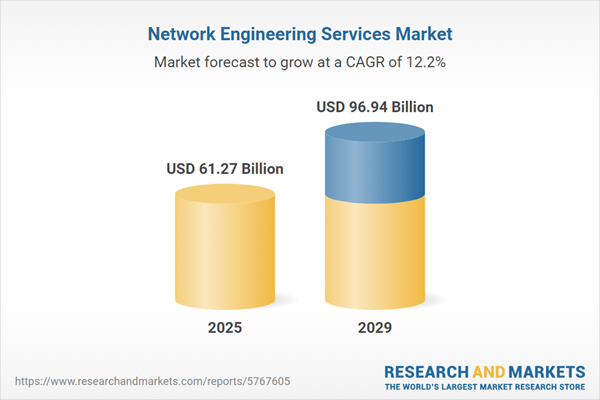

The network engineering services market size has grown strongly in recent years. It will grow from $56.85 billion in 2024 to $61.27 billion in 2025 at a compound annual growth rate (CAGR) of 7.8%. The growth in the historic period can be attributed to growth of internet usage and data traffic, explosion of mobile devices and connectivity, globalization and distributed workforces, enterprise digital transformation, cloud computing adoption.

The network engineering services market size is expected to see rapid growth in the next few years. It will grow to $96.94 billion in 2029 at a compound annual growth rate (CAGR) of 12.2%. The growth in the forecast period can be attributed to demand for skilled network engineers, adoption of advanced network analytics, global connectivity and network integration, increasing complexity of network environments, focus on sustainable and green networking. Major trends in the forecast period include green networking and energy efficiency, adoption of intent-based networking, compliance with regulatory standards, network slicing for customized services, remote workforce connectivity.

The growing adoption of broadband is expected to drive the growth of the network engineering services market. Broadband refers to high-speed internet connectivity that is consistently faster than traditional dial-up access. It facilitates high-quality and rapid access to information, teleconferencing, data transfer, and various other functions across multiple sectors, including healthcare, education, and technological development. Network engineering services strike a balance between security and the increasing demand for faster, more efficient, and more adaptable computing solutions. The COVID-19 containment measures, which included social distancing, remote working, and the closure of businesses, prompted organizations to reorganize their operations to enable remote work, leading to increased broadband adoption. For example, in July 2023, the UK Parliament's House of Commons Library reported that, as of January 2023, 72% of premises in the UK had access to gigabit-capable broadband, up from 64% in January 2022. Thus, the rise in broadband adoption is anticipated to enhance the demand for network engineering services during the forecast period.

The network engineering services market is experiencing growth due to the rising popularity of home automation. Home automation involves connecting everyday products over the internet through hardware, communication, and electronic interfaces, enabling remote control via smartphones or tablets. This trend expedites routine tasks, offering users enhanced comfort and convenience. Network engineering services ensure strong and consistent Wi-Fi coverage throughout homes, facilitating seamless communication among smart devices and with the central automation hub. With over 54% of U. S. households projected to have at least one smart home gadget in 2022, and similar adoption rates in the UK, Germany, and France, the increasing popularity of home automation is expected to be a driving force behind the growth of the network engineering services market.

Major companies in the network engineering services market are concentrating on technological advancements like Daisy to enhance collaboration, streamline project management, and boost efficiency in content creation. Daisy is a platform launched by CreatorUp that simplifies content creation by offering tools for project management, resource allocation, and workflow automation, thereby improving collaboration and efficiency for teams. For example, in April 2023, CreatorUp, a U.S.-based company dedicated to empowering creators and brands through innovative content creation and collaboration tools, introduced Daisy as the first AI content creation platform. It combines advanced AI tools with a human touch, allowing creators to produce high-quality content efficiently while maintaining the creativity and nuances that only human input can provide.

Major players in the network engineering services market are focusing on developing innovative solutions to remain competitive. These solutions encompass advanced cybersecurity systems, software-defined networking (SDN) technologies, and intelligent network automation tools aimed at optimizing network performance and security. Tech Mahindra's launch of SANDSTORM in February 2023 exemplifies such innovation, providing a remote real-time network monitoring and smart device assurance service for telcos and enterprises.

In June 2024, Accenture, an Ireland-based global professional services firm that offers consulting, technology, and outsourcing services across various industries, acquired Fibermind for an undisclosed amount. This acquisition aims to enhance Accenture's digital capabilities and bolster its expertise in telecommunications and technology consulting. Fibermind, based in Italy, provides digital solutions and consulting services, focusing on telecommunications, technology, and data analytics to assist businesses in optimizing their operations and enhancing customer experiences.

Major companies operating in the network engineering services market include Accenture PLC, Telefonaktiebolaget LM Ericsson, Huawei Technologies Co. Ltd., Juniper Networks, IBM Corporation, Cyient Limited, Datavision Inc., Imagit Inc., Infosys Limited, Atisdigital, Fujitsu Limited, ABB Ltd., Avaya Inc., Capgemini SE, Cisco Systems Inc., Nokia Corporation, OpenGov, Oracle Corporation, UTI Group, General Electric, Honeywell International Inc., Itron Inc., KAPSCH Group, Microsoft Corporation, SAP SE, Schneider Electric SE, Siemens AG.

North America was the largest region in the network engineering services market in 2024 and is expected to be the fastest-growing region in the forecast period. The regions covered in the network engineering services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the network engineering services market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

Network engineering services encompass the planning, implementation, and management of computer networks, providing in-house phone, data, video, and wireless network services. Service providers in network engineering collaborate with consultants, telecom companies, corporations, ISPs, and others to prepare, develop, plan, and implement projects based on customer recommendations and requirements.

The primary services offered by network engineering include network assessment, network design, and network deployment. Network assessment involves a comprehensive examination of the existing IT infrastructure, providing an overview of the current environment and suggesting changes such as network consolidation, simplification, or automation. Small, medium, and large enterprises utilize both wired and wireless network engineering services for their daily operational activities. Industries benefiting from network engineering services include banking, financial services, and insurance; telecom; information technology; healthcare; education; media and entertainment; energy and utilities; manufacturing, and other sectors.

The network engineering services market research report is one of a series of new reports that provides network engineering services market statistics, including network engineering services industry global market size, regional shares, competitors with a network engineering services market share, detailed network engineering services market segments, market trends and opportunities, and any further data you may need to thrive in the network engineering services industry. This network engineering services market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The network engineering services market includes revenues earned by entities by organizing computer networks that provide internal phone, data, video, and wireless network services. These networks are planned, put into place, and managed. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Network Engineering Services Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on network engineering services market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for network engineering services? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The network engineering services market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Service Type: Network Assessment; Network Design; Network Deployment2) by Transmission Mode: Wired; Wireless

3) by Organization Size: Large Enterprises; Small and Medium-Sized Enterprises (SMEs)

4) by Industry Vertical: Banking, Financial Services, and Insurance (BFSI); Telecom; Information Technology; Healthcare; Education; Media and Entertainment; Energy and Utilities; Manufacturing; Other Industry Verticals

Subsegments:

1) by Network Assessment: Current Network Performance Evaluation; Security Assessment; Capacity Planning; Compliance Assessment2) by Network Design: Logical Network Design; Physical Network Design; High-Level Design (HLD); Low-Level Design (LLD)

3) by Network Deployment: Installation and Configuration Services; Migration Services; Testing and Validation Services; Documentation Services

Key Companies Mentioned: Accenture PLC; Telefonaktiebolaget LM Ericsson; Huawei Technologies Co. Ltd.; Juniper Networks; IBM Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Network Engineering Services market report include:- Accenture PLC

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co. Ltd.

- Juniper Networks

- IBM Corporation

- Cyient Limited

- Datavision Inc.

- Imagit Inc.

- Infosys Limited

- Atisdigital

- Fujitsu Limited

- ABB Ltd.

- Avaya Inc.

- Capgemini SE

- Cisco Systems Inc.

- Nokia Corporation

- OpenGov

- Oracle Corporation

- UTI Group

- General Electric

- Honeywell International Inc.

- Itron Inc.

- KAPSCH Group

- Microsoft Corporation

- SAP SE

- Schneider Electric SE

- Siemens AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 61.27 Billion |

| Forecasted Market Value ( USD | $ 96.94 Billion |

| Compound Annual Growth Rate | 12.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |