100,000 individuals through 600 free online courses. This Memorandum of Understanding (MoU) establishes the framework for a lasting collaboration between AWS and the New Zealand government, focusing on cloud adoption, innovation, advanced digital skills, sustainability, and cybersecurity.

In September 2022, Vista Equity Partners, an American investment firm and Evergreen Coast Capital Corporation, a US-based private equity firm acquired Citrix Systems Inc for $16. 5 billion. The acquisition will fuel the growth of Citrix to make it a global leader in enterprise software. Citrix Systems Inc is a US-based cloud computing and virtualization technology company that provides software as a service, cloud computing technologies, server, application and desktop virtualization, and networking.

Major companies operating in the function-as-a-service market include Google Inc., Oracle Corporation, Microsoft Corporation, Amazon Web Services, SAP SE, International Business Machines Corporation, TIBCO Software Inc., Fiorano Software and Affiliates, Dynatrace LLC, FaunaDB, Infosys Ltd., VMware Inc., Red Hat Inc., Rackspace Inc., Joyent Inc., Iron.io Inc., OpenFaaS Ltd., Nuweba, Twistlock Ltd., StackPath LLC, Nimbella Inc., TriggerMesh Inc., Serverless Inc., Platform9 Systems Inc., Auth0 Inc., Cloudflare Inc., Kong Inc., Fission Labs Inc., Kubeless Inc., Bitnami Inc.

North America was the largest region in the function-as-a-service market in 2024. Asia-Pacific expected to be the fastest-growing region in the forecast period. The regions covered in the function-as-a-service market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the function-as-a-service market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

Function-as-a-service (FaaS) refers to a category of cloud computing service that is used to build, run, manage, and compute, application packages as functions without the need of having to maintain their own infrastructure. FaaS is a category of cloud computing services that. It divides servers into functions. So, they can automatically scale into microservices without the requirement for independent infrastructure management.

The main services of function as a service are tablets, smartphones, gaming consoles and laptops/PCs. Tablets service refers to providing FaaS services to cloud customers to run on tablet devices. The FaaS deployed on public, private, and hybrid clouds. These services are used by small, medium, and large enterprises in banking, financial services and insurance (BFSI), information technology (IT), and telecommunication, retail, healthcare, life sciences, and other sectors.

The function-as-a-service market research report is one of a series of new reports that provides function-as-a-service market statistics, including function-as-a-service industry global market size, regional shares, competitors with a function-as-a-service market share, detailed function-as-a-service market segments, market trends and opportunities, and any further data you may need to thrive in the function-as-a-service industry. This function-as-a-service market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The function-as-a-service (FaaS) market includes revenues earned by entities by providing cloud computing services that enable cloud customers to develop applications and deploy functionalities. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Function-as-a-Service Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on function-as-a-service market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for function-as-a-service? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The function-as-a-service market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) Covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Service: Tablets; Smartphones; Gaming Consoles; Laptops or PCs2) By Deployment Model: Public Cloud; Private Cloud; Hybrid Cloud

3) By Enterprise: Small and Medium Enterprises; Large Enterprises

4) By End-User: Banking, Financial Services, and Insurance (BFSI); Information Technology (IT) And Telecommunication; Retail; Healthcare and Life Sciences; Other End-Users (Media and Entertainment, Government, Educational Institutions)

Subsegments:

1) By Tablets: IOS Tablets; Android Tablets; Windows Tablets2) By Smartphones: IOS Smartphones; Android Smartphones; Feature Phones

3) By Gaming Consoles: Home Consoles; Handheld Consoles; Cloud Gaming Services

4) By Laptops or PCs: Ultrabooks; Gaming Laptops; Workstations

Key Companies Mentioned: Google Inc.; Oracle Corporation; Microsoft Corporation; Amazon Web Services; SAP SE

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Function-as-a-Service market report include:- Google Inc.

- Oracle Corporation

- Microsoft Corporation

- Amazon Web Services

- SAP SE

- International Business Machines Corporation

- TIBCO Software Inc.

- Fiorano Software and Affiliates

- Dynatrace LLC

- FaunaDB

- Infosys Ltd.

- VMware Inc.

- Red Hat Inc.

- Rackspace Inc.

- Joyent Inc.

- Iron.io Inc.

- OpenFaaS Ltd.

- Nuweba

- Twistlock Ltd.

- StackPath LLC

- Nimbella Inc.

- TriggerMesh Inc.

- Serverless Inc.

- Platform9 Systems Inc.

- Auth0 Inc.

- Cloudflare Inc.

- Kong Inc.

- Fission Labs Inc.

- Kubeless Inc.

- Bitnami Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 13.11 Billion |

| Forecasted Market Value ( USD | $ 29.28 Billion |

| Compound Annual Growth Rate | 22.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |