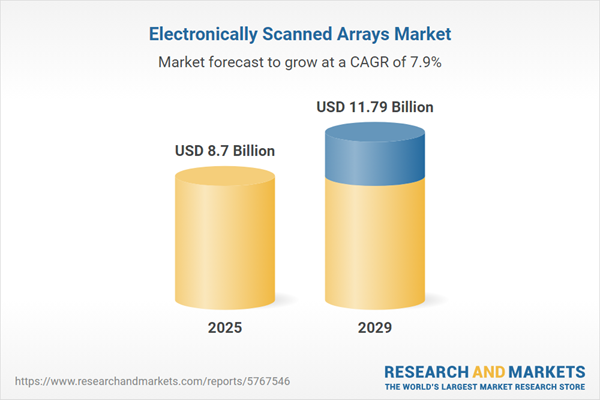

The electronically scanned arrays market size is expected to see strong growth in the next few years. It will grow to $11.79 billion in 2029 at a compound annual growth rate (CAGR) of 7.9%. The growth in the forecast period can be attributed to rapid advancements in aerospace technologies, growing demand for unmanned systems, expansion of space-based surveillance, national security concerns, global geopolitical tensions. Major trends in the forecast period include digital signal processing advancements, network-centric warfare integration, increased use in electronic warfare (EW), rapid scan and track capabilities, continued development of hybrid ESA solutions.

The significant growth of the electronically scanned arrays market is largely driven by rising government investments in the defense sector. Electronically scanned arrays are essential components in radar systems used in fighter jets for long-range detection and track generation within the defense industry. For example, in March 2023, according to the United States Air Force (USAF), a U.S. agency within the Department of the Air Force, the Air Force's fiscal year (FY) 2024 budget request was approximately $215.1 billion, reflecting a $9.3 billion or 4.5% increase from the FY 2023 approved figure. Thus, the increase in government defense investments is expected to fuel the growth of the electronically scanned arrays market in the coming years.

The substantial growth in global air traffic is a significant driver for the electronically scanned arrays market. Global air traffic encompasses the movement of aircraft in the air, including takeoffs, landings, and flights between airports worldwide. Electronically scanned arrays play a crucial role in air traffic control and management systems, significantly enhancing radar capabilities and improving airspace management. For instance, in September 2023, the International Air Transport Association, a Canada-based trade association of the world's airlines, reported a 29.6% increase in foreign air traffic compared to the same month in the previous year, with robust development observed in every market. International Revenue Passenger Kilometers (RPKs) reached 88.7% of the levels recorded in July 2019. The industry's passenger load factor (PLF) reached 85.7%, the highest monthly PLF ever noted globally. Consequently, the surge in global air traffic is anticipated to drive the growth of the electronically scanned arrays market in the coming years.

The development of new AESA (Active Electronically Scanned Arrays) technology is a key trend gaining traction in the electrically scanned arrays market. Companies within this sector are focusing on creating innovative technological solutions to enhance their position in defense and military applications. This new AESA technology is primarily utilized in radars for fighter jets. For instance, in March 2023, Intellian Technologies Inc., a South Korea-based company specializing in satellite communication solutions, unveiled its latest Electronically Scanned Array (ESA) technology at the Satellite 2023 event in Washington, D.C. This launch represents a significant advancement in satellite communication technology, especially for applications that demand high reliability and performance.

Major companies in the electrically scanned arrays market are directing their efforts towards developing innovative technological solutions, including breakthrough over-the-air (OTA) calibration and characterization solutions, to enhance their market positions. Over-the-air (OTA) calibration and characterization represent a testing methodology that assesses and refines the performance of antenna systems in their actual operating environment, eliminating the need for physical connections such as probes or cables. For instance, in October 2023, Keysight Technologies, a US-based manufacturer of electronic test and measurement equipment and software, introduced the Phased Array Antenna Control and Calibration Solution for Satellite Communications. This solution facilitates rapid testing and validation of active electronically scanned arrays in satellite communications, addressing the complexities of higher-frequency operations. With proprietary calibration algorithms, the system allows for accurate measurement of gain and phase, significantly reducing calibration times. The solution covers a broad spectrum of verification tests, offering a user-friendly interface and optimizing the utility of existing test chambers within Keysight's Antenna Measurement Toolset.

In April 2023, Milexia, a Europe-based company specializing in high-tech electronic components, systems, and scientific instruments, acquired CEL (Composants Electroniques Lyonnais). This acquisition is intended to bolster CEL's growth strategy by diversifying its presence in promising technology markets and significantly enhancing its technological offerings. CEL is a France-based value-added distributor of electronic components and subsystems.

Major companies operating in the electronically scanned arrays market include The Boeing Company, Airbus SE, Lockheed Martin Corporation, Raytheon Technologies Corporation, General Dynamics Corporation, Northrop Grumman Corporation, Honeywell International Inc., Mitsubishi Heavy Industries Ltd., BAE Systems plc, Thales Group, L3Harris Technologies Inc., Leonardo S.p.A., Leonardo S.p.A., Teledyne Technologies Incorporated, Elbit Systems Ltd., Rafael Advanced Defense Systems Ltd., Kongsberg Gruppen ASA, Cobham plc, Terma A/S, ASELSAN A.Ş., Kratos Defense & Security Solutions Inc., Mercury Systems Inc., RADA Electronic Industries Ltd., Israel Aerospace Industries Ltd., Radar Systemtechnik AG, Gallium Nitride Systems LLC, Macom Technology Solutions Holdings Inc., Rohde & Schwarz GmbH & Co KG.

North America was the largest region in the electronically scanned arrays market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the electronically scanned arrays market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the electronically scanned arrays market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

An electronically scanned array is a collection of antennas generating radio wave beams without physical movement. These arrays electronically direct released waves to a precise point, eliminating the need for moving parts. Unlike mechanically scanned solid apertures that require maintenance, electronically scanned arrays operate seamlessly.

The primary categories of electronically scanned arrays are active and passive. An active electronically scanned array (AESA) is composed of an array of antennas that can generate a beam of radio waves directed in various directions without the need for physical movement of the antennas themselves. AESA technology finds its primary application in radars. Electronically scanned arrays come in different geometries, including linear, planar, and frequency scanning, and they operate within different ranges, such as short, medium, and long. Major end-users of electronically scanned arrays include land-based, naval, and airborne applications. These arrays are predominantly utilized in defense, government, and commercial sectors.

The electronically scanned arrays market research report is one of a series of new reports that provides electronically scanned arrays market statistics, including electronically scanned arrays industry global market size, regional shares, competitors with an electronically scanned arrays market share, detailed electronically scanned arrays market segments, market trends and opportunities, and any further data you may need to thrive in the electronically scanned arrays industry. This electronically scanned arrays market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The electronically scanned array market consists of automotive radar, high pulse repetition frequency, phased-array antenna, phased-array, and active-arrays. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Electronically Scanned Arrays Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on electronically scanned arrays market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for electronically scanned arrays? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The electronically scanned arrays market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Active; Passive2) By Geometry: Linear; Planar; Frequency Scanning

3) By Range: Land; Navel; Airborne

4) By Application: Defense; Government; Commercial

5) By User: Short; Medium; Long

Subsegments:

1) By Active: Radar Systems; Communication Systems; Surveillance Systems2) By Passive: Electronic Warfare Systems; Intelligence Gathering Systems

Key Companies Mentioned: The Boeing Company; Airbus SE; Lockheed Martin Corporation; Raytheon Technologies Corporation; General Dynamics Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- The Boeing Company

- Airbus SE

- Lockheed Martin Corporation

- Raytheon Technologies Corporation

- General Dynamics Corporation

- Northrop Grumman Corporation

- Honeywell International Inc.

- Mitsubishi Heavy Industries Ltd.

- BAE Systems plc

- Thales Group

- L3Harris Technologies Inc.

- Leonardo S.p.A.

- Leonardo S.p.A.

- Teledyne Technologies Incorporated

- Elbit Systems Ltd.

- Rafael Advanced Defense Systems Ltd.

- Kongsberg Gruppen ASA

- Cobham plc

- Terma A/S

- ASELSAN A.Ş.

- Kratos Defense & Security Solutions Inc.

- Mercury Systems Inc.

- RADA Electronic Industries Ltd.

- Israel Aerospace Industries Ltd.

- Radar Systemtechnik AG

- Gallium Nitride Systems LLC

- Macom Technology Solutions Holdings Inc.

- Rohde & Schwarz GmbH & Co KG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 8.7 Billion |

| Forecasted Market Value ( USD | $ 11.79 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |