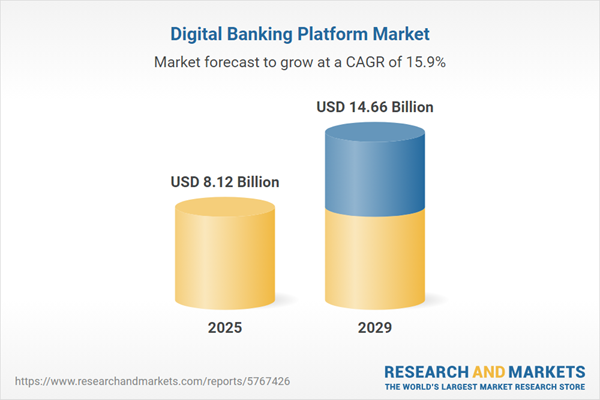

The digital banking platform market size is expected to see rapid growth in the next few years. It will grow to $14.66 billion in 2029 at a compound annual growth rate (CAGR) of 15.9%. The growth in the forecast period can be attributed to digital transformation investments, collaboration with fintech startups, global expansion and market competition, ai-powered insights and analytics, data security and privacy measures. Major trends in the forecast period include data-driven decision making, remote and digital onboarding, sustainability and green banking, ecosystem expansion.

The shift in trend from traditional banking to online banking is expected to propel the growth of the digital banking platform market going forward. Online banking refers to an electronic payment system that enables customers to conduct a range of financial transactions through a website or payment app. Online banking helps improve services and increase profits, causing financial institutions to shift their focus to digital banking, resulting in the growth of the digital banking platform market. For instance, according to India Brand Equity Foundation, an Indian government export promotion agency, by 2025, India's fintech market is expected to reach Rs. 6. 2 trillion (USD 83. 42 billion). Fintech financial services are responsible for transforming the banking system into various digital channels, such as online channels and social channels. Therefore, the shift in trend from traditional banking to online banking is driving the digital banking platform market growth.

The increasing adoption of smartphones is expected to propel the growth of the digital banking platform market going forward. A smartphone is a multifunctional electronic device that combines the capabilities of a mobile phone with those of a personal computer. Digital banking platforms in smartphones offer a convenient, secure, and efficient way for individuals to manage their finances, while financial institutions benefit from reduced operational costs and improved customer engagement. For instance, in March 2023, according to a report published by Cybercrew, a UK-based developing and providing cybersecurity solutions for businesses of all sizes, the percentage of UK households using smartphones reached 91. 43% in 2021. This percentage is projected to increase to 93. 8% in 2026. Therefore, the increasing adoption of smartphones is expected to propel the growth of the digital banking platform market.

Technological advancements are a key trend gaining popularity in the digital banking platform market. Major companies operating in the digital banking platform market are developing new technologies to reduce operating costs and enable faster and safer transactions. For instance, in September 2023, SC Ventures, a US-based fintech investment company launched audax financial technology. With its modularized capabilities, audax offers a comprehensive digital banking platform that can effectively manage millions of customer data at once. The complete client lifecycle is supported by its plug-and-play system, which includes data reporting, deposits, lending products, client servicing, and staff interfaces. The infrastructure-agnostic technology of audax, which was developed to support the core systems of established banks, also gives banks the ability to pursue contemporary digital transformation without having to invest in expensive and time-consuming internal development or migration.

Major companies operating in the digital banking platform market are focusing on innovative products and services such as cloud-banking services to build and deliver their services and sustain their position in the market. Cloud banking services refer to the use of cloud computing technology to provide various financial and banking services over the internet. For instance, in February 2023, Oracle, a US-based cloud technology company, launched Oracle Banking Cloud Services, a new set of componentized, composable cloud-native services such as banking accounts cloud service, banking payments cloud service, banking enterprise limits and collateral management cloud service, banking origination cloud service, banking digital experience cloud service, and banking APIs cloud service. Banks now have access to six new services that enable scalable corporate demand deposit processing, enterprise-wide limit and collateral management, real-time worldwide payments, API management, retail customer onboarding, and self-service digital experiences. These services facilitate the rapid and secure modernization of bank business capabilities through a microservices architecture.

In March 2022, SoFi Technologies, Inc., a US-based online bank and online personal finance company, acquired Technisys S. à. r. l. for an undisclosed amount. With the acquisition, Technisys brings a unique, strategic technology and company to the SoFi family, supporting SoFi in its goal of developing the AWS of fintech by offering best-of-breed products as a one-stop-shop financial services platform. Technisys' business also complements and strengthens SoFi's Galileo division. Technisys S. à. r. l. is a Canada-based digital banking company.

Major companies operating in the digital banking platform market include Appway AG, Crealogix Holding AG, EdgeVerve Systems Limited, Fiserv Inc., Oracle Corporation, SAP SE, Sopra Steria, Temenos AG, Worldline SA, Cor Financial Solution Ltd., Fidelity National Information Services Inc., Vsoft Corporation, Apiture, The Bank of New York Mellon Corporation, CR2 Ltd, Alkami Technology Inc., Finastra Group Holdings Limited, Urban FT Group Inc., Q2 Software Inc., Sopra Banking Software SA, Tata Consultancy Services Limited, Backbase B. V., ebankIT- Sistemas de Informação S. A., Intellect Design Arena, Mambu GmbH, MuleSoft LLC, nCino Inc., National Cash Register Corporation, NETinfo Plc, Technisys S. A.

A digital banking platform refers to financial services that enable a bank to begin the transformational process of becoming a truly digital bank that is ecosystem-centric. The digital banking platform is used by the banks to adapt and optimize enhanced technologically advanced services delivered via mobile phones, laptops, smart TVs, desktop computers, and other devices.

The main types of digital banking platforms are corporate and retail banking. Corporate banking refers to the aspect of banking that deals with corporate customers. The various components include platforms and services. The various banking modes include online banking and mobile banking, which are deployed through the cloud and on-premise.

The digital banking platforms market research report is one of a series of new reports that provides digital banking platforms market statistics, including digital banking platforms industry global market size, regional shares, competitors with a digital banking platforms market share, detailed digital banking platforms market segments, market trends and opportunities, and any further data you may need to thrive in the digital banking platforms industry. This digital banking platforms market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

North America was the largest region in the digital banking platforms market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the digital banking platform market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

The countries covered in the digital banking platform market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

The digital banking platform market consists of revenues earned by entities by providing digital investment banking platforms. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Digital Banking Platform Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on digital banking platform market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for digital banking platform ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The digital banking platform market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Corporate Banking; Retail Banking2) By Component: Platforms; Services

3) By Banking Mode: Online Banking; Mobile Banking

4) By Deployment: Cloud; On-Premise

Subsegments:

1) By Corporate Banking: Cash Management; Trade Finance; Commercial Lending; Treasury Management; Corporate Investment Services2) By Retail Banking: Online Banking; Mobile Banking; Digital Payments; Personal Loans; Savings And Investment Accounts

Key Companies Mentioned: Appway AG; Crealogix Holding AG; EdgeVerve Systems Limited; Fiserv Inc.; Oracle Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Appway AG

- Crealogix Holding AG

- EdgeVerve Systems Limited

- Fiserv Inc.

- Oracle Corporation

- SAP SE

- Sopra Steria

- Temenos AG

- Worldline SA

- Cor Financial Solution Ltd.

- Fidelity National Information Services Inc.

- Vsoft Corporation

- Apiture

- The Bank of New York Mellon Corporation

- CR2 Ltd

- Alkami Technology Inc.

- Finastra Group Holdings Limited

- Urban FT Group Inc.

- Q2 Software Inc.

- Sopra Banking Software SA

- Tata Consultancy Services Limited

- Backbase B. V.

- ebankIT- Sistemas de Informação S. A.

- Intellect Design Arena

- Mambu GmbH

- MuleSoft LLC

- nCino Inc.

- National Cash Register Corporation

- NETinfo Plc

- Technisys S. A.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | January 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 8.12 Billion |

| Forecasted Market Value ( USD | $ 14.66 Billion |

| Compound Annual Growth Rate | 15.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |