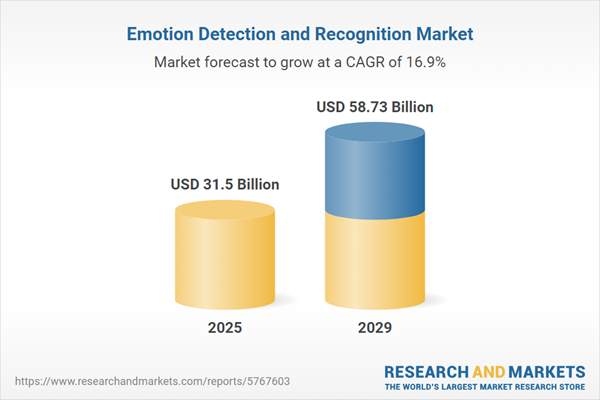

The emotion detection and recognition market size is expected to see rapid growth in the next few years. It will grow to $58.73 billion in 2029 at a compound annual growth rate (CAGR) of 16.9%. The growth in the forecast period can be attributed to rise of remote and virtual interactions, focus on mental health applications, application in education, expanding use in automotive industry, privacy-preserving solutions. Major trends in the forecast period include integration with artificial intelligence (AI) and machine learning (ML), advancements in facial recognition technology, integration with wearable technology, advancements in facial recognition algorithms, application in human-computer interaction.

The growth of the emotion detection and recognition (EDR) market is expected to be propelled by the increasing applications of IoT and the adoption of wearable devices. This surge in IoT applications and wearable device adoption is driven by factors such as the shift towards digital processes, enhanced productivity with reduced costs, improved efficiency, and accurate data collection and analysis. As IoT and wearable devices become more prevalent, the integration of emotion detection and recognition technologies becomes crucial. EDR can be seamlessly incorporated into IoT applications and wearable devices to capture physiological and behavioral data, analyze responses, and generate automated responses based on emotions. This integration holds the potential to facilitate better decision-making and enhance the performance and functionalities of businesses or products. For example, data published in May 2022 by an independent review site, DataProt, revealed that the number of active IoT devices is anticipated to exceed 25.4 billion by 2030. Additionally, by 2025, 152,200 IoT devices are expected to connect to the internet every minute, and IoT solutions could generate $4-11 trillion in economic value. Notably, 83% of organizations have experienced improved efficiency through IoT technology. These statistics underline the global increase in IoT applications. Consequently, the growing prevalence of IoT applications and the widespread adoption of wearable devices are poised to drive the growth of the emotion detection and recognition (EDR) market.

The rapid growth in digitization is expected to drive the expansion of the emotion detection and recognition (EDR) market. Digitization involves the conversion of analog information into a digital format, representing data, media, or objects using discrete numerical values. Within this digital landscape, emotion detection and recognition (EDR) play a crucial role in enhancing user experiences and tailoring digital interactions. By discerning and understanding emotional cues, EDR enables more personalized and empathetic human-computer interactions. For example, data from Augusta Free Press, a US-based news service company, reported that global digital transformation spending reached approximately $1.85 trillion in December 2022, marking a 16% increase compared to the previous year. This data underscores the significant investment and emphasis on digitization globally. As organizations and industries continue to embrace digitization, the integration of emotion detection and recognition technologies becomes instrumental, contributing to the overall growth of the EDR market.

The widespread use of emotion detection and recognition (EDR) in smart cars stands out as a significant and increasingly popular trend in the emotion detection and recognition market. Smart cars, equipped with advanced electronics, technology, and software, aim to enhance mobility and safety. EDR plays a crucial role in these vehicles by recognizing the emotions of drivers. This application extends from detecting signs of drowsiness for driver safety to identifying whether the driver is attentive or distracted while driving, ultimately contributing to the creation of a highly personalized and intimate driving experience. In practical terms, an EDR software system installed in a device within the smart car collects real-time data on driver behavior through facial analysis. It then alerts the driver, ensuring safety on the road. As an example, Smart Eye, a Swedish AI company, offers Interior Sensing solutions based on Emotion AI through its subsidiary Affectiva. This solution integrates a camera and sensors in the car, capturing data through facial analysis of the driver to enhance road safety and elevate the overall mobility experience. This trend reflects the increasing integration of EDR in the automotive industry, particularly in smart cars, to prioritize driver safety and deliver a more personalized driving environment.

Leading companies in the emotion detection and recognition (EDR) market are advancing technology by developing models to identify user emotions, aiming to enhance user experience, boost customer engagement, and support personalized interactions across sectors like marketing, healthcare, and entertainment. Emotion-detection models are computational frameworks or algorithms that process data - such as facial expressions, voice tone, physiological signals, or text input - to recognize and interpret individuals' emotional states. For example, in May 2024, OpenAI, a US-based tech company, introduced GPT-4o, a model capable of detecting user emotions. GPT-4o is an advanced AI system that leverages cutting-edge machine learning techniques to analyze and interpret emotions from various inputs, including text and voice. Using deep learning algorithms, GPT-4o identifies emotional cues, enabling more empathetic and contextually aware interactions. This innovation aims to improve user experience by tailoring responses to users’ emotional states, enhancing engagement in applications like customer support, mental health assistance, and interactive storytelling.

In January 2022, Raydiant, a US-based company specializing in cloud-based digital signage technology for retail businesses and restaurants, acquired Sightcorp for an undisclosed amount. This strategic move involves integrating Sightcorp's AI-powered analytics software into Raydiant's experience management platform. The objective is to provide anonymous in-store screen engagement analytics, enabling brands to enhance sales and deliver optimized content while prioritizing consumer privacy. Sightcorp, based in the Netherlands, is recognized for its expertise in AI-powered emotion recognition software.

Major companies operating in the emotion detection and recognition market include Apple Inc., IBM Corporation, Emotional AI, Emteq Limited, NVISO SA, Tobii AB, Cogito Corporation, Paravision Inc., Noldus Information Technology BV, Entropik Technologies Pvt. Ltd., Xpression Technologies Pte. Ltd., Cognitec Systems GmbH, Realeyes OU, B-Yond, Affectiva lnc., Beyond Verbal Communications Ltd., iMotions A/S, Ayonix Corporation, CrowdEmotion Ltd., Sentiance NV, Sightcorp BV, SkyBiometry, Nemesysco Ltd., Sension Technologies Inc., Vokaturi BVBA, Emotion AI Limited, Kairos AR Inc., Emotion Research Lab S.L, Eyeris Technologies Inc., EmoGraphy Private Limited, Emotion Technology Ltd.

North America was the largest region in the emotion detection and recognition market in 2024. The regions covered in the emotion detection and recognition market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the emotion detection and recognition market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Emotion detection and recognition involve the use of technologies such as facial recognition, speech and voice recognition, machine learning, biosensing, and pattern recognition to detect and recognize human emotions. This technique aims to improve decision-making, enhance focus and performance at work, manage stress, and promote healthier and more productive working styles.

The primary software tools for emotion detection and recognition encompass facial expression and emotion recognition, gesture and posture recognition, and voice recognition. Facial Emotion Recognition (FER) is a technology that scrutinizes facial expressions in static images and videos to discern information about an individual's emotional state. The underlying technologies include pattern recognition networks, machine learning, natural language processing, and various other technologies. The main end-users in this domain span commercial, entertainment, retail, and other sectors.

The emotion detection and recognition market research report is one of a series of new reports that provides emotion detection and recognition market statistics, including emotion detection and recognition industry global market size, regional shares, competitors with an emotion detection and recognition market share, detailed emotion detection and recognition market segments, market trends and opportunities, and any further data you may need to thrive in the emotion detection and recognition industry. This emotion detection and recognition market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The emotion detection and recognition market includes revenues earned by entities by identification and recognition of human emotions using technological tools such as biosensing, machine learning, speech and voice recognition, facial recognition, and pattern recognition. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Emotion Detection and Recognition Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on emotion detection and recognition market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for emotion detection and recognition? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The emotion detection and recognition market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Software Tool: Facial Expression and Emotion Recognition, Gesture and Posture Recognition, Voice Recognition2) By Technology: Pattern Recognition Network, Machine Learning, Natural Language Processing, Other Technologies

3) By End-User: Commercial, Entertainment, Retail, Other End Users

Subsegments:

1) By Facial Expression and Emotion Recognition: 2D Facial Recognition; 3D Facial Recognition2) By Gesture and Posture Recognition: Hand Gesture Recognition; Full-Body Gesture Recognition

3) By Voice Recognition: Speech Emotion Recognition; Voice Tone and Intonation Analysis

Key Companies Mentioned: Apple Inc.; IBM Corporation; Emotional AI; Emteq Limited; NVISO SA

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Apple Inc.

- IBM Corporation

- Emotional AI

- Emteq Limited

- NVISO SA

- Tobii AB

- Cogito Corporation

- Paravision Inc.

- Noldus Information Technology BV

- Entropik Technologies Pvt. Ltd.

- Xpression Technologies Pte. Ltd.

- Cognitec Systems GmbH

- Realeyes OU

- B-Yond

- Affectiva lnc.

- Beyond Verbal Communications Ltd.

- iMotions A/S

- Ayonix Corporation

- CrowdEmotion Ltd.

- Sentiance NV

- Sightcorp BV

- SkyBiometry

- Nemesysco Ltd.

- Sension Technologies Inc.

- Vokaturi BVBA

- Emotion AI Limited

- Kairos AR Inc.

- Emotion Research Lab S.L

- Eyeris Technologies Inc.

- EmoGraphy Private Limited

- Emotion Technology Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 31.5 Billion |

| Forecasted Market Value ( USD | $ 58.73 Billion |

| Compound Annual Growth Rate | 16.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |