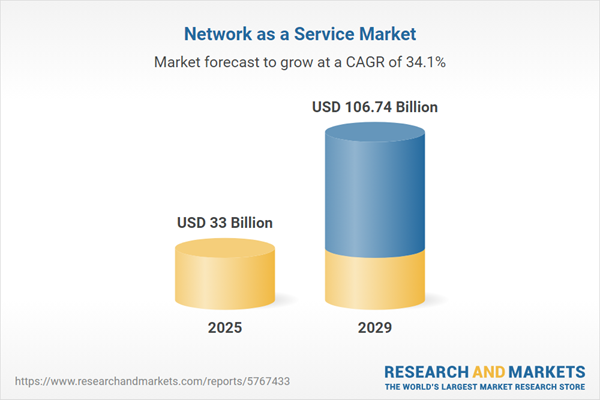

The network as a service market size is expected to see exponential growth in the next few years. It will grow to $106.74 billion in 2029 at a compound annual growth rate (CAGR) of 34.1%. The growth in the forecast period can be attributed to edge computing expansion, security and compliance requirements, industry-specific networking solutions, flexible subscription models. Major trends in the forecast period include 5G integration, digital transformation initiatives, software-defined networking (SDN) adoption, network security as a service (SECaaS), network analytics and intelligence.

The increasing number of cloud-based applications across enterprises is expected to drive the growth of the network as a service (NaaS) market in the future. Cloud-based applications utilize cloud computing for data storage, and the rise in internet usage during remote work has heightened the demand for high-speed network connections. NaaS leverages cloud computing, allowing customers to operate their own networks by deploying cloud-based applications while providing direct and secure access to network infrastructure. For example, a 2023 forecast indicates that the United States will be the largest public cloud market, with spending projected to reach $697 billion by 2027. Western Europe is expected to be the second-largest market, with investments anticipated to total $273 billion, while China is projected to be third, with spending reaching $117 billion by 2027. Thus, the growing number of cloud-based applications across enterprises is a key factor driving the growth of the NaaS market.

The increasing use of smartphones, combined with the rise of digitalization, is expected to drive the growth of the network devices market. Digitalization is expanding to foster new business practices, cultures, and customer experiences, while also adapting existing ones to meet changing company and market demands. The demand for smartphones is rising due to factors such as greater internet penetration, more subscriptions to social media, increasing income levels, and heightened communication needs. During the COVID-19 pandemic, smartphone usage and digitalization surged due to prolonged quarantine periods and remote work scenarios. This growth in smartphones necessitates network devices for efficient data transfer between devices. For instance, in 2023, approximately 92% of Americans owned a smartphone, indicating significant growth in mobile device usage. Additionally, the World Economic Forum projects that digital transformation will contribute around $100 trillion to the global economy by 2025, highlighting its crucial role in boosting demand for network devices. As of 2023, the estimated number of internet users worldwide reached 5.4 billion, up from 5.3 billion the previous year, further underscoring the need for effective network solutions. Therefore, the rising use of smartphones and growing digitalization are set to propel the growth of the network devices market.

Prominent companies in the network-as-a-service market are actively engaged in developing innovative products, such as digital orchestrations, to cater to broader customer bases, drive increased sales, and boost overall revenue. Digital orchestration involves the coordination, integration, and management of diverse digital resources, processes, and technologies with the aim of achieving specific outcomes or goals An exemplar in this realm is BT Group PLC, a UK-based telecommunications operator, which, in October 2023, introduced Global Fabric. Operating on a network-as-a-service model, Global Fabric prioritizes flexibility, scalability, and resilience in connectivity. Notably designed for adaptability and convenience, it adopts a pay-as-you-use structure, allowing customers to harness the power of digital automation and artificial intelligence (AI). A distinguishing feature is the empowerment of customers to select and manage their preferred connectivity for applications and workloads, providing control over the routes traversing the network. BT emphasizes that this control enhances application performance, facilitates efficient cost management, and ensures compliance with regulatory data transit requirements. The introduction of such innovative products highlights the industry's commitment to meeting evolving customer needs and driving advancements in the network-as-a-service market.

Major companies in the network-as-a-service market are increasingly adopting a strategic partnership approach to expedite the adoption of optical LAN. Strategic partnerships involve companies leveraging each other's strengths and resources for mutual benefits and success. An illustrative example is the collaboration between Nokia Corporation, a Finland-based telecommunications company, and Furukawa Electric LatAm S.A., a Brazil-based manufacturer of structured cabling, in August 2022. In this strategic partnership, Furukawa Electric LatAm becomes Nokia's partner for implementing optical LAN solutions within the Latin American enterprise sector, with initial deployment initiatives focusing on Brazil. The agreement outlines Furukawa Electric LatAm's integration of Nokia's optical networking equipment into its Laserway passive optical LAN solution. Marketed through its partner ecosystem, this collaboration is geared towards delivering advanced optical LAN solutions to enterprises in the Latin American region. The objective is to enhance connectivity and network capabilities, demonstrating the commitment of these companies to drive advancements in optical LAN solutions through strategic partnerships in the network-as-a-service market.

In March 2022, Acuative, a United States-based information technology services company, successfully acquired Tenfour for an undisclosed sum. This strategic acquisition is designed to reinforce and broaden Acuative's expertise in network as a service, allowing the company to better meet the evolving demands of its customer base. Tenfour, a U.S.-based network as a service provider, offers a range of services including managed infrastructure, security, and digital analytics. The integration of Tenfour's capabilities into Acuative enhances the overall network services portfolio of the combined entity, positioning Acuative to deliver enhanced solutions and address the dynamic needs of the information technology services market.

Major companies operating in the network as a service market include China Telecom Corporation Limited, Verizon Communications Inc., China Mobile Limited, AT&T Inc., Deutsche Telekom AG, NTT Communications Corporation, IBM Corp, Cisco Systems Inc., Vodafone Group plc, KDDI Corporation, Orange SA, Telefonica S.A., Oracle Corp, BT Group plc, Lumen Technologies Inc., Telstra Corporation Limited, TELUS Corporation, Singtel, Wipro Limited, Comcast Business, Telia Company AB, Juniper Networks Inc., Colt Technology Services Group Limited, Tata Communications Ltd., Cloudflare Inc., Axians, PCCW Global, GTT Communications Inc., Aryaka Networks Inc.

North America was the largest region in the network as a service market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the network as a service market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the network as a service market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Network as a Service (NaaS) denotes a subscription-based or flexible consumption model that allows clients to utilize and operate network infrastructure. This service model is employed to deliver networking infrastructure to customers, providing them with the necessary network capabilities without the need for extensive physical infrastructure investments.

The primary types of Network as a Service (NaaS) include LAN as a Service, WAN as a Service, Bandwidth on Demand (BoD), VPN as a Service, and Managed Services. A Local Area Network (LAN) refers to a group of computers and peripheral devices sharing a common communications line or wireless link to a server within a specific geographic area. This service caters to both large enterprises and SMEs. Various end-users benefiting from NaaS are found in sectors such as banking, financial services, and insurance (BFSI), government and the public sector, healthcare, IT and telecommunications, manufacturing, retail, e-commerce, and other industries.

The network as a service market research report is one of a series of new reports that provides network as a service market statistics, including network as a service industry global market size, regional shares, competitors with a network as a service market share, detailed network as a service market segments, market trends and opportunities, and any further data you may need to thrive in the network as a service industry. This network as a service market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The network as a service market consists of revenues earned by entities by providing data center connectivity services. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Network as a Service Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on network as a service market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for network as a service? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The network as a service market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: LAN as a Service; WAN as a Service; Bandwidth on Demand (BoD); VPN as a Service; Managed Services2) By Enterprise Size: Large Enterprises; SMEs

3) By End-User: Banking, Financial Services, and Insurance (BFSI); Government and Public Sector; Healthcare; IT and Telecommunication; Manufacturing; Retail and E-commerce; Other End Users

Subsegments:

1) By LAN as a Service (LaaS): Virtual LAN Services; Network Configuration and Management2) By WAN as a Service (WaaS): Software-Defined WAN (SD-WAN); Wide Area Network Optimization

3) By Bandwidth on Demand (BoD): Dynamic Bandwidth Allocation; Pay-As-You-Go Bandwidth Services

4) By VPN as a Service: Secure Remote Access VPN; Site-to-Site VPN; VPN for Mobile Users

5) By Managed Services: Network Monitoring and Management; Security as a Service; Network Optimization and Support Services

Key Companies Mentioned: China Telecom Corporation Limited; Verizon Communications Inc.; China Mobile Limited; AT&T Inc.; Deutsche Telekom AG

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- China Telecom Corporation Limited

- Verizon Communications Inc.

- China Mobile Limited

- AT&T Inc.

- Deutsche Telekom AG

- NTT Communications Corporation

- IBM Corp

- Cisco Systems Inc.

- Vodafone Group plc

- KDDI Corporation

- Orange SA

- Telefonica S.A.

- Oracle Corp

- BT Group plc

- Lumen Technologies Inc.

- Telstra Corporation Limited

- TELUS Corporation

- Singtel

- Wipro Limited

- Comcast Business

- Telia Company AB

- Juniper Networks Inc.

- Colt Technology Services Group Limited

- Tata Communications Ltd.

- Cloudflare Inc.

- Axians

- PCCW Global

- GTT Communications Inc.

- Aryaka Networks Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 33 Billion |

| Forecasted Market Value ( USD | $ 106.74 Billion |

| Compound Annual Growth Rate | 34.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 29 |