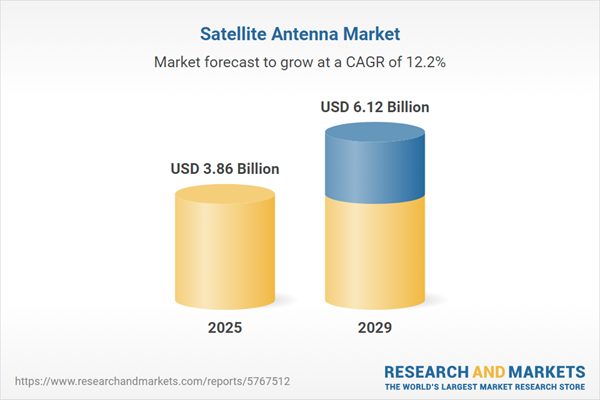

The satellite antenna market size is expected to see rapid growth in the next few years. It will grow to $6.12 billion in 2029 at a compound annual growth rate (CAGR) of 12.2%. The growth in the forecast period can be attributed to emergence of low earth orbit (LEO) satellites, demand for high-frequency bands, expansion of 5G satellite networks, increasing space exploration missions. Major trends in the forecast period include integration of artificial intelligence (AI) in antenna systems, demand for high-throughput satellite (HTS) systems, focus on antenna design for electrically small satellites, increased emphasis on antenna testing and simulation, rising interest in inter-satellite links (ISL).

The growing demand for small satellites is propelling the satellite antenna market. Small satellites are cost-effective and less expensive to launch while providing efficient connectivity. The increased deployment of these satellites has spurred innovation and growth within the satellite antenna industry, creating a need for more compact, affordable, and technologically advanced antenna systems. For example, the United States Government Accountability Office (GAO) and Euroconsult plan to launch a significant number of small satellites by 2030. As of spring 2022, there were approximately 5,500 active satellites in orbit, with projections estimating an additional 58,000 launches by 2030, primarily in low Earth orbit (LEO). Thus, the rising demand for small satellites is expected to enhance the market demand for satellite antennas.

The growing adoption of IoT devices is likely to drive the expansion of the satellite antenna market in the future. IoT refers to a network of interconnected physical devices, vehicles, appliances, and other objects embedded with sensors, software, and network connectivity. Satellite antennas offer global coverage, enabling IoT devices to connect and communicate seamlessly across remote locations. This ensures that IoT devices remain operational during natural disasters, facilitates real-time data transmission, asset tracking, and management, and provides a secure and reliable means of connectivity for IoT devices, thereby reducing vulnerabilities associated with traditional communication networks. For instance, in March 2023, Exploding Topics, a US-based online platform offering insights into emerging and trending topics, projected that there will be 25.4 billion IoT devices by 2030. Consequently, the increasing adoption of IoT devices is driving the growth of the satellite antenna market.

Major companies in the satellite antenna market are focusing on advancements in ultra-compact satellite antennas, including maritime satellite TV antennas, to improve connectivity, portability, and performance across various applications. A maritime satellite TV antenna is a specialized device designed to receive satellite television signals on moving vessels. It automatically adjusts to maintain a stable connection, ensuring that users have access to entertainment and news while at sea. For example, in July 2024, Cobham Satcom, a Denmark-based company, introduced the Sea Tel 370s TV, which enhances television access onboard cruise ships and mega yachts by offering high-quality programming with automatic C-band switching and 5G interference mitigation. This innovation aims to boost guest satisfaction while lowering operational costs and maintenance requirements.

Major companies in the satellite antenna market are introducing new products such as flat panel antennas to gain a competitive edge. A flat panel antenna, characterized by its flat, planar shape, was launched by Kymeta Corporation, a US-based company specializing in satellite communication and flat-panel antenna technology, in June 2023. The Peregrine u8 LEO terminal aims to revolutionize marine communications with its energy efficiency, compact size, and not requiring high-power below-deck hardware, providing solutions for military and commercial applications.

In May 2023, Viasat Inc., a US-based communications company providing satellite and wireless communication services, acquired Inmarsat Global Limited for an undisclosed amount. This acquisition was expected to broaden access to a wider range of international services, emphasizing enhanced connectivity for government and consumer markets. Inmarsat Global Limited, based in the UK, is a satellite telecommunications company providing mobile communication services via satellite.

Major companies operating in the satellite antenna market include Airbus SAS, General Dynamics Corporation, Mitsubishi Electric Corporation, Honeywell International Inc., Thales Group, L3Harris Technologies, CommScope Holding Company Inc., Viasat Inc., Cobham plc, Advantech Wireless Inc., EchoStar Corporation, Romantis GmbH, Maxar Technologies Inc., Inmarsat Global Limited, Skyware Technologies Ltd., Airbus Defence and Space Government Solutions Inc., MacDonald Dettwiler and Associates Ltd., Communications & Power Industries LLC, Comtech Telecommunications Corp, Gilat Satellite Networks Ltd., Intellian Technologies Inc., Satcom Direct Communications Inc., SpaceStar Technology Applications Co Ltd., Kymeta Corporation, Norsat International Inc., TECOM Industries Inc., C-COM Satellite Systems Inc., Pulse Power & Measurement Ltd., Elite Antennas Ltd., Orbital Systems (Pty) Ltd., SatPro Agro Pvt Ltd., Skytech Research Ltd., ThinKom Solutions Inc.

North America was the largest region in the satellite antenna market in 2024. Asia Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the satellite antenna market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the satellite antenna market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

A satellite antenna is a device designed for transmitting or receiving microwaves to and from satellites. Operating by focusing the satellite's transmitting power on a specific geographical region on Earth, these antennas prevent interference from signals transmitted outside the designated service area.

The primary types of satellite antennas encompass flat panel antennas, parabolic reflector antennas, and horn antennas. Parabolic reflector antennas find applications in domestic satellite television reception, terrestrial microwave data links, and general satellite communications. The components of satellite antennas include reflectors, feed horns, feed networks, low-noise converters, and others. These antennas operate in frequency bands such as C band, K/KU/KA band, S and L band, X band, VHF and UHF band, and are used in space, land, and maritime navigation.

The satellite antenna research report is one of a series of new reports that provides satellite antenna statistics, including satellite antenna industry global market size, regional shares, competitors with satellite antenna shares, detailed satellite antenna segments, market trends and opportunities, and any further data you may need to thrive in the satellite antenna industry. This satellite antenna research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The satellite antenna market consists of sales of wire antennas, horn antennas, reflector antennas, and array antennas. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Satellite Antenna Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on satellite antenna market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for satellite antenna? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The satellite antenna market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Antenna Type: Flat Panel Antenna; Parabolic Reflector Antenna; Horn Antenna2) By Component Type: Reflectors; Feed Horns; Feed Networks; Low Noise Converters; Other Component Types

3) By Frequency Band: C Band; K/KU/KA Band; S and L Band; X Band; VHF and UHF Band; Other Frequency Bands

4) By Application: Space; Land; Maritime

Subsegments:

1) By Flat Panel Antenna: Active Flat Panel Antenna; Passive Flat Panel Antenna2) By Parabolic Reflector Antenna: C-Band Parabolic Reflector Antenna; Ku-band Parabolic Reflector Antenna; Ka-Band Parabolic Reflector Antenna

3) By Horn Antenna: Standard Horn Antenna; Sectoral Horn Antenna; Conical Horn Antenna

Key Companies Mentioned: Airbus SAS; General Dynamics Corporation; Mitsubishi Electric Corporation; Honeywell International Inc.; Thales Group

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Airbus SAS

- General Dynamics Corporation

- Mitsubishi Electric Corporation

- Honeywell International Inc.

- Thales Group

- L3Harris Technologies

- CommScope Holding Company Inc.

- Viasat Inc.

- Cobham plc

- Advantech Wireless Inc.

- EchoStar Corporation

- Romantis GmbH

- Maxar Technologies Inc.

- Inmarsat Global Limited

- Skyware Technologies Ltd.

- Airbus Defence and Space Government Solutions Inc.

- MacDonald Dettwiler and Associates Ltd.

- Communications & Power Industries LLC

- Comtech Telecommunications Corp

- Gilat Satellite Networks Ltd.

- Intellian Technologies Inc.

- Satcom Direct Communications Inc.

- SpaceStar Technology Applications Co Ltd.

- Kymeta Corporation

- Norsat International Inc.

- TECOM Industries Inc.

- C-COM Satellite Systems Inc.

- Pulse Power & Measurement Ltd.

- Elite Antennas Ltd.

- Orbital Systems (Pty) Ltd.

- SatPro Agro Pvt Ltd.

- Skytech Research Ltd.

- ThinKom Solutions Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.86 Billion |

| Forecasted Market Value ( USD | $ 6.12 Billion |

| Compound Annual Growth Rate | 12.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 33 |