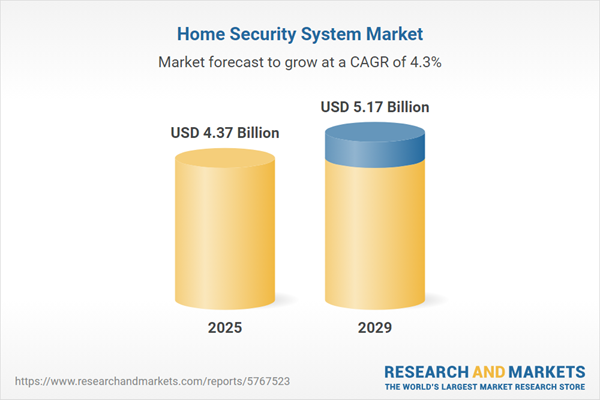

The home security system market size has grown steadily in recent years. It will grow from $4.25 billion in 2024 to $4.37 billion in 2025 at a compound annual growth rate (CAGR) of 2.7%. The growth in the historic period can be attributed to increased affordability, remote monitoring and control, consumer awareness and education, insurance discounts for security systems.

The home security system market size is expected to see steady growth in the next few years. It will grow to $5.17 billion in 2029 at a compound annual growth rate (CAGR) of 4.3%. The growth in the forecast period can be attributed to energy efficiency and sustainability, elderly and child monitoring solutions, interoperability standards, growing demand for video surveillance systems. Major trends in the forecast period include advancements in technology, integration with smart home ecosystems, video analytics and facial recognition, increased adoption of wireless technologies, smart sensors and detectors, innovations in alarm technologies, elderly and child monitoring solutions.

The growing adoption of Internet of Things (IoT) devices is anticipated to drive the expansion of the home security system market in the coming years. The IoT refers to a network of internet-connected objects capable of collecting and transferring data through a wireless network without human intervention. In the context of home security, IoT solutions enable users to gain real-time insights into who enters and exits a facility, monitor conditions reliably and securely from any location with Wi-Fi access, and receive critical security notifications directly on their mobile devices, allowing for prompt action. As of 2024, the number of IoT devices has surged significantly, with estimates indicating around 18.8 billion connected devices worldwide. This marks a notable increase of approximately 13% from the previous year. Analysts project that this upward trend will continue, predicting that the number of IoT devices will reach around 30 billion by 2025.

The increasing crime rates are expected to propel the growth of the home security system market going forward. A crime is a legally prohibited act or omission that can result in punishment by the government, such as fines or imprisonment. Home security systems play a crucial role in deterring and preventing crimes, offering peace of mind, and protecting homes from intruders. For instance, according to the Office for National Statistics, a UK-based statistics authority, the metropolitan saw an increase in the number of knife or sharp instrument offenses from 10,605 to 11,232 during the fiscal year ending in June 2022, leading to a rate of 125 per 100,000 people. In the West Midlands, a metropolitan county in England reported offenses increased from 3,299 to 4,958, equating to a rate of 169 per 100,000 population. Similarly, in Greater Manchester, offenses increased from 3,297 to 3,563, resulting in a rate of 125 per 100,000 population. Therefore, the increasing crime rate is propelling the home security system market.

The integration of artificial intelligence (AI) and deep learning into home security systems is significantly influencing the home security system market. AI is employed in home automation to analyze human behavioral patterns and to automate household devices. This technology plays a crucial role in daily household activities, enhancing the effectiveness of home security systems. For instance, in 2024, Samsung's upgraded Bixby is designed to improve user interaction and simplify appliance usage, making home management more intuitive and personalized. This new functionality is available across a range of appliances, including the Bespoke 4-Door French Door Refrigerator and the Bespoke AI Laundry Combo.

Major companies operating in the home security system market are focused on developing security cameras with Wi-Fi 6 technology to gain a competitive edge in the market. Security cameras with Wi-Fi 6 technology offer faster and more reliable wireless connectivity for enhanced surveillance systems. For instance, in September 2022, Lorex Technology Inc., a Canada-based provider of security cameras and systems, launched the Lorex 4K spotlight indoor or outdoor Wi-Fi security camera with smart security lighting. The innovative 4K Wi-Fi security camera features Smart Security Lighting and Wi-Fi 6 Technology that provides quicker data transmission and reduced download times, ensuring exceptional resolution quality while minimizing disruptions to concurrent online tasks. It has dual capabilities in color night vision and infrared night vision due to which it excels in capturing clear video footage during nighttime, regardless of lighting conditions.

In September 2022, State Farm, a US-based group specializing in insurance and financial services, acquired a 15% stake in ADT for approximately $1.2 billion. This partnership is aimed at creating a comprehensive safety and security solution for customers, enhancing the offerings of both companies in the areas of home and mobile safety. ADT is a US-based provider of security and automation solutions for both residential and commercial properties.

Major companies operating in the home security system market include ADT LLC, Honeywell International Inc., Johnson Controls International plc., Hangzhou Hikvision Digital Technology Co. Ltd., Assa Abloy AB, Secom Co. Ltd., Robert Bosch GmbH, Godrej & Boyce Mfg. Co. Ltd., Allegion plc, Control4 Corporation, Schneider Electric SE, Nortek Security & Control LLC, Vivint Inc., Armorax Limited, Google Nest, Canary Connect Inc., Scout Security Group, SimpliSafe Inc., Securitas AB, Bosch Security Systems Inc., Legrand Group, Resideo Technologies Inc., SkyBell Technologies Inc., Apple Inc., LiveWatch Security LLC, Amazon. com Inc., FrontPoint Security Solutions LLC, NETGEAR Inc., Samsung Electronics Co. Ltd., Alphabet Inc., Comcast Corporation, Swann Communications Pty Ltd., Lorex Technology Inc., Night Owl SP LLC, Defender, Amcrest Technologies LLC, Zmodo Technology Corporation, Reolink Digital Technology Co. Ltd., LaView Inc., ANNKE INNOVATION (HK) CO. LIMITED, Shenzhen Foscam Intelligent Technology Co. Ltd.

North America was the largest region in the home security system market in 2024. Europe was the second-largest region in the home security system market share. The regions covered in the home security system market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the home security system market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

A home security system is a collection of devices that work together to keep the house safe and secure which avoids the entry of burglars and home intruders.

The main types of systems in-home security systems are fire protection systems, video surveillance systems, access control systems, entrance control systems, and intruder alarm systems. A fire protection system is used as a monitoring service in home security. It has a wireless fire alarm that monitors fire risks easily and acts as the most reliable option to protect the family. The different components include hardware, software, service and have various security types such as professionally installed and monitored, self-installed and professionally monitored, do-it-yourself (DIY). The home security system is used in condominiums; apartments and independent homes.

The home security system market research report is one of a series of new reports that provides home security system market statistics, including home security system industry global market size, regional shares, competitors with a home security system market share, detailed home security system market segments, market trends and opportunities, and any further data you may need to thrive in the home security system industry. This home security system market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The home security systems market includes revenues earned by entities by offering devices such as control panel, door sensors, window sensors, motion sensors, and surveillance cameras which act as wire and wireless configurations for utmost security. Values in this market are 'factory gate' values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Home Security System Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on home security system market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for home security system? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The home security system market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) Covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By System: Fire Protection System; Video Surveillance System; Access Control System; Entrance Control System; Intruder Alarm System2) By Component: Hardware; Software; Services

3) By Security Type: Professionally-Installed and Monitored; Self-Installed and Professionally Monitored; Do-It-Yourself (DIY)

4) By End User: Condominiums; Apartments; Independent Homes

Subsegments:

1) By Fire Protection System: Smoke Detectors; Heat Detectors; Fire Alarms2) By Video Surveillance System: CCTV Cameras; IP Cameras; Video Recorders

3) By Access Control System: Keypad Entry Systems; Card-Based Access Systems; Biometric Systems

4) By Entrance Control System: Intercom Systems; Gate Control Systems; Turnstiles

5) By Intruder Alarm System: Motion Detectors; Door or Window Sensors; Sirens and Strobes.

Key Companies Mentioned: ADT LLC; Honeywell International Inc.; Johnson Controls International plc.; Hangzhou Hikvision Digital Technology Co. Ltd.; Assa Abloy AB

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Home Security System market report include:- ADT LLC

- Honeywell International Inc.

- Johnson Controls International plc.

- Hangzhou Hikvision Digital Technology Co. Ltd.

- Assa Abloy AB

- Secom Co. Ltd.

- Robert Bosch GmbH

- Godrej & Boyce Mfg. Co. Ltd.

- Allegion plc

- Control4 Corporation

- Schneider Electric SE

- Nortek Security & Control LLC

- Vivint Inc.

- Armorax Limited

- Google Nest

- Canary Connect Inc.

- Scout Security Group

- SimpliSafe Inc.

- Securitas AB

- Bosch Security Systems Inc.

- Legrand Group

- Resideo Technologies Inc.

- SkyBell Technologies Inc.

- Apple Inc.

- LiveWatch Security LLC

- Amazon. com Inc.

- FrontPoint Security Solutions LLC

- NETGEAR Inc.

- Samsung Electronics Co. Ltd.

- Alphabet Inc.

- Comcast Corporation

- Swann Communications Pty Ltd.

- Lorex Technology Inc.

- Night Owl SP LLC

- Defender

- Amcrest Technologies LLC

- Zmodo Technology Corporation

- Reolink Digital Technology Co. Ltd.

- LaView Inc.

- ANNKE INNOVATION (HK) CO. LIMITED

- Shenzhen Foscam Intelligent Technology Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 4.37 Billion |

| Forecasted Market Value ( USD | $ 5.17 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 42 |