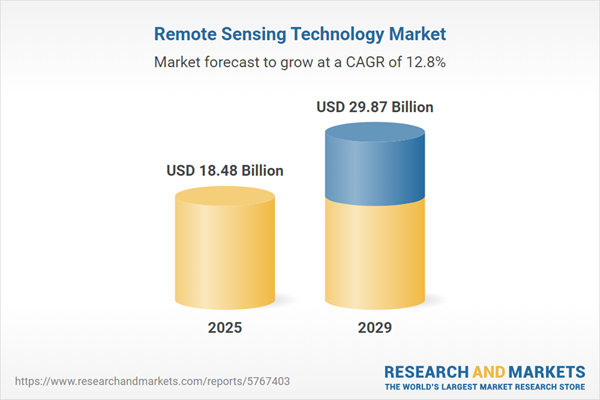

The remote sensing technology market size has grown strongly in recent years. It will grow from $17.14 billion in 2024 to $18.48 billion in 2025 at a compound annual growth rate (CAGR) of 7.8%. The growth in the historic period can be attributed to environmental monitoring and climate studies, precision agriculture, natural resource management, urban planning and infrastructure development, disaster management and response.

The remote sensing technology market size is expected to see rapid growth in the next few years. It will grow to $29.87 billion in 2029 at a compound annual growth rate (CAGR) of 12.8%. The growth in the forecast period can be attributed to increasing demand for earth observation data, rapid expansion of satellite constellations, emergence of new remote sensing platforms, increasing accessibility for small and medium-sized enterprises (SMEs), regulatory support and standards development. Major trends in the forecast period include development of hyperspectral imaging, rapid growth in unmanned aerial vehicles (UAVs) or drones, improved spectral and spatial resolution, focus on privacy and ethical use, expansion into new industry verticals.

The increasing adoption of precision farming technology is propelling the growth of the remote sensing technology market. With rapid global population growth and climate change, the agricultural sector is experiencing significant transformations, placing additional pressure on the food supply chain. Precision farming involves planning food production through technologies that provide economic advantages by reducing farming costs and enhancing production levels, while also offering environmental benefits. For example, in January 2024, the United States Government Accountability Office, a U.S.-based government agency, reported that 27 percent of U.S. farms and ranches employed precision agriculture techniques for managing crops or livestock in 2023. Therefore, the rising adoption of precision farming technology is driving growth in the remote sensing technology market.

The growth of the remote sensing technology market is expected to be propelled by infrastructure development. Infrastructure development involves the planning, design, construction, and maintenance of physical structures and facilities supporting economic and social activities within a region or country. A robust infrastructure, including elements like high-speed internet, communication networks, and data centers, facilitates the seamless transmission and storage of remote sensing data. Improved accessibility serves as a catalyst for the widespread adoption of remote sensing technology across various industries. For example, in 2022, the Indonesian government committed to investing $430 billion in public infrastructure development by 2024. Additionally, in March 2022, the South African government, under the Department of Public Works and Infrastructure, announced the National Infrastructure Plan 2050 (Nip 2050) Phase I to enhance critical infrastructure in the country. Therefore, infrastructure development is a driving factor for the growth of the remote sensing technology market.

Technological advancement stands out as a key trend gaining popularity in the remote sensing technology market. Major companies in the market are dedicated to providing technologically advanced solutions to strengthen their market positions. These companies are incorporating next-generation remote sensing technology into their devices, including active sensors, LiDAR, InSAR, PSInSAR, SAR, SRT, SqueeSAR, passive sensors, UAV, and others. These technologies gather information about material objects through distance measurements without the need for physical contact. For example, in March 2022, China successfully launched a new remote sensing satellite into space. This optical remote sensing satellite is intended for applications such as land rights confirmation, urban planning surveys, disaster reduction and prevention, and crop yield estimation.

Major companies in the remote sensing technology market are embracing new technological products, such as the Azista BST Aerospace First Runner (AFR), to maintain their market position. The Azista BST Aerospace First Runner (AFR) is a remote sensing satellite launched by the company, built on a modular bus platform and equipped with a wide-swath optical remote sensing payload that features both panchromatic and multispectral imaging capabilities. For example, in June 2023, Azista BST Aerospace, an India-based developer of satellite components and subsystems, launched the Azista BST Aerospace First Runner (AFR). This satellite is designed to offer remote sensing services for agricultural mapping, disaster monitoring, and environmental observations continuously, unaffected by lighting changes or cloud cover that can obstruct visible light cameras. It can also resolve surface features smaller than a yard when focused on a specific target.

In July 2024, Sanborn Map Company Inc., a U.S.-based provider of geospatial solutions, acquired the assets of VeriDaaS. This acquisition will enhance Sanborn's capability to deliver comprehensive and advanced technological solutions and services to its customers. VeriDaaS is a U.S.-based remote sensing technology firm that specializes in Geiger-mode lidar.

Major companies operating in the remote sensing technology market include Thales Group, Environmental Systems Research Institute Inc., General Dynamics Mission Systems Inc., Hexagon AB, Maxar Technologies, Planet Labs PBC, L3 Harris Technologies Inc., Airbus SE, Trimble Inc., Neteera Technologies, Centre for Process Innovation Limited, Orbital Insight Inc, Cognitive Space Inc., Sensera Systems Inc, Michigan Tech Research Institute, LongPath Technologies, Chloris Geospatial, Resonon Inc., Muon Space Inc., Array Labs Ic., Satyukt Analytics Pvt Ltd., Spanish Maritime Safety & Rescue Agency, Lockheed Martin Corporation, Raytheon Technologies Corporation, Teledyne Technologies Incorporated, Leidos Inc.

North America was the largest region in the remote sensing technology market in 2024. The regions covered in the remote sensing technology market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the remote sensing technology market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

Remote sensing technology encompasses both active and passive sensing methods for collecting and analyzing information about the physical characteristics of a target area. Active remote sensing involves transmitting coherent electromagnetic (EM) waves towards a target, such as the Earth's surface, and detecting the reflected radiation using sensors. Passive remote sensing, on the other hand, relies on the detection of naturally emitted or reflected radiation from the target.

Remote sensing technologies utilize various tools and techniques, including Lidar, unique cameras, and radar scanning, among others. The applications of remote sensing technology are diverse and include military and intelligence, weather monitoring, disaster management, agriculture, living resources and infrastructure assessment. This technology is employed in satellite and aerial systems, with applications ranging from landscape assessment, security, air quality monitoring, hydrology, and forestry to floodplain mapping, emergency management, and healthcare.

The remote sensing technology market research report is one of a series of new reports that provides remote sensing technology market statistics, including remote sensing technology industry global market size, regional shares, competitors with an remote sensing technology market share, detailed remote sensing technology market segments, market trends and opportunities, and any further data you may need to thrive in the remote sensing technology industry. This remote sensing technology market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The remote sensing technology market includes revenues earned by entities by providing services such as agricultural mapping, mining and geology mapping, environmental impact assessment mapping, clutter data for wireless telecommunication network planning. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Remote Sensing Technology Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on remote sensing technology market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for remote sensing technology? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The remote sensing technology market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Technology: Active Remote Sensing; Passive Remote Sensing2) by Platform: Satellite; Aerial Systems

3) by Application: Landscape Assessment; Security; Air Quality; Hydrology; Forestry; Floodplain Mapping and Emergency Management; Healthcare

4) by End User: Military and Intelligence; Weather; Disaster Management; Agriculture and Living Resources; Infrastructure

Subsegments:

1) by Active Remote Sensing: Radar Systems; Lidar; Sonar Systems2) by Passive Remote Sensing: Optical Sensors; Infrared Sensors; Multispectral and Hyperspectral Sensors

Key Companies Mentioned: Thales Group; Environmental Systems Research Institute Inc.; General Dynamics Mission Systems Inc.; Hexagon AB; Maxar Technologies

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Remote Sensing Technology market report include:- Thales Group

- Environmental Systems Research Institute Inc.

- General Dynamics Mission Systems Inc.

- Hexagon AB

- Maxar Technologies

- Planet Labs PBC

- L3 Harris Technologies Inc.

- Airbus SE

- Trimble Inc.

- Neteera Technologies

- Centre for Process Innovation Limited

- Orbital Insight Inc

- Cognitive Space Inc.

- Sensera Systems Inc

- Michigan Tech Research Institute

- LongPath Technologies

- Chloris Geospatial

- Resonon Inc.

- Muon Space Inc.

- Array Labs Ic.

- Satyukt Analytics Pvt Ltd.

- Spanish Maritime Safety & Rescue Agency

- Lockheed Martin Corporation

- Raytheon Technologies Corporation

- Teledyne Technologies Incorporated

- Leidos Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 18.48 Billion |

| Forecasted Market Value ( USD | $ 29.87 Billion |

| Compound Annual Growth Rate | 12.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |