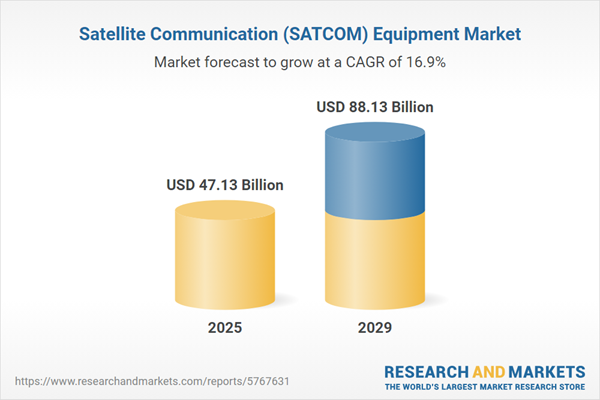

The satellite communication (SATCOM) equipment market size has grown rapidly in recent years. It will grow from $41.99 billion in 2024 to $47.13 billion in 2025 at a compound annual growth rate (CAGR) of 12.2%. The growth in the historic period can be attributed to expansion of satellite-based broadcasting, growth in military and defense satellite communication, increased demand for broadband connectivity, growth in remote sensing and earth observation, growing use of satellite technology in defense and government sectors.

The satellite communication (SATCOM) equipment market size is expected to see rapid growth in the next few years. It will grow to $88.13 billion in 2029 at a compound annual growth rate (CAGR) of 16.9%. The growth in the forecast period can be attributed to deployment of high-capacity geostationary satellites, integration with 5g networks, demand for low earth orbit (LEO) satellite constellations, expansion of satellite internet services, emphasis on secure satellite communication. Major trends in the forecast period include miniaturization of satellite communication equipment, use of software-defined satellite technology, hybrid satellite and terrestrial communication solutions, integration of artificial intelligence in satcom systems, adoption of high-frequency satellite bands for improved connectivity.

The rising number of mobile satellite services and small satellites is propelling the growth of the satellite communication (SATCOM) equipment market. Mobile satellite services (MSS) provide two-way voice and data communications to individuals worldwide who are traveling or living in remote regions. The growing adoption of small and mobile satellites offers significant flexibility for Earth science research missions. Satellite communication equipment enables small satellites to support scientific advancements and human exploration, lower the costs of new space missions, and enhance access to space. For example, in June 2023, the Satellite Industry Association, a US-based trade association, reported that the Satellite Ground Segment sector generated over $145 billion in 2022, with more than 7 billion satellite-enabled smartphones and an increase in broadband and GNSS terminals worldwide. Therefore, the increasing prevalence of mobile satellite services and small satellites is driving the demand for growth in the satellite communication (SATCOM) equipment market.

The satellite communication (SATCOM) equipment market is expected to experience growth due to the increasing adoption of low-earth orbit satellites across various sectors. Low-earth orbit (LEO) satellites orbit the planet at lower altitudes than geosynchronous satellites and find applications in areas such as image capture, military reconnaissance, spying, and communications. LEO satellite constellations are designed to provide global broadband internet coverage, leading to a growing demand for SATCOM equipment, including user terminals and ground stations. In June 2022, the US Space Force’s Commercial Satellite Communications Office (CSCO) announced plans to award nearly $2. 3 billion in commercial satcom contracts over the next two years. This includes a significant multiple-award deal of $875 million for low earth orbit satellite broadband services over a 10-year period. Investments in low earth orbit satellites are anticipated to be a driving force behind the growth of the satellite communication market.

A prominent trend in the satellite communication equipment market is the focus on product innovations. Leading companies in the sector are actively engaged in developing new products and solutions to enhance their market positions. For example, in September 2023, Hanwha Systems, a South Korean aerospace and defense company, introduced land, marine, and manportable versions of its on-the-move (OTM) satellite communications (satcom) antenna at the Defence & Security Equipment International (DSEI) 2023 in London. The land variant, suitable for first responders, heavy artillery platforms, and command-and-control vehicles, is set to be available for purchase by the end of 2024.

Major companies operating in the satellite communication (SATCOM) equipment sector are placing a strong emphasis on collaboration with aerospace companies to integrate high-speed satellite communication (SATCOM) systems in aircraft for enhanced ground connectivity. This high-speed satellite communications system improves communication and tracking for safer air travel, reducing the distance between two aircraft from 100 nautical miles to 30 nautical miles. For instance, in June 2023, Collins Aerospace, a US-based aerospace and defense technology company, launched a business jet cabin high-speed satellite communications (SATCOM) system utilizing the Iridium Certus 700 broadband satellite service. The purpose of this system is to provide global cabin connectivity for business jets of all sizes, with Bombardier Inc., a Canada-based aircraft manufacturing company, collaborating to equip all Challenger 3500 aircraft with Iridium Certus connectivity.

In October 2022, Endurance Acquisition Corp., a US-based publicly traded special purpose acquisition company, completed the acquisition of SatixFy Communications Ltd. for an undisclosed amount. This strategic move aligns with SatixFy's focus on next-generation technologies, offering significant opportunities in the introduction of LEO mega-constellations in the field of satellite communications. SatixFy Communications, an Israel-based communications equipment company founded in 2012, specializes in next-generation satellite space and ground communications systems.

Major companies operating in the satellite communication (SATCOM) equipment market include SKY Perfect JSAT Holdings Inc, L3 Technologies Inc., SES S. A, Telesat LLC, Intelsat S. A., Viasat Inc., General Dynamics Corporation, Cobham Limited, Thuraya Telecommunications Company, Qualcomm Technologies Inc., EchoStar Corporation, Honeywell International Inc., Hughes Network Systems LLC, Boeing Company, General Dynamics Mission Systems Inc., Iridium Communications Inc., ASELSAN A. S., Intellian Technologies Inc., Campbell Scientific Inc., ST Engineering iDirect Inc., Thales Group, Raytheon Technologies Corporation, Inmarsat Communications, KVH Industries Inc., Orbcomm Inc., Cobham PLC, Maxar Technologies Inc., Viking SatCom Inc., Kepler Communications, Gilat Satellite Networks, Comtech Telecommunications Corp., GomSpace Group AB, NanoAvionics, AAC Clyde Space AB, Spaceflight Industries, Satellogic, Spire Global Inc., Planet Labs Inc., OneWeb Satellites, Blue Canyon Technologies.

North America was the largest region in the satellite communication (SATCOM) equipment market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the satellite communication (satcom) equipment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the satellite communication (satcom) equipment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Canada, Spain.

Satellite communication (SATCOM) equipment comprises electronic devices, encompassing mounting style, product type, and connector type or interface, facilitating communication with satellites in Earth's orbit or space. Primarily utilized for traditional point-to-point communications, mobile applications, and the distribution of TV and radio programs, satellite communication involves the transmission, conditioning, and reception of signals via communication satellites orbiting the Earth.

In satellite communication (SATCOM) equipment, satellites are categorized into large satellites (> 2500 kg), medium satellites (501-2500 kg), small satellites (1-500 kg), and cube sats (0. 27-27 cubic units of 103 cm). Large satellites serve to directly transmit television signals to homes, forming the backbone of cable and network TV. These satellites relay signals from a central station that generates programming for smaller stations, which, in turn, transmit the signals locally via cables or airwaves. Key components of SATCOM equipment include amplifiers, transceivers, space antennas, transponders, and others, utilized in navigation, scientific research, communication, remote sensing, and various applications. End-users of satellite communication span commercial, government, and military sectors.

The satellite communication (SATCOM) equipment market research report is one of a series of new reports that provides satellite communication (SATCOM) equipment market statistics, including satellite communication (SATCOM) equipment industry global market size, regional shares, competitors with a satellite communication (SATCOM) equipment market share, detailed satellite communication (SATCOM) equipment market segments, market trends and opportunities, and any further data you may need to thrive in the satellite communication (SATCOM) equipment industry. This anomaly detection market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The satellite communication (SATCOM) equipment market consists of sales of satcom moderns, satcom receivers, block upconverters (BUC), low-noise block converters (LNB), equalizers, frequency converters, splitters, and switchover units. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Satellite Communication (SATCOM) Equipment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on satellite communication (satcom) equipment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for satellite communication (satcom) equipment? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The satellite communication (satcom) equipment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Satellite Type: Large Satellite (>2500 KG); Medium Satellite (501 - 2500 KG); Small Satellite (1 - 500 KG); Cubesat (0. 27 - 27 Cubic Unit of 103 Cm)2) by Component Type: Amplifiers; Transceivers; Space Antennas; Transponders; Other Components

3) by Application: Navigation; Scientific Research; Communication; Remote Sensing; Other Applications

4) by End-Use: Commercial; Government and Military

Subsegments:

1) by Large Satellite (>2500 KG): Geostationary Satellites; High-Throughput Satellites (HTS)2) by Medium Satellite (501 - 2500 KG): Communication Satellites; Earth Observation Satellites

3) by Small Satellite (1 - 500 KG): Microsatellites; Nanosatellites

4) by CubeSat (0.27 - 27 Cubic Units of 10 cm): 1U CubeSat (10 cm x 10 cm x 10 cm); 3U CubeSat (10 cm x 10 cm x 30 cm); 6U CubeSat (10 cm x 20 cm x 30 cm)

Key Companies Mentioned: SKY Perfect JSAT Holdings Inc; L3 Technologies Inc.; SES S.A; Telesat LLC; Intelsat S.A.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Satellite Communication (SATCOM) Equipment market report include:- SKY Perfect JSAT Holdings Inc

- L3 Technologies Inc.

- SES S. A

- Telesat LLC

- Intelsat S. A.

- Viasat Inc.

- General Dynamics Corporation

- Cobham Limited

- Thuraya Telecommunications Company

- Qualcomm Technologies Inc.

- EchoStar Corporation

- Honeywell International Inc.

- Hughes Network Systems LLC

- Boeing Company

- General Dynamics Mission Systems Inc.

- Iridium Communications Inc.

- ASELSAN A. S.

- Intellian Technologies Inc.

- Campbell Scientific Inc.

- ST Engineering iDirect Inc.

- Thales Group

- Raytheon Technologies Corporation

- Inmarsat Communications

- KVH Industries Inc.

- Orbcomm Inc.

- Cobham PLC

- Maxar Technologies Inc.

- Viking SatCom Inc.

- Kepler Communications

- Gilat Satellite Networks

- Comtech Telecommunications Corp.

- GomSpace Group AB

- NanoAvionics

- AAC Clyde Space AB

- Spaceflight Industries

- Satellogic

- Spire Global Inc.

- Planet Labs Inc.

- OneWeb Satellites

- Blue Canyon Technologies

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 47.13 Billion |

| Forecasted Market Value ( USD | $ 88.13 Billion |

| Compound Annual Growth Rate | 16.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 40 |