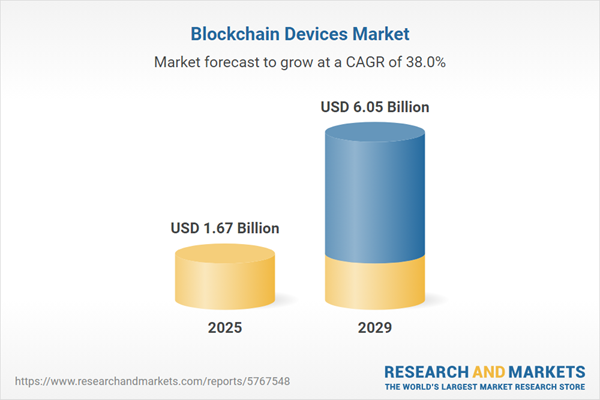

The blockchain devices market size has grown exponentially in recent years. It will grow from $1.22 billion in 2024 to $1.67 billion in 2025 at a compound annual growth rate (CAGR) of 36.9%. The growth in the historic period can be attributed to increase in cryptocurrency growth, decentralized finance (defi) expansion, security and tamper-proofing, enhanced privacy solutions, hardware-based security modules, regulatory compliance solutions.

The blockchain devices market size is expected to see exponential growth in the next few years. It will grow to $6.05 billion in 2029 at a compound annual growth rate (CAGR) of 38%. The growth in the forecast period can be attributed to decentralizing identity solutions, emergence of tokenization, increasing adoption in emerging markets, decentralizing autonomous organizations, cross-chain solutions. Major trends in the forecast period include smart contracts execution devices, blockchain in healthcare devices, real-time transaction verification, smart contracts execution devices, integration with artificial intelligence.

The increasing investments in blockchain technology are significantly contributing to the growth of the blockchain devices market. There has been an increase in adoption and implementation of real-world blockchain solutions across a wide range of industries and businesses. Organizations have expanded their investments in blockchain technology, proving their dedication to the technology. For instance, in August 2022, Alphabet, a US-based technology company, invested $1. 5 Billion in various blockchain companies. The investment indicates wider trend of tech companies and investors leaning more towards blockchain and Web 3. 0 as means for a more democratized information technology environment.

The increasing adoption of cryptocurrency is significantly driving the growth of the blockchain devices market in the future. Cryptocurrency is defined as any currency that exists in digital or virtual form and utilizes cryptography to secure transactions. To function as a decentralized currency, cryptocurrency relies on blockchains for security, which in turn requires blockchain devices for continuous operation. For example, in July 2024, according to USAFacts, a US-based nonprofit organization, men were nearly three times more likely to use cryptocurrency in 2023, with 11% of men participating compared to only 4% of women. Consequently, the rise in cryptocurrency adoption is expected to propel the growth of the blockchain devices market.

Leading companies in the Blockchain Devices market are concentrating on creating new technological solutions, such as the Web3 Acceleration Platform, to improve interoperability and scalability in decentralized applications. A Web3 Acceleration Platform serves as a comprehensive framework that allows developers to effectively build, deploy, and scale decentralized applications (dApps) by offering essential tools and resources for smart contract integration and user identity management across various blockchain networks. For example, in June 2023, Fujitsu, a Japan-based information and communications technology firm, launched the Web3 Acceleration Platform to support the development of Web3 services. This platform enhances collaboration by enabling secure data exchange and advanced computing capabilities through its innovative Data e-TRUST technology. It cultivates a global co-creation environment, allowing diverse partners to work together on cutting-edge applications while promoting digital trust and authenticity in transactions.

Major companies operating in the blockchain devices market are focusing on developing innovative hardware wallets for increasing the security of cryptocurrency users and simplify the cryptocurrency use for entry level customers. Hardware wallet refers to a physical device that stores the user’s private keys in an environment separated from an internet connection and provides users with a way to sign transactions and interact with the blockchain. For instance, in October 2023, Trezor, a Czech Republic-based developer of cryptocurrency wallets launched Trezor Safe 3, an innovative an innovative private key backup solution, and an exclusive Bitcoin-centric hardware wallet compatible with over 7,000 cryptocurrencies. Trezor's latest wallet utilises open-source development principles, particularly in the deployment of its security components. Because of the firm's engagement with an external secure element provider, any found vulnerabilities can be disclosed transparently.

In October 2023, Depository Trust & Clearing Corporation (DTCC) a US-based financial services company acquired Securrency for $50 million. The acquisition adds blockchain devices and platforms that enable clients to tokenize real-world assets through comprehensive, patented compliance technology to DTCC’s portfolio of offerings. Securrency Inc. headquarters is a US-based blockchain developer.

Major companies operating in the blockchain devices market include Ledger SAS, SatoshiLabs Group, Sirin Labs AG, Pundi X Labs Pte. Ltd., Genesis Coin Inc., GENERAL BYTES s. r. o., HTC Corporation, RIDDLE&CODE GmbH, ShapeShift AG, Bitaccess Inc., Coinsource Inc., SAMSUNG Electronics Co. Ltd., Infineon Technologies India Private Ltd., Helium Systems Inc., Avado, Lamassu Industries AG, SafePal, PAYMYNT Financial Group Inc., modum. io AG, NXM Labs Inc., Blockchain Luxembourg S. A, Tangem AG, Filament Corporation, Sikur Inc., CoVault Inc., ELLIPAL, International Business Machines Corporation, Microsoft Corporation, Canaan Creative Co. Ltd., Ebang International Holdings Inc., Bitfury Holding B. V., CoolBitX Technology Ltd., OPENDIME by Coinkite Inc.

The blockchain devices is referred to as a decentralized architecture with built-in security to improve transaction trust and integrity. Blockchain has revolutionized the exchange of information and media. Blockchain technology is widely regarded as a game-changing breakthrough and the harbinger of a new economic era.

The main types of blockchain devices are blockchain smartphones, crypto hardware wallets, crypto automated teller machines (ATMs), and point of sales (POS) terminals. Blockchain smartphones have more control of users over their online personalities and data thanks to blockchain technology. By connectivity, types of blockchain devices included wired and wireless. Blockchain devices are used in personal and corporate applications. Major end-users of blockchain devices include the consumer, BFSI, government, retail and e-commerce, travel and hospitality, automotive, transportation and logistics, IT and telecommunication, and other industries.

The blockchain devices market research report is one of a series of new reports that provides blockchain devices market statistics, including blockchain devices industry global market size, regional shares, competitors with a blockchain devices market share, detailed blockchain devices market segments, market trends and opportunities, and any further data you may need to thrive in the blockchain devices industry. This blockchain devices market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

North America was the largest region in the blockchain devices market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the blockchain devices market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

The countries covered in the blockchain devices market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

The blockchain devices market consists of sales of devices such as positioning system (GPS) devices. Values in this market are 'factory gate' values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Blockchain Devices Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on blockchain devices market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for blockchain devices? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The blockchain devices market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Blockchain Smartphones; Crypto Hardware Wallets; Crypto Automated Teller Machines (ATMs); Point Of Sales (POS) Terminals2) By Connectivity: Wired; Wireless

3) By Application: Personal; Corporate

4) By End User: Consumer; BFSI; Government; Retail And E-commerce; Travel And Hospitality; Automotive; Transportation And Logistics; IT And Telecommunication; Others (Energy And Utilities, Education, Agriculture, Healthcare, Manufacturing)

Subsegments:

1) By Blockchain Smartphones: Encrypted Communication Smartphones; Blockchain-Enabled Payment Smartphones; Decentralized App (DApp) Smartphones2) By Crypto Hardware Wallets: USB Hardware Wallets; Bluetooth Hardware Wallets; Multi-Currency Hardware Wallets

3) By Crypto Automated Teller Machines (ATMs): Two-Way Crypto ATMs; One-Way Crypto ATMs; Multi-Currency ATMs

4) By Point Of Sales (POS) Terminals: Mobile POS Systems; Traditional POS Systems With Crypto Integration; Contactless Payment POS Terminals

Key Companies Mentioned: Ledger SAS; SatoshiLabs Group; Sirin Labs AG; Pundi X Labs Pte. Ltd.; Genesis Coin Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Blockchain Devices market report include:- Ledger SAS

- SatoshiLabs Group

- Sirin Labs AG

- Pundi X Labs Pte. Ltd.

- Genesis Coin Inc.

- GENERAL BYTES s. r. o.

- HTC Corporation

- RIDDLE&CODE GmbH

- ShapeShift AG

- Bitaccess Inc.

- Coinsource Inc.

- SAMSUNG Electronics Co. Ltd.

- Infineon Technologies India Private Ltd.

- Helium Systems Inc.

- Avado

- Lamassu Industries AG

- SafePal

- PAYMYNT Financial Group Inc.

- modum. io AG

- NXM Labs Inc.

- Blockchain Luxembourg S. A

- Tangem AG

- Filament Corporation

- Sikur Inc.

- CoVault Inc.

- ELLIPAL

- International Business Machines Corporation

- Microsoft Corporation

- Canaan Creative Co. Ltd.

- Ebang International Holdings Inc.

- Bitfury Holding B. V.

- CoolBitX Technology Ltd.

- OPENDIME by Coinkite Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | January 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.67 Billion |

| Forecasted Market Value ( USD | $ 6.05 Billion |

| Compound Annual Growth Rate | 38.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 34 |